Nine themes poised to reshape portfolios and the future

Polarization continued to rock geopolitics, national politics, and financial markets in 2024. Ironically, last year’s turbulence has left thematic investing even better positioned to benefit from opportunities.

Summary

- From stalwarts to start-ups, the business of finance is booming

- Broader growth as AI tools are practically applied across sectors

- Reshoring and regulation should boost robotics and automation

But how so? Why should 1. January 2025 mark the start of an investment reversal? The answer lies within markets operating in extremes that should eventually revert to a mean. This year, we expect a broadening of performance, or at least of attention. The yearslong “passivization” trend – where investments are funneled into an increasingly concentrated basket of AI-linked stocks – is likely to continue. However, this time round, we expect growth to expand to include the derivatives of AI success – the practical AI use cases – which until now have been largely overlooked by markets.

2025 should also see some important drivers of structural change – from the implementation of Trump’s post-election promises to key regulatory decisions in global markets. In reaction, we will also see a slew of new business plans and budgets on the corporate level, all of which will be influenced by supply chain dynamics, potentially higher funding rates, and intensified M&A. Much awaits in 2025. Here we summarize the analyses and insights driving our high-conviction themes for the coming year.

Fintech enjoyed a powerful comeback in 2024, supported by strong operational results, attractive valuations and optimism surrounding Trump 2.0. Traditional financials buoyed by ‘higher for longer’ rates also thrived, boosted by Net Interest Income (NII) across the board. Looking ahead, economic growth, less regulation, and fintech IPOs should continue to feed the momentum into 2025. While the interest rate cycle may be nearing its peak, we don’t foresee a sharp erosion of banking profits as many banks continue to benefit from strong fee-based income streams less sensitive to interest rate changes. Lower rates, meanwhile, could also stoke more M&A activity, unlocking scale, innovation and profits in both fintech and financials.

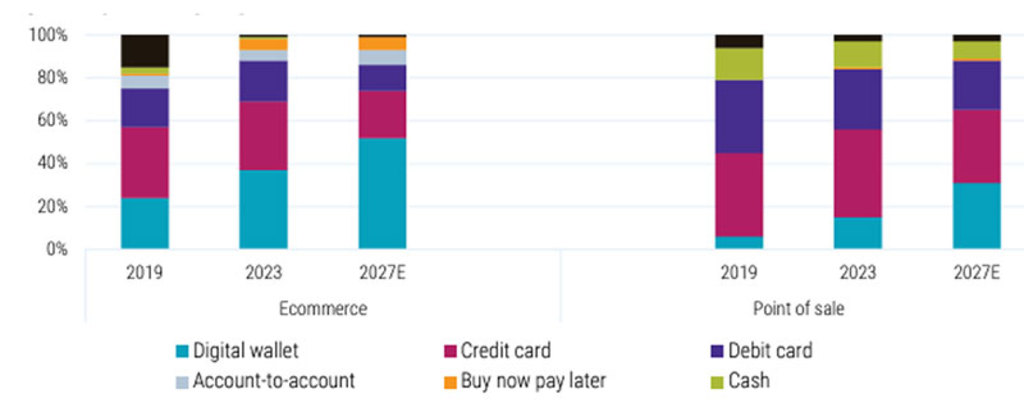

In the consumer space, the appetite for immersive, personalized experiences across travel, entertainment, and digital platforms is trending higher, benefitting providers of digital payment solutions for consumers and merchants (e.g., digital wallets, contactless payment systems and buy-now-pay-later financing). More digitization means more demand for credit solutions and cross-border transactions, especially in underserved markets, boosting demand for traditional payment companies like Visa. Broadening markets and less emphasis on the Magnificent Seven, should also benefit financials, specifically fintech, which is brimming with overlooked and underappreciated AI and Big Tech innovation.

Figure 1 – Digital wallets gaining market share online and in stores (point-of-sale)

Source: Worldpay, Robeco, June 2024.

2. Digital Innovations – AI must show real gains rather than peddle potential

In 2024, AI proved again to be the driving force for technological innovation and earnings growth. While capital investments in high-performance semiconductors and supportive infrastructure should continue, investors and corporates will increasingly demand tangible productivity gains rather than speculative potential. Gartner forecasts software sector revenue growth will accelerate to 14% in 2025, while cloud computing and software-as-a-service revenues are expected to expand at nearly twice that rate. This underscores the expanding influence of AI-enabled platforms in driving real digital transformation across the economy.

AI is also making inroads into the physical world. Connected robotic systems are leveraging real-time data from factories and supply chains via the cloud. Such technology arrives at a time when production bottlenecks and geopolitical security are spurring renewed interest in reshoring manufacturing. AI, robotics and automation will help overcome reshoring obstacles (e.g., high labor costs, worker shortages, and rapid operational scaling). As a result, we expect accelerated spending for new and retrofitted manufacturing facilities that integrate AI.

What’s trending?

All the latest thematic investing trends just one newsletter subscription away.

