The long march of the machines in China

Robotic installations are set to accelerate globally but worries loom over a slowdown in China. Our analysis suggests these fears are overblown.

Summary

- Multiple structural themes driving automation in manufacturing

- Industry sources indicate China’s robotic uptake is approaching a ceiling

- Internal analysis reveals China’s potential much higher than estimates

It is widely acknowledged that industrial automation is the only viable solution for addressing multiple structural shifts in manufacturing globally. Labor shortages are widespread and are hitting not only industries but entire economies. In addition, geopolitical tensions and the global pandemic, have invigorated the push for more resilient supply chains. In response, governments are launching large-scale plans to support strategic (and automation-intensive) industries including semiconductors, solar panels, and batteries. Unsurprisingly, reshoring, nearshoring, and just-in-case production continue to capture headlines as a means for companies to reduce labor costs, time delays and uncertainty across manufacturing supply chains.

Labor shortages, geopolitical tensions and the global pandemic, have invigorated the push for more resilient supply chains

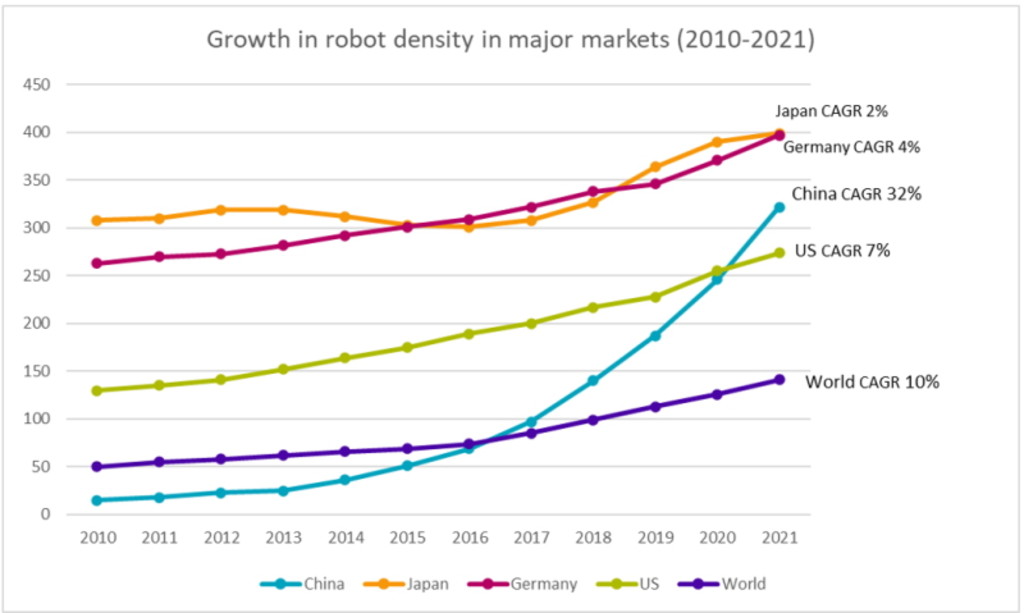

But beyond media headlines, what does empirical data suggest about the demand for industrial automation? According to the International Federation of Robotics (IFR), global robot density, which measures the number of operational industrial robots to the number of workers, has increased over the last decade (2010-2021) at a rate of 10% CAGR. Over the same period, Japan and Germany – established leaders in advanced manufacturing and robotics adoption – experienced only modest growth in robot density. China’s manufacturing sector, on the other hand, underwent a remarkable productivity upgrade, with 2021 robot density expanding 20-fold compared to 2010, surpassing the US and rapidly catching up with Japan and Germany (see Figure 1).

Figure 1: The rise of the robots in China

Note: We exclude the Republic of Korea and Singapore since we believe re-exports are making their robot density data incomparable.

Source: Robeco, IFR

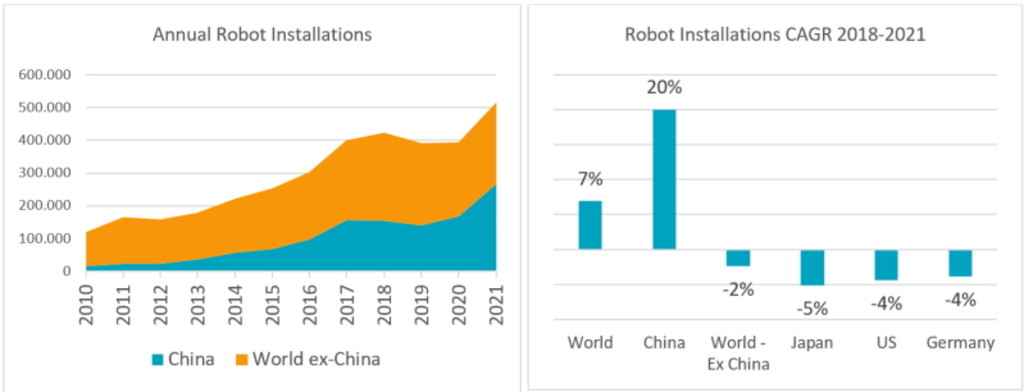

With almost 30% of the world's manufacturing output taking place within its borders, China has earned the reputation of being the world's factory thanks to its vast manufacturing workforce, skilled labor, and exceptional logistics infrastructure. China's shift from labor-intensive sectors to highly specialized and productive sub-sectors has resulted in the country accounting for a whopping 52% of global robot installations in 2021, following a remarkable 30% CAGR in annual installations over the previous decade (see Figure 2a). Since the peak of the previous capex cycle in 2018, installations in the ‘world ex-China’ have decreased by 2% but have surged by 20% in China (see Figure 2b).

