Thematic equity outlook: Reflecting on the year behind, anticipating the year ahead

In 2023, while general markets experienced upswings, some segments saw declines. Depending on their focus, Robeco’s thematic investment strategies sat in both camps. Despite highs, lows, and plateaus our vision and focus on themes that address enduring problems remains intact. Here we offer some observations on 2023, armed with the wisdom of hindsight, as well as some foresight on the factors likely to impact thematic developments in 2024.

Summary

- Strong growth and resilience make tech the new ‘safe haven’ of stocks

- Sustainability focus give EU stocks strong upside potential in coming decade

- Given their high quality, pure themes are trading at a discount

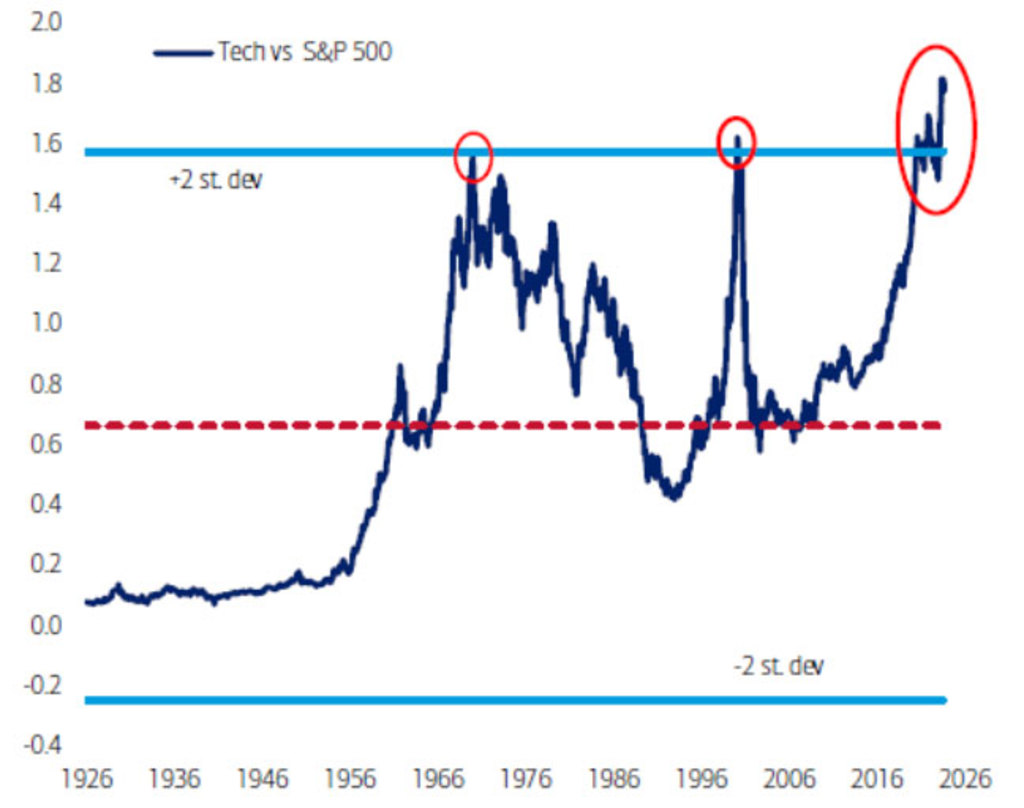

One key observation from 2023 was the strong allocation toward quality-growth factors. We are thematic investors and are therefore somewhat agnostic in terms of deliberate factor positioning. Still, the divergence of performance this year is noteworthy. More specifically, technology stocks in the S&P 500 hit an all-time high in 2023, and again in early 2024. This spectacular performance has been driven by the potential of emerging technologies (AI in particular) to deliver productivity gains in the wider economy. It is also being driven by the perception of tech stocks as a new ‘safe haven’.

Figure 1 – Decades-long soar for tech stocks

Tech stocks are at all-time highs relative to the S&P 500 (in USD). Computer hardware sector index used prior to 1990. Data is monthly.

Source: Bank of America Investment Strategy, Global Financial Data, Bloomberg.

