The origin of the SDGs

The Sustainable Development Goals (SDGs) are 17 objectives for improving human society, ecological sustainability and the quality of life launched by the UN in 2015. They cover a broad spectrum of sustainability topics, ranging from eliminating hunger and combating climate change to promoting responsible consumption and making cities more sustainable.

All 193 countries – no matter how rich or poor – have agreed to work toward achieving the 17 SDGs by 2030, thereby establishing a 15-year timeframe for progress. The goals are part of ‘Transforming our World: the 2030 Agenda for Sustainable Development’ and are branded by the UN as “a blueprint to achieve a better and more sustainable future for all.”

The SDGs succeed the Millennium Development Goals (MDGs), eight objectives launched in 2000. They included a commitment to eradicate extreme poverty and hunger, achieve universal primary education, and combat HIV/AIDS. Developed from 2012 using a global consultation period in which more than one million people gave their inputs, the SDGs are much broader in scope – and they apply to all countries, not just those earmarked as ‘developing’.

Figure 1: The UN’s Sustainable Development Goals

Source: United Nations

The goals themselves

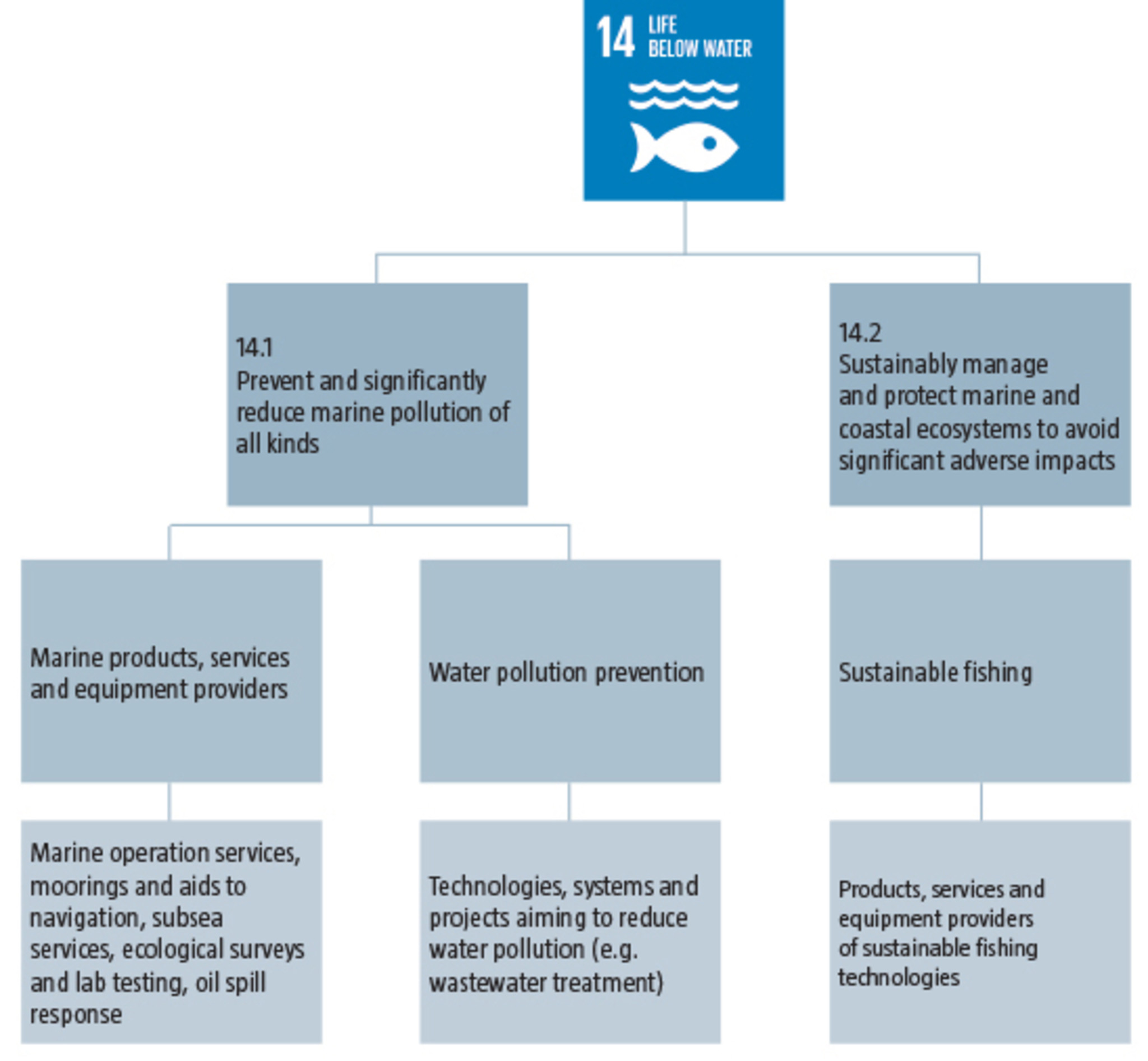

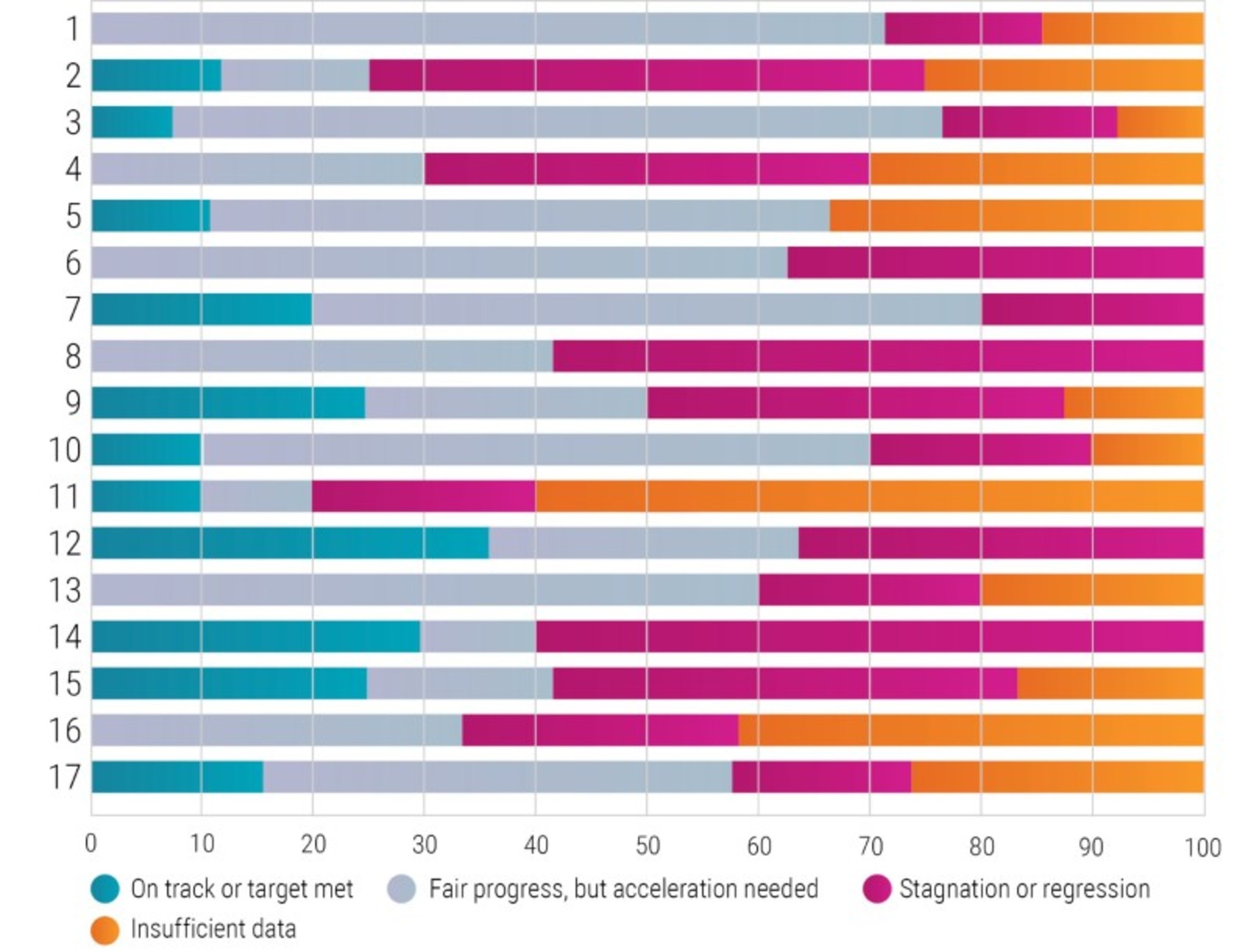

The 17 goals have 169 underlying targets and 232 approved indicators, which are used to track progress toward achieving them. For example, the targets for SDG 3 (Good health and well-being) aim to end premature mortality, halt the spread of communicable diseases such as malaria and HIV/AIDS, and promote the attainment of affordable universal health coverage. The indicators measure factors such as a country’s child mortality rate, the number of new malarial or HIV infections, and the number of people covered by health insurance.

In terms of tangible investing, health care companies can contribute to SDG 3 by developing drugs that combat certain diseases, or by improving people’s access to affordable medicines. Conversely, some companies may negatively contribute to the SDGs by producing harmful products such as tobacco or firearms.

Aside from benefiting the under-served, it’s also a massive business opportunity and a means of job creation. One estimate predicted as much as USD 12 trillion of market opportunities per year and 380 million new jobs, particularly in projects related to combating climate change.1,2

