Alternative asset managers primed for growth

We believe listed alternative asset managers are primed for growth with the global savings pool set to surge as an aging global population plans for retirement.

Summary

- An aging global population demands a deeper global savings pool

- Alternative asset managers will be one of the key beneficiaries

- Re-accelerating capital markets flywheel is a catalyst

Alternative asset managers (AAMs) enjoyed rapid growth in assets in the decade to 2020, especially in private equity, but the exit from zero interest rate policies in the US and Europe has prompted slowing asset accumulation and tepid stock market performance in listed AAMs, prompting some skepticism over the future return profile of the whole sub-sector.1

We don’t share that concern. In the short term, we think fund raising is likely to get easier as cash flows recover on a revival in capital markets activity, providing long-awaited openings for monetization. Within the sector itself we believe there is quiet confidence on the outlook for alternative assets. This is confirmed by IPO activity with CVC Capital Partners’ recent successful listing in Amsterdam (April 2024), following stock market debuts by rivals EQT in Stockholm in 2019, and Bridgepoint in London in 2021. Discussions with leading global players also echo this positive outlook with robust flows from pension funds, insurers, sovereign wealth funds and increasingly high net wealth and private banking customers reported. In our view, this leaves a window of opportunity to increase exposure in listed AAMs before any relaxation of US monetary policy provides an obvious catalyst.

In the longer term, we think there is structural strength in the alternative assets sector’s position within the asset management industry, as global demographics increase the total savings pool, and investors look for enhanced returns through diversification.

Aging Finance is one of the key trends we focus on in our New World Financials strategy, alongside Digital Finance and Emerging Finance. The global population is aging and there is a significant savings deficit. With fewer workers and inadequate savings, traditional pay-as-you-go systems for pensions and healthcare are increasingly unsustainable. The World Economic Forum predicts a USD 400 trillion savings gap by 2050 in key economies, including the US, Japan, and the UK, despite their substantial pension funds. We see the asset accumulation needed to fill this gap as a long-term growth opportunity and one of the strongest drivers of the Aging Finance trend. While the life and health insurance sector will be key beneficiaries, especially in emerging economies, we will also see increased demand for asset management solutions that can help manage and deploy the surge in savings that we expect.

Pension funds, sovereign wealth funds, high net wealth individuals and many other (retail) investors are increasingly searching for long-term oriented, high yielding investments with relatively low volatility. AAMs offer a wide range of solutions that fit this profile and can earn high and predictable fee levels, which opens up interesting investment opportunities for us.

Confidence that alternative assets will flourish in the coming decades is reflected within the industry

Alternative assets are in a sweet spot

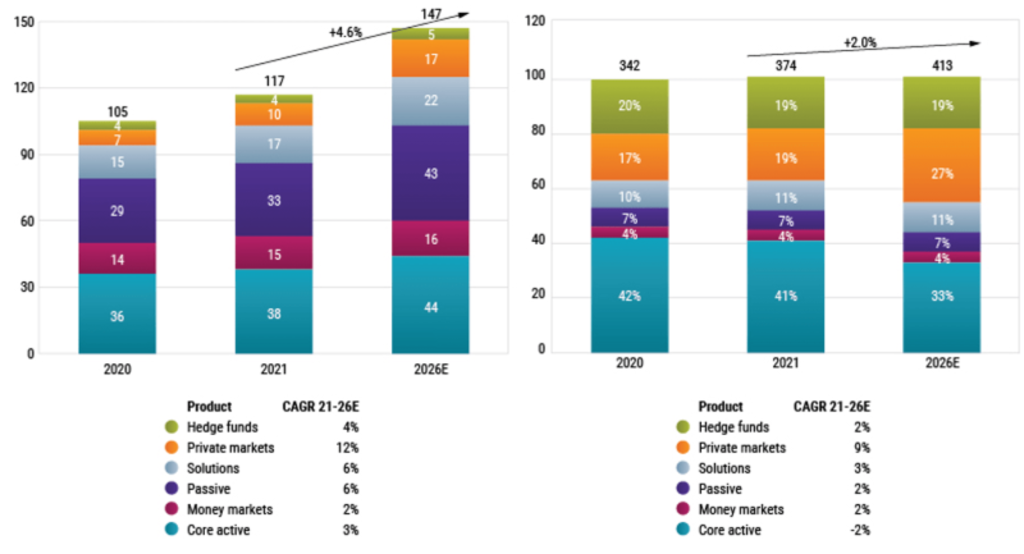

Within traditional asset management we have seen a shift from active to passive investments, alongside pressure on management and distribution fees for both. More recently there have even been some outflows from passive investments, while active asset managers remain in a tough battlefield for market share. In contrast, AAMs have a clearer long-term growth narrative with traditional private equity, alternative credit, infrastructure, long-term capital and green finance all expected to see assets under management rise in the coming years. This is shown in Figure 1, where the private asset category is expected to grow revenues three times (9% CAGR) faster than the next highest growth categories (passive and solutions).