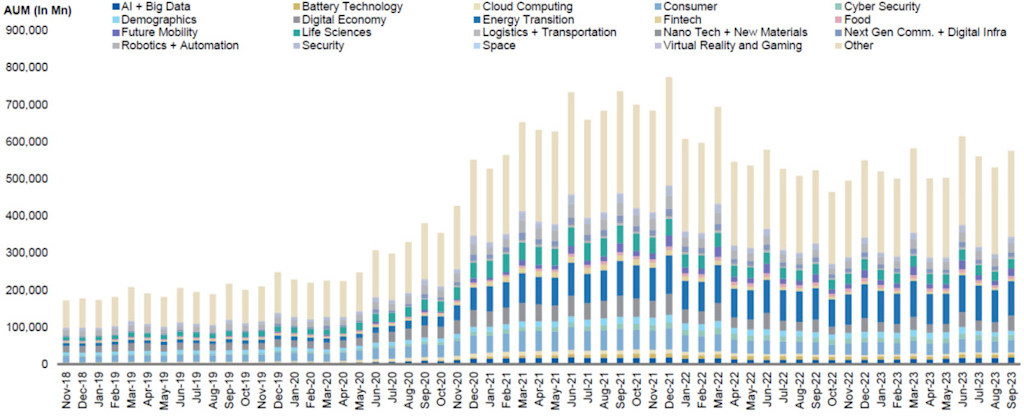

Despite bouts of turbulence, thematic flows have been stabilizing since late 2022, with relatively steady growth around ‘Energy Transition’, ‘Mobility’, and ‘Digital Innovation’ – all key themes with extensive technology exposure that are covered within Robeco’s thematic platform.

Figure 2 – Monthly fund flows by theme over the last five years (2019-2023)

Fund flows measured in AuM from November 2019 to September 2023.

Source: Morningstar, Morgan Stanley Research.

Europe is down but not out

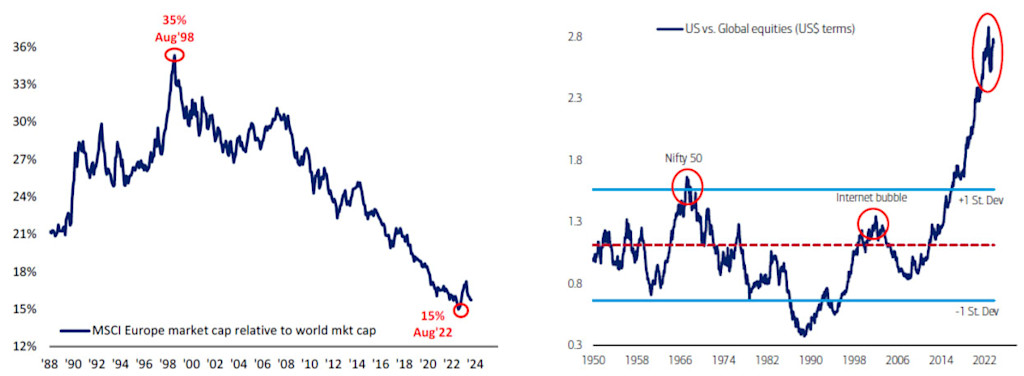

Tech stocks are outperforming at +2 standard deviation above the long-term average (see Figure 1). The same pattern can be observed in the US compared to the rest of the world (driven partly by tech). Europe's global market cap share has decreased from 20% to 15% over the past two decades. Though short on tech, Europe is home to many companies enabling sustainability and nature-based themes with strong upside potential. If Europe as a political and economic unit would be able to form a relevant, neutral block in geopolitics, there would certainly be a long-term valuation premium ascribed to some themes and a reversal of trending declines.

Figure 3 and 4 – Europe’s market cap sinking while tech lifts US to all-time highs

Figure 3: Europe’s share of world market cap near an all-time low. Data is monthly.

Source: Bank of America Global Investment Strategy, MSCI, DataStream.

Figure 4: US versus global equities.

Source: Bank of America Global Investment Strategy, Global Financial Data, Bloomberg.