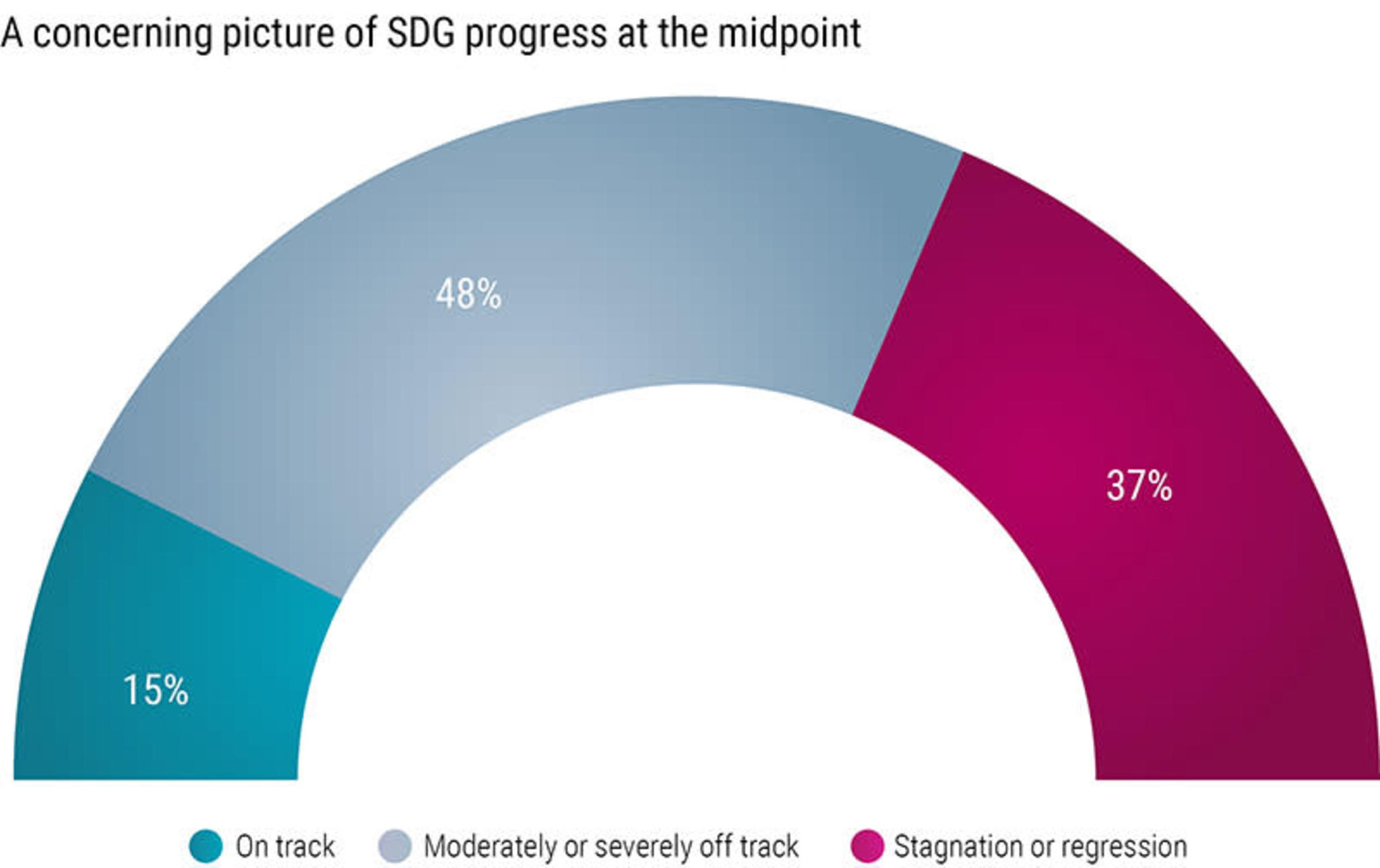

Tracking progress

As all UN member states are expected to track their SDG progress, the UN Statistics Division (UNSTATS) has the primary responsibility of collecting each nation’s SDG metrics. These can be accessed via ‘SDG Indicators’ in the UN’s Global SDG Database.3

Other initiatives are helping to monitor progress. The online publication SDG Tracker was launched in June 2018 and backed by Our World in Data – a joint project between the University of Oxford and the non-governmental organization Global Change Data Lab4. It collects data on all indicators relevant to the SDGs.

