Secular themes and trends

Determining the right themes while capturing multiple trends to ensure proper diversification and minimize drawdowns.

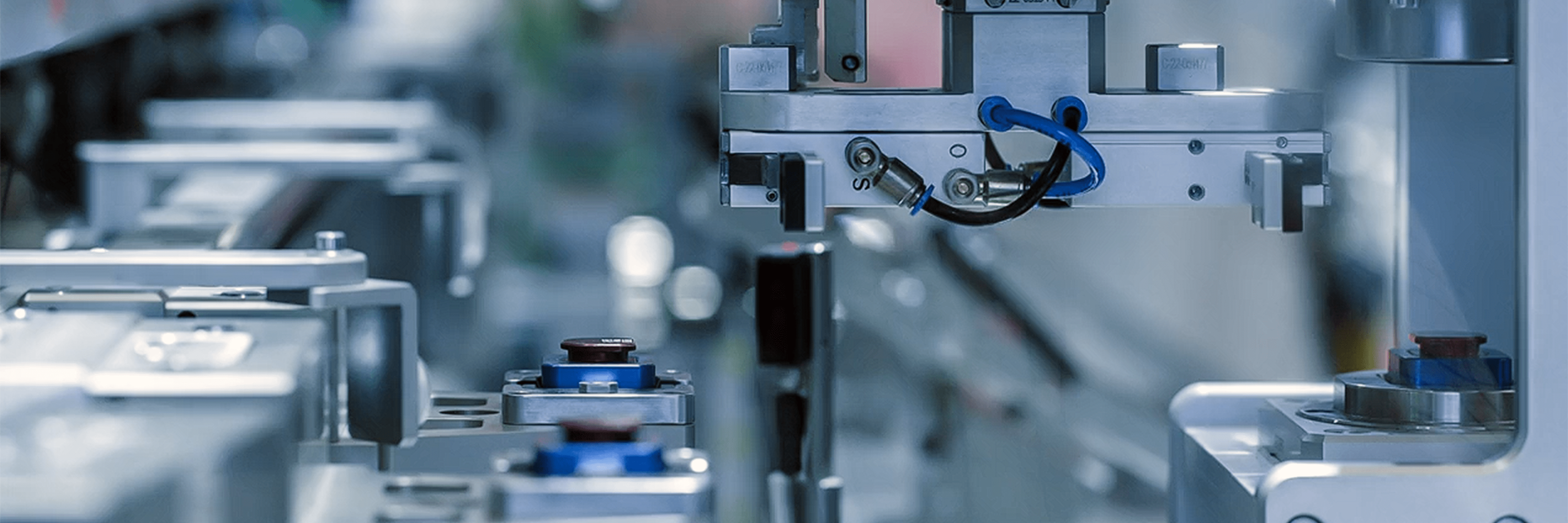

Capture long-term value potential of solutions that address structural change

Focus on the companies that are likely to be long-term structural winners

Capitalize on decades of expertise underpinning forward-looking, high-conviction portfolios

The human brain vastly underestimates the exponential growth of trends and their long-term impact. Yet constant change defines our socioeconomic environment.

Companies benefiting from these structural changes in consumer preferences, technological innovation and governmental regulations possess substantial competitive advantages.

By maximizing exposure to such high-return industries, we can identify and invest in those companies that are likely to be long-term, structural winners.

The Thematic investing team uses a four-step process to select the best stocks for the portfolio:

Determining the right themes while capturing multiple trends to ensure proper diversification and minimize drawdowns.

Identifying companies positioned to benefit from these trends based on fundamental inputs.

Building a short list of quality companies with pure-play exposure that grow their economic profits.

Selecting the strongest convictions within a focused portfolio.

For nearly a quarter century, Robeco has been at the forefront of thematic investing – sensing early on the building under-currents of trends and their powerful potential for reshaping business and society.

Our first thematic product was launched in 1998. Since then, an effective collaboration between Robeco’s in-house investment teams has developed a diverse range of cutting-edge thematic investment strategies.

The breadth and depth of industry knowledge, technical expertise and investment experience in thematic equity and sustainability research helps ensure our thematic equity portfolios are optimized to generate superior returns and align to sustainability goals.

We aim to effectively monetize the value from megatrends shaping the world by investing in companies solving inefficiencies Ralf Oberbannscheidt

Monetizing the growing digitalization for financial institutions and end users.

Balanced approach to structural winners among consumer-oriented companies.

Monetizing growth trends in financial services, aging finance, emerging finance and digital finance.

Capitalizing on the digital transformation of the enterprise side of the economy.

Capitalizing on the electrification and decarbonization of the energy value chain.

Combining innovative materials and process technologies that reduce demand for natural resources.

Monetizing the electrification of the transportation sector, connectivity of cars and autonomous driving.

Investing in infrastructure, equipment and technologies for a clean and safe water supply.

Prevention, effective treatment of chronic diseases and mitigation of rising health care costs.

Monetizing the shift toward less waste and pollution, keeping products and materials in use for longer.

Investing in solutions for a sustainable use of natural resources and restoration of natural habitats.

This strategy is a global equity portfolio that draws from Robeco’s comprehensive thematic range to efficiently capture the upside potential of megatrends while mitigating downside risk.

The thematic strategies incorporate sustainability in the investment process through exclusions, ESG integration, voting and engagement.

Exclusions

The Thematic strategies do not invest in issuers that are in breach of international norms or where activities have been deemed detrimental to society following Robeco's exclusion policy. For some strategies, these exclusions are strengthened by the use of Robeco's internally developed SDG Framework, which avoids companies that have a negative impact on the SDGs.

ESG integration

Robeco systematically integrates ESG factors into our investment activities to make better informed investment decisions. Our ESG integration approach is based on a three-step approach. First, we identify which ESG factors are financially material to the performance of a company. Then, we analyze how the business model is exposed to these factors. And finally, we integrate the impact of the ESG analysis into the valuation assessment.

Some strategies have a sustainability objective and will invest in companies that have a significant thematic alignment, thus contributing positively to achieving sustainability goals.

Voting and engagement

As an active shareholder we aim to exercise our rights and vote at AGMs around the world on behalf of our clients. In addition, we engage via a constructive dialogue with companies to address ESG issues and business strategy. This can encourage them to reduce risks and enhance investment returns.

Under the EU Sustainable Finance Disclosure Regulation all strategies are classified as Article 8 or Article 9.

For over 25 years, Robeco has been a pioneering leader in constructing thematic strategies.

Focusing on companies that cause radical change through innovation

Concentrated portfolio to reflect our highest-conviction stocks

A true understanding of the topic has been in our DNA since the start

Looking to take advantage of long-term, underestimated socioeconomic changes