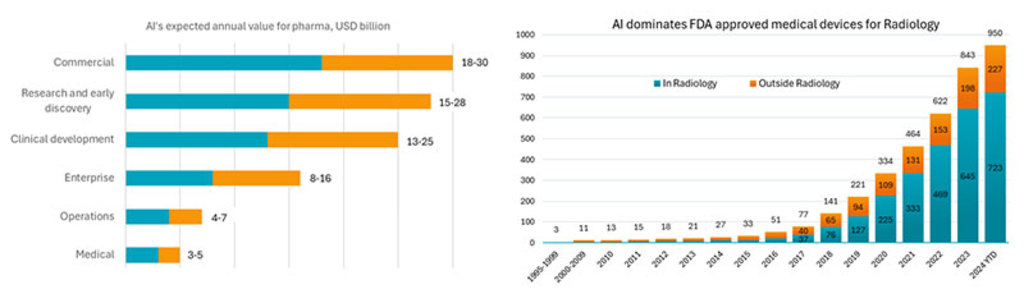

3. Healthcare – diverse trends and innovation signal positive prognosis

Shortages of doctors and rising healthcare costs mean AI will be good medicine for healthcare. AI-powered advances in medical imaging and life science tools are already improving early detection, treatment outcomes, and the development of personalized therapies. On the dietary front, consumers are still under pressure and seeking value from purchases. Food producers with healthier and innovative products should be better protected from not only cost-inflation but also a host of other challenges such as the increasing use of appetite-suppressing GLP-1 drugs and the ‘Make America Healthy Again’ nutritional policies of the Trump administration. The shift towards healthy and sustainable foods benefit upstream ingredient companies, supporting superior growth compared to consumer-facing staples further downstream.

Trump’s healthcare agenda should also drive performance of Pharmacy Benefit Managers (PBMs), managed care networks, Medicaid beneficiaries and vaccines in the first half of 2025. For biopharmaceuticals, antibody-drug conjugates, RNA drugs, radioligand cancer therapy and lipoprotein A for cardiovascular disease will be key points of innovation. Longer term, population growth, higher life expectancies, shifting demographics, rising lifestyle disease burden and the emerging middle class will continue to drive strong demand for healthcare services.

Figure 2 – AI will add a healthy dose of value to key healthcare segments

Left: Generative AI’s annual value add to the pharmaceutical value chain. Source: McKinsey, January 2024.

Right: Radiology dominates FDA’s list of approved AI and Machine Learning enabled medical devices. Source: US FDA, Morgan Stanley, Robeco

4. Circular Economy – stricter laws boost circular producers

A key principle of the circular economy is replacing hazardous substances with non-harmful alternatives and preventing their release into the environment. A recent example is the US FDA’s ban on Red No. 3, a petroleum-based, cancer-causing food and drug dye. Another is the FDA’s recent push to simplify product nutrition labels on food packaging. Both efforts will be key in driving growth among holdings that specialize in naturally non-toxic ingredients for food, pharma and personal care products. We also expect moves from a growing group of food chains dedicated to bio-labels and healthy food alternatives. Moreover, the EU’s newest packaging laws1 will also benefit holdings involved in recycling and biodegradable packaging.

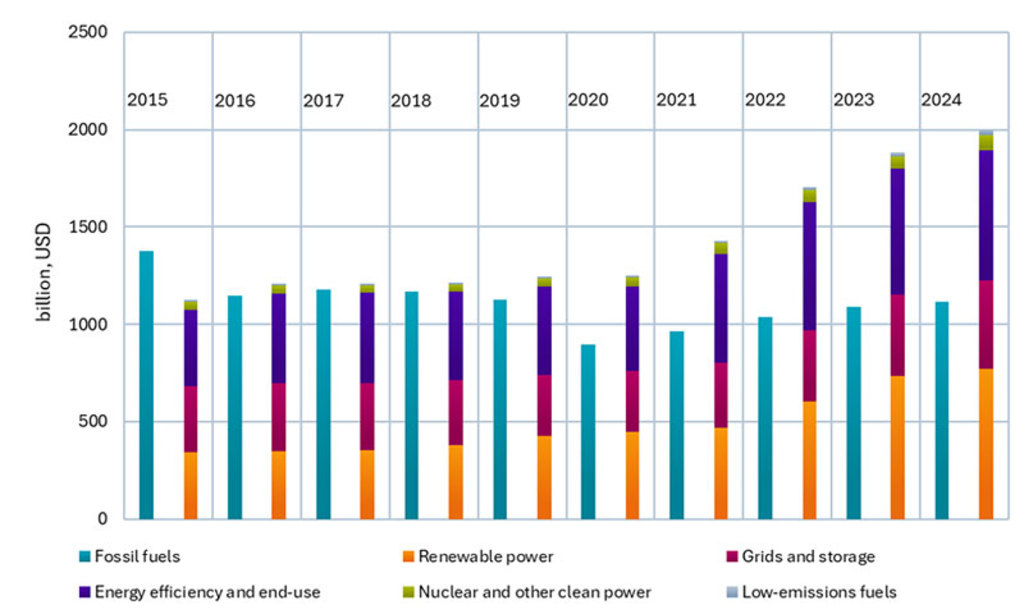

5. Smart grids – the dual solution for rising security and power demands

Global electricity demand is accelerating, highlighting the urgency of expanding infrastructure. The IEA projects that power consumption from data centers, AI, and cryptocurrency could double by 2026. In the near term, renewables, gas, and storage solutions are the best technologies to meet this surge in demand.

