Sustainable investing: Don’t sign the divorce papers just yet

In light of the ongoing debate over ESG investing we analyzed a core global strategy to see how much performance could be attributed to ESG factors in the previous six years.

Summary

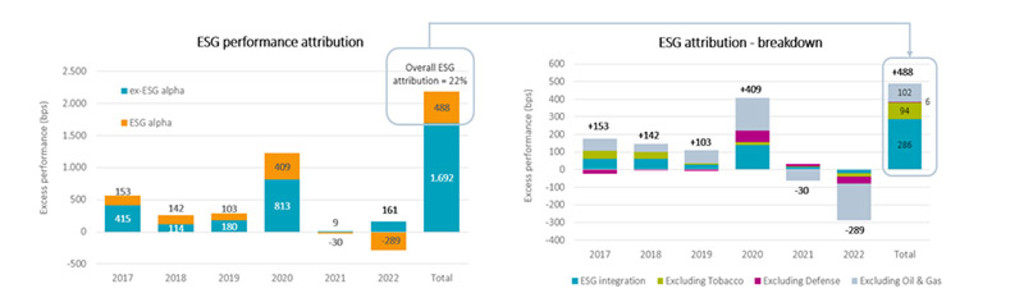

- Between 2017-2022 our research showed 22% of excess returns can be attributed to ESG

- Unsurprisingly 2022 bucked the trend and provided headwinds

- Sustainable investing is very much alive; a fall-out doesn’t mean an imminent divorce

From time to time even best friends can experience a fallout. For years it seemed the stock market and ESG tailwinds were a great match, with little to worry about. Then 2022 happened: war, an energy crisis, rampant inflation – we’ve all seen the headlines. For sustainable investment strategies, in particular, all these events proved to be a perfect storm.

2022 turned out to be the year where former ESG darlings struggled, whilst ESG ‘baddies’ such as defense companies, fossil fuels, and even tobacco, thrived. In other words, sustainable strategies got a reality check. It also reinvigorated the discussion over what “ESG” actually brings to the table return-wise, something we again explore here with reference to our core global equity strategy, Sustainable Global Stars Equities. In doing so, we’ve analysed the impact of ESG on our investment performance over the years, concluding the following:

Tracking the data since 2017, ESG integration and specific sector exclusions had a positive contribution to investment performance, despite 2022 being an ‘annus horribilis’.

2022 marked the first year though where all ‘sin sector’ exclusions detracted from performance.

Between 2017-2022, around 22% of the strategy's excess returns can be attributed to ESG1

Put differently, of the annualized 334 basis points (bps) excess performance achieved over this time period, about 75 bps can be attributed to material ESG factors.

Sustainable investing is essentially about broad value creation, investing in companies that do business with respect for all stakeholders. In practice, we do not only look at financial sustainability, but we are integrating the concept more broadly and consider environmental and societal value creation too. Technically, this way of sustainable or ESG investing is called “ESG integration”, whereby material ESG factors form an additional lens in the decision-making process. Note that ESG is not a political ideology but a key step in our investment process.

To that end, within the Sustainable Global Stars Equities strategy, we invest in quality businesses that have strong sustainability strategies that can really impact a company’s business model, potentially creating value over the longer term. At the same time, we might also want exposure to so-called ESG improvers, or even ESG laggards, where upside potential can be quite meaningful if challenges are properly addressed. The benefit of such a barbell approach is that it enables us to invest in different segments of the market, making the portfolio more robust across different market cycles.

Global Stars Equities D EUR

- performance ytd (31-12)

- 0.42%

- Performance 3y (31-12)

- 15.63%

- morningstar (31-12)

- SFDR (31-12)

- Article 8

- Dividend Paying (31-12)

- No

The 6-year track record

Even though we’ve incorporated ESG into our decision-making since inception of the strategy, we started explicitly measuring the ESG attribution to investment performance in 2017. Hence, we now have a six-year track record for our analysis (2017-2022), which is illustrated in Figure 1. The left chart of Figure 1 illustrates the strategy's overall excess performance split by ex-ESG and ESG alpha contribution. For example, in 2020, excess performance totalled 1,222 bps of which 409 bps could be attributed to the aforementioned way of ESG integration plus ESG exclusions. The figures also indicate that the ESG attribution to excess performance from 2017-2022 has been significant: ESG explains about 22%, or 75 bps, of the annualized 334 bps of excess performance.

Figure 1: ESG attribution to investment performance

Source: FactSet data

As we’ve argued previously, we believe sustainable investing is very much alive, despite the 2022 reset. A fall-out doesn’t mean an immediate divorce. There is a clear need though to move to the next level, finding the right balance between idealism and realism in the practical implementation of ESG considerations in investment portfolios. In renewing the ESG wedding vows, a forward-looking approach, ESG financial materiality, enhanced engagements in combination with thoughtful exclusions are critical; this should not only be a thought process at the asset manager level, but also among asset owners and regulators.

At Robeco Fundamental Equities, we go beyond nice-sounding ESG narratives and try to measure the actual impact ESG has on investment performance. As demonstrated, our way of consistently integrating and tracking ESG in our decision-making, allows for a good proxy of the importance of ESG in our investment portfolios.

Download the complete paper for a deep-dive into our methodology, results, and a case study illustrating how ESG factors influence investment performance for a specific company in our universe.

Footnote

1Sustainable Global Stars uses the MSCI World EUR Index as a reference index.