China on track despite geopolitical balloons being popped

Our constructive stance on Chinese equities is intact ahead of the ‘Two Sessions’ in early March, despite renewed geopolitical tension.

Summary

- National People’s Congress in March to confirm growth focus

- We are positioned for consumption to lead the economic revival

- Geopolitical tension is back and will continue to generate volatility but is largely priced-in, in our view

China has been a crowded trade at the start of 2023 but the bullish sentiment has dissipated somewhat in February. Negative news stories on China are dominating in western media, led by the shooting down of the ‘spy balloon’ by US forces, which caused the scheduled visit of US Secretary of State Blinken to China to be postponed.

From our perspective the geopolitical tension will wax and wane with the US and China now strategic competitors, but it’s an ongoing risk factor rather than something that will directly influence equity valuations in the short to medium term in the key sectors we focus on.

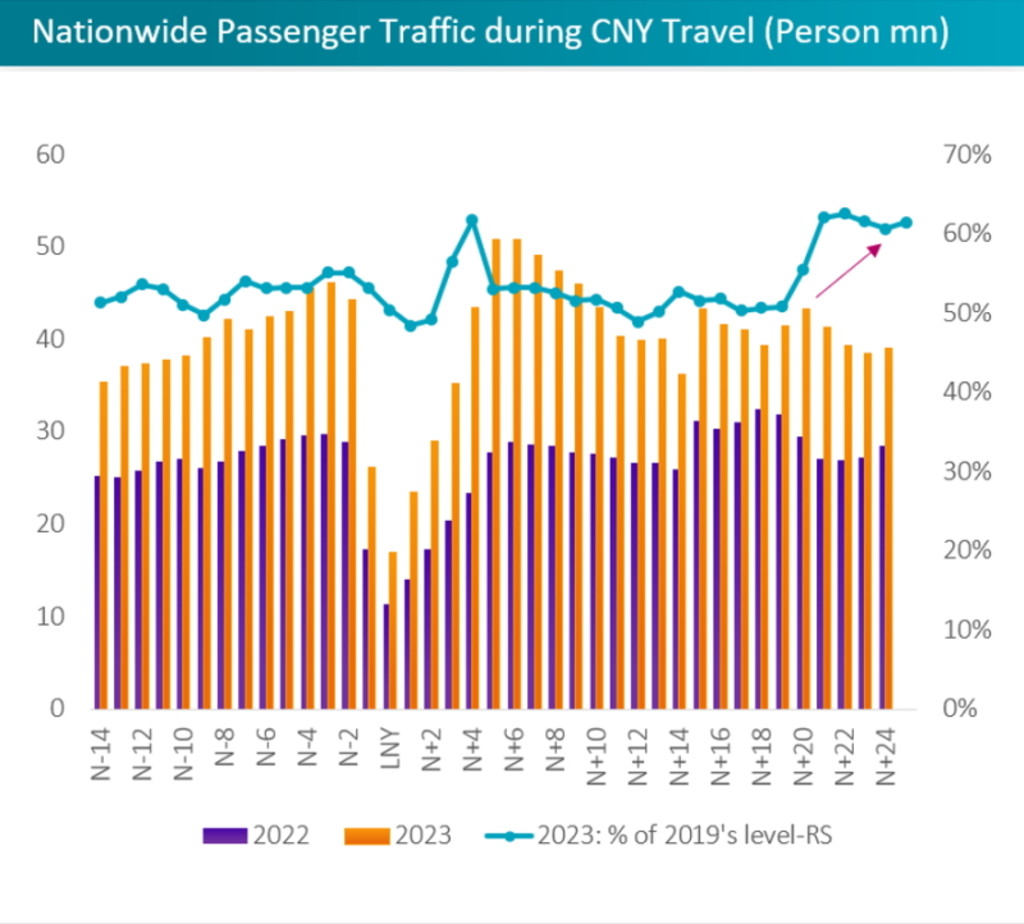

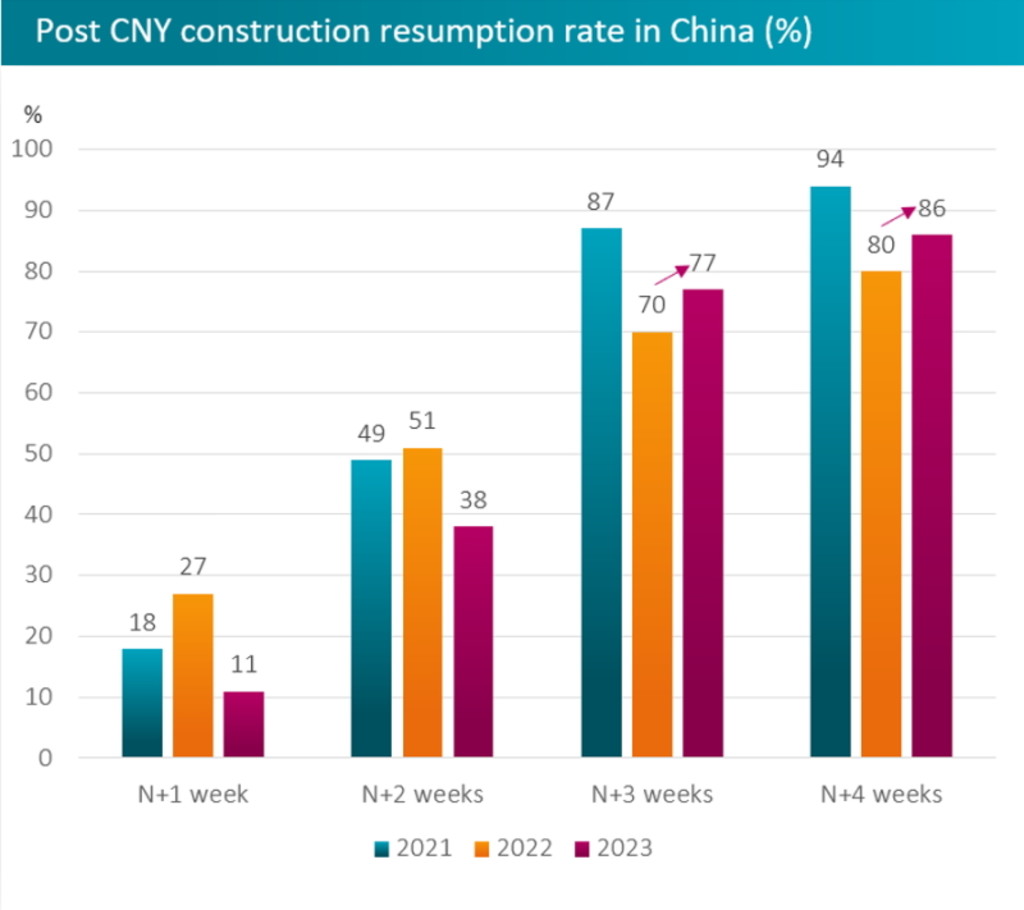

Data indicators like traffic flows show that China’s re-opening has gathered pace since the Lunar New Year holiday, which is positive news1. With rural migrant workers gradually back to the cities after the Lantern Festival (15th day of Chinese New Year) this year, the resumption rate for construction activities showed a strong year-on-year sequential rebound. Inflation remains subdued at 2.1% YoY while China’s PMI surprised on the upside in January2, which will hearten policymakers as they formally announce growth targets for the year at the National People’s Congress in early March.

Figure 1: The rebound is real

Source: Goldman Sachs Research as of Feb 15, 2023. N is the first day of Lunar New Year Day of the respective years.

Source: 100NJZ, February 23, 2023. N is the first day of Lunar New Year Day of the respective years.

However, the all-important property market remains subdued with signs of stabilization but no firm revival as yet, despite being a primary focus of policy action since October. China’s developers saw home sales fall 33% YoY in January according to CRIC data. Iron ore prices have rallied in February though, anticipating a construction rebound.

