Charting an informed course to net zero

The road to a net-zero economy will be long, bumpy and disruptive. To navigate the transition’s risks and capture its opportunities, investors need forward-looking metrics. Robeco’s Sector Decarbonization Pathways (SDP) move investors one step closer to the holy grail of climate analytics.

Summary

- Pathways assess the timeliness, credibility and capacity of company emission targets

- Company performance compared to sector peers and science-based benchmarks

- Forward-looking data used to distinguish transition leaders from laggards

Since the Paris Agreement, awareness of climate change has dramatically increased, especially as once-distant risks materialize into increasingly catastrophic events. Hinged between regulatory restrictions and departing customers, companies that don’t act fast enough risk low valuations at best and extinction at worst.

Investors are also exposed. Portfolios with high-emission holdings are subject to transition risks and serious mid- to long-term losses. But simply purging portfolios of carbon-intensive sectors is also not the most effective sustainable investing strategy. Without slashing emissions from high-emitting sectors, the world will never reach net zero. Divestment also deprives investors of opportunities to contribute to the clean and green-focused innovation of companies as they race to decarbonize and participate in the growth and returns their transition will bring.

Acknowledging that holding heavy emitters brings both risks and benefits, Robeco favors a “best-in-sector” approach – identifying companies that are outperforming sector peers in cutting future carbon emissions through 2050. Robeco’s SDP series models and tracks the carbon-cutting performance of companies within sectors in order to distinguish future sector leaders from likely laggards.

Most companies have pledged to cut emissions, yet fulfilling those commitments in a credible and timely manner is a whole other mountain. Complicating matters further, for some sectors decarbonization performance is largely tied to reductions in Scope 3 emissions (emissions from consumer use rather than product manufacturing). That’s a game changer as until now even Big Oil could score relatively well on environmental footprint metrics based on (largely operational) Scope 1 and 2 emissions data.

Though models differ slightly based on sector-specific factors, their essential features include: a decarbonization performance assessment that charts a company’s emission reductions trajectory and a financial assessment that measures a company’s operational and financial capacity to meet decarbonization targets, as well as analyses on the financial impact of regulatory mandates.

The SDP methodology

Guided by climate and emissions scenarios from the world’s foremost climate-science authorities, SI researchers construct a company’s decarbonization pathway through 2050 using backward and forward-looking emissions data1 (company-disclosed and projected estimates). Companies’ decarbonization pathways are then compared with scientifically modelled, sector-specific benchmark trajectories as well as sector peers to evaluate which companies are most closely aligned. Decarbonization scores are then assigned to each company according to their degree of alignment. The closer the alignment, the better the score. Timing also matters; emission reductions in the short and mid-term count more than those in the long-term, meaning that the scores of companies planning to cut emission intensities earlier rather than later will be higher.