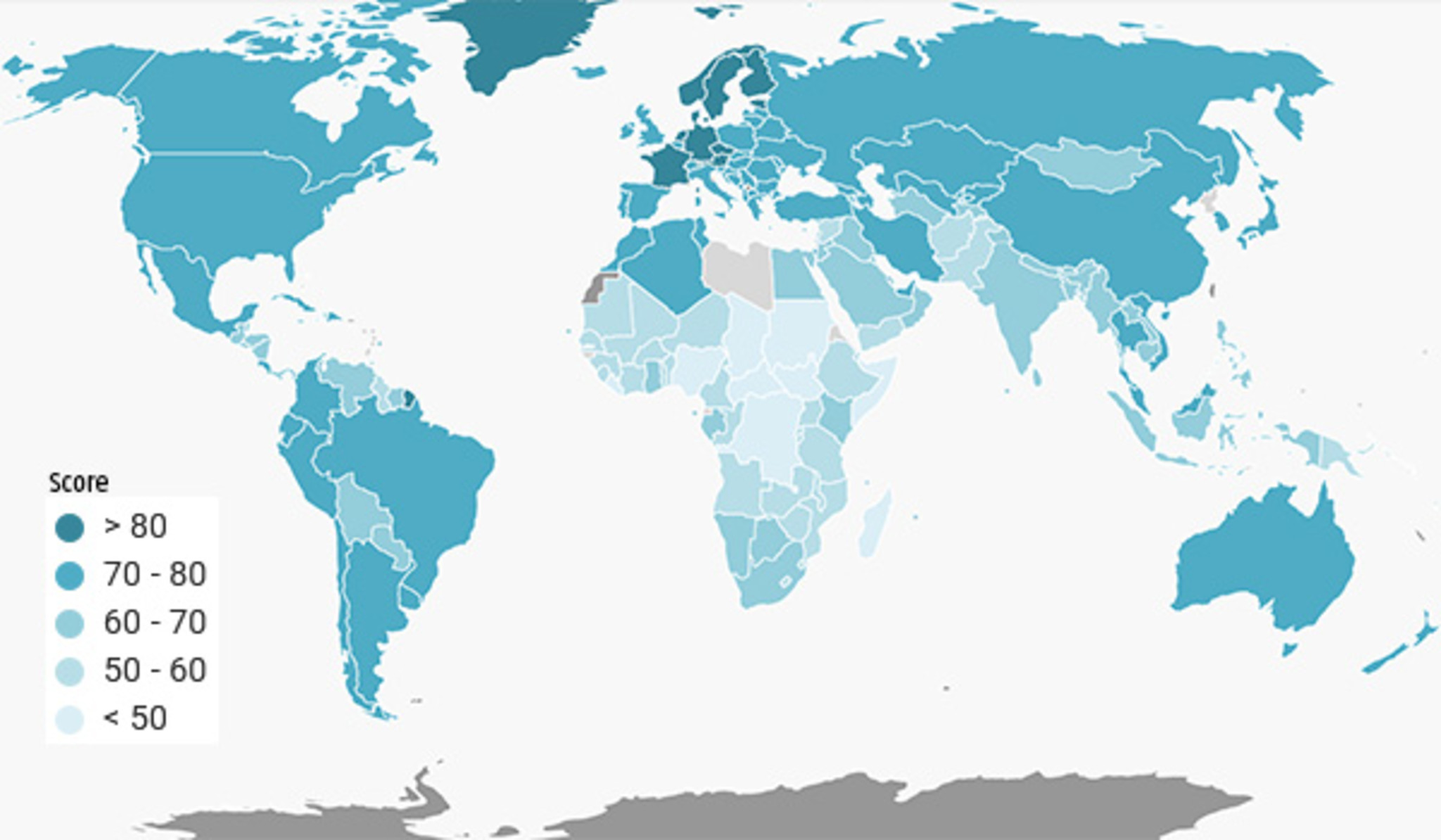

Another project is the Global SDG Index and Dashboards Report. The SDG Index does more than track performance with respect to all 17 goals; it also ranks countries in terms of their achievements, thereby facilitating comparisons. This annual publication is co-produced by Bertelsmann Stiftung, a foundation run by the German Bertelsmann media group, and the UN’s Sustainable Development Solutions Network.5

Figure 2: The Global SDG Index and Dashboards Report is interactive

Check out how your region is performing on any one of the 17 goals by clicking on the interactive chart via the link below.

Source: https://datahub.sdgtransformationcenter.org/reports/sustainable-development-report

