Carbon capture and storage (CCS) is the process of capturing waste CO2 and placing it into a geological storage site in such a way that it will not re-enter the atmosphere. While still too small scale to make a real difference to global warming, the technology is improving and the use of it is growing. It can also be used to generate carbon credits that can be sold for offsetting purposes.

CCS uses several technologies, including absorption, chemical looping and membrane gas separation to prevent the CO2 generating by industrial processing from entering the air. It is primarily aimed at large new build industrial facilities or real estate projects; retrofitting it to existing facilities such as power stations is currently prohibitively expensive

Carbon credit/offset projects. Source: carboncredits.com

In order for CCS to be effective, concentrated emissions are necessary. A carbon capture system placed on top of a factory, for example, works very well and is fairly cost efficient. There are currently 35 commercial facilities using CCS, capturing 45 million tons of CO2 per year. A further 300 CCS projects are planned, with the target of capturing 220 million tons of CO2 per year by 2030.

As the wide-scale application of CCS necessary to make an impact on climate mitigation is many years away, investors subsequently view carbon capture as not currently having the scale to make a meaningful difference to global emissions. Instead, natural carbon capture methods led by restoration of natural habitats have received a great focus and investor interest.

CCS can be used as part of carbon offsetting – where a company can show that it has taken action to reduce its carbon footprint. An offset carbon credit can be generated for every ton of CO2 or CO2 equivalent that a company stops from entering the atmosphere. This can then be used to mitigate other emissions for which CCS or natural methods such as reforestation are not available.

Creating returns that benefit the world we live in

Carbon removal technology

Direct air capture (DAC) technology that can actually remove carbon by sucking it out of the air is in its infancy. The captured CO2 can also be used in food processing or combined with hydrogen to produce synthetic fuels, rather than being stored.

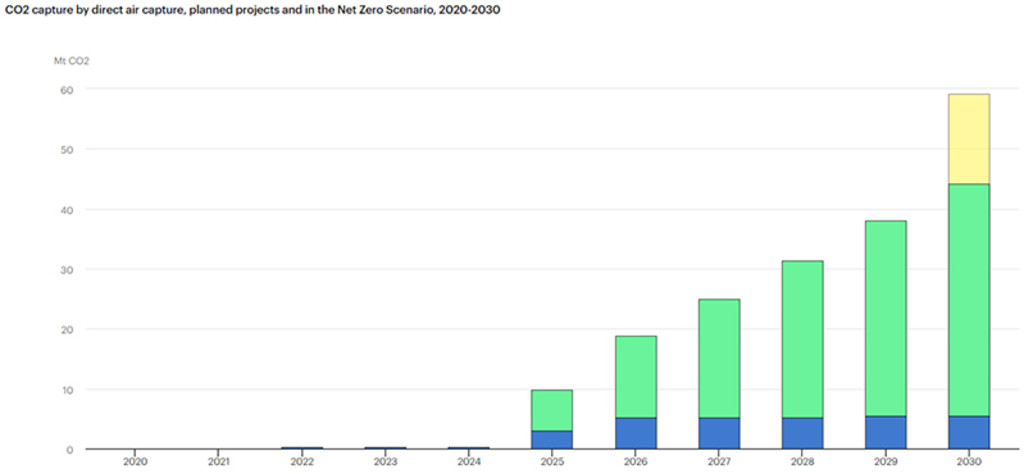

The CO2 that is saved can be used to generate carbon credits for offsetting other emissions. There are currently a few projects up and running which are generating credits worth about USD 750 a ton. While small, the DAC market is expected to grow to be able to capture 60 million tons of CO2 by 2030, as shown in the chart below.