Carbon allowances and carbon credits/offsets form part of carbon markets that attempt to reduce greenhouse gas emissions by putting a price on them, effectively turning CO2 into a commodity. They are growing in size to account for an increasing amount of global emissions. While the terms are often used interchangeably, they trade on two distinct markets – an official, or compliance market for carbon allowances, and an unofficial, voluntary one for carbon credits/offsets.

Carbon allowances

Carbon allowances are essentially permission slips from a government or governmental agency that allow a company to emit one ton of CO2, or CO2 equivalent (CO2e). Governments set emission targets in advance and gradually reduce them over time as they attempt to meet net-zero targets by 2050.

As they are officially sanctioned, they form part of compliance markets that allow the slips to be traded. If the allowance isn’t used, it can be sold to another company on ‘cap and trade’ carbon markets. Likewise, extra permission slips can be purchased if a company thinks it will exceed its allowance. The market’s existence encourages companies to reduce their emissions in line with the government’s targets, or face an increasingly expensive bill for the extra slips.

There are now about 25 cap and trade compliance markets around the world, the biggest of which are in the EU, the UK, California and China. They were rather ineffective when first launched in the 2000s, as the price of the credits was too low and implementation too sporadic. But they are now working well, with an average global credits price of USD 28 per ton of CO2e, and a much higher price of EUR 90 ton/CO2e within the EU’s Emission Trading Scheme. If taken together with carbon taxes, the two pricing mechanisms now cover 20% of global emissions.

Carbon credits / carbon offsets

A carbon credit, also known as a carbon offset, is traded between private parties on the voluntary carbon market. They are issued by carbon crediting schemes and represents the reduction, removal or avoidance of one ton of CO2e. Carbon credits/offsets are uniquely serialized, issued, tracked and cancelled by means of an electronic registry.

There are two types of carbon credits/offsets. Removal credits are generated by projects that directly remove CO2 from the atmosphere either naturally through reforestation or other habitat restoration, bioenergy or soil carbon enhancement, or through technology such as direct air capture technology with geological storage.

Avoidance credits are created by preventing the CO2 from entering the atmosphere in the first place, most commonly by replacing fossil fuels with renewable energy, or through biodiversity preservation projects. Avoided emissions are theoretical reductions measured against a future projected baseline level, but do not lower the amount of carbon entering the atmosphere elsewhere.

Carbon credit/offset projects. Source: carboncredits.com

Creating returns that benefit the world we live in

Credibility problems

The credits/offsets are issued by certification agencies such as the not-for-profit VERRA, which issues the Verified Carbon Standard. As with carbon allowances, they can be traded. A company that wishes to mitigate its carbon footprint can buy a credit on the voluntary market to offset it. In this way, they are also known as carbon offset credits, making the terms interchangeable.

These voluntary markets are growing in popularity, but have credibility issues. One is that many of the credits were issued at historic prices that may be meaningless in relation to the impact of the emissions that occur many years later. They offer a ‘feelgood factor’ for companies rather than genuine emissions reductions.

Another is that it is essential to show ‘additionality’ – that the action actually resulted in emissions reduction outside of what was legally required. A company paying for reforestation would need to show that the land would not have been reforested anyway, resulting in no new net contribution due to its efforts. This is often hard to verify and can lead to accusations of greenwashing.

The best time to plant a tree was 20 years ago; the second-best time is now – old Chinese proverb

Use by companies, consumers and investors

Nearly all corporate climate strategies rely heavily on carbon offsets, particularly in hard-to-abate sectors such as airlines. This has prompted a fierce debate on the performance and credibility of carbon credit markets and the legitimacy of carbon offsets in decarbonization strategies.

Carbon offsetting is gaining traction though with consumers, as it can be used to compensate for emissions in sectors such as tourism. Airlines now offer customers the opportunity to offset the emissions caused by their flight by paying for trees to be planted on land sequestered by the airline. A flight from Amsterdam to Athens, for example, would require three trees to offset the emissions.

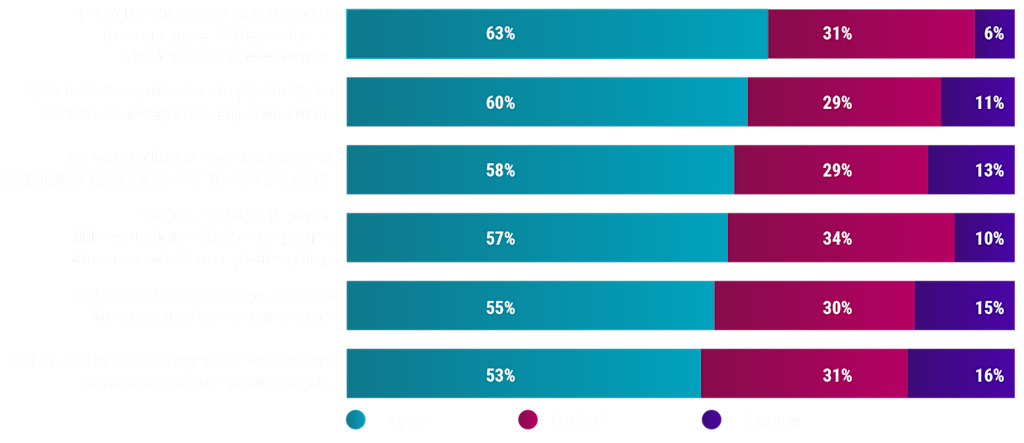

For investors, the Robeco Global Climate Survey 2022 showed that the carbon credits and related offsets concept is also winning over investors as well. Some 63% of those surveyed said they thought that higher-cost carbon credits could be a powerful tool for reducing emissions, while 58% thought they would become an asset class over the next two to three years. However, 55% also thought that carbon markets were still too illiquid to be considered by their organization.

Carbon credits have a role in reducing carbon emissions

Investor views on carbon credits. Source: Robeco Global Climate Survey, March 2022