The next frontier in value investing in credits: integrating machine learning

Robeco is pushing the boundaries of value investing by augmenting its existing approach with machine learning (ML) techniques. By leveraging ML, we are able to enhance our assessment of bond valuations, leading to improved risk-adjusted returns for our multi-factor credit portfolios.

Summary

- It is crucial to discern between undervalued bonds and those that are low-priced due to higher risk

- We have enhanced our existing value factor approach by incorporating machine learning techniques

- With ML, we can enhance our assessment of bond valuations and improve risk-adjusted returns

Traditionally, value investing in credits involves identifying undervalued bonds and capitalizing on their eventual price recovery to their fair value. For many years, Robeco has implemented a robust value factor that incorporates relevant risk measures and precise statistical techniques to estimate the fair value of corporate bonds. This value factor has been a key driver of the outperformance of Robeco’s multi-billion Multi-Factor Credits strategy since its inception in 2015.

Value investing in credits revolves around buying undervalued (‘cheap’) bonds and profiting from their subsequent recovery when prices revert back to expected (‘fair’) levels. Bonds can experience temporary misvaluations for many reasons, often related to investor behavior. For instance, when investors overreact to bad news, a bond’s price might drop beyond what the news justifies. Similarly, a bond’s price may decline excessively after a credit rating downgrade, surpassing what its revised rating implies.

However, it is crucial to discern between bonds that are undervalued and those that are low-priced due to higher risk. Avoiding these so-called ‘value traps’ is pivotal for successful value investing. The goal is to sidestep bonds that appear undervalued but are unlikely to rebound to higher price levels.

The academic literature contains various studies on factor investing in corporate bonds and the value factor in particular. A typical academic approach is to assess the extent to which a bond’s valuation is explained by its credit rating and time to maturity. The underlying assumption is that bonds with similar credit ratings and maturities have similar risk profiles, and thus should have similar valuations. Based on this approach, a value strategy aims to buy bonds whose valuations are significantly lower than their expected values. This value-based approach has demonstrated better risk-adjusted returns, as evidenced for example in our academic publication.1

However, this academic approach is not without limitations. Firstly, the bond’s credit rating serves as a decent but not perfect measure of its risk. This is mainly because credit ratings can be slow to adjust to new information, as they are typically updated only a few times per year. Secondly, to determine the extent of undervaluation, the bond’s valuation is compared to bonds with similar credit ratings and maturities using a linear estimation model.

However, the relationship between valuation and these factors is far from linear in reality. This becomes particularly evident for bonds with very high spread levels, where the linear estimation leads to less accurate valuations. Lastly, as the number of risk measures increases, the academic approach struggles to effectively handle interactions between the different risk factors.

Robeco’s approach to value investing

Building on the academic approach to value investing, Robeco developed an enhanced value factor and incorporates it into its multi-factor credit strategies. This enhanced value approach follows the same principle as the academic approach but introduces two important improvements. Firstly, it expands upon the credit rating by incorporating multiple, more accurate, and adaptive risk measures, such as leverage, distance to default, and equity volatility. Secondly, it moves beyond the simplistic ‘straight line approach’ by employing a curved line to estimate the fair value. This improved methodology better captures the non-linear nature of credit spread curves observed by investors in real-world scenarios and enhances the ability to differentiate between truly undervalued bonds from value traps.2

Robeco has successfully implemented this enhanced value approach in its multi-factor credits and high yield strategies. In the flagship Global Multi-Factor Credits strategy, the value factor has consistently been the strongest contributor to its outperformance since its inception. Remarkably, it has even performed well during periods when value strategies in equities have underperformed.3

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Taking things to the next level by integrating machine learning

Although Robeco’s enhanced approach to value has yielded positive results, with up to EUR 5 billion of client assets invested in strategies that utilize this factor, our latest research indicates that there is room for further improvement in fair value assessments, particularly in the higher risk segments of the credit market, such as high yield bonds. In these segments, where absolute spread levels are higher, a more precise approach is necessary to avoid value traps. As a result, following extensive research, we have decided to enhance our existing value approach by incorporating machine learning (ML) techniques, which are better equipped to assess the degree of undervaluation of bonds.

The specific ML technique we will employ, known as regression trees, is designed to better exploit the complex relationships and patterns that exist between the different risk measures we utilize. This enhanced methodology enables us to identify true value opportunities more effectively, leading to a further improvement in risk-adjusted returns. For more detailed technical information regarding the ML techniques we will be applying, please refer to the white paper on this topic.4

Improved risk-adjusted returns

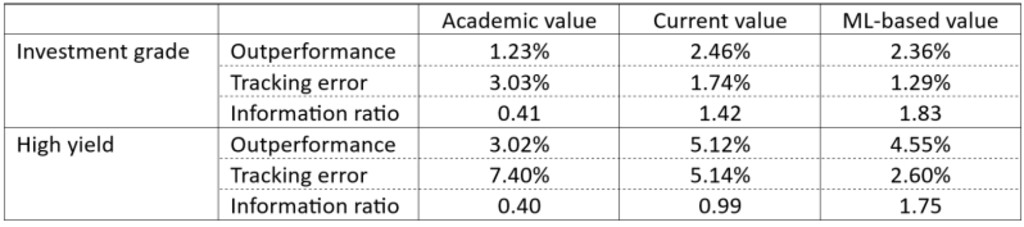

The table below shows the research results for a global universe of corporate bonds over the research period from 1994 to 2022. The table shows the backtested outperformance, active risk (tracking error) and the return-to-risk ratio (information ratio) of the academic approach to value, the current Robeco approach, and the ML-based approach.

The key improvement of the ML-based compared to the current value approach lies in the reduction of active risk (tracking error). ML-based value excels in avoiding value traps within the higher risk segment of the market, resulting in lower exposure to bonds with the highest risk. In investment grade, this active risk reduction is achieved while delivering slightly lower levels of outperformance compared to the current approach. In high yield, although the level of outperformance is lower, the ML-based approach significantly reduces active risk, leading to a substantial improvement in the overall risk-adjusted performance of the strategy, as indicated by the information ratio. This highlights the ML-based value factor’s ability to generate attractive outperformance at a modest level of risk.

Implementation in existing strategies

Robeco’s Multi-Factor Credits, Multi-Factor High Yield, Conservative Credits, and Enhanced Index strategies offer balanced exposure to multiple factors. Value is one of the five factors alongside low-risk, quality, momentum and size. We will now complement the existing value factor with 50% ML-based value. This addition will primarily aim to reduce the risk contribution from the value factor, thereby improving risk-adjusted returns. By integrating ML-based value, the strategy will be better able to distinguish between truly undervalued bonds and value traps, resulting in more refined investment decisions.

Footnotes

1 Houweling & Van Zundert, 2017, “Factor Investing in the Corporate Bond Market”, Financial Analysts Journal.

2 Houweling, Van Zundert, Beekhuizen & Kyosev, 2016, “Smart Credit Investing: The Value Factor”, Robeco white paper.

3 Berkien & Houweling, 2021, “There’s no quant crisis in credits”, Robeco white paper.

4 Messow, ‘t Hoen & Houweling, 2023, “Enhancing the Value factor in Credits with Machine Learning”, Robeco white paper.