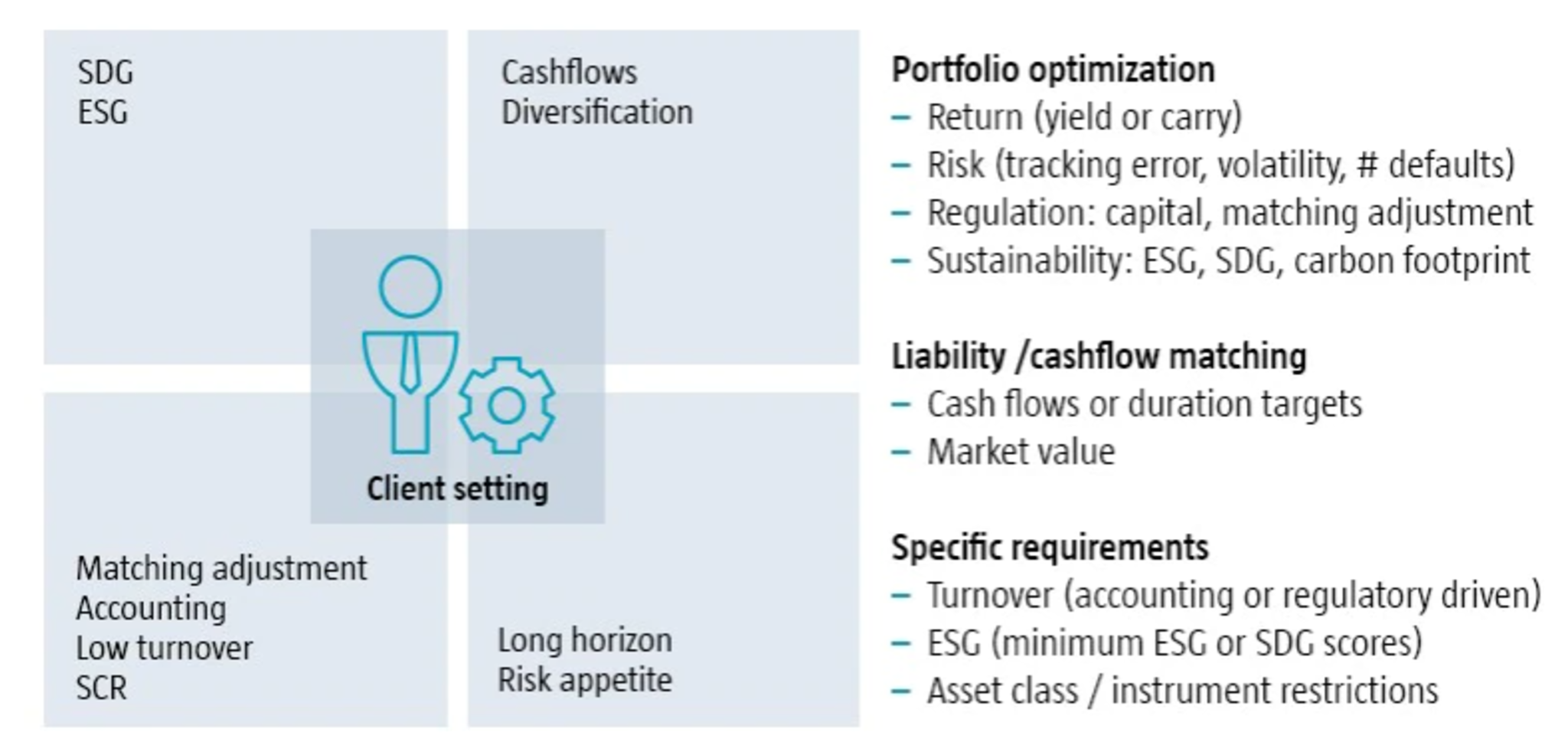

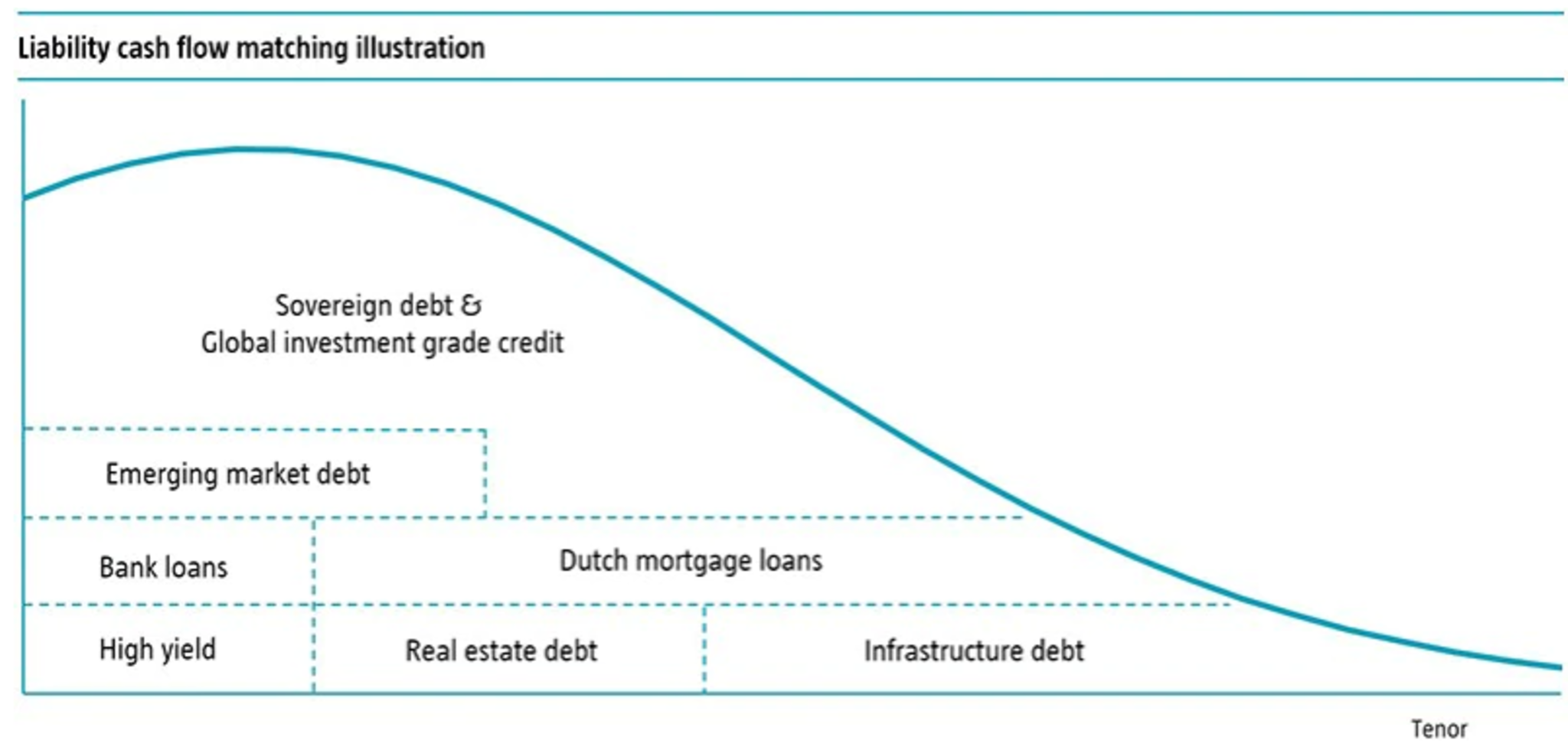

Phase 1: Understand the client

To design customized solutions, we first make sure we understand our clients and their specific objectives. The optimal portfolio depends on their specific needs in terms of objectives, requirements and regulation. Our portfolio managers spend significant time on the design phase, focusing on the actual purpose of the investment, such as cash flow matching, protecting the solvency ratio or accumulating wealth.

Client setting: identifying optimization targets, liability considerations and specific requirements