The stars align for European equities

Europe’s stock markets have lived in the shadow of the US since the financial crisis, leaving valuations languishing. This means great companies, with global reach and strong competitive positions, are underowned creating a clear opportunity for long-term investors.

Summary

- Historic valuation discount to US creates window of opportunity for rerating

- Europe provides a deep pool of sustainable and differentiated business models

- Stock picking is key amid macroeconomic uncertainty

Europe has had a strong start to 2024 with the MSCI Europe Index gaining 9.05%1 by the end of June, driven by solid earnings and expected interest rate cuts. Despite this, the US S&P 500 outperformed with a 19.03%2 gain due to its tech sector dominance. As global investors assess their level of exposure to the technology sector, this could offer a unique opportunity for European stocks.

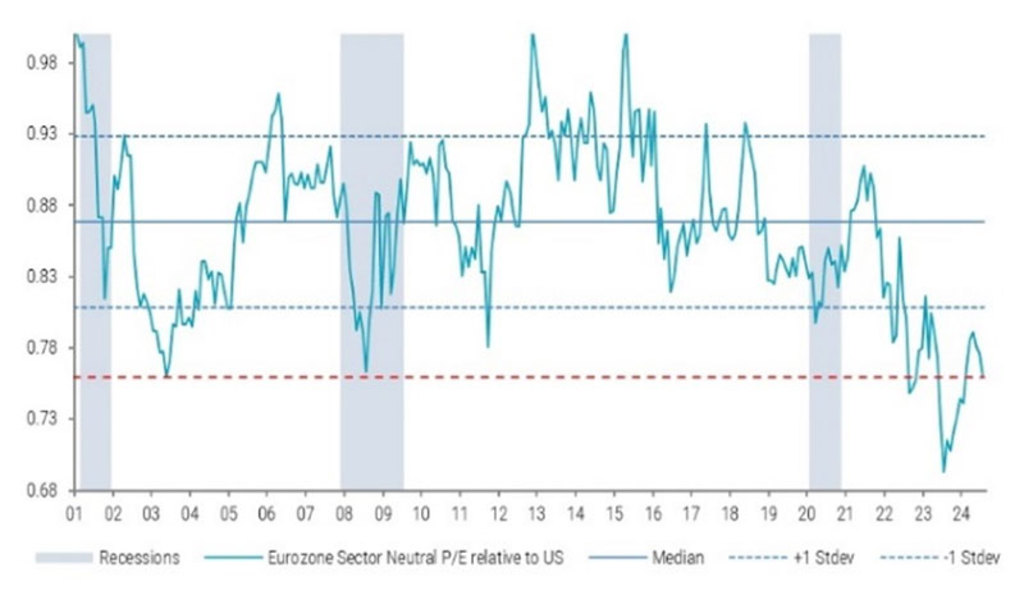

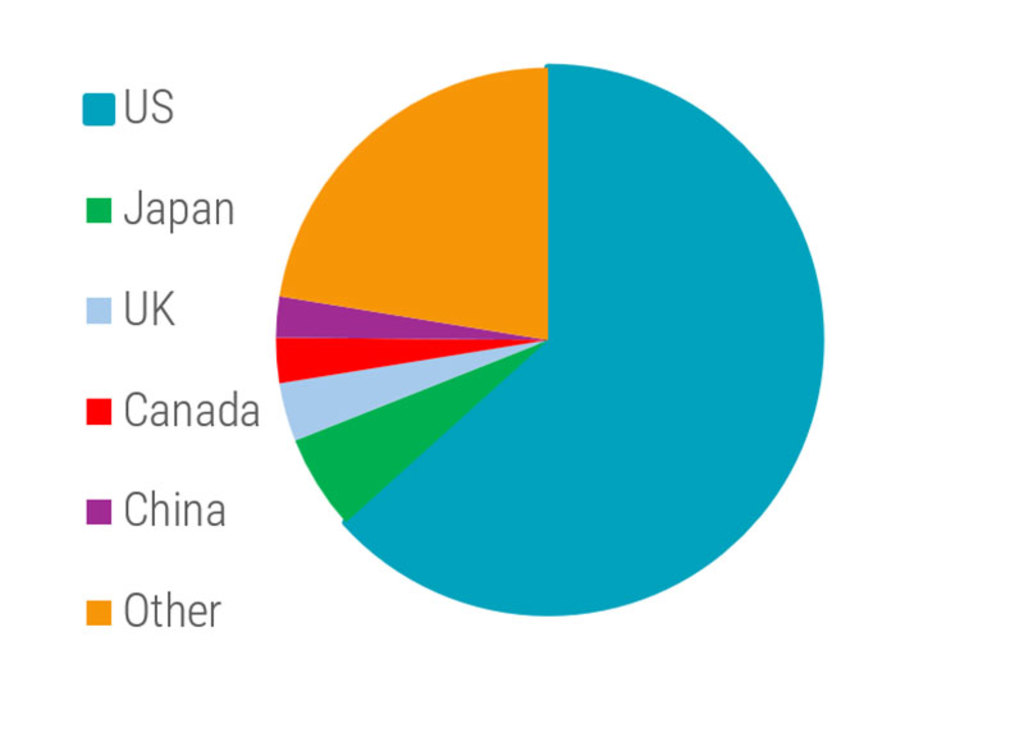

The MSCI Eurozone sector neutral P/E discount relative to the US (see Figure 1) is near the largest pre-COVID, on par with the dotcom, GFC and Euro crisis extremes despite the buybacks yield having moved closer to the US, and dividend yields remaining double the US3. Measured by the MSCI ACWI (see Figure 2) the US weighting in the index, which includes 99% of the world’s investable stocks, was 62.6% in March 2024 up from 49.5% ten years earlier, mostly at the expense of Europe. The near historic valuation discount versus the US, coupled with investors being underweight the region, provides a firm floor for European equities.

Figure 1: Eurozone valuations remain near historic lows relative to US

Source: J.P.Morgan Global Equity Strategy

Figure 2: MSCI ACWI geographical weighting

Source: MSCI, as of 31 March 2024

A modest reversion to the mean could imply relative outperformance for European stocks, even if underlying market trends remain difficult in the short term.

GDP growth isn’t a good proxy for equity market performance

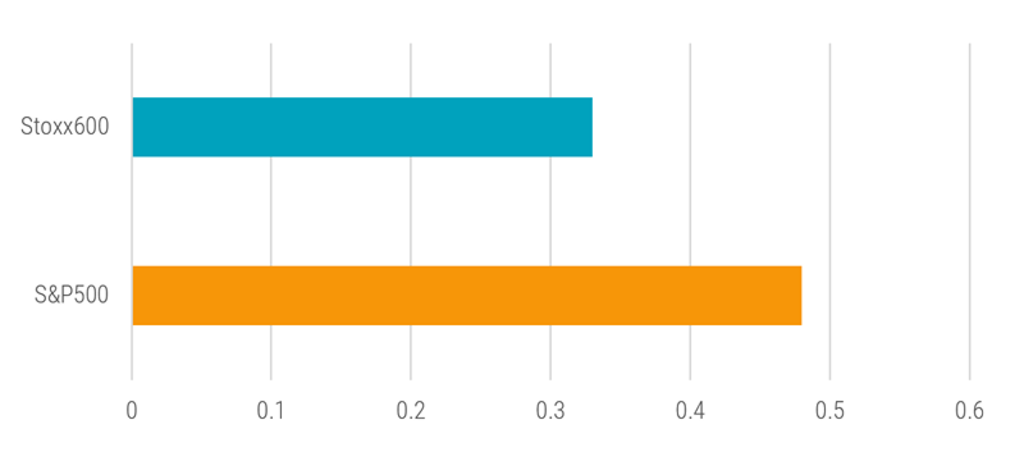

