Next-generation quant

As technology advances, so do the opportunities for quantitative investors. By incorporating more data and leveraging advanced modelling techniques, we can develop deeper insights and enhance decision-making.

Do you like watching old Asian movies from the 60s and 70s? Perhaps you’re a connoisseur of kung fu or monster movies; popular genres from that era. If you are, and you live in a Western country, those movies would have been translated from their original Chinese or Japanese into a Western language, most likely English.

If so, you may have noticed that when the actors speak, their mouths move for far longer than it took to say the English translation, and you might even have wondered what it was you were missing. Of course, everyone knows that a lot of context and information – actors’ performance, accents, nuances and local culture references – gets lost in translation when a movie is dubbed. But have you ever wondered whether investment information also gets lost in translation?

Natural Language Processing (NLP), an application of artificial intelligence, is a popular tool that is revolutionizing quantitative finance and being applied to many types of texts. However, most NLP tools are developed for texts in English. Since English is not the only language spoken around the world1, a popular approach to process non-English texts is to translate them into English, and then apply English NLP models to the translated texts.

In recent research, Robeco discovered that just like in those old Asian movies, the above-described approach based on translated text also results in some information (alpha) being lost in translation. When a local-language-based NLP model is applied to the local-language text, additional information (alpha) can be revealed and therefore harvested.

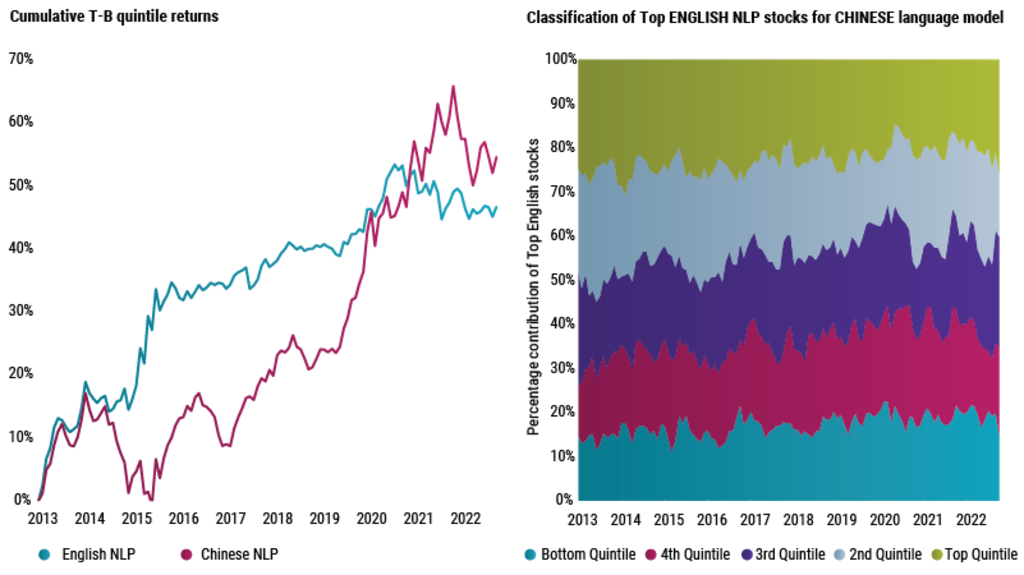

Take, for example, Chinese investment texts. The left-hand chart in Figure 1 shows the performance of factors built from Chinese and English-based NLP engines. The good news is that both are positive, so not all information is lost in translation. However, the right-hand chart in Figure 1 shows that of the top quintile-ranked stocks from the Chinese NLP model, only 50% of which would be classified in the top two quintiles under the English NLP model.

Source: I/B/E/S, Refinitiv, Orbit Financial Technology, Robeco. The left panel of the figure displays the return spread between the top and bottom quintile portfolios based on the NLP sentiment score using the Chinese and the English language. The right panel of the graph displays the similarity in stock classification between the two signals. More specifically, it shows the percentage of top English NLP stocks classified in the corresponding quintiles based on the Chinese language. The investment universe consist of MSCI China A index constituents. The portfolios are equally weighted, rebalanced monthly. The left and right charts illustrate the results for the sample period of January 2013 till December 2022.

This shows that the stocks selected are different because there is no perfect overlap. Like those old Asian movies from the 60s and 70s, information may also be lost in translation. To fully grasp the nuances of a movie’s dialogue, it is worth watching the film in the original language, if possible. And to fully understand what is being communicated in an investment text, it may be worth reading the texts in their original local language.

As technology advances, so do the opportunities for quantitative investors. By incorporating more data and leveraging advanced modelling techniques, we can develop deeper insights and enhance decision-making.

1 English is only spoken natively by 400 million people around the world, or ~5% of the global population.