Tariffs retaliation – the markets bite back

It’s been the expected explosive start to the second Trump presidency, but he will have been reminded of forces more powerful than presidential authority – the markets. And that could serve to neutralize the impact of tariffs and any trade war, says multi-asset investor Colin Graham.

Summary

- Tariffs cause US equities, bonds and currency to fall at the same time

- Conversion of dollars held overseas into local assets more likely

- Investors will question the premium now needed to hold US assets

All the major asset classes tanked on the tariffs news, though the biggest shock came with a trillion-dollar sell-off in the US Treasury market – by far the largest bond market in the world. This move by the ‘bond vigilantes’ prompted the White House to water down or postpone much of the tariff plans.

And now the US economy itself is threatened by the self-defeating mantra of trying to correct trade imbalances with taxes on imports that will only dampen consumer demand and import inflation, says Graham, co-head of Robeco Investment Solutions.

The art of the deal?

“From our vantage point, President Trump is not following his own mantra of the art of the deal,” Graham says. “He blinked when the bond vigilantes emerged from hibernation, and is now folding as his bluff was called by friends and foes alike. The climbdown over tariffs will continue, but the negative macro impact on the US will start to emerge.”

“The consumer and manufacturing survey data has been poor, though the actual spending or labor data has yet to be affected. There is evidence that US consumers are pulling spending forward, and that companies have been stockpiling before the tariffs hit.”

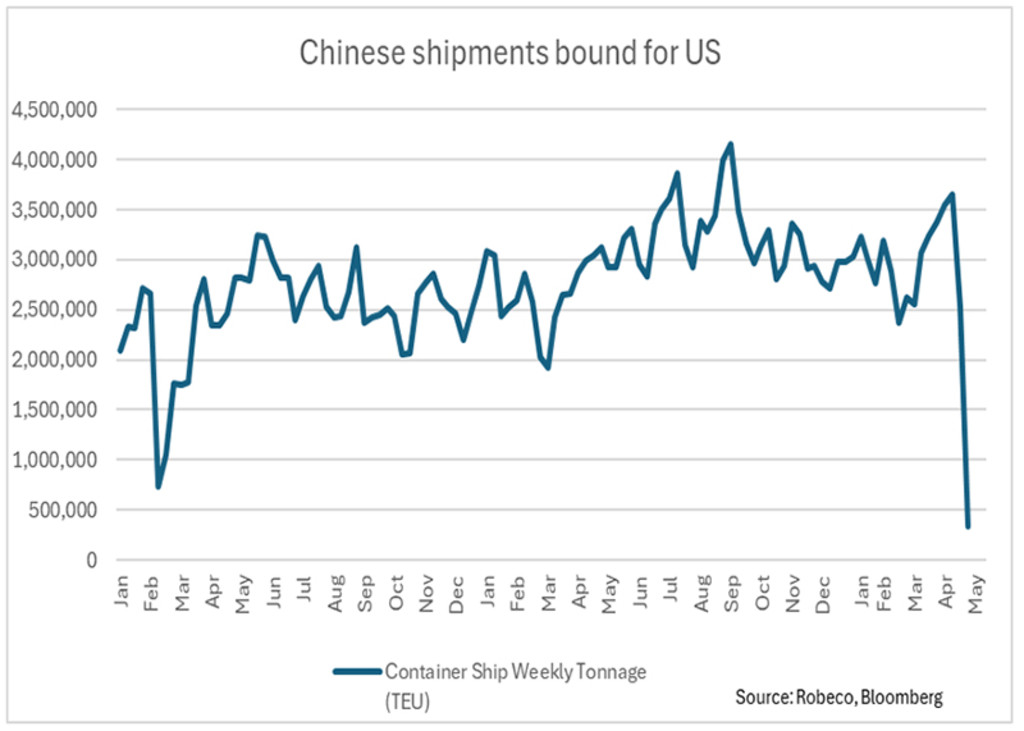

“As a consequence of the tariffs, shipping volumes from China have ground to a halt. The most recent parallels can be drawn with the supply shock of the 2020 pandemic, as goods became scarce and inflation skyrocketed.”

Figure 1: Container ship volumes: shipments bound for the US from China have fallen off a cliff

Source: Robeco, Bloomberg

Upending the world order

The first major casualty of the new regime has been a significant weakening of the US dollar, and its role as the global reserve currency that is normally highly prized by foreigners. Its historic strength has largely allowed the US to fund its huge budget and trade deficits.

“Reversing this system could have dire consequences for the US and global economy,” Graham says. “Since the tariff announcements, the US economic outlook has been universally downgraded, coupled with everyone scrambling to understand the extreme policy uncertainty.”