Now the initial excitement of Chain’s re-opening is over investors will start to focus on the earnings trend and policy actions from central government. Next on the agenda is the first session of the 14th Chinese People’s Political Consultative Conference (CPPCC) and the first session of the 14th National People’s Congress (NPC), known colloquially as the ‘Two Sessions’, which take place in early March and is likely to reiterate the pro-growth policy framework established at the end of 2022.

Our expectations for the meeting are straightforward. According to reports of a February 21 CCP politburo meeting3 the focus remains on growth and raising the quality of growth so we don’t expect any departure from that script. That means a GDP growth target well above 5% which we believe is realistic. In terms of new policy announcements we also don’t expect anything dramatic but an allowance for a wider budget deficit to support the growth target. More encouragement for a further loosening of monetary conditions is also possible, aimed at supporting the property market. The already accommodative monetary stance is being reflected in loan growth data which saw a jump of 23% YoY in January4, backing up December’s strong data.

Consumption will lead the economic revival

We don’t expect any particular catalysts to excite investors from the ‘Two Sessions’. The market requires real evidence that the re-opening is starting to be reflected in earnings to move higher. Another possible catalyst would be evidence the property market is normalizing.

We are however confident that the government’s support for domestic demand will drive increased economic activity and this in turn could stimulate renewed entrepreneurial zest in China, which is the key to China’s long term growth. This will be initially reflected in retail sales but we believe the wider economy, including the property market will gather momentum as 2023 unfolds. With this in mind we have positioned for a consumption revival while continuing to favour long-term themes where we believe value lies, including the green economy, technology innovation, and the technological upgrade of China’s industrial base. China’s equity market is trading at attractive valuations below its historical average level, and earnings revisions could be a driver going forward.

Footnotes

1 https://www.bloomberg.com/news/articles/2023-02-21/china-s-clogged-roads-show-economic-recovery-gathering-pace

2 https://think.ing.com/snaps/china-pmi-surprises-the-market/

3 https://www.bloomberg.com/news/articles/2023-02-21/china-pledges-to-meet-economic-goals-as-recovery-takes-hold

4 https://www.reuters.com/article/china-banks-idINL1N350059