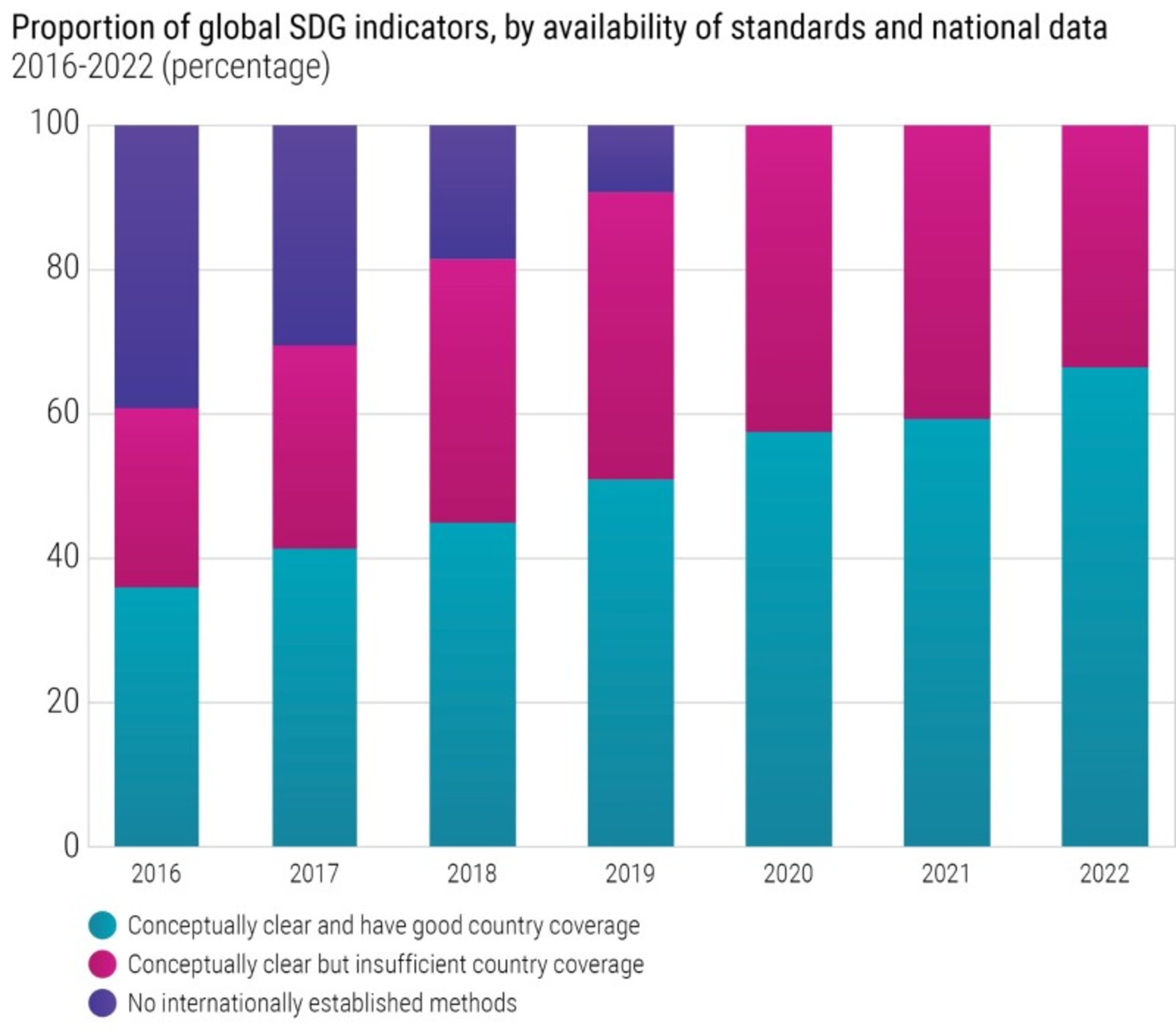

Problems with indicators

The sheer scale and diversity of the indicators makes tracking progress a difficult task. Some statisticians struggle with obtaining data as numerous indicators are not compiled regularly. Others have problems creating methodologies for less mainstream indicators. Even the richest countries have shown significant gaps in their ability to track progress. 6

