We routinely integrate environmental, social and governance factors across almost our entire range of fundamental equity, fixed income, quantitative and bespoke sustainability strategies. This makes Robeco one of the few asset managers in the world to take such an all-encompassing approach. It’s been our standard since 2010, regardless of how much you prioritize sustainability. We do this because it adds a different lens to our analysis and makes us better informed investors.

Definition of ESG integration

ESG integration is the consideration of environmental, social and governance factors when deciding which stocks or bonds to buy for a portfolio. It is defined by the UN Principles for Responsible Investment as: “The explicit and systematic inclusion of environmental, social and governance issues in investment analysis and investment decisions.”

The practice has been widely adopted by asset managers, as it is perfectly suited for investors seeking to implement ESG, but without defining or applying a specific sustainability risk budget. Such investors believe that using ESG information that is financially relevant leads to better informed investment decisions, or enhanced risk/return rewards. The goal is clearly financial rather than just ‘ethical’.

ESG integration is not, however, the same thing as sustainable investing – though it forms part of it. An asset manager integrating ESG criteria in a portfolio is not obliged to have stocks with a positive ESG profile in a portfolio if these stocks are not attractive based on financial metrics such as valuation or profitability. It simply offers a mechanism for being able to make a more informed decision.

Importance of materiality

Financial materiality is the crucial ingredient in ESG integration. The factors considered are not just ‘nice to have’ – they must also have a direct impact on the company’s bottom line. For example, an investor will not just look at pollution from an environmental perspective. Such considerations should also have a financial impact, from attracting fines and raising costs to regulatory risks. These factors feed through into a company’s results, and therefore into its market value.

The financial materiality component is based on the premise that ESG considerations can have a major impact on a company’s ability to create shareholder or bondholder value in the same way as analyzing traditional financial and fundamental criteria. It is done alongside standard metrics such as a company’s profitability, market share, new product pipelines and activity such as M&A.

Use of ESG integration by Robeco

Robeco has integrated ESG factors into the investment decision-making process since 2010, and it now covers almost all Robeco’s portfolios. Our investment teams usually integrate these factors in three steps:

Step 1

Identify and focus on most material issues

Step 2

Analyze the impact of material factors on the business model

Step 3

Incorporate into valuation analysis and/or fundamental view

ESG integration and investment performance

ESG integration is partly an art as well as a science; proving that ESG integration contributes to performance is notoriously difficult. Half a century of academic research finds that in most cases, companies that apply ESG principles tend to be higher quality and financially superior. Curiously, those same results are less robust for investment portfolios.

A 2015 meta-study undertook an exhaustive, quantitative study of the entire universe of 2,250 published academic studies on ESG performance spanning four decades of data from 1970 to 2014.1 The analysis concluded that ESG correlated positively to corporate financial performance in 62.6% of studies and produced negative results in less than 10% of cases (the remainder were neutral).

A 2023 study analyzed company performance from 2015 to 2020. The results were similar, supporting the notion that integrating ESG information into corporate operations and decision-making may add value that translates to better managed companies and better corporate financial performance.2

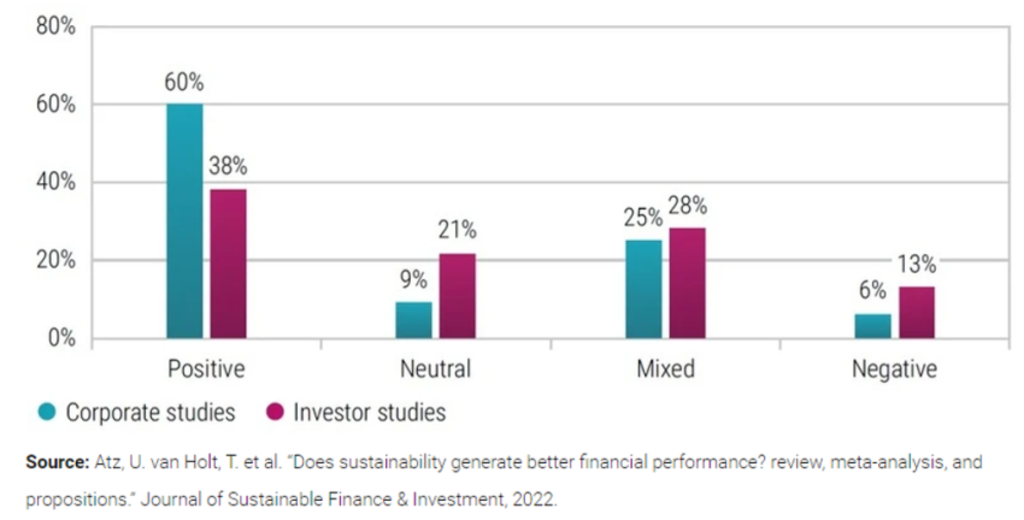

Intuitively, what works for individual companies should also work for investment portfolios. However, while still positive, the link between ESG and overall portfolio returns was less robust. Sustainability data positively influenced portfolio returns in 38% of cases, while a negative influence was found only 13% of the time. This is shown in the graphic below:

Figure 1 - ESG impact on corporate financials vs investment portfolio performance (2015-2020)

Given this evidence, it is therefore very important to take a structured and well-researched approach to ESG integration instead of simply using ESG scores. We must also distinguish which information is already priced in by the market, and which information is not. Proprietary research is key and this is exactly what Robeco does in its ESG integration process.

Read more: Investigating the link between ESG and investment performance

A stepping stone to sustainability

In conclusion, Robeco structurally integrates financially material ESG issues into almost all of its investment processes. The aim is to achieve even better investment returns for our clients. This is a standard feature of our strategies.

Next to this standard feature, Robeco also has a lot of experience implementing client-specific sustainability characteristics into investment strategies. This includes:

Targeted SDG investing using the SDG scoring framework for a range of equity and credits strategies

Transition investing targeting companies at the forefront of the move to a low-carbon economy

Climate and net-zero investing that set specific decarbonization pathways for inclusion

Thematic investing under Article 9 of the SFDR with a specific sustainability objective such as Smart Energy

Footnotes

1Friede, G. Busch, T. and Bassen, A. “ESG and financial performance: aggregated evidence from more than 2000 empirical studies.” (2015). Journal of Sustainable Finance & Investment, 5:4, 210-233.

2Atz, U. van Holt, T. et al. “Does sustainability generate better financial performance? review, meta-analysis, and propositions.” (2022). Journal of Sustainable Finance & Investment.