Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.

Climate change is the problem, net zero is the goal, and decarbonization is the means. But are there obstacles blocking the road ahead? Masja Zandbergen, Robeco’s Head of Sustainability Integration, explains the caveats and challenges that may trip up investors in their quest to decarbonize portfolios and contribute to the net zero transition.

“Put simply, it is reducing the carbon intensity of the portfolio by including companies with low emissions or which have made credible commitments to reduce their emissions. Similar to a portfolio’s financial performance, progress in this area requires continuous measurement against a reference point. Otherwise, the informational value of reported emissions is low. That reference could be the overall market, such as the emissions performance of a global index, or an internal standard such as a point in time from which a portfolio’s year-on-year progress is measured. The emissions amount is irrelevant; what matters is that you start to measure.”

“It would be if company-reported data were complete, but the bulk of emissions generated is excluded from this, so true emissions performance is underestimated. Currently, companies report and investors measure emissions from production processes (Scope 1) and the electricity used to power those processes (Scope 2). But they don’t report emissions generated further along in the supply chain by a product’s consumers. Oil and gas producers have a high carbon footprint in the production phase, but that’s still only 20% of total emissions. The other 80% is generated when the oil is burned by customers (Scope 3).”

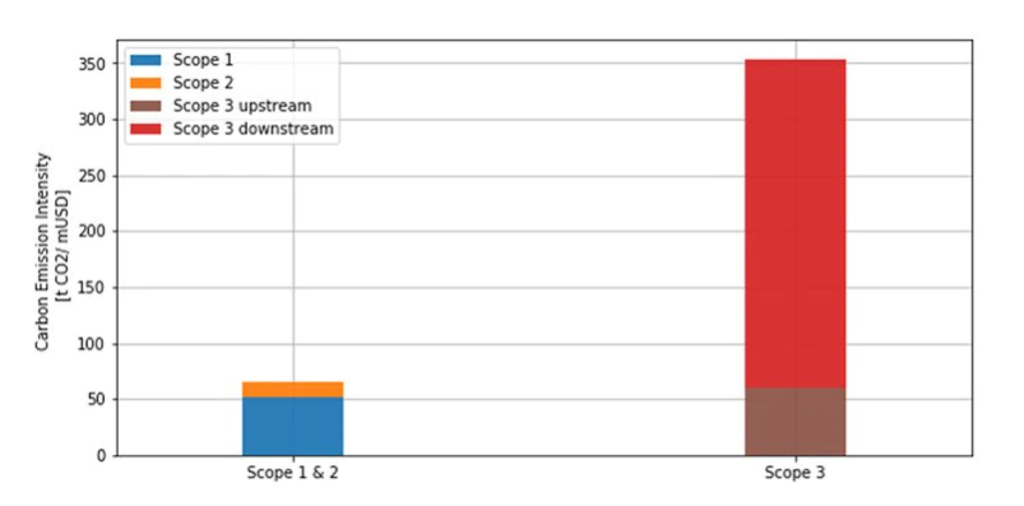

“Oil and gas companies aren’t alone; economy-wide scope 3 emissions are underestimated. Many food companies, for example, have comparatively low operational footprints upstream, yet hefty unaccounted emissions from things such as deforestation and fertilizers in other parts of their supply chains. Comprehensive supply chain data is not yet calculated, publicly disclosed or considered by most investors (see Figure 1).”

Source: Robeco, Trucost

The graphic shows the annual weighted average carbon intensity (WACI) of constituents of the MSCI All World AC. Constituent emissions data are based on average annual emissions reported by companies for 2019. WACI measures the carbon intensity (Scope 1 + 2 + 3 emissions / enterprise value including cash in millions USD) for each portfolio company multiplied by its portfolio weight.

“It can lead to the emissions of some companies and sectors being underestimated or overestimated. Many ‘green and clean’ solution providers have paradoxically high carbon emissions if you only take backward-looking emissions into account. For example, wind turbine operators, electric vehicle makers and hydrogen producers, are all clean technologies but their carbon-reducing benefits lie in the consumer use phase further down the supply chain. Given they may need steel for parts or use electricity from a carbon-intensive regional power grid, their Scope 1 and 2 emissions may still be high. That means their decarbonization potential is not being fully realized in portfolios. Predictive power is needed to combat this effect.”

“Our most advanced decarbonization strategies take Scope 3 emissions into account. For other strategies, we use proprietary estimation techniques and third-party modelling to derive best case estimates of future emissions. This involves mapping out net zero transition pathways for sectors based on available or near-term technologies. Besides Scope 3 emissions, we incorporate other types of forward-looking data to help predict companies’ climate preparedness and future climate-adjusted performance. Which companies have strategic plans that incentivize a shift to low-carbon technologies and business models? How are they expected to benefit and profit from the net zero transition? Which are financially strong enough to make the capital investments needed to transition?”

“The ultimate goal is to ensure client portfolios are climate proof by reducing their exposure to carbon risk and ensuring they are climate-ready. This is a much more complex responsibility, involving many more considerations than how a portfolio measures up against a benchmark in terms of emission reductions.”

“ESG integration brings more information across a wide range of risk factors; social, economic, governance and environmental. This can be combined with financial analysis to more accurately assess future risks, evaluate financial performance and make better-informed investment decisions.”

“Decarbonization, on the other hand, is often done to reduce climate risks as well as to combat climate change. An investor’s decision to decarbonize their portfolio is not always based on purely financial objectives. Often, it is motivated by a desire to invest in companies that are making positive impact by not contributing to climate change and environmental damage.”

“The economy grows where capital flows, so channeling capital towards companies with strong carbon reduction momentum and away from laggers accelerates the transition to a carbon-free global economy. That said, selling the securities of a high carbon emitting company has no immediate effect on the real economy. Real world impact requires large pools of investors to ‘vote with their feet’ by refusing to own securities of heavy polluters. This will ultimately raise their financing costs and expedite change.”

“However, there are caveats to this approach. For one, denying financing will hurt many companies that want to transition but need capital to do it. In addition, some heavy polluters are so cash-flow rich, they don’t need new capital. In the latter case, financing boycotts may have little effect. But even cash-rich companies care about their reputations, so if investors position their portfolios away from these companies, it sends an amplified, high-alert message to company management.”

“Investors must also use active engagement and voting as a tool to exert their influence over company management. Given that carbon emissions are spread across entire economies and require major structural changes, engagement needs to take place not just with the company but also at the country level. Robeco has recently started engaging with country leaders to help them understand the aggregate effects of conflicting carbon policies at the national level. It is counterproductive to force some industries to decarbonize while allowing others to cut down forests or to offer protective subsidies to heavy carbon polluters. Country leaders must also understand that national decarbonization policies will impact their ability to attract global businesses, foreign investments and financing via sovereign bonds.”

Join our newsletter to explore the trends shaping SI.

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.