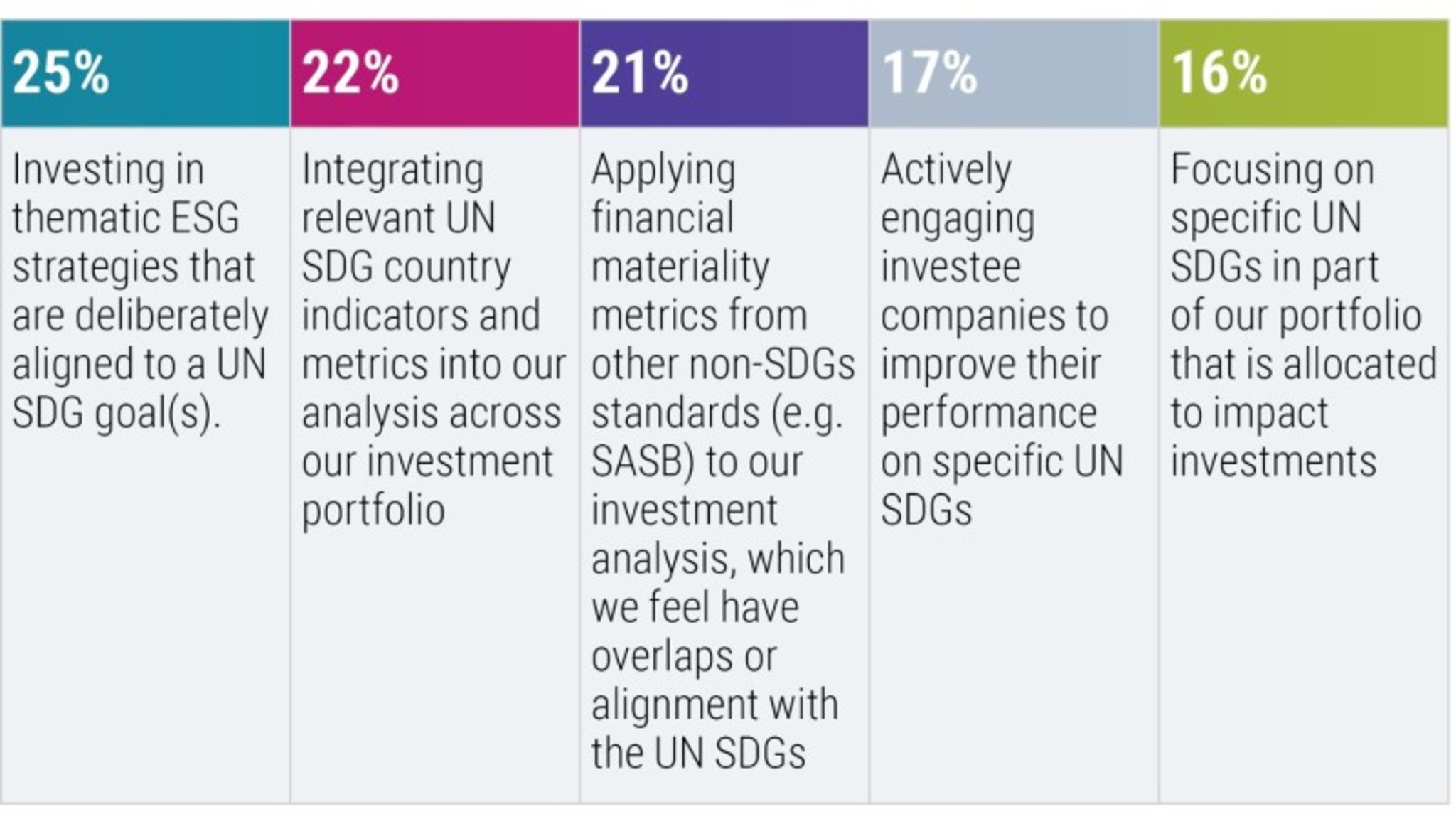

Companies also face challenges in measuring their contributions to the SDGs. The investment process of asset managers including Robeco offers strategies that target these objectives. This is discussed more fully in . However, a lot more needs to happen in order to achieve the SDGs, including the core issue of funding.