Forecasts for Europe’s GDP growth in the coming years are consistent; growth will likely trail the US and emerging markets. For example, the IMF forecasts 2025 euro-area growth at 1.5% compared to the US at 1.9% and the world at 3.2%4. Should this matter to equity investors? Not that much, as equity markets are not very correlated with economic growth, with Europe especially showing a very weak relationship (see Figure 3).

Figure 3: Correlation of real GDP and Europe, US equity index performance

Source: Deutsche Bank, based on quarterly data (yoy) from 2001 to 2023, total return.

The other major factor that explains why equities are relatively indifferent to the growth outlook is that Europe’s best companies derive revenues from all over the world. For example, Deutsche Bank estimates that of Germany’s DAX 40 index, only 18% of revenues come from Germany compared to 22% from the US, and 15% from China. Overall 60% of MSCI Europe’s revenues come from outside the Eurozone. Of course, this makes some political or macroeconomic issues, like EU trade relations with China, very important for specific stocks, but that can be taken into account in fundamental analysis rather than from a top-down perspective. Moreover, geographic revenue diversification is a very much a feature, not a bug, for investors seeking exposure to global growth without country or region-specific risk.

Europe’s best companies possess unique and irreplaceable competitive advantages

Deep pool of differentiated business models in Europe

Europe is home to numerous companies with well recognized global brands spanning various industries. Some of these companies possess unique and irreplaceable competitive advantages, allowing them to either capture more market share through value-enhancing acquisitions, or expand in markets with low penetration, growing their total addressable market (see Figure 4 below). Many of these firms are large and continuing to grow internationally while others are national champions serving a local niche. The aggregated average annualized return of the group of stocks in Figure 4 has been approximately three times that of the MSCI Europe and approximately two times that of the S&P 500 over the last two decades.

The Robeco Sustainable European Stars strategy consciously invests in opportunities from various industries and does not get overly concentrated in any particular one, no matter how popular it might be at a time when everything looks rosy. The strategy looks to identify companies with a sustainable pathway to growth rather than focusing purely on a ‘high’ growth number. The team likes differentiated business models that are resilient, that can thrive through an entire business cycle, and can take advantage of downturns to come out stronger, or can mitigate pressures by having a solid foundation. In addition, Robeco’s sustainable investment team helps identify companies where management is aligned with broader targets through proper incentives, corporate governance and product focus. In the long run markets reward strong business models and sustainable growth over an entire cycle.

Figure 4: Diverse business models with examples

Source: Robeco Schweiz AG. The companies are listed for illustrative purposes only and are not necessarily components of the Robeco Sustainable European Stars strategy. This is not a buy, sell or hold recommendation for any particular security. No representation is made that these examples are past or current recommendations, that they should be bought or sold, nor whether they were successful or not.

Through the cycle, staying invested pays

Given the ongoing uncertainty in the economic outlook across many countries, market participants are concentrating on potential short-term market drawdowns. However, we believe this focus is misguided and amounts to little more than noise. The true value emerges when looking through an entire business cycle. This is where some of the great returns have been generated in the past.

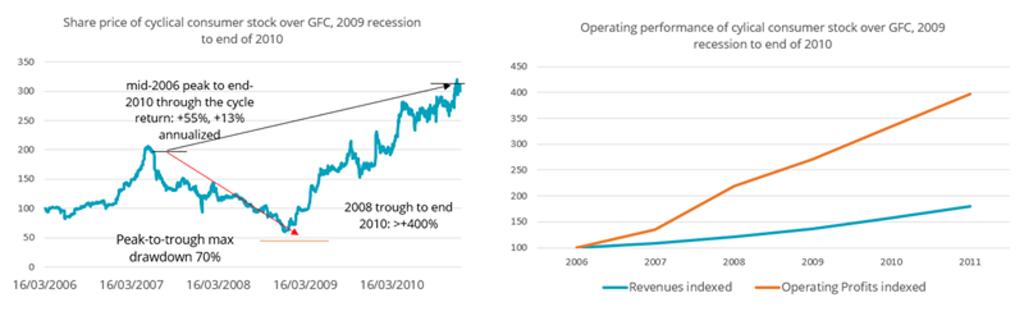

In Figure 5 below we show the share price development of an unnamed cyclical consumer stock from 2006 to the end of 2010. As one would expect, the share price drastically increased up to the peak of the bull market in June 2007. As the cycle rolled over, so did the share price which contracted by a massive 70% from that point to the end of 2008. The market is driven by fear and greed, and share price movements most of the time go beyond anything justified by underlying fundamentals.

Share prices often fail to reflect longer-term views on revenues and earnings. This company’s revenue went on to almost double from its 2006 base until 2011, and its operating profit went up four-fold. Thus, from that 2008 bottom, the shares recovered by a substantial 400% as the market realized its longer-term, structural profit potential. Even measured from the absolute bull market peak in June 2007 to the end of 2010, a medium-term three-and-a-half-year horizon, the share price increased by 55%, a 13% CAGR, through a financial crisis and a recession.

Figure 5: Does the cycle matter to growing, high-quality companies?

Source: Bloomberg

What this means is that where we see structural growth opportunities, robust balance sheets, good market positions, defendable or even expanding profitability, cash generation and reasonable valuations, forward expected returns can still be attractive, even facing an uncertain economic outlook and the risk of a market drawdown.

Durable quality will outperform the broad market

The Robeco Sustainable European Stars strategy is a high-conviction portfolio which aims to make investments in companies with sustainable, differentiated business models taking a full-cycle view. This multifaceted definition ensures that companies are not only growing but doing so sustainably and profitably through an entire cycle. The strategy is grounded in several key principles:

High-return businesses: Prioritizing companies that consistently create value.

Efficient capital allocation: Ensuring growth reinvestment and cash distributions are optimized.

Moats and niche dominance: Focusing on businesses with strong competitive advantages and unique assets.

Durability of business models: Assessing the long-term viability and adaptability of business models.

Full-cycle return potential: Recognizing the importance of returns throughout economic cycles.

An approach that invests in businesses with durable quality and focuses on expected returns (valuation) and attractive risk-to-reward opportunities on a longer-term basis compared to the broad market can be a powerful tool for achieving attractive returns.

Footnotes

1 MSCI Europe Index. All figures in EUR. Data end of June 2024.

2 Bloomberg, total return numbers. All figures in EUR. Data end of June 2024.

3 J.P.Morgan Global Equity Strategy

4 IMF World Economic Outlook Database, April 2024.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.