Want to outperform? Stick to your knitting!

Maintaining a strict discipline in difficult markets has paid off handsomely for veteran portfolio manager Chris Hart.

Summary

- Global Premium Equities enjoys 15% outperformance in 2022

- Strict adherence to value investing principles and strong stock selection

- Value rally seen continuing in post-ZIRP world even if rates start falling

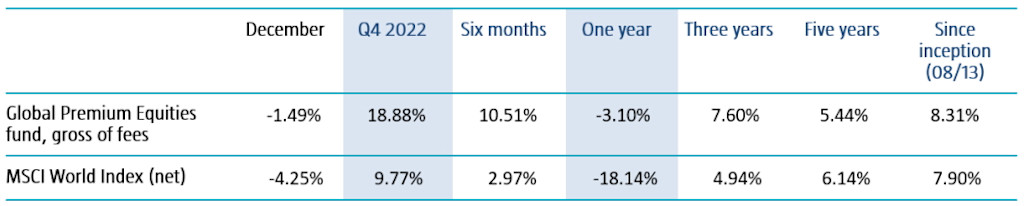

His Global Premium Equities strategy achieved 15 points of outperformance during the market chaos of 2022, two thirds of which came in the fourth quarter. It follows years of strict adherence to the Boston Partners approach to value investing, which seeks stocks whose true value is not reflected in their market price.

The strategy rose 18.88% in the final quarter of 2022 compared to a 9.77% rise for the benchmark, the MSCI World Index. For the year, the strategy kept its losses down to 3.10% compared to an 18.14% drop in the overall market, thereby achieving relative outperformance of 15.04%.1 The year was dominated by global central banks tightening at a record pace, Russia’s invasion of Ukraine triggering a spike in energy prices and global inflation, sending all stocks plummeting.

Part of the success was through the companies chosen for inclusion in the portfolio. Real estate investors often say that true property value boils down to ‘location, location, location’; in active value investing, it could be similarly described as ‘selection, selection, selection’.

“It's really through sticking to our philosophy of identifying lower-multiple businesses that are significantly mispriced, while maintaining a quality bias in the portfolio, in addition to ensuring that we continue to always have positive business momentum,” says Hart, who has managed the portfolio since 2008.

“The performance was driven through stock selection across virtually every sector. Historically, when we look at the time periods when the portfolio has outperformed, it has always been through stock selection.”

“There's no tactical allocation; we don’t think that we want to have a specific exposure to something; it’s all driven through the bottom up. So it really comes down to stock selection across a wide universe and sticking to our knitting.”

Overweight Europe

This kind of discipline has resulted in being ‘overweight’ to Europe – where the portfolio has a greater proportion of European stocks in it than the global benchmark does – because North America has not offered the same kind of value opportunities.

“Throughout the life of the strategy, we’ve been overweight Europe probably 75-80% of the time, which again is really driven by mispricing,” says Hart. “In Europe, we can find companies that have the same type of quality and momentum characteristics as those in the US, but at much lower valuations.”

“We are overweight European industrials and significantly underweight US industrials for this reason. We can get the same type of characteristics from a fundamental or profitability perspective, but with valuation characteristics that are 30 to 40% cheaper relative to the opportunities in the US. I would argue that at least in recent years the US is fully valued to overvalued.”

BP Global Premium Equities I GBP

- performance ytd (31-1)

- 2.00%

- Performance 3y (31-1)

- 13.58%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Dividend Paying (31-1)

- No

Defining value

It boils down to what constitutes value using the strict Boston Partners characteristics-based approach, he says. “Value investing to us is finding good businesses that are mispriced. Many indices tend to be populated with low-multiple businesses that are simply bad businesses – they’re cheap for a reason.”

“But we‘re not buying cheap companies just because they're inexpensive – that's not what we do. We're looking for good businesses that are mispriced and you can find a lot of those for example in the industrials, health care and communications sectors.”

“These three sectors have done well for us, and we’ve often been overweight here. The concept of a ‘hot sector’ cycles are the same as economic cycles. Over time, different industries will cycle through overweight and underweight exposures as the economy fluctuates, and as value emanates through the market.”

