Rapid fintech adoption can underpin emerging markets' growth

The second order effects of improved financial inclusion include increased economic activity and greater resilience to shocks, underpinning our positive long-term macroeconomic view on emerging markets.

Summary

- Fintech solutions have spurred financial inclusion across the world

- This is increasing economic activity, savings and access to credit

- Long term, this underpins our constructive macro view on EM

Robeco’s emerging markets (EM) thesis rests on a strong macroeconomic foundation. We have consistently argued that three tailwinds – rapid technology adoption, a rising share of international trade (especially between EM nations), and a multipolar global economic landscape – will combine to make EM equities a preferred asset class in coming years. A structurally weaker US dollar, lower government debt burdens, and in some cases advantageous demographics will also be supportive. In this article we are going to look deeper at rapid technology adoption and in particular how the second-order effects of financial inclusion can support a higher trend level of economic growth.

Financial inclusion, the ability of individuals and businesses to access and utilize a range of financial services, is an important catalyst for economic growth and poverty reduction. In emerging markets, where a significant portion of the population remains excluded from the formal financial system, technology is playing an increasingly transformative role in bridging this gap.

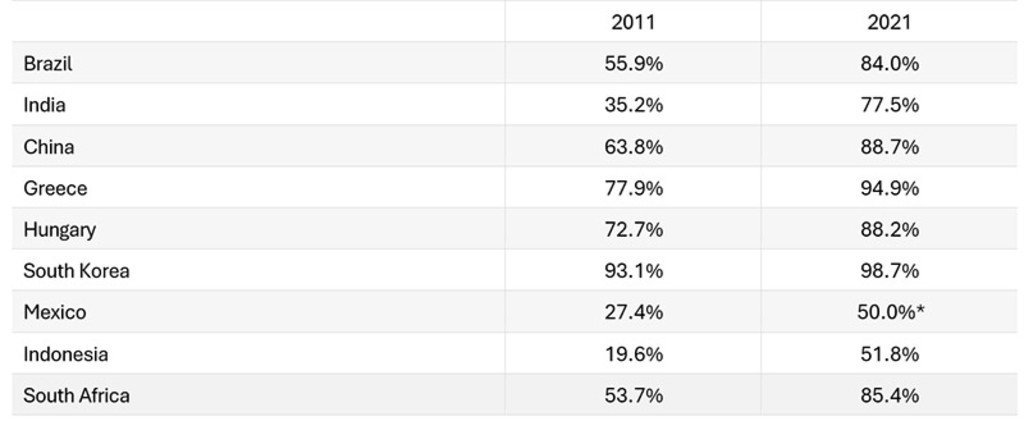

In Table 1 below we show how many adults over the age of 15 had a bank account, using this as a proxy for financial inclusion in a selection of emerging markets that Robeco’s EM strategies invest in. This ranges from South Korea and Greece, which have levels comparable to developed markets, to Mexico and Indonesia, where financial inclusion remains a significant challenge.

All the markets showed improved financial inclusion over the period and we believe a significant driver of this was smartphone adoption, which gave underserved individuals and communities access to financial services like payments apps and bank-like services. For example, in Brazil, smartphone adoption (whole population) grew from 15% to more than 60% from 2011 to 2021 and in India from an estimated 4% in 2011 to over 50% by 2021,1 coincident with the rise in the number of working-age people with access to banking services.

Table 1: Percentage of population (15 years and older) with a bank account

Source: World Bank – Global financial inclusion – July 2025. *Mexico 2021 data is estimated as World Bank data is unavailable.

What EM opportunities are out there?

Receive our newsletter to dive deep into EM investment opportunities.

The variance in financial inclusion depends on much more than smartphone adoption or the general level of economic development. For example, in Mexico, lack of trust in government institutions, gender inequality, and a culture that favors cash and informal networks have limited financial inclusion so far. The entrance of a raft of fintech providers like Nubank and local competitor Spin by Oxxo is likely to lead to rapid progress in our view.

Governments and regulatory bodies also play a key role in enabling financial inclusion. This includes introducing policies to promote financial literacy, consumer protection, and responsible lending practices. For example, India makes use of the Aadhaar System. This biometric identification system has facilitated the opening of millions of bank accounts for previously unbanked individuals. By providing a unique identity, Aadhaar has enabled easier access to financial services and government benefits.

