Having it both ways with long/short investing

Fears that the stock market rally is overdone, or that the US could be heading for an economic downturn, are rekindling interest in long/short investing.

Summary

- S&P 500 valuations are stretched after nearly three years of double-digit gains

- Uncertainty over trade and tariffs worldwide has led to a less certain outlook

- Shorting offers a means of generating returns when share prices fall

Most equity investment strategies are long only, meaning they generate positive returns when the share prices of the companies held in the portfolio rise. Stock prices can go up for a number of reasons, but over the long term the most reliable driver of equity performance has been earnings: when a company’s profits rise, its share price tends to rise with it.

However, sometimes equity values can get ahead of earnings, and after a three-year rally in the S&P 500, some investors are beginning to wonder whether certain parts of the market are now overvalued. That’s especially true of the handful of giant tech firms known as the Magnificent Seven: Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla.

“For more than two years, US equity market performance has been driven by an unusually small number of high-flying tech stocks, the so-called Magnificent Seven,” says Josh Jones, Portfolio Manager of the Robeco Boston Partners Global Long/Short strategy.1 “One result of the S&P 500’s lopsided performance has been the concentration risk the market now carries.”

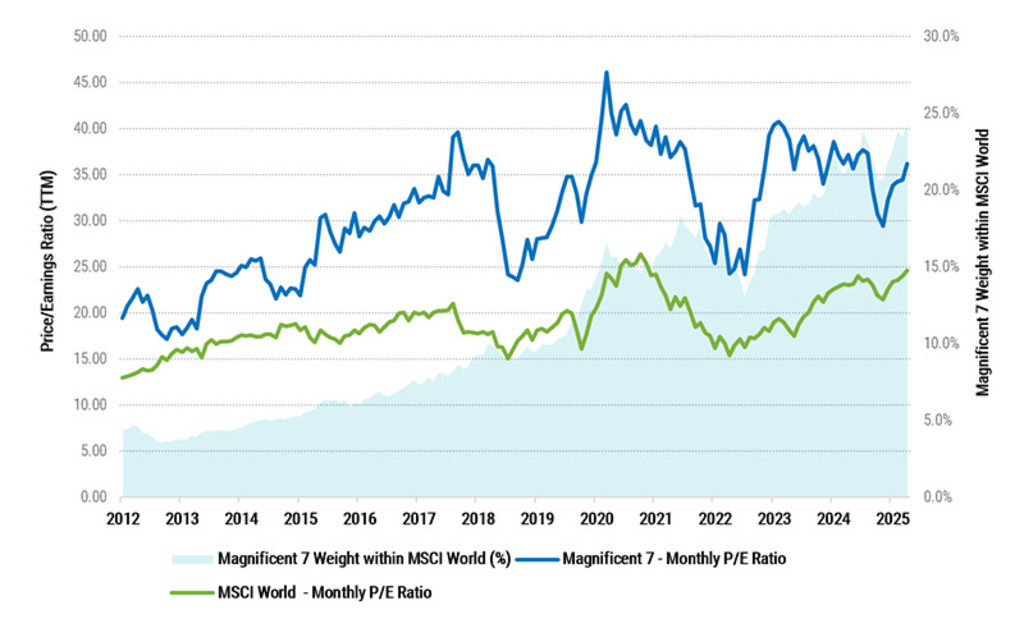

Figure 1: The price/earnings ratios of the Magnificent Seven are much higher than the MSCI World

Past performance is no guarantee of future results. The value of your investments may fluctuate. For illustrative purposes only. Source: Morningstar, 30 September 2025.

“This unusually high concentration risk means a downturn in the tech sector or disappointing earnings results from just a handful of companies would have severe implications for investors – particularly those tracking the S&P 500 or with growth-oriented positions.”

Just how significant are those concentration risks? Today, the Magnificent Seven make up almost 30% of the S&P 500 Index and more than half the Russell 1000 Growth Index. Nvidia recently became the world’s first USD 5 trillion company, and now has a market cap greater than the GDP of Germany.