Meanwhile, energy security is high on the political agenda, and government incentives for clean energy infrastructure are spurring new construction projects to upgrade energy systems and modernize the grid. Global policy goals include tripling renewable energy and doubling efficiency by 2030. The Inflation Reduction Act supports US efforts, while the EU’s REPower Plan and Green Deal underpin Europe’s energy shift. Though policy risks may challenge offshore wind and higher-cost technologies, increased US protectionism could benefit US solar module manufacturers. Furthermore, growing power demand, driven by data center build-out, favors low-carbon, low-cost electricity developers/utilities.

Figure 3 – Global investments in clean energy are dwarfing fossil fuels

Source: IEA, Robeco, 2024.

6. Mobility – innovation and policies are revving EV markets

In 2024 China’s overall EV penetration rate almost reached 50%. 2 And if battery production levels are any indication, rates could reach as high as 75% in 2025 according to some industry experts.3 In Europe, new fleet CO2 emission standards will get even stricter, catalyzing new EV model launches and uptake from consumers. Consumer uptake and producer profitability will also be aided by the growing use of cheaper lithium iron phosphate (LFP) batteries. In 2025, lithium prices are likely to decline further, creating significant opportunities for smart mobility holdings when demand returns.

Assisted and autonomous driving (ADAS) will likely be a life-changing AI application, and 2025 looks set to be its break-out year as legislation by the UNECE4 could pave the way for rapid global growth in robotaxi services. Meanwhile, the Trump administration may be the catalyst that propels ADAS forward in the US.

7. Water – diverse demand makes the blue liquid an evergreen investment

Water challenges are set to intensify in 2025 as stringent regulations target pollutants like PFAS and biological threats such as algal blooms, bacteria, and viruses. Clean drinking water and micropollutant control remain bipartisan priorities in the US for 2025, positioning advanced water treatment and infrastructure providers for long-term growth.

In addition, the demand for treated water is intensifying from US-based industrial and municipalities, alongside reshoring trends for semiconductors and EVs and other manufacturing sectors. Moreover, growth in water demand among a range of industries (from chip plants and data centers to pharma and healthcare) are driving growth in advanced water testing and analytics, recycling, and wastewater management. Emerging technologies also play a pivotal role. AI applications in data centers are driving demand for efficient cooling systems, often requiring substantial water resources as air cooling becomes less effective.

8. Biodiversity – new laws and practices drive investments

Resource scarcity and degrading ecosystems keep boosting biodiversity on the corporate and political agenda. The EU's Nature Restoration Law, enacted in 2024, sets binding targets to rehabilitate EU ecosystems, benefiting such industries as engineering consultants, construction and forestry. Sustainable practices such as organic farming, agroforestry, and advanced land management should push biodiversity investments that improve soil health, water quality, and carbon sequestration. Treating hazardous waste such as PFAS is another essential aspect of pollution control that should promote biodiversity.

9. Smart materials and manufacturing – converging tailwinds support double-digit growth

Manufacturing capex and construction is growing stronger thanks to Trump’s ‘America first’ industrial policies. Though painful in the short-term, tariffs and trade tensions should accelerate investments in automation and robotics in response to reshoring trends. Anticipated fiscal stimulus should also reignite automation investments in China.

Electrification and automation segments expect robust growth rates in the mid-20% range, further supported by lower interest rates and the re-emergence of M&A activity. Inflationary pressures are expected to moderate in 2025, creating opportunities in commodities and critical minerals as demand stabilizes. Structural trends such as renewable energy adoption and energy independence should drive demand for lithium, copper, and rare earths, while decarbonization policies and financing from the EU Green Deal will provide tailwinds in energy-efficient materials.

Conclusion

The media and markets constantly remind us that AI is the future, sending investors ferociously clamoring for a ‘byte’. From healthcare and e-commerce to manufacturing and mobility, we recognize AI’s transformative potential across the entire economy. Yet, if decades of thematic investing have taught us anything, it’s that innovation doesn’t happen in isolation – regulation, macroeconomics, and resource scarcity are critical to its deployment, adoption and scaling. That’s why we analyze complex technological, political, and market currents to best position our themes to capitalize on the short and long-term growth these changes spawn. Closely navigating themes and impact enables us to shape portfolio returns and our clients the chance to help reshape the future.

Footnotes

1 Packaging and Packaging Waste Regulation (PPWR) of 2024

2 Robeco estimates, 2024.

3 Statements by William Li, CEO of NIO, a China-based EV manufacturer, CnEVPost, December 2024.

4 United Nations Economic Commission for Europe, an international standards-setting board for vehicles

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.