AI and fintech: A perfect match

2025 heralds the beginning of the agentic era in commerce and finance. Leading AI and fintech companies preparing for the next AI phase will shape the way we search, shop, buy and pay.

Summary

- Fintechs are leveraging AI to transform operations

- Agentic commerce will be ubiquitous

- From general commerce to genius commerce

The enterprise adoption of Generative AI (GenAI) is still in its early stages although we see continuous developments emerging from payments, financial infrastructure, financial management, data and analytics, and digital assets companies. A tech-first mindset is helping fintech companies to adopt GenAI tools successfully and leapfrog incumbent traditional financial institutions. We believe that co-pilots and AI agents belong most naturally within the existing workflow or system of record. Even though we have an open mind about potential winners and losers, we do believe that putting agentic AI to work within ecosystems could turn a general AI solution into a genius AI solution.

The use of AI, and machine learning in particular, has been integral for fintech companies for many years. Many leading fintech companies are software-centric and data-driven. AI tooling is hence very natural and, whether it is for credit risk scoring, fraud detection or automating workflows, companies like CapitalOne, Adyen and Equifax already rely heavily on AI. GenAI however has the potential to perform tasks traditionally done by humans, including those involving creativity, problem-solving, and handling unstructured data. Tasks ranging from customer support to engineering, and from wealth advisory to commerce all come into scope.

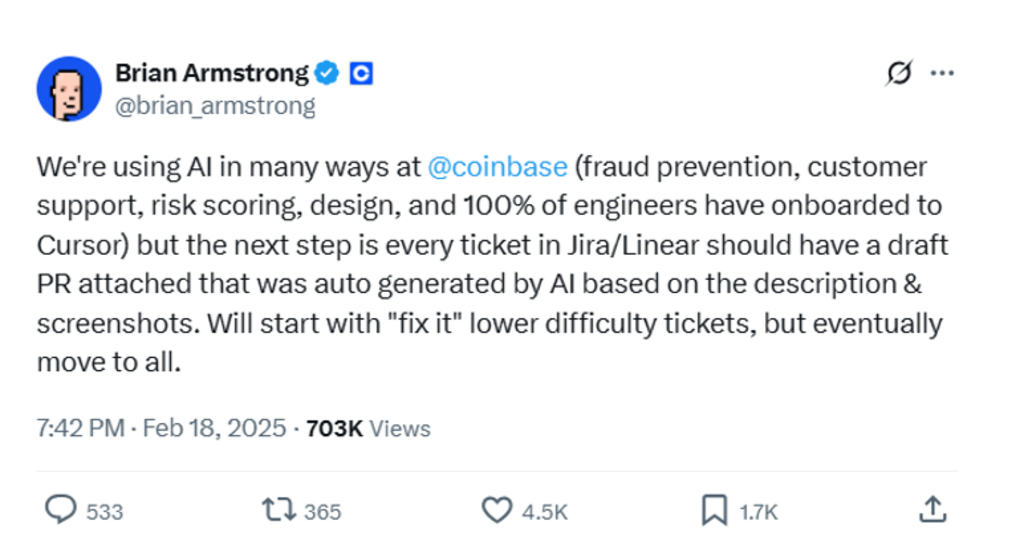

Figure 1 – Coinbase is using AI in many ways

Source: Brian Armstrong, Coinbase CEO, on X, 18 February 2025

Digital asset company Coinbase is a perfect example. As depicted in Figure 1, Coinbase CEO Brian Armstrong recently highlighted that, next to risk and fraud prevention, efficiencies for GenAI lie at both customer care and engineering. Next to co-pilots writing code, tools like Cursor help with pull requests and test evidence to merge or deploy code in a production environment.

The AI-powered code editor Cursor was launched in 2023 and reached over USD 100 million in annual recurring revenue (ARR) in just two years. With cutting-edge AI tools like Cursor, Co-pilot, and Claude code, the CEO of Shopify Tobias Lütke mentioned1 in a recent internal memo that AI usage is a baseline expectation at Shopify nowadays and that before asking for more headcount and resources, teams must demonstrate why they cannot get what they want done using AI. This is going to be the standard operating procedure for many firms.