Promising performance from broad and focused themes

For the past two months ending late January, thematic flows have been trading with no observable pattern. A look at inflows over the past two years reveals that narrowly focused themes had declining inflows. In contrast, broader-based themes, with a more diverse scope of underlying stocks, have bucked the downward trend showing resilient contrarian performance and inflows. A plausible explanation for attenuating flows is that after years of TINA (there is no alternative ‘to equities’), investors now have more attractive low-risk returns elsewhere. Though nothing to write home about a decade ago, returns ranging from 4-5% are definitely an alternative to thematic equities now.

Despite market headwinds, most of our themes outperformed their strategic thematic reference indices.1 Similar to the reference index, almost all of the themes outperformed global equity markets over five- to ten-year time frames. Furthermore, a factor scan of our strategies with a regression over ten years revealed that portfolio management teams do exactly what we (and investors) expect them to do – select the relevant and outperforming stocks within their respective theme.2

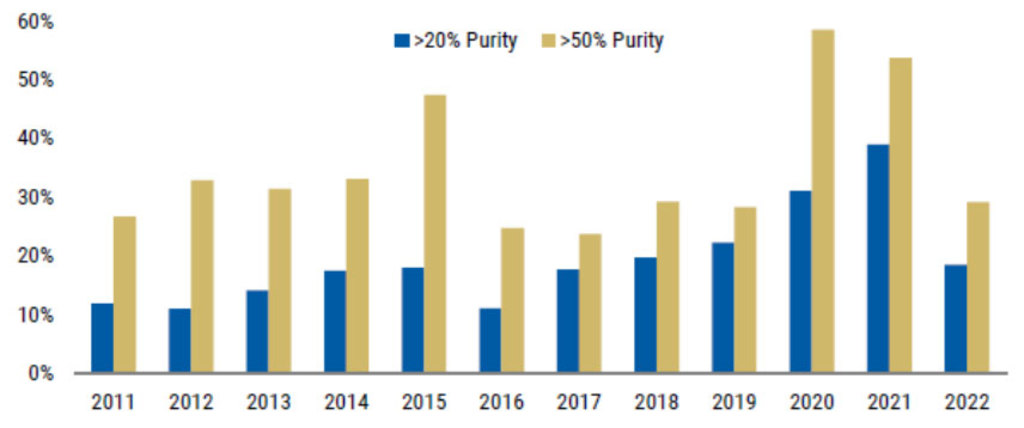

The price of purity

Thematic purity means holding companies whose operations are predominantly within the scope of the chosen theme. For Robeco, thematic purity is critical. It helps guard against themes that are too broadly (or vaguely) defined, making it difficult to form a clear picture of the drivers of growth and areas of risk. Rigorously defining the basket of theme stocks also means an appropriate benchmark can be constructed to more accurately measure performance.

Given our focus on sustainability, maintaining this kind of thematic purity means many of our themes tend to be tilted toward small and mid-cap companies whose business models and growth channels are still tightly targeted and less diluted compared to the diverse services and revenue streams of mega-cap stocks. This kind of purity results in a higher-quality portfolio relative to the general market, that merits a higher price premium. A study by Morgan Stanley found that companies aligned with enduring themes tend to see their stock value increase over time (See Figure 5). Specifically, a 1% rise in revenue linked to a thematic area can lead to an approximate 1.2% increase in the stock's valuation.

Considering their quality, many of our thematic portfolios are currently trading at a discount, providing a good entry point for investors.

Figure 5 – Greater purity, higher valuations

The average valuation upside resulting from thematic purity >20% and >50% company revenue exposure to a theme. Average of 12-month-forward EV/Sales, EV/EBITDA, P/E on 31. Dec of each year.

Source: Thomson, Morgan Stanley Research.

Looking ahead into 2024

We have entered this year with a strong sense of purpose and optimism. We are encouraged by several trends which present significant growth opportunities that our thematic strategies are well-positioned to leverage.

Healthy balance sheets and earnings – From small-cap to mega-cap, companies’ balance sheets are in much better shape, having spent the past 15 years repairing outstanding debt issues. Healthier balance sheets have also been accompanied with positive earnings.

The ‘Magnificent 500’ – 2023 ended with a broad equity market rally that included not just magnificent mega-cap tech stocks but also small and mid-cap companies. The latter have been noticeably absent from past recoveries. It could be that the indiscriminate selling (which also included not only individual stocks but also multi-stock ETFs) has led let to attractive valuations across the board.