Underweight tech

The technology sector provides a different case study in how it is important to avoid expensive, high-multiple household names – but where true value can still be found on a company-by-company basis.

“Everything is idiosyncratic now,” Hart says. “We can find really well positioned, idiosyncratic names that are at low multiples relative to a core index. But overall, it's very difficult for us to maintain close to a market weight to technology because there simply aren’t enough suitable names in there to make a 25% to 30% index exposure worthwhile.”

“And remember, it always, always comes down to valuation. Some of these tech businesses are still massively overvalued. I have owned the big tech stocks in the past when they had valuation multiples that were commensurate with their growth rates. When those multiples expanded and no longer reflected the underlying growth, we sold them. That's corporate finance 101.”

It's also what you don’t own

One factor in achieving relative outperformance is in the stocks that you don’t own as much as the stocks that you do. If you avoid buying a company whose share price falls by more than the index, your relative performance will rise, even if markets fall in absolute terms. This can only be achieved through active management; a passive strategy will buy the whole index without being able to weed out the wheat from the chaff.

“Active management is not just about buying well-run businesses at the right valuation – it’s about not buying businesses that are overvalued,” says Hart, who is based in Boston.

“The first question of value investing is what's the valuation multiple? The meteoric rise and fall of some businesses from a multiples perspective gives you an indication that there was no actual valuation consideration given to them. Avoiding overpriced stocks is just as important as purchasing underpriced stocks.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Also avoiding emerging markets

Regionally, the strategy retains a bias for Western markets, and Hart does not buy into the idea that emerging market equities will make a comeback in 2023, since the sector remains dominated by China.

“For all of the bad ESG issues that we face and discuss, China is the tip of the spear, and yet everyone conveniently forgets about it when it comes to making a buck in emerging markets,“ he says. “Any ESG standards that they had are magically thrown out the window when they want to make an extra dollar, and I find that ironic and hypocritical.”

“Most of our own emerging markets exposure over time has been through South Korea and Taiwan. There are interesting opportunities out there, but on a risk-adjusted basis, I can find similar characteristics elsewhere without having to take on the country risk. So we tread lightly in emerging markets; it’s still only about 5% to 6% of the portfolio and has been as low as 0%.”

Don’t fear rates

But can the rally seen in value investing continue? The end of zero interest rate policies (ZIRP) have been good for the value style and conversely bad for growth investing, but rates and inflation are both seen peaking and then declining in 2023. Yes, says Hart, since zero rates propped up unprofitable but glamorous businesses for more than a decade.

“One of the problems in the market is that there is a massive misallocation of capital, where we have businesses with USD 30-50 billion in market capitalizations that have never once generated a dime of operating cash flow in 10-15 years. So, if you haven't made money in all that time, when will you? It's preposterous, but that's what zero interest rates have done.”

“Now with rising interest rates, the real cost of capital is being applied to businesses. Those businesses that have no earnings but whose valuation metrics are based on sales will be worth nothing. Falling rates doesn’t mean that businesses that were worth nothing at 5% are now worth more at 3%. If it doesn't generate cash flow, it's still worth nothing.”

Welcoming the new normal

In short, the new normal is to be welcomed, even if markets are currently still adjusting to the post-pandemic, post-ZIRP world, Hart says.

“A normalized interest rate is good for all investing, including value, because what it does is create a rational cost to capital based upon which businesses can be valued. And the irony of it is that these ‘growth’ businesses still have not even faced a recession yet. They’ll be in real trouble if top-line sales start to fall.”

“And so my point is that value will still work in a normal interest rate environment because there's a cost to capital associated with it that’s fundamentally associated with valuation. There is plenty of life in the rally yet.”

Footnote

1 The performance figures correspond to the D USD share class of the Robeco Global Premium Equities UCITS fund. Performance for other share classes may vary. Performance over one year is annualized. The value of your investments may fluctuate. Past results are no guarantee of future performance. In reality, management fees and other costs are also charged. These have a negative effect on the returns shown. All data to 31 December 2022.