Using AI effectively is now a fundamental expectation of everyone at Shopify

Buy-now-pay-later provider Klarna has been most vocal about replacing standard call transcripts with actual to-the-point solutions for clients for that call. In its IPO filings, Klarna stated that its AI assistant “does the equivalent work of over 800 full-time agents (…) and delivered USD 39 million of cost savings in 2024.” Even though that is just over 1% of total operating expenses of USD 2.9 billion, it is far more significant when looking at customer service and operations expenses. That actually came down from USD 287 million in 2022 to USD 203 million in 2024. Klarna recently chose to re-hire some human customer service representatives, working remotely, to complement its agentic service, but still expects the adoption of AI in its operations to see its overall headcount fall in the next 12 months.2

Last year, Stripe processed USD 1.4 trillion in payments, comparable to Adyen, and made several key observations. Their data from 2024 indicates that their AI clients are expanding business at an unprecedented pace. As illustrated in Figure 2, the median time for its top 100 AI companies to reach USD 5 million in annualized revenue is merely 24 months, which is 30-40% faster than Software-as-a-Service (SaaS) companies. This suggests that AI software solutions could impact existing players even more swiftly than the disruptive force of SaaS in the 2010s. Stripe anticipates that these new industry-specific AI tools will enable individual industries to fully harness the economic potential of Large Language Models, with the integration of context, data, and workflows providing lasting value.

Figure 2 – SaaS and AI startups’ median time to annualized revenue milestone

Source: Stripe, Robeco, February 2025

Agentic commerce evolution

AI agents and tech applications that can take action rather than merely answer questions should continue the trend. These AI agents are working their way into existing software to automate tasks that often involve data entry or the manual process of integrating information from multiple applications. OpenAI launched Operator earlier this year with an array of partners including Uber, Doordash, Instacart, and Open Table, which could see ChatGPT buying your groceries, booking your next trip, or reserving a table at a restaurant.

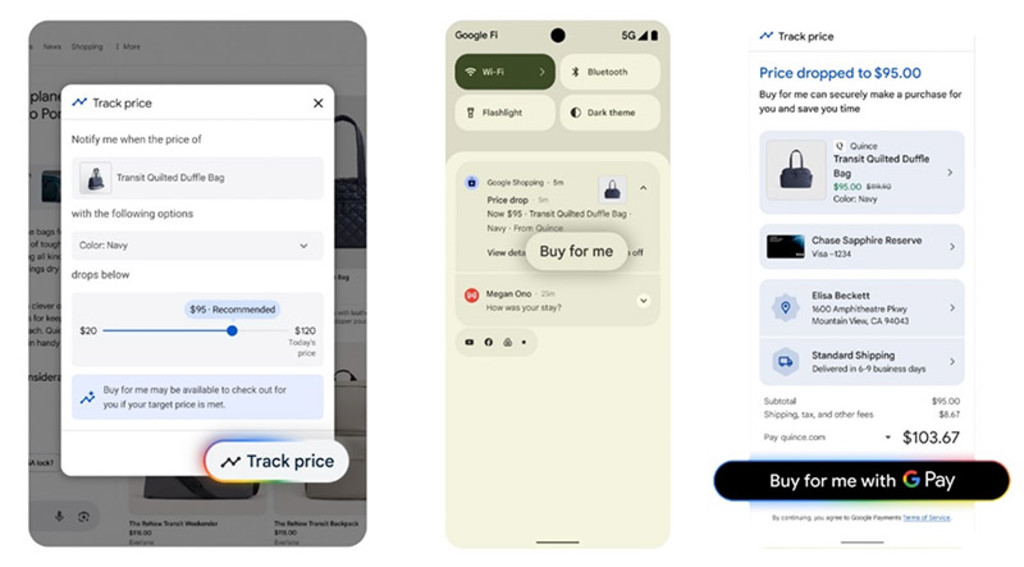

Figure 3 – Google’s agentic shopping experience

Source: Google, Robeco, May 2025

Google introduced Shop with AI Mode with price tracking, agentic checkout, and virtual try-on at its Google I/O event in May (Figure 3). Meanwhile, Perplexity announced PayPal to power its agentic commerce experience, payment, shipping, tracking, and invoicing will be handled behind the scenes with PayPal’s account linking, secure tokenized wallet and emerging passkey checkout flows.