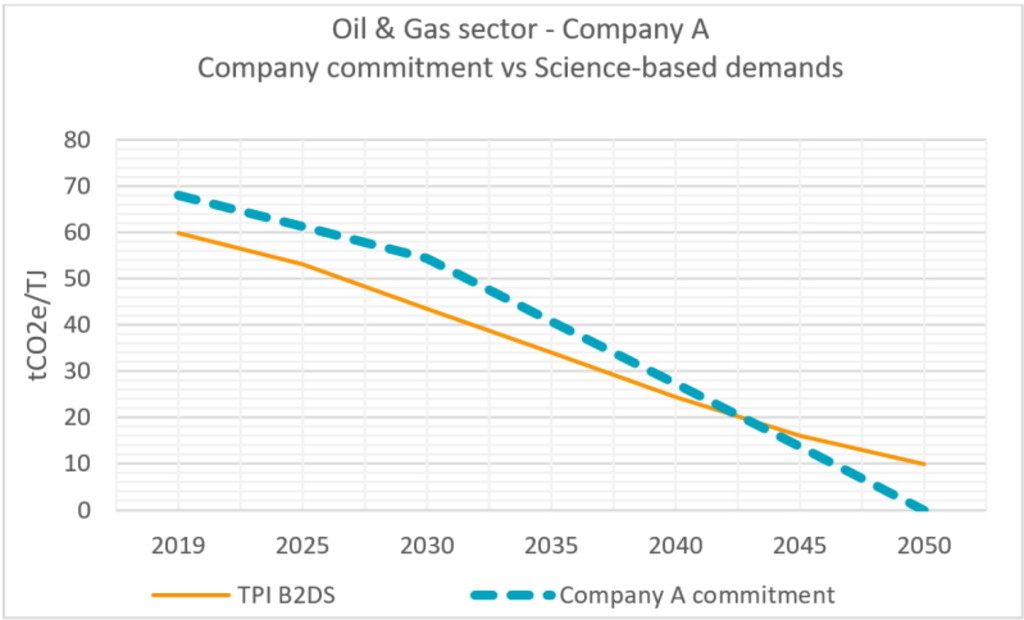

Figure 1 | Comparing an O&G company’s commitments with science-backed targets

Source: Robeco model as of December 2022

The blue dotted line indicates Company A’s Commitment Pathway based on its planned emission reduction disclosures. The orange line indicates the scientifically modelled benchmark for the oil and gas sector in order to keep global temperatures below 2 °C by 2050 (the TPI Below 2 °C Pathway (or TPI B2DS). The closer the alignment between pathways, the better a company’s decarbonization score.2

True leadership, however, demands plans that are both ambitious and credible. To measure credibility, SI analysts calculate the required level of investment (both capital and operational expenditures) needed to achieve the company’s disclosed decarbonization pathway and compare those to the company’s current and projected capex investments into carbon abatement technologies (e.g., battery electric vehicle production for the automotive sector, clean and renewable energy generation for oil and gas). Severe shortfalls in capex spending cast doubt on a company’s intention or even ability to cut future emissions and reach its own or regulatory emission targets.

Finally, the model assesses the financial impact of regulatory fines, stranded assets and demand reduction – critical threats for carbon-intensive industries. Though insignificant at present, the financial impact of fines on revenues (and valuations) will intensify as regulations are tightened and the reputations of lagging companies are damaged.

But for oil and gas companies in particular, fines will be negligible compared to revenue loss from drastically reduced demand, as governments unleash a blitzkrieg on heavy emitters in order to make good on net-zero pledges. A critical feature of the O&G SDP is that it captures the economic impact of reduced demand and write-downs on capital assets (e.g., plants, property and equipment) on future enterprise value.

Portfolio impact

SDP models allows Robeco to pinpoint where companies are in the transition and where they are most likely to be in the decades ahead. As a result, we can better anticipate future emissions performance against sector peers, estimate future cash flows, and more accurately calculate the fair value and risk-return potential of stocks and bond issues. And with automation, SDP models enable analysts to construct and assess the short-, mid- and long-term decarbonization performance of thousands of companies across product universes and asset classes.

Moreover, the SDP assessment’s granular analysis provides our engagement specialists with objective, specific and quantified data on a companies’ decarbonization performance relative to peers – powerful ammunition for prioritizing, driving, and accelerating engagement activities among slow movers.

Pathways have been constructed for the economy’s most carbon-intensive sectors including oil and gas, automotive, meat production, cement and aluminum manufacturing, real estate and power generation. The SDPs are the latest in Robeco’s pioneering innovations that continue to advance sustainable investing and achieve real-world impact through objective data, rigorous analysis and consistent frameworks.

Footnotes

1 More specifically, in order to account for differences in company size and future growth, analysts measure reductions in CO2-emission intensities rather than absolute CO2 emissions.

2 The Transition Pathway Initiative (TPI) Below 2°C Benchmark Pathway was recently updated with new emission targets from the IEA as a result of the increased carbon output related to the energy crisis. While changes have not been reflected in the current graphic, they have been incorporated into Robeco’s O&G sector’s decarbonization pathway model for use by internal experts and investment teams.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.