Back from the dead – The M&A market is slowly reviving which means valuations of targeted companies (the sellers) are looking more attractive to buyers. We also expect to see more IPOs, given renewed appetite and liquidity in the market.

Themes are as relevant as ever – A healthy consumer (thanks to strong employment), productive companies (generated through technological innovation), supply chain insecurities (intensifying due to geopolitical tensions) and civic changes (nurtured by sustainability concerns) are all contributing to a diverse basket of investment opportunity sets.

Global Consumer Trends D EUR

- performance ytd (31-1)

- -1.66%

- Performance 3y (31-1)

- 9.93%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Dividend Paying (31-1)

- No

Potential bumps in the road

Credit cards as canaries – Credit card debt and delinquencies among US consumers might be a ‘canary in a coal mine,’ signaling consumer troubles down the road.

Bankruptcy bellwether? – Despite better balance sheets, there’s still been an uptick in bankruptcies among US companies. Granted, some are due to the market’s natural cleansing of companies with dubious business and profitability models. But it could also mean pockets of distress among consumers and sector segments.

A lull in logistics – US trucking data is showing a slowdown. Historically, this has been a reliable lead indicator for US economic development.

Susceptible supply chains – Though a headwind for many, supplier dependencies, bottlenecks, price increases and other disruptions clearly demonstrate inefficiencies and insecurities across multiple supply chains. These provide tailwinds for many of our strategies including Smart Energy, Mobility, Sustainable Water, and Smart Materials.

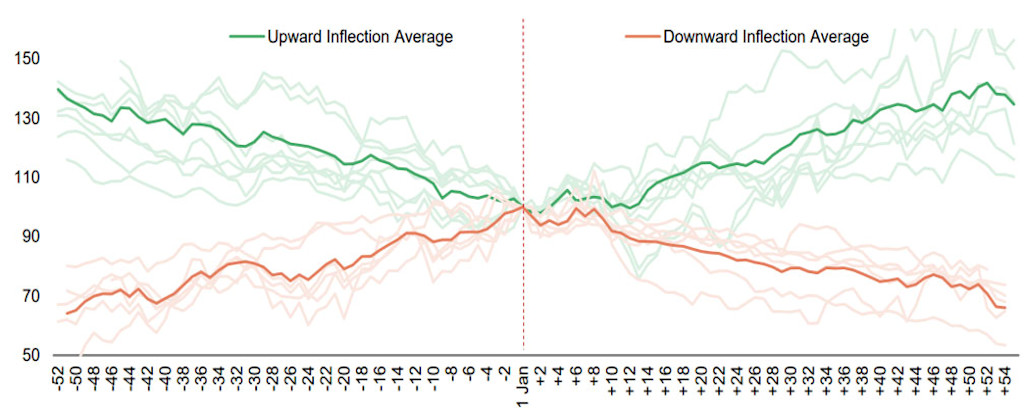

Reversal of fortune

The start of the new year could mark a point of inflection for many thematic strategies. Historical data suggests that the previous year’s more volatile themes often reverse performance early in the following year. In contrast, previously high-performing themes tend to lose steam. On the back of this research, we expect our more tightly targeted environmental strategies, which underperformed general markets, to turn a corner and gain some positive momentum. We also see no signs of stopping companies exposed to themes of obesity, digital innovation, fintech, and broad consumer trends.

Figure 6: Wintertime wonders – January may mark the start of dramatic performance reversals

Source: Bloomberg, Morgan Stanley Research.

Thematic investments remain relevant even after experiencing a recent period of diverging performance across our thematic platform. What defines our approach to thematic investing is a disciplined focus on long-term trends unfolding in business and society. These include sociodemographic shifts, social and environmental sustainability, as well as technological transformations and the pace of change given strengthening geopolitical cross-currents.

We focus on companies enabling and developing solutions which, we believe, create consistent sources of shareholder value for not years but decades to come. Moreover, in our experience, these bigger issues turn out to be hallmarks of innovation and growth as well. What follows is our round-up of the factors that fueled or foiled themes this past year and where we see opportunities unfolding in the year ahead.