Funding needed

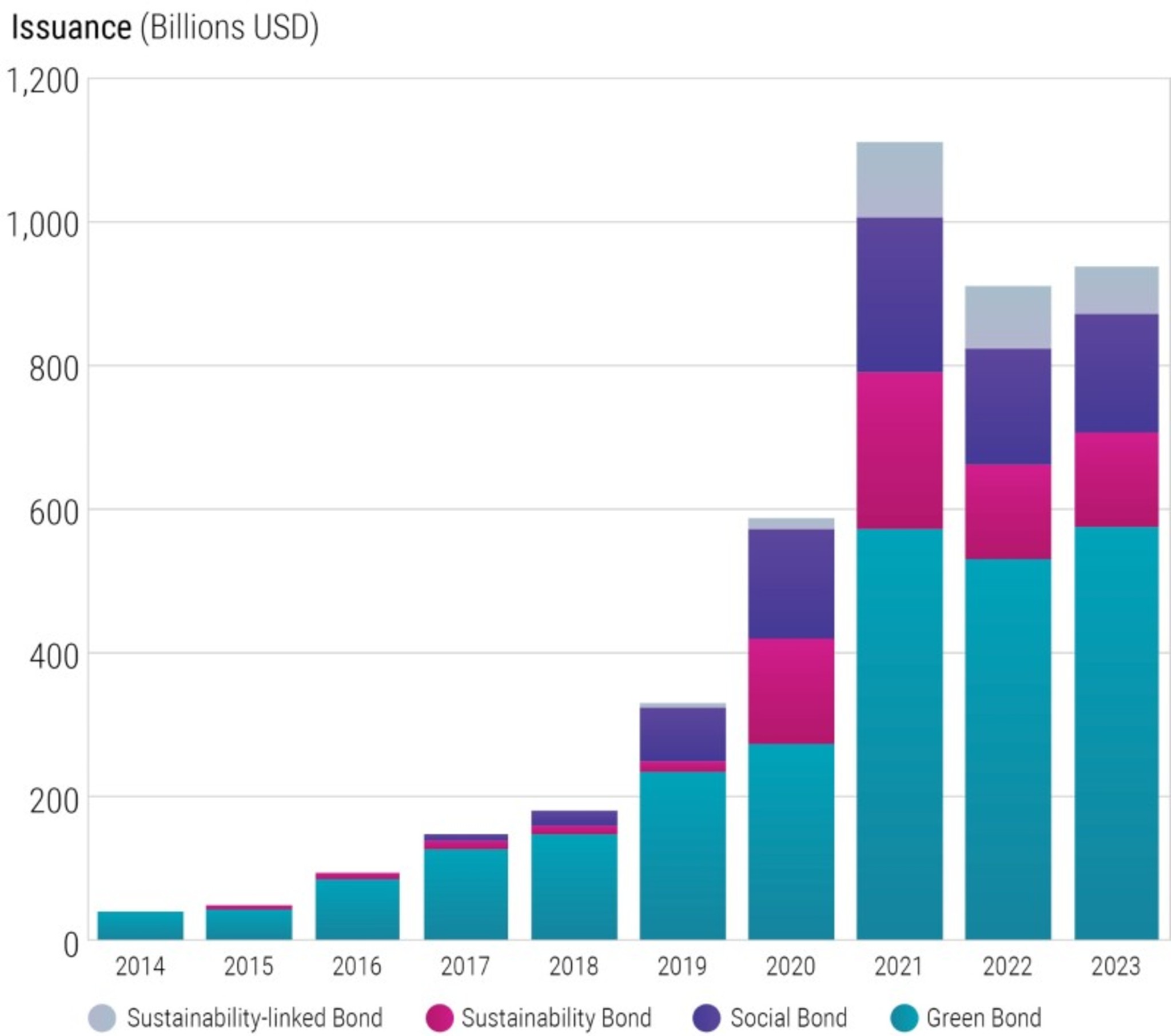

Estimates vary widely for how much funding is needed to meet all 17 goals by 2030. The UN Trade and Development’s World Investment Report of 2023 suggested that the funding gap was about USD 4 trillion per year – up from USD 2.5 trillion in 2015 when the SDGs were adopted. The report said global foreign direct investment fell 12% in 2022, and that emerging markets need renewable energy investments alone of about USD 1.7 trillion each year, but attracted only USD 544 billion.7

The financing gap is particularly wide in poorer nations. Whereas larger or more advanced emerging market economies like Guatemala and Indonesia need to spend an additional 4% of their GDP per year to attain the SDGs by 2030, this figure rises to 15.4% for lower-income developing countries such as Vietnam, Rwanda and Benin, also according to the UN. 8

These numbers starkly contrast the additional spending requirements of richer states. High-income countries must invest more in some areas linked to the SDGs, like renewable electricity, roads, and water and sanitation, but the additional annual investments needed are estimated to be below 1% of their GDP.

Since the public sector is unable to finance the SDGs by itself, there is a need to involve the private sector including financial institutions like banks, asset managers, insurers and pension funds. As we will see in later chapters, this has led to the creation of many investment initiatives including bespoke SDG-focused strategies, along with products focusing on themes or even individual goals.

