Hydrogen power — between hype and hope

Decarbonizing national economies is central to government plans. But significant challenges sit between hydrogen’s potential and its uptake and use across sectors. In road transport, better economic and more sustainable options already exist.

Summary

- Green hydrogen is clean and can capture and carry renewable energy

- Generating green hydrogen is still costly to produce, store, and distribute

- Battery-powered electric vehicles are cheaper and better solutions for road transport

Hydrogen as an energy carrier has experienced a surge in attention from corporations, governments, investors, and the general public. It is being heralded as the critical link for transitioning the energy sector away from fossil fuels towards clean and renewable sources. As a result, countries and companies are investing heavily in research to make hydrogen commercially viable, especially within industries that are energy and pollution heavy.

Hydrogen is no industry newcomer. From oil and steel to chemicals and fertilizers, industrial sectors are already using its “grey” form to supplement their intense energy demands. Though global demand for hydrogen has grown steadily over the past few decades, reaching 120 million tons in 2019, production is far from the levels needed to cover future industrial needs in a low carbon economy. Production must be significantly scaled.

What’s more, it must be green and clean, not the grey and dirty sort that is responsible for 830 million metric tons of CO2 emissions each year. Currently, green hydrogen – the sort made using renewable energy and water electrolysis, and the sort needed to reach net zero by 2050 – represents less than 4% of all hydrogen produced. Ramping up production is necessary but costly, hampered by a host of technical challenges across the supply chain.

Tightening emissions standards, a clean renewable fuel, and a sector in transition would imply that hydrogen fuel cell vehicles are the sustainable solution of choice for cutting emissions in transport

Powerful potential

The idea is simple. Use an electric current to break water into hydrogen and oxygen molecules. If that electric current comes from renewable sources, then the process is carbon-free. Reversing the process via a fuel cell (putting hydrogen and oxygen back together) creates an electric current (and water as a byproduct). Scaling, however, adds complexity.

At every stage of hydrogen’s supply chain – storage, transmission, and distribution – challenges grow as scale increases. Generating green hydrogen at industry scale remains the biggest hurdle and explains why volumes have remained low.

Despite the significant technical, economical, and logistical hurdles, most experts agree that within five to ten years, hurdles will be cleared and hydrogen’s decarbonizing potential will be realized.

Road transport is a heavy carbon-emitting sector and with the pending demise of the internal combustion engine, it is already in a state of disruption. Tightening emission standards, a clean renewable fuel, and a sector in transition would imply that hydrogen fuel cell vehicles are the sustainable solution of choice for cutting emissions in transport. However, closer analysis reveals a better path forward – battery-powered electric vehicles (BEVs).

Battery breakthroughs

Batteries certainly have disadvantages. For one, they are heavy, which limits range. In addition, fuel cell EVs offer faster refueling. Moreover, battery manufacturing is energy intensive and recycling is not optimal from an economic point of view. Finally, battery manufacturing employs controversial minerals like cobalt, where ethical sourcing poses problems.

But even these arguments against batteries are weakening. Breakthroughs that surmount previous challenges are emerging across all aspects of battery technology – from weight, range and charging to recycling and raw materials in production.

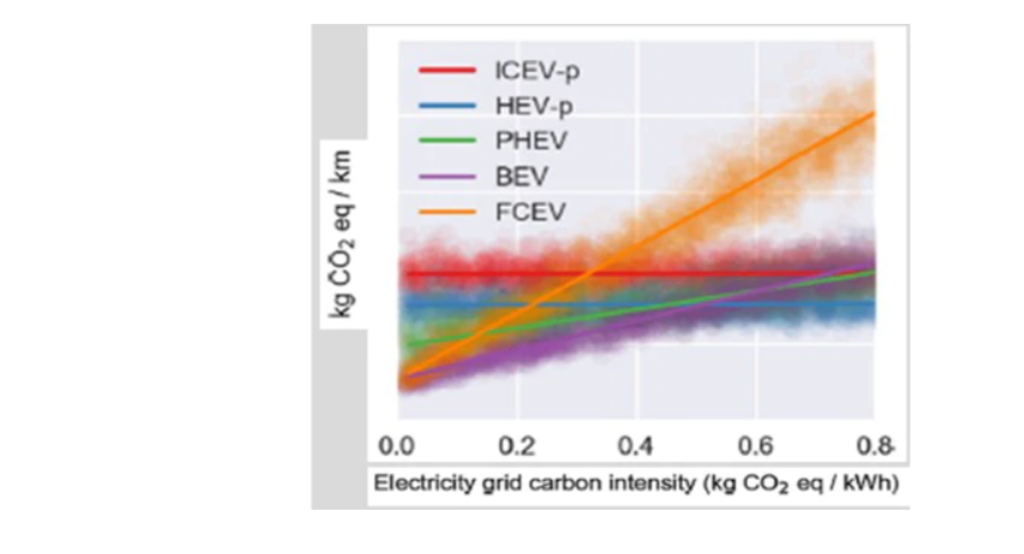

Dirty electrical grids make hydrogen fuel cell vehicles (FCEVs) more polluting than combustion engines (ICEs)

Source: Cox et al., 2020

Battery-powered electric vehicle (BEVs) also start with some significant advantages of their own. The cost of owning and using a BEV is cheaper (fuel cell components are currently costly), their lifetime emissions and carbon footprints are lower (most hydrogen fuel is still produced using dirty sources, see graph), and their energy efficiency is higher (green hydrogen-powered cars still need twice the amount of renewable electricity to cover the same range).

What’s more, battery-powered EVs are popular among consumers and sales are increasing worldwide. More demand means increased economies of scale, which will drive costs further down and infrastructure spending further up.

The outlook for hydrogen-powered vehicles improves when applied to the larger scales needed for public transport. But here too, batteries win in terms of sustainability and economic costs where infrastructure and networks already exist.

Long-hauls and fork-lifts

Hydrogen’s long-range, lightweight and fast-fueling features make it ideal for long-haul cargo transport, and companies such as Daimler, Shell, Hyundai, and Toyota are investing heavily in developing fuel cell fleets. Meanwhile, BEV suppliers are working to optimize vehicle designs in order to shed weight in other areas.

Moreover, in markets like the EU, regulations mandating driver breaks have reduced the time and cost advantages of fuel cell electric vehicles. For long-haul transport, freight trains electrified by overhead wire infrastructure offer a more economical and sustainable alternative.

To maximize efficiency in warehousing requires forklifts to be at near 100% operating capacity. Unlike battery powered forklifts, fuel cells can operate for long stretches without stopping for lengthy recharges that take both forklift and driver out of action. Added efficiency is why warehousing and distribution giants like Walmart and Amazon are expanding fuel cell forklift fleets.

So, is the hype around hydrogen justified? The answer is a yes, but the hype should be directed to the right sectors

Super-charged hype?

So, is the hype around hydrogen justified? The answer is a yes, but the hype should be directed to the right sectors. Though exceptions exist, notably forklifts, battery-powered vehicles offer a more sensible way to decarbonize road transportation with immediate effect.

As technology advances, production scales and supplies increase, the hope and hype of green hydrogen for decarbonizing heavy-emission sectors will cede to probable and predictable. 2050 is a few decades removed, but the one directly ahead will be especially critical for revealing how quickly hydrogen technologies can surmount challenges and turn hope into a tangible alternative for fueling the world’s economies.

Download the publication

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.