Why diversity and demographics favor investing in India

Investors looking for growth may start turning to a diverse country with more middle-class consumers than the whole of Europe – India.

Summary

- India’s diversity is reflected in its stock market sectors

- Large and rising middle class is driving consumer spending

- Big themes are formalization, financialization and urbanization

The subcontinent is often overlooked in favor of its higher profile neighbor, China. Yet India offers much more choice in its investible sectors, an increasingly wealthy consumer, and demographics that China can only dream of.

The number of middle-class people with disposable income to spend on an increasing array of consumer goods – the bedrock of any growing economy – is about 350 million, or higher than the entire EU. It was once said that India has almost as many deities as languages (over 100), and such diversity is also reflected in its equity market.

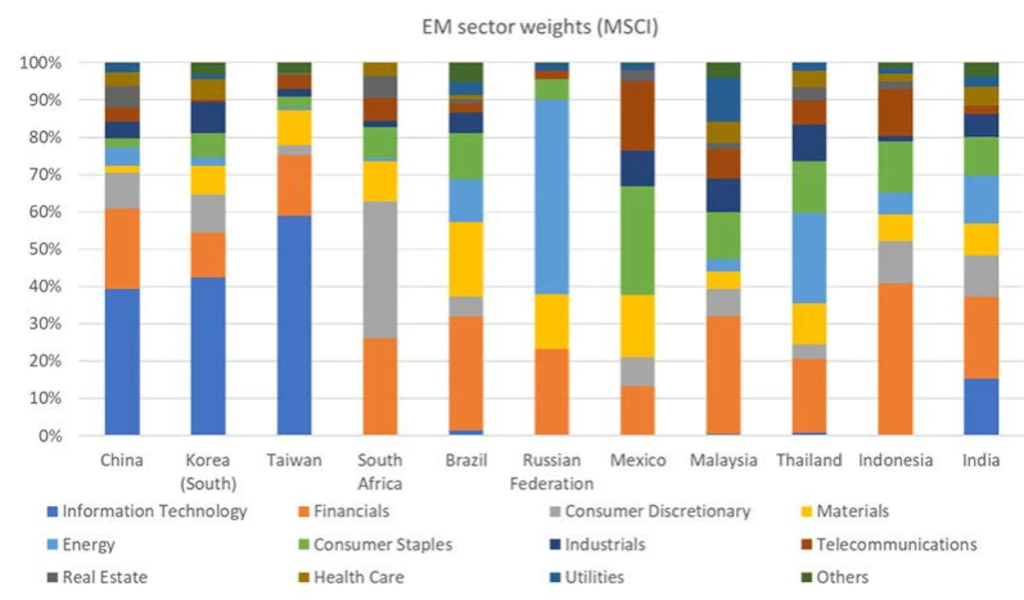

“India is probably the most diversified among all the emerging markets in terms of the number of sectors contributing to the index,” says Nimesh Chandan, portfolio manager of the Robeco Indian Equities strategy.

“Large sectors such as pharmaceuticals, consumer staples and telecoms contribute to index earnings, and these have been relatively immune (or less affected) during the Covid-19 pandemic.”

“That has given comfort to earnings: in fact, in the second quarter, Indian companies outperformed analysts’ earnings expectations by 10 percentage points. So, it seems like we are through the worst of the slowdown induced by the pandemic, and are looking for better opportunities and better times ahead.”

The Indian stock market is far more diversified compared to other emerging markets. Source: MSCI.

As a nation, India is going through three transformations – formalization, financialization and urbanization. This is slowly changing the conventional image of India as a colorful but chaotic melee of small shops selling everything from rice and chickens to wedding attire.

“Formalization is where much of the informal, unorganized sector is yielding market share towards the formal, organized sector,” says Chandan. “It’s also moving from organized smaller local players to larger national players and brands.”

“The market leaders in this organized sector are able to garner better growth. And so, on a bottom-up basis, we would look at market leaders in areas where the economy is getting more formalized.”

Financialization includes everything from the increased use of debit cards and credit cards and online payments to better consumer lending and financing. You will also see penetration of products such as life insurance and general insurance increasing.”

“Urbanization is not just building new towns; it includes everything from going ‘from the street to the high street’, from shops to malls, and installing a much better infrastructure like a typical Western metro city would have, with more and more towns in the country.”