These risks are also present for global investors. The US currently represents more than 70% of the MSCI World Index, while the Magnificent Seven make up a staggering 25% of the index. Much depends on whether the rally does last much longer.

“With large parts of the market looking fully valued, there isn’t a lot of opportunity in prices to absorb any bad news,” Jones says. “After more than two years of stellar performance in US equities, new cracks are beginning to show in the foundation that’s supported such a rally.”

“The job market in the US has been underwhelming, to say the least, with many companies reluctant to hire, and workers equally hesitant to seek new roles. Inflation, meanwhile, continues to hover around 3%, somewhat higher that the Fed’s stated 2% target.”

“And the housing market – with 30-year mortgage rates north of 6% – is suffering from a dearth of inventory. When taken as a whole, the overall environment in the US has begun to take on signs of the 1970s era of stagflation, the undaunted AI-fueled stock market rally notwithstanding.”

Investors would be wise to ask themselves now whether their portfolios are positioned to endure increased volatility in the markets

Uncertainty outside the US

Outside the US, broad economic conditions are equally uncertain. The European Central Bank cut rates four times in 2025 before pausing in October amid a slight uptick in inflation and steady growth. The central bankers indicated that current policy was appropriate, but that resuming an easing stance could prove necessary should conditions deteriorate.

“Investors would be wise to ask themselves now whether their portfolios are positioned to endure increased volatility in the markets,” Jones says.

Just because certain sectors – or even the market as a whole – appear overvalued, this doesn’t necessarily mean investors need to head for the sidelines, Jones says. The practice of shorting stocks can actually help investors make money when asset prices decline.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

How shorting works

Traditionally, shorting a stock involves borrowing it from a party that already owns it and then selling it on the open market, based on the belief that it can be repurchased later (and returned to its original owner) for less money. The difference between the sale price and the repurchase price represents a profit.

While the basic concept remains the same, in today’s market, there are other ways to achieve the same effect. Purchasing a ‘contract for difference’ (CFD) derivative allows an investor to gain the same exposure that a short sale would allow, without having to go through the actual process of borrowing and then selling a security.

Long/short strategies come in many different styles, but as a rule they can generate a positive return in any of three ways

Three ways to generate returns

When long and short positions are combined in a single portfolio, it creates a number of avenues for generating returns. “Long/short strategies come in many different styles, but as a rule they can generate a positive return in any of three ways,” Jones says.

“The long positions can appreciate; long positions can outperform short positions; and the proceeds from the short sales can be reinvested and earn a positive return themselves, such as by buying high-quality short-term Treasuries.”

How long/short investing works in practice depends on the particulars of the strategy. A market-neutral strategy, for example, tends to hold a 50/50 balance of long and short positions. Other strategies pursue what’s called a long-biased approach, meaning they tend to hold more long positions than short ones.

Different portfolio strategies

As far as how investors work a long/short strategy into their portfolio, there are any number of options. A multi-asset portfolio that typically might be split 60/40, with 60% in equities and 40% bonds, could allocate 10% to a long/short strategy, making the new portfolio either a 60/30/10 or 50/40/10 blend, depending on whether the reallocation comes from stocks or from bonds.

The approach ultimately depends on the investor appetite and perception about the market’s likely direction. But in the end, there’s no ‘wrong’ time to consider adding a long/short strategy to a diversified portfolio, Jones says.

“In just about any environment – even a strong bull market – there are usually opportunities to identify securities that appear overvalued and due for a price correction,” he says. “This is one key way that shorting stocks can add value over time.”

“With a myriad of varieties of long/short strategies available to investors, and multiple ways to implement long/short into a diversified portfolio, we believe investors concerned about the downside risk in equities should be asking how, not whether, to work long/short strategies into their long-term allocations.”

Footnote

1Past performance is no guarantee of future results. The value of your investments may fluctuate. For illustrative purposes only.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.