Themes to watch in 2024

Changing socio-demographics – shifts in consumer habits and spending provide dynamic yet diversified channels of investment and growth.

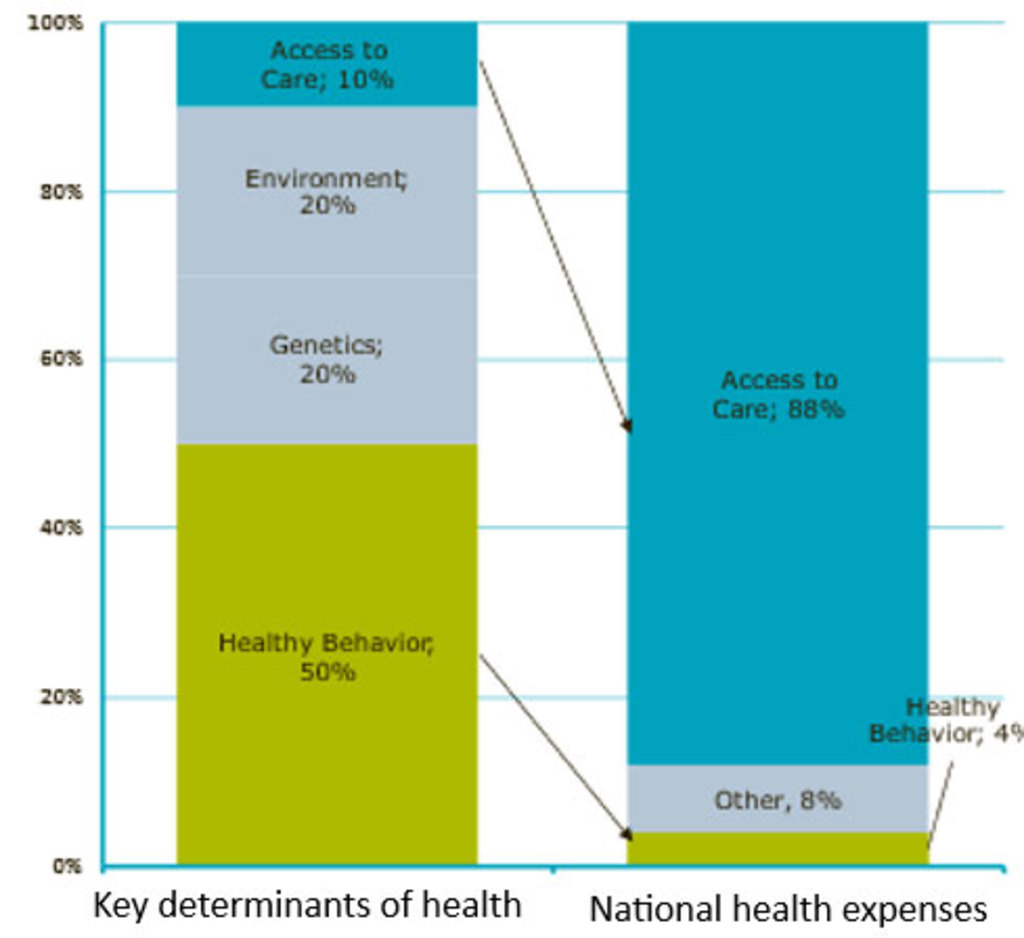

Healthy bodies and healthcare budgets - The Covid pandemic shifted consumer attitudes and awareness on enduring issues from preserving the environment to preserving health. Companies that serve up better nutrition, physical fitness, personal care and hygiene will continue benefit. Meanwhile, a greater cross-generational focus on healthy living is also stoking innovation in early disease protection and prevention; that’s good medicine for inflammatory healthcare costs plaguing society.

Figure 7 – A mismatch in healthcare spending

Investments in healthy lifestyles are key to boosting population health.

Source: Boston Foundation.

Slower sales prompt bargain hunting – Fears of macroeconomic, geopolitical and climate change are crimping the fibers of fashion. In 2023, fashion-focused shopping among consumers in high- and low-end segments diminished in the US, Europe and China. Sales are expected to slow to 2-4% this year, but there are also perks: lower valuations should create attractive stock-picking bargains.