India versus China

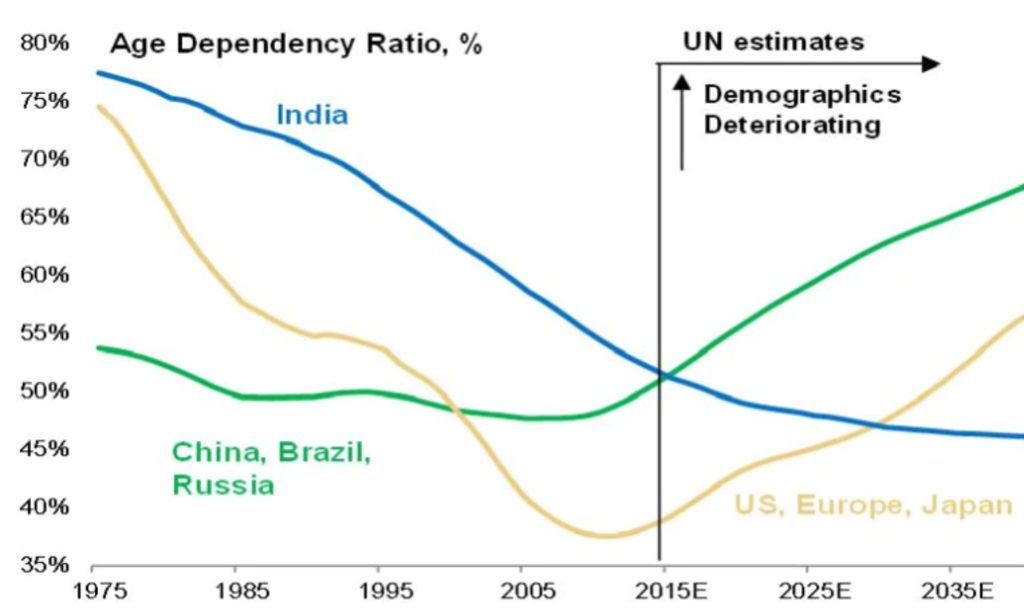

Chandan says comparing India and China is futile: both countries have similar GDP growth rates and total populations, but the underlying demographics, economy and businesses are worlds apart.

Chandan says comparing India and China is futile: both countries have similar GDP growth rates and total populations, but the underlying demographics, economy and businesses are worlds apart.

“India is more services and consumption driven than China,” says Chandan. “India has about two-thirds of its GDP coming from the services segment, and on the expenditure side, two thirds of that comes from private consumption. Typically, private consumption is less volatile than an investment-driven and export-led economy.”

“A decade ago, India had a pyramid in terms of its income distribution, where a large population was at the bottom. That pyramid has now become a diamond, where the largest population is in the middle. This is a population for which you see rising incomes, high aspirations, and now with financing options available to it.”

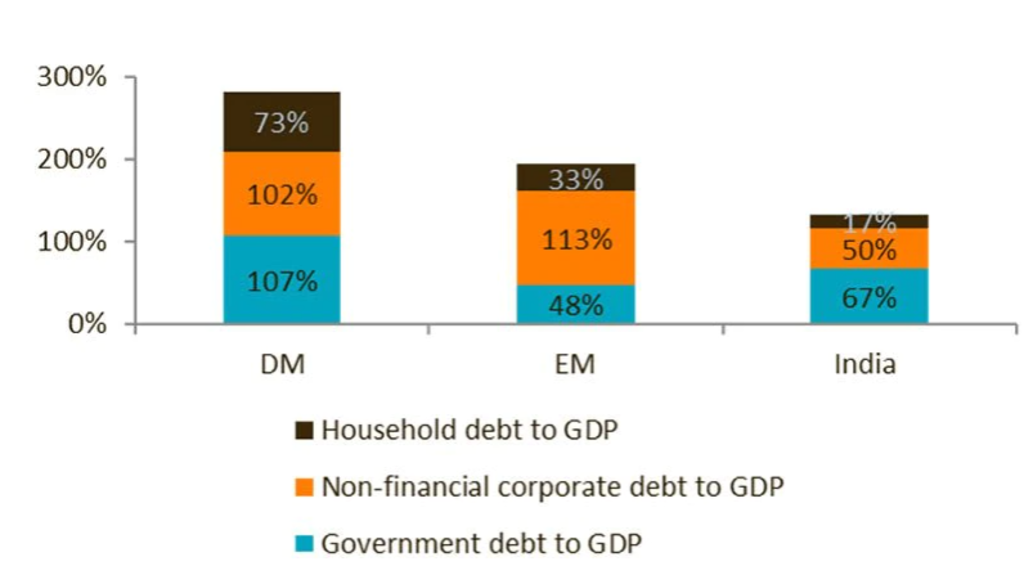

“And one of the important differences is that the Indian government, households and corporates are all relatively less leveraged than in other emerging markets. India is able to generate better growth with limited capital requirements now that things are returning to normal after the pandemic.”

India is much less indebted than developed markets or other emerging markets. Source: MS Research, Bloomberg.

Favorites for the strategy

So, what does the strategy invest in? “Our biggest overweight – and our biggest bullish story for the longer term – is in consumer discretionary,” Chandan says. “Thanks to rising household incomes, more of the household budget is now allocated towards discretionary spending rather than staples. That gives a lot of opportunity for growth in businesses such as quick service restaurants, automobiles, entertainment, and the media.”

“We also favor the large-caps, which provide scale and scalability for investors. We want to offer international investors the best of India, and we have a lot of companies that are large by Indian standards, but are actually mid-caps or small-caps by global standards. The revenue and earnings growth for large caps is much better than for small caps in the world elsewhere. “

It’s a strategy that is proving successful. “We’ve outperformed against the MSCI Index every year for the past 10 years,” says Chandan. “We have a five-star rating by Morningstar and that shows we’ve been able to handle volatility and any drawdowns, as well as capitalize on the upturns in the Indian markets.”

ESG acceptance

A possible tailwind is the negative impression that some investors might have about Indian companies’ record on environmental, social and governance (ESG) disclosures – but things are massively improving, according to Chandan. This is reflected in the ESG performance of the strategy, which is independently monitored.

“We check our investments on an ESG basis and we score well above average – we have a four-star rating in Morningstar on ESG parameters and in most of the internal qualifications, so the strategy stands out as being much better than its peers,” he says.

“Part of this is because for the past seven years or so, we've seen a significant change in the ESG consciousness in the country and at corporates, as well as among Indian investors. We now have several large companies that publish annual sustainability reports and with disclosures that are probably among the best in the world.”

Being on the right path

“The private corporates, while interacting with international investors, have learned the value of being on the right path, and we have seen a lot of large corporates improve their ESG, particularly their environmental awareness.”

“A lot of Indian companies are also either attracting international investors, or they are investing in international businesses themselves. They are therefore conscious about the environmental and social obligations of businesses. They want to be part of this global citizenship, and we can see the results.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.