Looking forward: We the People

Still, the SDGs have captured the world’s imagination. They have started a movement that began with the optimism that this new millennium brought for the future. As this learning module will demonstrate, there are many opportunities for investing in one or more of the goals.

And we all have a role to play, as this ‘We the People’ video, featuring some very famous faces, suggests. It’s not just governments, companies, investors or special interest groups that should be involved – it’s everyone!

This video isn't available to you because you have not accepted our advertising cookies yet. If you accept them, then you'll be able to view all content:

Learning outcome

You should now know how the 17 SDGs came into being as the successor to MDGs, the methods (and limitations) for tracking their progress, and the funding still needed to achieve them as the Covid pandemic hurt progress.

Footnotes

1 https://www.un.org/sustainabledevelopment/sg-finance-strategy/

2 Business & Sustainable Development Commission, 2017. “Valuing the SDG prize”. London.

3 https://unstats.un.org/sdgs/indicators/database/

4 https://sdg-tracker.org/; https://ourworldindata.org/about

5 https://www.sdgindex.org/

6 https://onlinelibrary.wiley.com/doi/full/10.1111/1758-5899.12595

7 https://unctad.org/publication/world-investment-report-2023

8 Integrating the Sustainable Development Goals in Government Bond Investment Strategies by Jan Anton van Zanten, Laurens Swinkels, Rikkert Scholten, Max Schieler :: SSRN