Investing for performance – with purpose at its core

Christoph Wolfensberger is Portfolio Manager of the Robeco Global SDG Equities strategy. Here he talks about his background in finance and the strategy’s approach to bridging its dual objective: aligning investments with the UN SDGs while delivering attractive returns.

Summary

- Macro turmoil is creating opportunities through mispricing

- Global SDG Equities strategy aims to balance exposure to growth trends with owning solid, resilient businesses

- Focusing on SDGs promotes investing for performance – with purpose at its core

“I first got into investing back when I was an intern, curious to explore what was possible in finance. I liked working with numbers, building models, and taking a research-driven approach to understanding how outcomes might play out. At the time, I saw it as this exciting world where, if you did your homework right, the possibilities were endless.

I quickly learned it could just as easily become your nightmare – because the market doesn’t always agree with your spreadsheet even if you are quite convinced it should. But that balance of challenge and opportunity is what hooked me. It kept me on my toes and made the job feel less like work and more like a never-ending escape room I actually enjoy getting stuck in every day.”

What makes a good stock?

“Well, the simplest answer is: a good stock is one that goes up – and one that fits within your investment restrictions, of course. But in practice, with our bottom-up approach, a ‘good stock’ is one where the fundamentals, valuation, and long-term prospects line up – where the odds are in your favor. At the end of the day, I think investing is very much a probability game, and the market will test your patience over and over again. And we all know, that you’ll be wrong almost half the time, if you’re lucky.

That’s why a good stock is also one that aligns with your investment thesis – something you feel comfortable buying, scaling into, but also trimming or selling when the time is right or your thesis wrong. The key is knowing what drives the business and being able to incorporate that understanding into your decisions. And, of course, it should offer substantial room for future value creation that the market hasn’t yet fully recognized.”

What’s your biggest lesson learned over the years?

“I’d say one of the biggest lessons is that the market can be absolutely brutal – and it has a way of humbling you the moment you become too convinced of your own view. Much easier said than done, but it’s about trying not to forecast the market and instead focusing on where we can truly add value: finding high-quality businesses with a competitive edge, strong fundamentals, and buying them without overpaying.”

