SI Opener: Loss of biodiversity is a bigger threat than climate change

Biodiversity represents the knowledge learned by evolving species over millions of years. It reflects the ability of animals and plants to survive the vastly varying environmental conditions that Earth has experienced. It encompasses life in all forms, from genes to entire ecosystems. The interactions played by these different elements have ensured that the Earth has been habitable for millions of years. Yet biodiversity is declining faster than it has at any other time in human history: the current rate of extinction is tens to hundreds of times higher than the average over the past 10 million years.

Summary

- Biodiversity loss has passed a planetary boundary posing high risk

- Financial firms need to check if they are part of the problem

- Call on investors to sign the UN Finance for Biodiversity Pledge

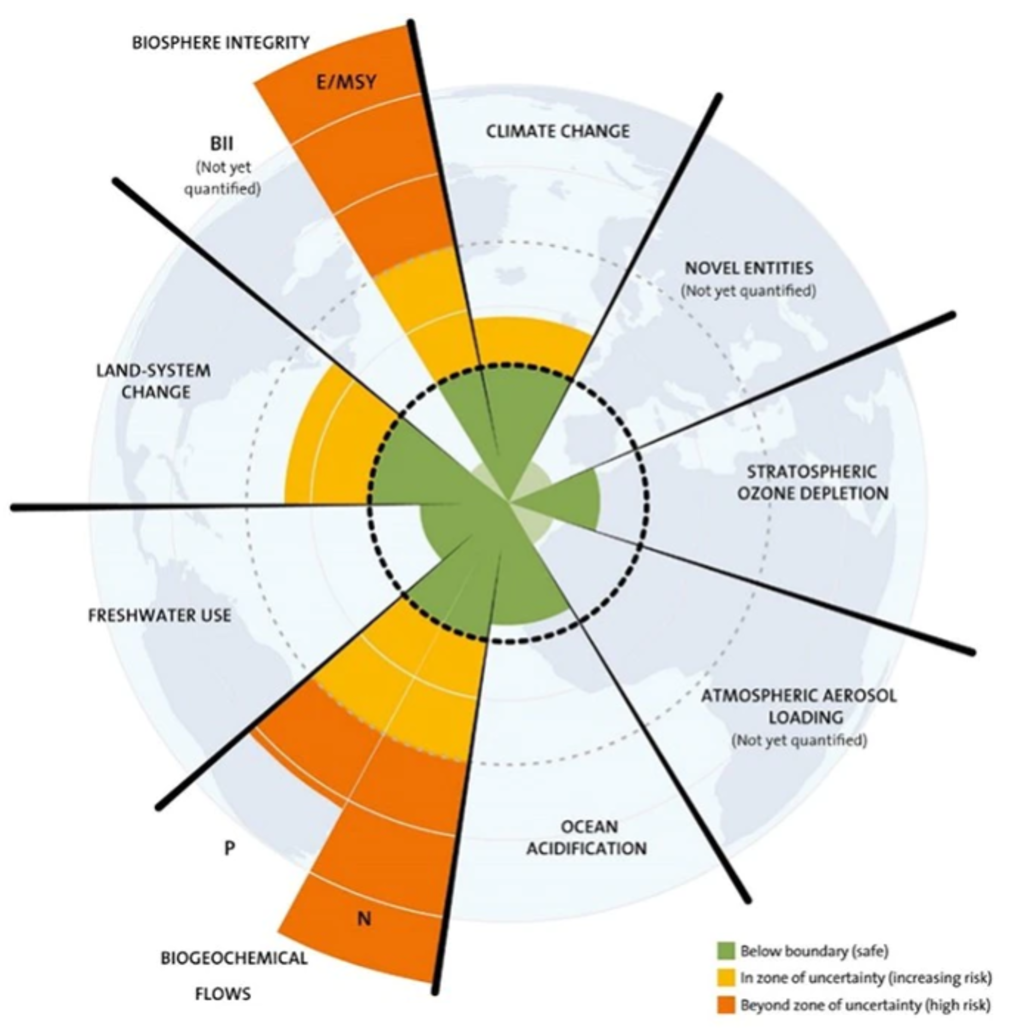

For this reason, scientists warn that we are in the middle of the ‘sixth mass extinction’. Research undertaken by the Stockholm Resilience Centre analyses threats to what they have termed ‘planetary boundaries’. They define these boundaries as nine processes through which humans can ‘regulate the stability and resilience of the Earth system’. Within these boundaries, the planet can continue to thrive and cater to the needs of humanity.