The practical benefits

Fintech-driven inclusion typically expands access to the following broad categories of service in emerging economies:

Mobile payments: Mobile money platforms, such as M-Pesa in South Africa, Dana in Indonesia and PicPay in Brazil have revolutionized how people send and receive money, pay bills, and access essential services. These platforms allow users to conduct financial transactions using their mobile phones, even without a traditional bank account.

Online lending: Fintech companies are leveraging alternative data sources and AI-powered algorithms to assess creditworthiness and provide loans to individuals and small businesses with limited credit history. This is opening up new avenues for accessing credit and fostering entrepreneurship.

Digital savings and investment: Fintech platforms are offering innovative savings and investment products that are accessible and affordable, encouraging individuals to save for the future and build financial security.

In emerging markets, the adoption of fintech solutions tends to be faster than in developed markets, as traditional finance is bypassed by the previously excluded income cohorts.2 For example, in Brazil this has resulted in a fintech company, Nubank, an online-only neobank, which entered the market in 2013, becaming the country’s biggest retail bank in terms of customers in 2024 with more than 92 million.3 Even neobanks which launched in developed economies like Revolut have seen greater market penetration in emerging economies with its retail market share higher in Eastern Europe at 22% than Western Europe at 7%.4

How does financial inclusion impact economic growth?

The impacts on the broader economy can be summarized in these two broad categories:

Growth through increased economic activity: Increased financial inclusion supports economic activity by reducing transaction costs and enabling individuals and businesses to save, invest, and participate more fully in the economy. A recent study of global data encompassing all UN member states found that financial inclusion significantly boosts economic growth.5 Using a composite financial inclusion index and panel data models, the study showed that a 1% increase in financial inclusion leads to a 0.316% increase in global economic growth.

Improved economic stability and resilience: With more people able to save and access insurance, households and businesses become more resilient to macroeconomic shocks, helping stabilize communities and economies during downturns. As more households and firms use financial and wealth management services, their ability to smooth consumption increases, which can make monetary policy easier to manage. This should be reflected over time in a positive credit ratings trend for both sovereign and corporate debt in EM. The difference between the yield on EM debt and that of top-rated developed market government bonds has been narrowing since the end of the Covid pandemic, although it’s not possible at this stage to measure what contribution improving financial inclusion may have made.

Risks and impediments

While increased financial inclusion brings substantial long-term benefits for growth, resilience, and social integration, it also introduces new challenges for financial stability, regulatory oversight, and consumer protection that must be managed.

Financial literacy is a problem in large population cohorts in both developed and emerging markets and digital literacy gaps have also opened the way to new forms of fraud and scams. If digital financial services outpace improvements in digital literacy and trust, certain groups may remain excluded or become vulnerable to misbehavior.

A recent high-profile case in India, where new cohorts of online retail stock investors have been using complex derivatives to leverage their exposure to individual companies and the broader index, has seen many retail participants incur substantial losses, while international market makers have profited from arbitrage trades, drawing the scrutiny of regulators.6 In this case, the retail behavior resembles gambling more than investing and requires either stricter regulation or better financial education so the benefits of wider stock market participation can be enjoyed.

Conclusion

Financial inclusion is a long-term trend in emerging markets, but in many countries it still remains a significant challenge. We believe the improving macroeconomic fundamentals that many EM economies are demonstrating partly reflect the positive aspects of financial inclusion, and the academic evidence is supportive. We track the adoption of fintech in EM, both to benefit from investing in the companies that provide financial services, and as part of our top-down macroeconomic assessment of individual countries. Investors seeking to increase their allocation to emerging markets equities should take this positive trend into account when considering their level of exposure and deciding where best to invest.

FinTech investing

Digitalization has hit the financial services sector, creating attractive growth opportunities for the transformative technologies of fintech companies.

Footnotes

1World Development Indicators – Mobile penetration database –World Bank - July 2025

2The tech leapfrog effect is producing EM fintech winners – Robeco – May 2024

3The neobank era is here – Robeco – September 2024

4Revolut’s 2024 growth seeks for 100M customers in 100 countries – paymentexpert.com – April 2025

5New insights into the impact of financial inclusion on economic growth: A global perspective - Mohammad Naim Azimi – November 2022

6‘Sinister scheme’: India ban threatens Jane Street’s money machine – Financial Times - 9 July 2025