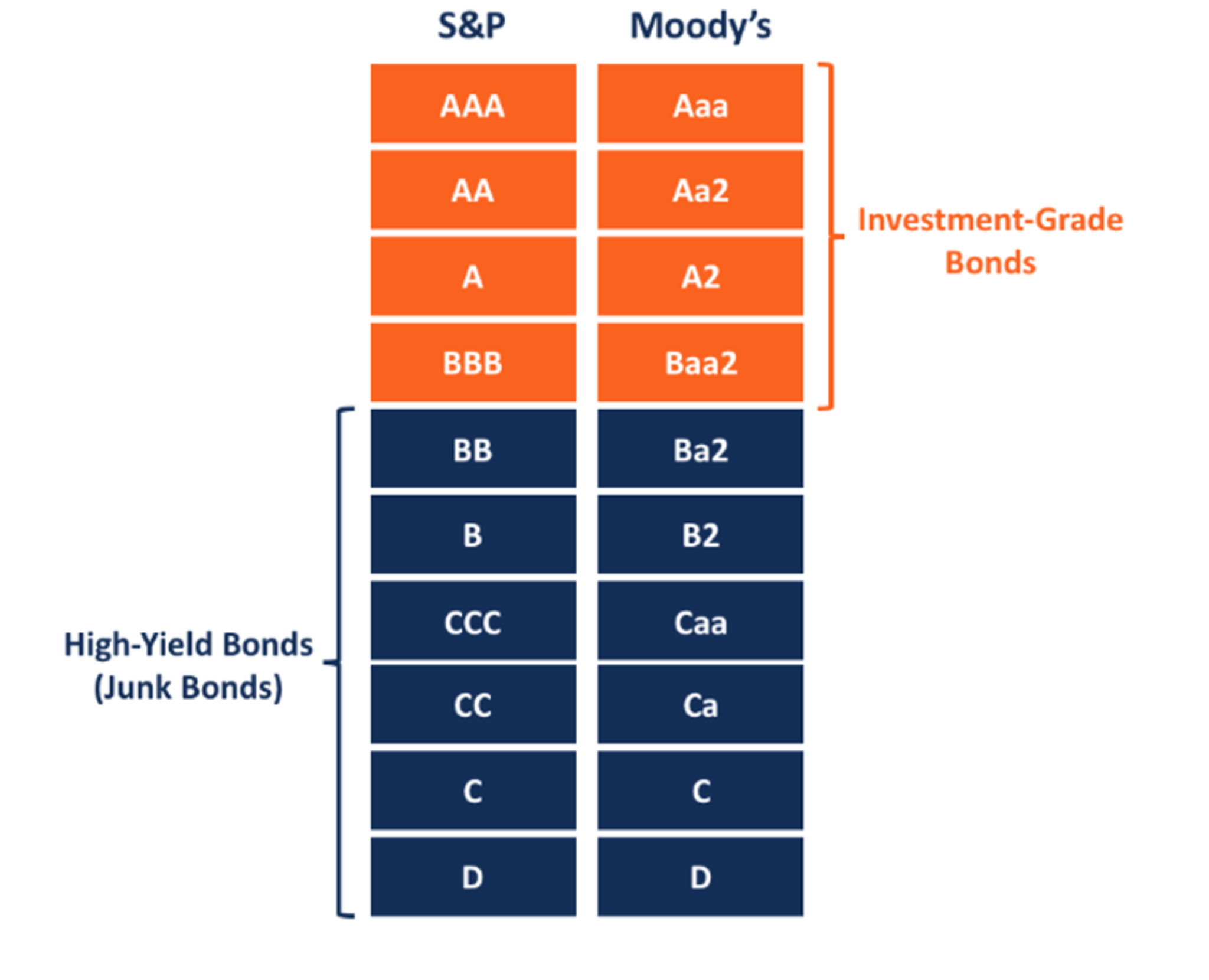

A bond rating is a formal assessment of the creditworthiness of a bond issuer or the financial stability of the bond itself. It is typically provided by professional rating agencies such as Moody’s Investors Service, Standard & Poor’s (S&P), and Fitch Ratings.

These ratings serve as an assessment of the issuer's ability to meet its debt obligations. They are crucial for investors to evaluate the risk associated with a particular bond investment.

Key aspects of bond ratings

The key aspects of bond ratings are:

Investor information: Bond ratings provide investors with an indication of the likelihood that they will receive the principal and interest payments as promised by the issuer.

Market liquidity: High-rated bonds are generally more liquid, as they are considered safer investments.

Pricing and yield: Bonds with lower ratings typically offer higher yields to compensate investors for the higher risk of default.

Ratings impact the degree of risk associated with the bond, they range from AAA through to D, where a company is in default, with little prospect for recovery.

Source: CFI

Bond’s rating upgrades

When a bond’s rating is upgraded, it typically leads to a decrease in yield and an increase in price, reflecting improved creditworthiness. Bond ratings are a vital tool in the fixed income market, providing transparency and helping investors understand the risk associated with bond investments.

Also read: