The amended European Shareholder Rights Directive II (“ SRD II”), which is applicable as of 10 June 2019, includes transparency obligations for European institutional investors – i.e. pension funds and insurers - as well as a European asset managers (e.g. Robeco) to the extent investments in EU equity instruments are made.

Robeco is very committed and well positioned to adhere to SRD II, in addition to relevant stewardship codes, which aims to encourage long-term shareholder engagement. We have a long-standing focus on responsible investing and long-term shareholder engagement. We use our ownership rights to constructively engage with investee companies and to serve the long-term interests of our clients.

1. Engagement policy & reporting

Pursuant to SRD II Robeco is required to disclose a shareholder engagement policy on a ‘comply or explain’ basis. This policy must describe how Robeco:

i. monitors investee companies on relevant matters (e.g. strategy, (non-) financial performance, risk, and ESG);

ii. conducts dialogues with investee companies;

iii. exercises voting and any other shareholder rights;

iv. cooperates with other shareholders;

v. communicates with relevant stakeholders;

vi. manages (potential) conflicts of interests in their engagement.

The Robeco engagement policies include the Robeco Stewardship Policy, which incorporates the Robeco Proxy Voting Policy and Robeco Engagement Policy, as well as the Robeco Exclusion Policy. These policies are fully compliant with SRD II and available on our website.

SRD II also requires annual reporting on the policy’s implementation, including a general description of voting behavior, votes cast, an explanation of the most significant votes and the use of proxy advisors. Robeco‘s engagement and voting activities are reported on in our annual Stewardship Report. This includes descriptions of our significant votes casted, e.g. cases in which:

there has been considerable news flow about a proposal or shareholder meeting

we have received questions from clients and beneficiaries, or the item is of strategic importance to them

the topic of the item is particularly salient at a given time

we oppose management’s recommendation and hold a significant economic interest in the company.

More information about voting

Shareholder engagement team

A dedicated team of engagement specialists maintains an active dialogue with some 200 companies a year on themes, which are material from a financial and sustainability perspective, and which we identify in consultation with our investors. This has proven to be a successful means of influencing corporate behavior. Robeco also votes at approximately 7,000 shareholder meetings each year. All of Robeco’s activities are in line with the Principles for Responsible Investing (PRI), which require asset managers to be active owners and incorporate ESG factors into their ownership policies and practices, in addition to SRD II.

Conflicts of interests

Robeco has a policy and framework to manage conflicts of interest. Conflicts in relation to our stewardship responsibilities are covered by our ‘Conflict of interest procedure’.

Several conflicts of interest could arise related to Robeco’s stewardship activities. Examples of these potential conflicts of interest are:

A company that is selected for engagement is related to one of our (prospective) clients;

Robeco has voting rights in a company that is related to one of our (prospective) clients;

A company that is selected for engagement or is related to our parent company or related subsidiaries;

Robeco has voting rights in a company that is related to our parent company or related subsidiaries;

Clients have differences in engagement preferences.

In these instances, Robeco will execute its voting and engagement policy, as normal on behalf of our ultimate investors following our standard voting policy and engagement guidelines. In case a business relationship might threaten the objectivity or the nature of stewardship activities, Robeco’s compliance department is consulted. If, after consultation with Robeco’s compliance department, voting and engagement activities are to be pursued, different stakeholders including the Robeco Executive Committee and clients are informed.

2. Mandate and/or fund specific disclosures

SRD II requires Robeco to annually disclose how its investment strategy complies with the mandate we have with an institutional mandate client or a Robeco equity fund an institutional client has invested in, and how it contributes to the medium to long-term performance of the institutional client’s assets. The disclosure obligation can be met by either individual client reporting or by generic publication on our website. The disclosure shall include reporting on the key material medium to long-term risks associated with the investments, the use of proxy advisors, turnover and turnover costs, our policy on securities lending and whether conflicts of interests have arisen regarding engagements activities and how we have dealt with them.

Alignment long term liabilities and investment strategies

We have published information on how we ensure that our equity investment strategies aligns with our clients liabilities and how we make decisions based on our assessments about medium to long-term (non-) financial performances and risks of the underlying investee companies and how we engage with them. This is contained in the Robeco Sustainability Policy, which is available on our website.

Key material medium to long-term risks associated with the investments

Our equity investment strategies with the exposure to the European Economic Area (EEA) are subject to various mid- and long term risks. The key risks include:

Political tensions and adverse developments within and between countries as well as regions (e.g. trade conflicts or controversial policy actions by governments and regulators)

Macroeconomic risks (e.g. debt crisis, recession, unexpectedly high inflation or deflation)

Specific risks of single stocks and industry sectors (e.g. poor corporate governance practices, lack of innovation, product quality and safety risks)

Declining liquidity of some market segments or single stocks (e.g. may lead to significant price discounts)

Sustainability or other risks which have the potential to negatively impact the equity markets (e.g. natural disasters due to climate change, epidemics, or terrorist attacks).

The order from 1-to-5 does not imply that one has more probability of realizing or has more weight than any of the others.

The assessment of medium and long-term risks is an integral part of the investment and risk management framework. Our teams of experienced analysts and portfolio managers continually analyse the relevant markets as well as the relevant political, environmental and societal environment.

Our investment strategies are research-driven and executed in a disciplined, risk-controlled way.

Our key research pillars are fundamental research, quantitative financial research and sustainability research. We can create socioeconomic benefits in addition to competitive financial returns.

ESG integration leads to better-informed investment decisions and better risk-adjusted returns throughout an economic cycle.

More in-depth information per equity strategy

The use of proxy advisors

Robeco uses a proxy voting platform and proxy voting recommendations for all of the meetings which we vote. Our proxy voting advisor (Glass, Lewis & Co.) provides voting recommendations based upon Robeco’s custom voting policy. A Robeco team of dedicated voting analysts then analyze the merit of each agenda item. This analysis, based upon Robeco’s voting policy takes precedence over the recommendations of the proxy voting advisor. This means Robeco’s instructions often deviate from the recommendations of both management and the proxy advisor.

At least annually, we evaluate our proxy voting agent, on the quality of governance research and the alignment of (customized) voting recommendations and Robeco’s voting policy. This review is part of Robeco’s control framework and is externally assured.

Securities Lending

Robeco has a securities lending program for several of its funds. When shares are on loan, Robeco is contractually unable to exercise voting rights for these shares. For our funds we monitor if shares are out “on loan” for upcoming shareholder meetings. The decision to recall shares depends on two main guidelines.

In principle we aim to vote on all of our equity positions, with at least the majority of that stake.

In certain cases recalling shares to vote for an even higher percentage is desired when:

1. The company is a significant holding

2. The company is subject to our engagement program and / or engagement has proven unsuccessful thus far and/or

3. The agenda for the shareholder meeting contains a controversial proposal.

Robeco’s securities lending program is monitored by our lending agent, J.P. Morgan, including for any misuse of voting rights. For more information about the use of securities lending in a relevant fund, please go to the annual report or prospectus via our fund selector.

Portfolio turnover and turnover costs

For the mandate clients in scope, information on portfolio turnover will be included in the annual MiFID II client report - to be firstly submitted in Q1 2020. Portfolio composition and turnover costs are already part of the MiFID reporting you receive from us on a quarterly basis.

If you are invested in a relevant equity fund (to the extent investments in EU equity instruments are made), the annual report for that fund contain the SRD II required information on portfolio composition and turnover costs.

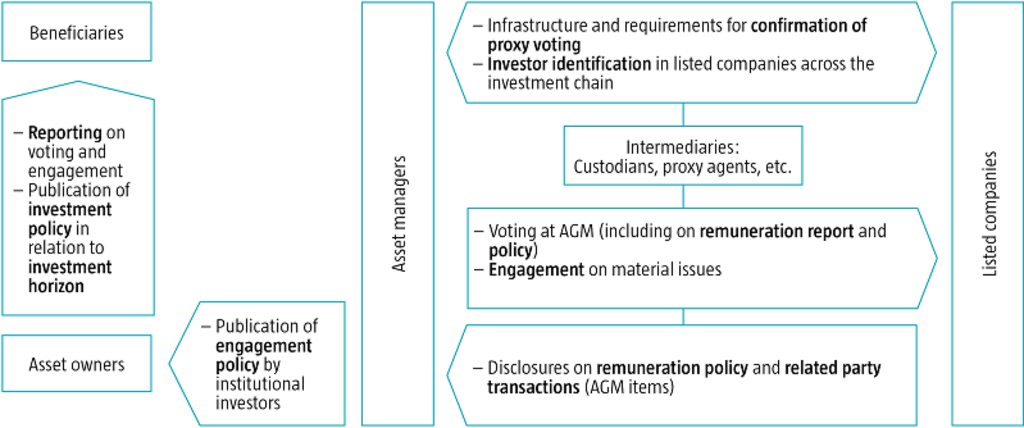

SRD II aims to improve feedback mechanisms to enhance the quality and long-term value orientation of the investment chain