Figure 1: Private assets enjoying rapid growth in AuM (in USD tln) and revenue (in USD bln) CAGR 21-26E

Source: December 2023, Morgan Stanley and Oliver Wyman.

The predictable cashflow streams to match the longer-term nature of liabilities are particularly attractive to pension funds, while other types of investors seek diversification and opportunities unavailable in public markets.

Confidence that alternative assets will flourish in the coming decades is reflected within the industry, with KKR quoting Preqin data at its 2024 investor day estimating that AuM will grow at a 12% annual CAGR to USD 24 trillion by 2028. KKR says investment in infrastructure is a particularly attractive opportunity both to enable the energy transition, the build out of the digital world and more broadly decarbonization. This all means investments in many different infrastructure sectors such as transportation, utilities, energy, digital and industrial. KKR estimates a total of USD 100 tln of infrastructure investments until 2040.

Dry powder across the asset class is high

Another feature of the current landscape is that there is ample cash ready to deploy. Despite subdued capital markets, recent years have seen strong capital raisings at leading managers for credit, infrastructure, and permanent capital vehicles (insurance, private wealth). Firms like Brookfield, Carlyle, KKR, CVC and Ares have had impressive fund raisings in a difficult environment. In the total alternative assets space encompassing buyout funds, private credit, venture capital real estate and infrastructure, Bain & Company estimates2 there is USD 3.9 trillion ready to deploy.

The biggest single portion of this is the uninvested capital pool at buyout funds, which has grown to historic highs with a record USD 1.2 trillion ready to invest at the end of 2023, says Bain. Difficulties exiting have also been manifest, with buyout-backed exits coming in at USD 345 billion globally in 2023 according to Bain, a decade low and a 44% decline from 2022. Meanwhile, interest rates seem to be stuck around the 4-5% levels. However, with an improving capital markets background in 2024 and interest rates likely to fall at some point, the whole industry is looking more interesting. Though with elevated valuations, you need to make clear choices in terms of whom to invest in based on franchise quality, the ability to raise, deploy and exit a fund, and relative valuations.

This is likely to lead to an even more select group of winners emerging among the already small group of around 20 leading alternative asset investors, which includes Blackstone, KKR, Ares, EQT, and Partners Group.

Private credit to benefit as banks suffer Basel 3 squeeze

Next to traditional private equity, private credit is the largest alternative asset category encompassing securitization, leveraged finance, asset-backed finance and commercial real estate. An important factor driving growth is tougher Basel 3 capital rules which are forcing large US banks to set aside more capital. Estimates are for an additional USD 2 of capital for every USD 100 of risk-weighted assets, which means that US banks need to raise equity capital by an estimated 16%.

Private credit can step into the void

This is good news for AAMs specialized in private credit as they can step into the void. They have two main advantages versus banks and insurers: 1) they do not have to hold capital against the credits as they deploy external capital in fund structures; 2) they typically can operate much faster than banks, insurers and loan syndicates, delivering faster and customized solutions to lenders. According to Preqin Pro, private credit will roughly double from 2023 to 2028 (from USD 1.4 trillion to almost USD 3 trillion of assets) while Morgan Stanley estimates that AAMs will take an increasing share in an overall addressable private credit market of USD 32 trillion (with USD 1.4 trillion representing only a 4.4% share today). Macquarie, Intermediate Capital Group, Ares, Apollo and KKR are some of the leading and best positioned players given their breadth and scale of private credit opportunities, deep origination funnels, and access to permanent capital vehicles like insurance company balance sheets

Large AAMs pivot to carry income to compensate talent

We have seen cost pressures to be relatively constant as talent in the alternative asset management sector is, and has been, quite expensive. Significantly, though, the larger asset managers are increasingly paying compensation from carry income. Carry income comes from the revenues originating from the selling of companies at a profit to the original investments made. Many AAMs increased the earnings coming from more highly regarded and rewarded management income by moving a part of the total compensation expense to carry income which is awarded with a significantly lower market multiple. This structural move will underpin higher valuations for leading AAMs in our view. It delivers a larger part of carry income to the investment partners who appreciate carry income more than (equity) investors.