Figures 2a and 2b: China’s appetite for robots has outpaced global markets

Source: Robeco, IFR

As Figure 1 shows, China is expected to reach the same level of robot density as Japan and Germany by the end of this year. However, there is no evidence that China could structurally surpass these countries in terms of robot density. Therefore, it would be reasonable to assume that China's demand for automation will eventually plateau, resulting in a global deceleration in demand for automation.

… [robotic] installations in China have surged by 20%

Moreover, it is also likely that reshoring and government interventions, like the IRA, Repower EU, and CHIPS Act, will lead to an increase in robot density in developed markets such as the US and Europe, offsetting China’s declines. Additionally, the ‘China Plus One’ strategy, which involves expanding supply chains to countries beyond China to ensure greater resilience, will push neighboring countries such as India, Vietnam, and Thailand to automate manufacturing. The question is whether these trends if realized, will be enough to compensate for the deceleration of a country driving more than half of global demand.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

China’s potential – grossly underestimated

But don’t discount China just yet. A closer analysis of the numbers shows gross discrepancies between the manufacturing figures shared by global statistical organizations like Eurostat and International Labour Organization (ILO) and those used by the IFR to compute robot density.

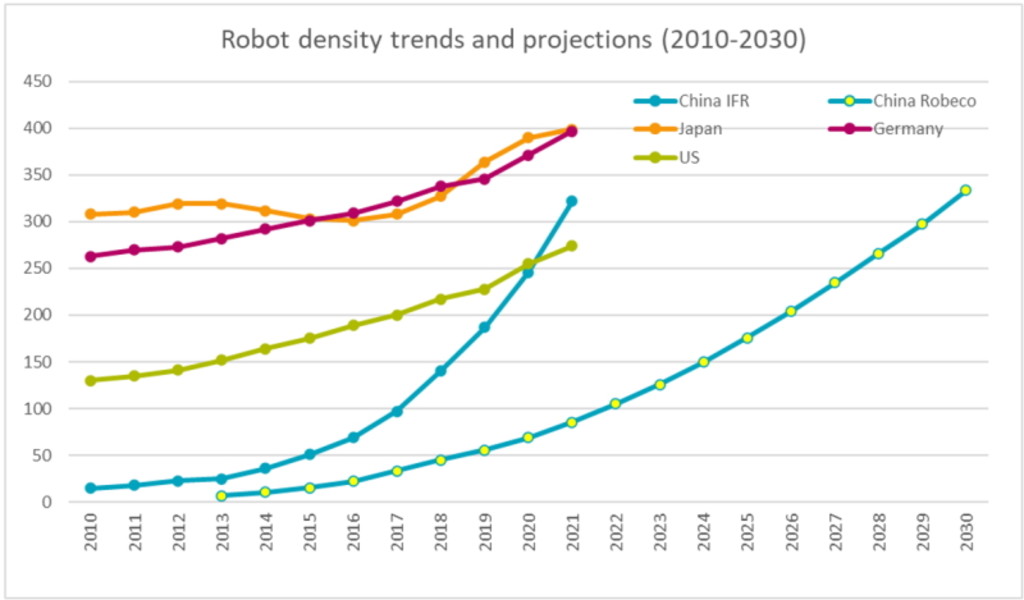

Based on operational stock and robot density figures, the IFR’s implied manufacturing workforce in China is around 40 million versus 140 million computed by the ILO. This means current figures may be underestimating China's actual manufacturing workforce by approximately 70%. Work by the US Bureau of Statistics1 seems to corroborate this assessment. Assuming ILO figures are right, today’s China robotic density would be below 100; by projecting a 10% annual growth rate in robot installations for the next decade, China’s robot density by 2030 would still be below current Japan’s and Germany’s robotic density (see Figure 3).

Figure 3: China has significant room for growth

Source: IFR, Eurostat, ILO, Robeco

Technological advances driving smart manufacturing

With or without China, robots and automation are helping shield manufacturers globally from the labor shortages, wage inflation, and supply chain disruptions that have hamstrung markets in recent years. With integration costs on the decline, customers now enjoy shorter payback periods and a wider array of use cases across sectors, from assembling cars and heavy machinery to more specialized and precision-driven work.

Moreover, robotics technology is making impressive strides thanks to collaborative robots (co-bots) that work alongside humans on increasingly sophisticated tasks. Similarly, AI-powered machine vision and movement algorithms are helping robots expand and optimize their motions further enabling their use in complex and changing environments.

AI-powered machine vision and movement algorithms are helping robots expand and optimize their motions and uses in complex and changing environments

Automation represents a key theme of the RobecoSAM Smart Materials strategy. We invest in smart manufacturing solutions that reduce resource use and waste and increase operational efficiency in supply chains. Robots provide a critical solution for helping manufacturers improve productivity, resilience, safety and profits in the 21st century. Our research suggests that China is still in the early innings of its transition to high-productivity sub-sectors in manufacturing. This, coupled with increased demand in the US, Europe, and emerging Asian countries, gives us more confidence in the prospects for industrial automation in the decade ahead.

Footnotes

1 US Department of Labor, Bureau of Labor Statistics. “Manufacturing Employment in China.” 2005. https://www.bls.gov/opub/mlr/2005/07/art2full.pdf

US Department of Labor, Bureau of Labor Statistics. “China’s manufacturing employment and compensation costs: 2002–06”. 2009. https://www.bls.gov/opub/mlr/2009/04/art3full.pdf