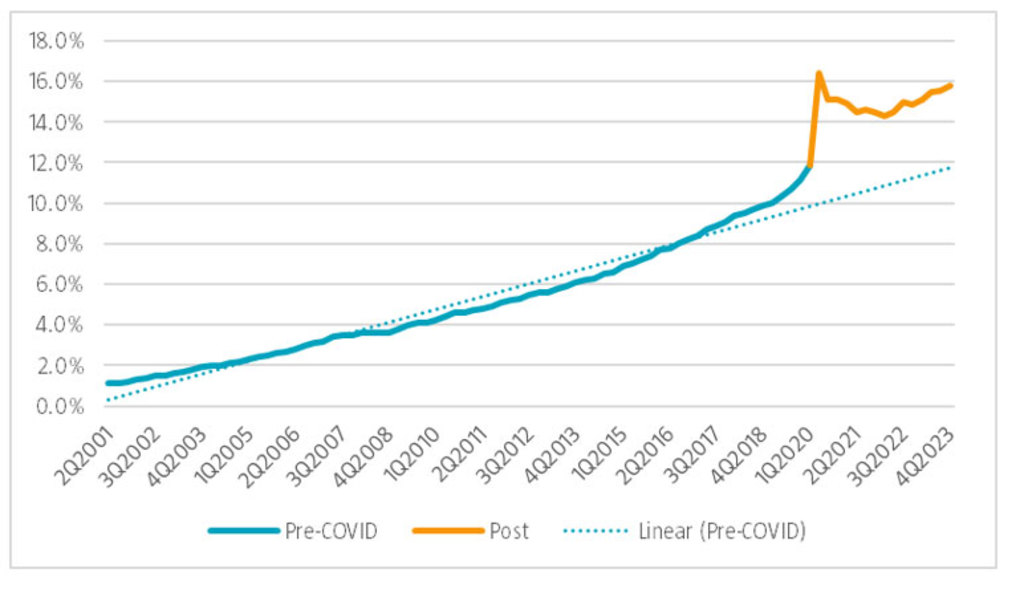

The confident, the resilient and the Magnificent – Despite a wall of worry built on wars, geopolitics, and general uncertainty, consumer confidence and spending in most areas remains resilient. Moderating inflation and low unemployment should carry positive trends forward. But not everyone is elated. Food staples look less appetizing as weight-loss drugs and product-touting media influencers take a bite out of sales. Still, spending on consumer health, cosmetics and personal care remains robust. As their name suggests, the ‘Magnificent 7’ didn’t disappoint. Strong e-commerce and demand for high-performance AI computing make another strong year likely.

Figure 8 – E-commerce sales continue to rise

US e-commerce Sales as a percent of total retail.

Source: US Department of Commerce.

Preserving Earth and its resources – addressing the unprecedented threats of climate change, resource scarcity, and loss of biodiversity create unprecedented opportunities over the long-term.

Sustainable energy production, transmission and storage – Weakening economic headwinds will create better earnings and a smoother ride for cleaner and greener energy investments. Lower inflation, policy supports and technological advancements are working in concert to lift investments in renewable energy producers, smart grid suppliers, electrification as well as power management and long-term storage solutions.

Chips, chargers and China – The electrification of the automotive sector is getting a jolt from peaking interest rates which should lower valuations and provide attractive entry points the automotive supply chain, especially in the US. Key investment targets include semiconductors in powertrains, exposure to China’s EV market as well as the buildout of charging infrastructure.

Materials, manufacturing, and management of waste – Much like energy currents, materials and manufacturing are benefitting from supportive decarbonization policies and net zero transition targets. Meanwhile, continuing focus on resource scarcity, energy efficiency and waste reduction are driving markets for better material composites, factory automation and recycling systems.

Biodiversity benefits from big endorsers – Investing in biodiversity means selecting companies with products and services that protect and restore nature. Along with decarbonization, biodiversity is a key transition theme and the strategy’s constituent holdings are beginning to get the attention they deserve. Companies stand to benefit from consumer, regulatory and rating changes currently under construction in the EU and globally, including COP28 (and its biodiversity counterpart COP 15) as well as a host of other supranational institutions.