There is also an Agentic AI that can sit within Weixin and the unique ecosystem of Weixin

The CEO of Tencent, Pony Ma, made it clear3 that Tencent sees a unique opportunity in deploying its general AI product Yuanbao within its own ecosystem. Weixin (WeChat) intends to lever its communications and community capability alongside its content ecosystem of video accounts, official accounts and mini-programs. On top of that, Tencent has transactional capabilities as Weixin Pay is the largest mobile payment operator in China. Applying AI in Tencent’s vast digital eco-system provides a rich environment to enhance user experience through personalized content, intelligent customer service and targeted advertising. In essence, it is another example of going from general to genius AI.

FinTech XH CHF

- performance ytd (31-1)

- -6.07%

- Performance 3y (31-1)

- 7.54%

- SFDR (31-1)

- Article 8

- Dividend Paying (31-1)

- No

- Current Price (27-2)

- 89.88

From general AI to genius AI: a reality check for paying in an AI world

The arrival of agentic commerce also brings along unprecedented change in how payments are done. AI agents promise frictionless automation, but merchants are likely to remain wary. The current reality also reflects a level of hype more than readiness as merchants see AI agents as bots not buyers, raising fraud concerns and undermining checkout security models. Trust is the biggest intangible asset any payments company has. Trust in both protecting customers’ money and digital identity. Online fraud already is a huge headache for merchants, just imagine what happens when autonomous agents roam the internet making purchases.

For agentic commerce to scale, payment methods like card tokenization, single-use virtual cards and stablecoins alongside digital identification are crucial. Tokenization of bank cards alongside single-use virtual cards probably means that the network companies like Visa and Mastercard are yet again well-positioned to define the standard agentic commerce will require. Visa and Mastercard offer the brand trust, global coverage and technical platform required and both unveiled AI powered platforms in April 2025 (Intelligent Commerce and Agent Pay, respectively) with a slew of features around agentic commerce including AI-ready cards, tokenized credentials and security, and programmable transaction controls.

The current payments infrastructure is already deeply entrenched, with over 100 million merchant endpoints and 8 billion consumer credentials. This creates a massive last-mile challenge for any new payment method attempting to achieve mainstream adoption. Stablecoins, tokenized currencies like the US dollar, would be an ideal foundation for agentic payments – offering programmability, support for micro-transactions, and a 24/7 global infrastructure. If we were designing the payments system from scratch today, these would be a natural choice.

As payment complexity increases and instant approvals are crucial, modern payment processors such as Stripe, Adyen and Braintree (PayPal) should benefit. An API-first and single technology stack plays into the hands of modern processors. Legacy platforms are more rigid and typically have problems adapting quickly to changes in payment protocols and custom token flows, especially in real time. This implies that traditional banks and scaled processors like Worldline, Nexi and Global Payments are likely to continue losing share. While the importance of digital identity should be beneficial for digital wallets like PayPal and Apple, the big question is whether ‘branded’ checkout remains as relevant as today. Two-sided wallets such as PayPal or Block’s Cash App can however expand their value proposition and help consumers dynamically find savings, rewards, personalization and trust. This could be a huge challenge for bank card issuers. Just imagine a world where an AI assistant recommends the right card for optimizing rewards. It would take competition to a whole new level, especially in the US where rewards are a huge driver of consumer payment behavior.

Agentic commerce presents an intriguing mid- to long-term thematic investment opportunity. However, there are current challenges related to infrastructure, incentives, and security (fraud) that need to be addressed for it to scale effectively in the near term. Network companies such as Visa and Mastercard are once again well-positioned to establish agentic commerce standards, much like modern payment processors such as Stripe and Adyen can benefit from. Additionally, (social) commerce platforms with integrated payments such as Tencent, MercadoLibre, and Shopify, may be at the forefront of advancing general to genius commerce. AI and fintech: a perfect match.

Footnotes

1 Tobias Lütke, CEO Shopify, in a memo to all Shopify employees – ‘AI usage is now a baseline expectation’, March 2025

2 Klarna Slows AI-Driven Job Cuts With Call for Real People – Bloomberg, 8 May, 2025

3 Pony Ma, CEO Tencent, Q1 2025 earnings call, May 2025

Important note: The companies referenced are for illustrative purposes only in order to demonstrate the investment strategy on the date stated. The companies are not necessarily held by the strategy. This is not a buy, sell or hold recommendation, nor should any inference be made on the future development of the company.

What’s trending?

All the latest thematic investing trends just one newsletter subscription away.