Capital markets are coming to life

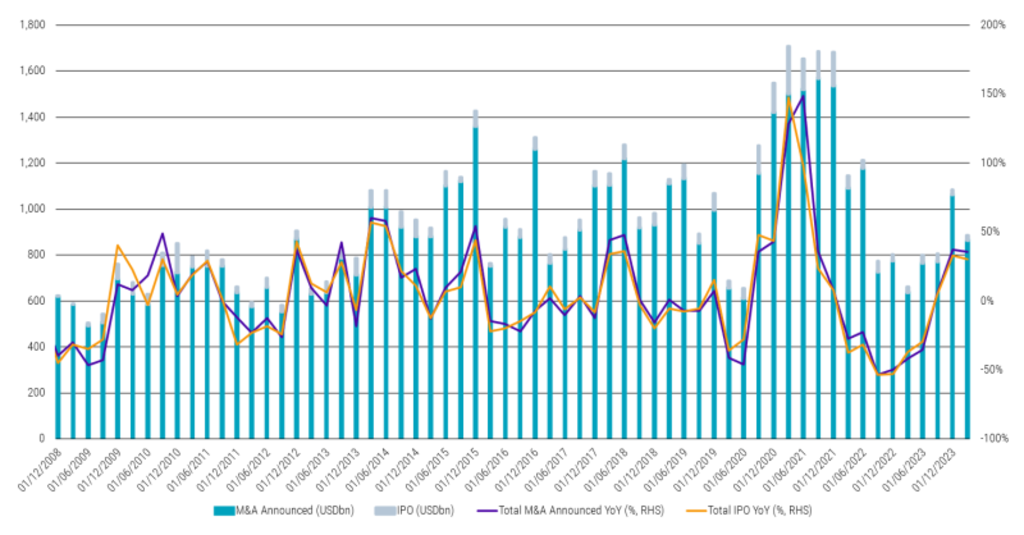

We currently see two developments which are clearly positive for the alternative asset industry. The flywheel of capital markets is starting to spin around with M&A and IPO activity coming back to life after two years of inactivity. M&A activity was up 30% at the end of April compared to the same period in 2023 according to EY.3 This is also evident in Dealogic deal volumes, showing a recovery from early 2023 levels.

Figure 2: M&A activity is recovering

Source: Dealogic, JP Morgan, Robeco, 31 March 2024.

This should help to return capital to investors which is a pre-requisite for raising new funds. Another potential catalyst would be falling longer-term interest rates. The move from zero interest rates to non-zero has surely helped to re-activate markets. Regardless, companies which were lending during the zero interest rate period are facing a debt maturity wall. In private credit, this could lead to problems as, with higher interest rates, companies need more equity to refinance existing loans. Fortunately (private) equity investors have so far been willing to provide additional equity. A clear positive would be if central banks cut interest rates which would also lead to longer-term interest rates declining with reduced inflation expectations. Even more advantageous however would be the move to an upward sloping yield curve, which provides the best backdrop for investing in AAMs as well as life insurers.

Conclusion

Alternative asset management, including private equity, infrastructure investments, private real estate investments and private credit, has strong growth opportunities for both assets under management as well as revenues, as the sustainability of fee levels tends to be very high. Finding the right investments in the AAM space means you need to look at historical track records and valuation, which also involves calculating net present value of current and potential future carry. You need the ability to source new capital, exit existing investments, and, crucially, manage investments to achieve better operational results, as financial engineering is not enough to earn adequate returns. We believe a select group of global AAMs will be able to capture the lion’s share of the total (and growing) available revenue pool, and our New World Financials strategy has been increasing its allocation to this part of the asset management industry in the past 12 months.

Footnotes

1 Is private equity actually worth it? – Financial Times – 5 March, 2024

2 Global Private Equity Report 2024 – Bain & Company

3 “‘There’s money everywhere’: Milken conference-goers look for a dealmaking revival” – Financial Times 10 May, 2024

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.