More people, politics and pipes – Population growth, urbanization, deteriorating infrastructure, and climate change are buoying investments in water. In the US, stricter regulations coupled with infrastructure investment are boosting the water testing and treatment market. Strong profitability and low valuations make water an attractive sector despite potential turbulence from higher interest rates, volatile elections and China’s property sector pivot.

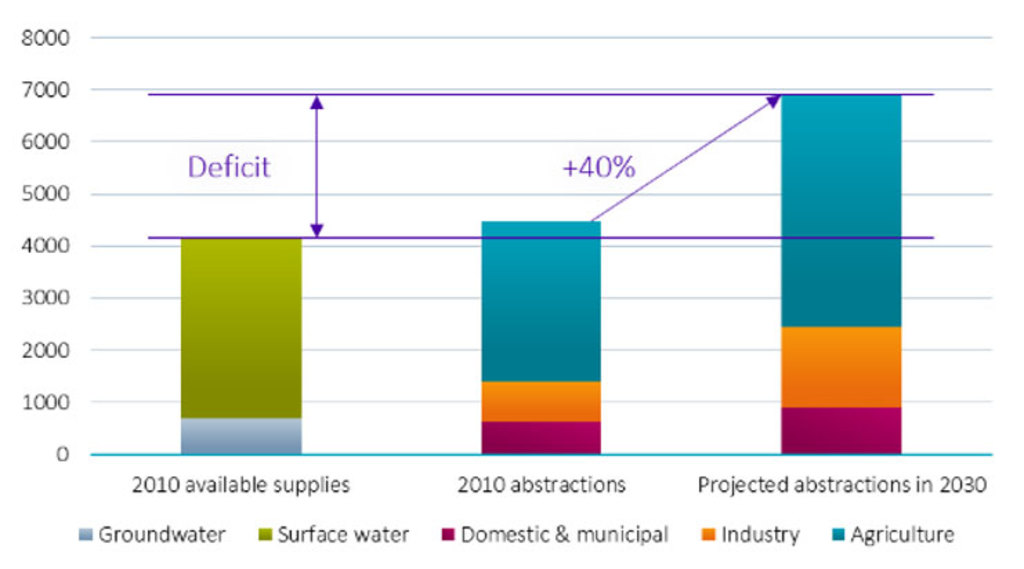

Figure 9 – Water demand continues to outstrip supply

Forecast for global water demand (in billions of cubic meters, m3). Water demand will rise by approximately 40% between 2010 and 2030 (1.7% CAGR). Agriculture accounts for approximately 70% of global water withdrawals (3,100 billion m3). In developing countries, agriculture consumes up to 90% of water, whereas industry is the biggest water consumer in developed countries.

Source: 2030 Global Water Supply and Demand model: agricultural production based on IFPRI IMPACT-water base case.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

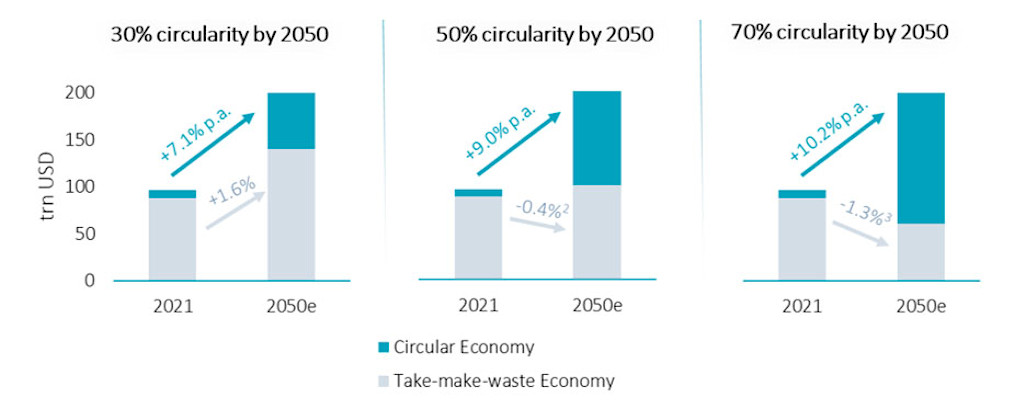

Inflation, normalization and legislation – Despite widespread uncertainty, consumer demand remained remarkably resilient, creating optimism for 2024. Supply-demand normalization after extreme pandemic induced disruptions and a global ‘de-stocking’ of inventories should improve operating margins, earnings and provide room for growth. The looming implementation of the EU Taxonomy should also create long-term tailwinds for companies infusing circularity into product design, logistics, production and end-of-life solutions.