“Non-US investors are now questioning the required risk premium for holding US assets. This is the USD 32 trillion question (the size of foreign portfolio holdings), which means the retaliation may come from different avenues.”

Reactions of asset classes

This retaliation has major implications for all asset classes, Graham says: “We came into the year with the dollar significantly overvalued compared to history as superior growth, higher interest rates and capital inflows drove it ever higher. Over the longer term, we expect a derating and rebalancing.”

“The downward pressure from a ‘buyer’s strike’ would be extended if investors do not allocate more assets to the US. Meanwhile, the repatriation of export proceeds from the US, allowing local currencies to appreciate against the dollar, means tariff policies are likely to continue to be watered down.”

“We have already seen central banks and individuals increasing dollar diversification through gold and other FX holdings. Going forward, we question whether US interest rate and growth rate dominance over the rest of the world will be enough to retain the attraction of US capital.”

“While the reduction of overweights to US assets by foreigners is a slow burn, this could speed up, as investors and corporates accelerate the de-dollarization process.”

Impact on Treasuries

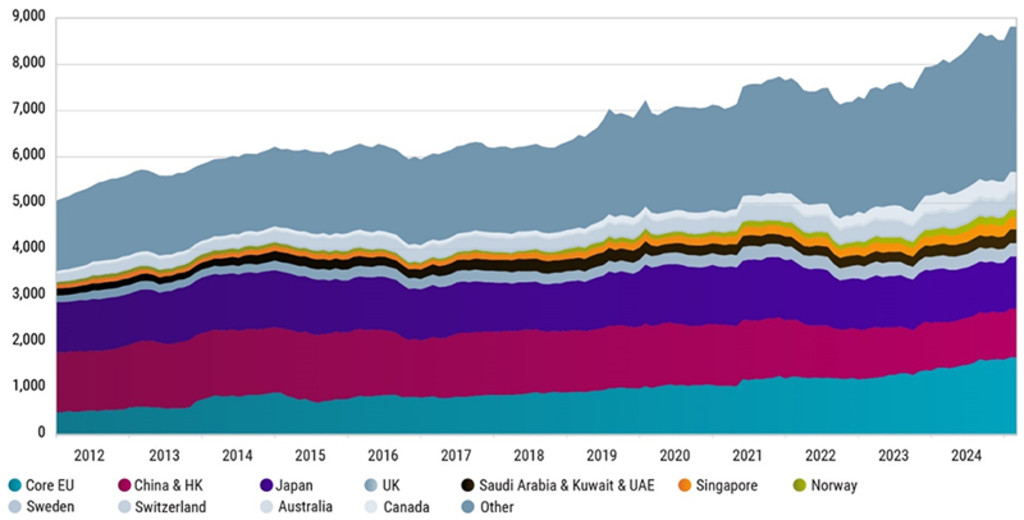

The biggest impact may be seen in US Treasuries, USD 9 trillion of which are owned by overseas actors, including China. The so-called bond vigilantes have been dumping them on the open market, forcing yields up and values down.

Figure 2: Foreign ownership of US Treasuries is huge

Source: US Department of Treasury, Robeco

“A reduction in trade will provide less incentive to hold proceeds in dollars, and the conversion of dollars held overseas into local assets becomes more likely,” Graham says. “China has been increasing its pile of US Treasuries held in the Euroclear system, thereby making it easier to switch to European bonds and avoid driving the renminbi up against the greenback.”

“We remain neutral on the duration of Treasuries as the US economy remains robust, but will be looking to add to holdings if yields rise, because the inflationary impact of the goods shortage is not yet priced in, and the risk (term) premium for holding US Treasuries should be higher.”

Outlook for earnings and equities

There are also implications for equities, not least in how any remaining tariffs cut into company earnings, at a time when many investors believe that the tech-dominated US stock market is overvalued, even after the recent correction.

“Previously, non-US investors had a cushion against any risk-off move lower in equities from a rising US dollar,” Graham says. “In the latest equity sell-off, European investors were hit with the double whammy of declining US equity prices and a falling US dollar.”

“Toward the end of 2025, it will be clearer where the additional costs of tariffs will be borne. We expect to see the cost split between corporate margins and price increases for consumers. This will impact US equity multiples, which are already expensive, and keep consumer inflation sticky.”

Murky guidance

“In this state of the world, the outlook for employment and capital expenditure intentions will significantly impact investors’ expectations. Currently, US employment data is strong, while companies’ earnings guidance has become murky to non-existent.”

“We remain hyper-vigilant on the changing landscape, currently maintaining defensive positions in portfolios.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.