Figure 1 shows the state of our Earth according to this research. You can see that biosphere integrity measured by the extinction rate (extinctions per million species/years (E/MSY)) is at high risk and has already passed the boundary of uncertainty. As biogeochemical flows (nitrogen and phosphorus) have also passed the boundaries, we do not know how ecosystems will react.

Figure 1 | Boundary threats to biosphere integrity

Source: Stockholm University1

According to this research, these two issues provide even bigger uncertainties than climate change. However, combatting global warming remains very important, as it ranks high on the list of direct drivers of biodiversity loss, and it increasingly aggravates the negative impact of other drivers, such as land use change, on nature.

Research conducted by De Nederlandsche Bank (DNB) and the PBL Netherlands Environmental Assessment Agency identify “EUR 81 billion in loans provided by Dutch financial institutions to high nitrogen-emitting sectors, and a EUR 28 billion exposure to companies that operate in protected or high conservation value (HCV) regions and face potential stranded assets risks”.2

This is an example of the interconnectedness of Dutch and other financial institutions to high-emitting and biodiversity-threatening industries. On the one hand, this confirms their negative role in reaching planetary boundaries of uncertainty. On the other hand, it highlights the risks they face if legislation or consumer behavior changes on this topic.

Next to this, biodiversity loss is posing a systemic risk, of which investors should become aware. As we find ourselves at the doorstep of the sixth mass extinction, both businesses and regulators have a huge role to play in shifting paradigms about who pays for the externalities created by ‘business-as-usual’.

Frontrunners in ESG are working together on this topic

Many investors are currently focusing on climate change and developing metrics to measure, manage and monitor climate risks and opportunities in their portfolios. However, given the growing body of evidence on the large impact that biodiversity loss will have globally, we believe more effort should be put into measuring the biodiversity impact of portfolios.

In the Netherlands, several investors under leadership of the ASN bank are collaborating in the Partnership for Biodiversity Accounting Financials (PBAF) to develop such metrics. They aim to create a framework for financial institutions to consider and address the biodiversity impact of their portfolios across asset classes.

Furthermore, Robeco started an engagement theme on biodiversity earlier this year. Land use change is one of the major contributors to biodiversity loss, and much of this is driven by crop commodity production. Therefore, our engagement will focus on the impact on biodiversity of deforestation that is linked to five high-risk crop commodities – cocoa, natural rubber, soy, beef, and tropical timber and pulp.

Our engagement centers around five issues. The first three engagement objectives will focus on environmental management, with a clear value placed on ‘zero deforestation’ commitments, biodiversity impact assessments, fauna and flora restoration and conservation, and circular economy principles within companies’ production lines. We deem these highly relevant, especially for the five commodities that fall under this engagement.

The fourth objective will address disclosures, certifications and traceability. The fifth will focus on the social aspect of the production of these commodities, and will tackle both community and land rights, along with labor rights. We want to steer towards reaching 100% traceability for producers and users of these chains. Only then will it be possible to trace the impact on biodiversity in the supply chain.

Call to action: join the Biodiversity pledge

On 25 September the Finance for Biodiversity Pledge will be launched during the Nature for Life Hub at the 75th UN General Assembly. The organizations that have signed the pledge have committed to protecting and restoring biodiversity through their financial activities and investments.

As one of the signatories, Robeco is extending a firm ‘call to arms’ to other investors to sign up. Then they can make sure they are not part of a problem which is already testing the Earth’s ability to digest it.

By signing the pledge, institutions commit to collaborating and sharing knowledge, engaging with companies, assessing impact, setting targets and report publicly on progress. This entails a roadmap that will take up several years, requiring commitment and resources from as many investors as possible. More information on the pledge can be found here.

Make it happen!

SI Opener: Seeing is believing.

Footnotes

Important information

This information is for informational purposes only and should not be construed as an offer to sell or an invitation to buy any securities or products, nor as investment advice or recommendation. The contents of this document have not been reviewed by the Monetary Authority of Singapore (“MAS”). Robeco Singapore Private Limited holds a capital markets services license for fund management issued by the MAS and is subject to certain clientele restrictions under such license. An investment will involve a high degree of risk, and you should consider carefully whether an investment is suitable for you.