Figure 10 – Circular Economy will outpace GDP growth

Growth of circular aligned part of the economy is expected to outpace overall global GDP growth by at least two to four times.

Source: Robeco; Ellen MacArthur Foundation, Global Circularity Metric (2020); World Bank.

Technological transformation – structural forces and technological innovation are accelerating, disrupting incumbents and creating new players, business models and revenue channels.

AI, clouds, and reshoring – AI dominated headlines in 2023 and its penetration to enterprises and across the economy will continue to gain traction in 2024. Despite its power, AI remains dependent on other enabling technologies including semiconductors, computing hardware, cloud infrastructure and cybersecurity software to name just a few. Last year saw a continuation in robust spending on enterprise-software and cloud-services. The re-shoring of manufacturing is gaining traction, benefitting factory-automation and robotics investments.

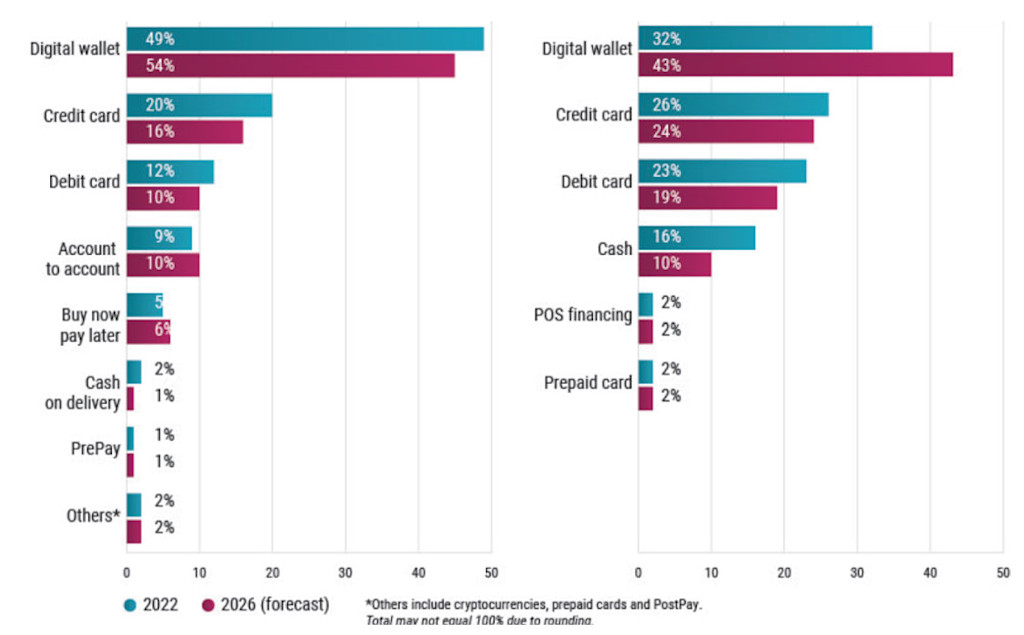

Powering past volatility – Fintech stocks, which include a broad base of companies providing banking, lending, payment, and other financial management services, have witnessed multiple expansion and compression thanks to the meteoric rise in e-commerce, payment apps, and the digitalization of legacy banking. The need for financial inclusion will drive fintech investments in emerging markets. Meanwhile, e-commerce, particularly in combination with ‘Buy now pay later’ models, will be a powerful force for long-term profitability and growth globally.

Figure 11 – Digital wallets will soon be the preferred payment online and in-store

Digital wallets are natural for e-commerce (left graph) but they will also soon dominate payments of physical point of sales (right graph).

Source: WorldPay (FIS), Robeco, April 2023.

Footnotes

1 An internal benchmark comprised of all theme-aligned stocks that form a theme’s investible universe.

2 The factor definitions included volatility, value (factors such as free cash flow or EBITDA), profitability, investments, quality, and size.