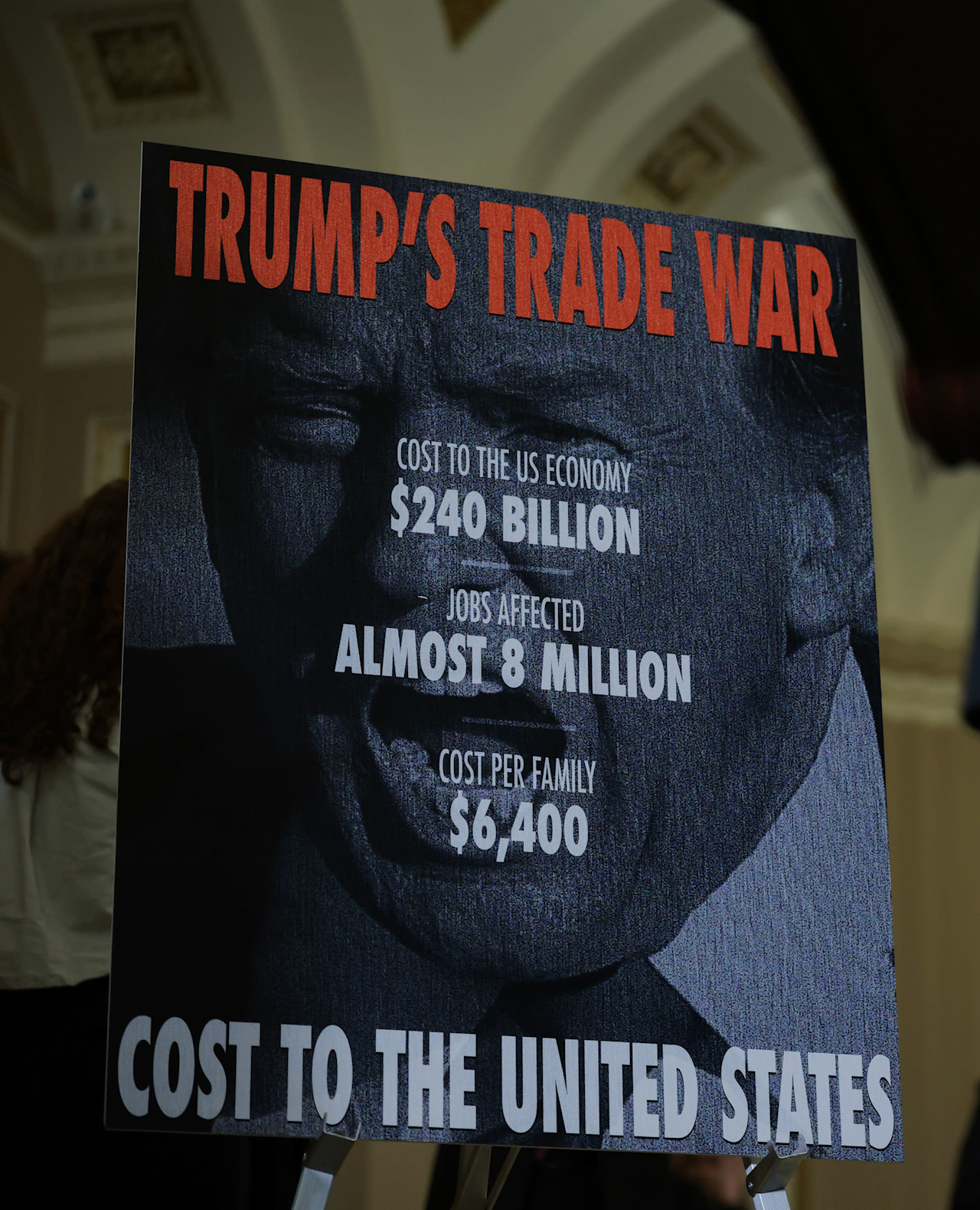

How do you see global markets at the moment?

“Right now, I’d describe global markets as somewhat out of control – driven far more by macro dynamics than by company fundamentals. Politics in particular seems to have an outsized influence, and that adds layers of uncertainty that make investment decisions more complex than they used to be. In many ways, markets feel less about rational pricing and more about reacting to headlines, central bank decisions, or geopolitical events. That doesn’t mean opportunities aren’t there. The large swings we see – sometimes seemingly disconnected from fundamentals – highlight that markets aren’t always efficient. For an active manager, that inefficiency is where the value lies: by doing deep, bottom-up research, identifying high-quality businesses, and understanding the real drivers behind them, you can take advantage of mispricing that short-term, headline-driven trading often creates.”

Which trends and opportunities are prominent in your strategy?

“On the trend side, the AI theme is clearly and unsurprisingly the most prominent in our strategy. We’re particularly exposed on the infrastructure side, through the businesses the strategy owns, which positions us well to benefit from the ongoing growth in this area. That said, the strategy aims to balance growth stories with more stable assets, and I believe this is where the largest opportunities lie. History shows that every cycle – no matter how long or strong – eventually reaches a point where growth slows, overcapacities appear, and profitability reverts. By combining exposure to exciting growth trends like AI with solid, resilient businesses, we position the portfolio to capture upside while managing the risks that come with cyclical shifts.”

Which are the main differences with the Global Stars strategy?

“Both Global Stars Equities and Global SDG Equities strategies are managed by Robeco’s global fundamental equity team, sharing a high-conviction, bottom-up investment philosophy and a focus on quality companies with integrated sustainability research. Robeco’s Global Stars Equities strategy is Article 8 under SFDR, and explicitly integrates sustainability into its investment decision making, investing within a robust sustainability framework. It has one objective, to generate financial outperformance versus its benchmark over time. Robeco’s Global SDG Equities strategy is the only diversified Article 9 strategy across Robeco’s fundamental global platform that fits into a traditional core allocation. However, it has dual objectives: delivering attractive long-term returns and making a positive, measurable contribution to UN SDGs. The strategy applies Robeco’s SDG Framework to select only companies with a positive SDG score, narrowing the investment universe to those clearly aligned with the UN SDGs.”

Which positive effects do the SDGs bring to the strategy?

“Focusing on the SDGs brings several positive effects to a portfolio. It makes the strategy highly attractive to investors seeking a dual objective: generating attractive financial returns while supporting positive social and environmental outcomes. By prioritizing companies that are aligned with the SDGs and avoiding those with unethical or unsustainable practices, the strategy reinforces responsible investing principles. From a regulatory point of view, the SDGs are becoming more and more relevant. They enable to measure progress over time and can be applied across the majority of asset classes.”

What’s been your best investment ever?

“It really depends on the time horizon and, of course, the magic of compounding. If we set aside mega-cap index names (which, let’s be honest, have delivered some jaw-dropping returns and may even feature in our Global SDG Equities strategy), and since cherry picking is the name of the game, I’d highlight two favorites*: Builders FirstSource, a manufacturer and distributor of building products, was among my best investments over a three-year stretch. We started building our position in early 2022, when the market was convinced a housing crash was imminent and sentiment was at rock bottom. Our view was different: we saw a structural housing undersupply, strong demographic tailwinds, and migration to low-tax states as powerful offsets. Builders FirstSource’s dominant market position, improving returns on capital, and clear M&A strategy fueled strong growth and cash flow. As the market rebounded in 2023, our conviction paid off – the stock nearly tripled at its peak.

The other, though more short-term, was Medpace, a Contract Research Organization (CRO) providing outsourced clinical development services. It traded at a very depressed valuation due to cyclical and structural CRO headwinds and weak healthcare sentiment. We concluded that its differentiated full-service model and focus on small to mid-sized biopharma clients make it less exposed to large pharma outsourcing shifts positioning it well for a rebound in biotech funding. Further, Medpace’s profitability, cash flow, disciplined financial management, and a large share buyback program supporting EPS growth made it an attractive candidate for inclusion. Call it luck or skill, but just weeks after we added the name to the strategy, the stock jumped over 50% on results day.”

*These are not buy, sell, or hold recommendations. Holdings are subject to change and shown for illustrative purposes only to demonstrate the strategy as of the stated date. Future inclusion of these securities in the strategy is not guaranteed, nor can their future performance be predicted.

This interview was originally published in the Robeco Fundamental Equity Quarterly.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.