Property decarbonization: A keystone in biodiversity

In our annual analysis, companies within the Robeco Sustainable Property strategy remain better positioned to comply with Paris Agreement decarbonization targets, but the whole sector must accelerate efforts.

Summary

- Disclosure and target-setting continued to improve in 2022

- Top 200 real estate companies increased carbon emissions by 3.0%

- 74% of benchmark companies mention biodiversity in their reporting

In our annual data review of metrics on Scope 1, 2 and 3 emissions target setting, embodied carbon and green leases, we found continued progress in data disclosures and target setting. The companies reviewed were those invested in the Robeco Sustainable Property strategy, and the top 200 largest listed real estate companies.

In addition, for the first time we examined the industry’s approach to biodiversity, and found evidence the topic is coming into focus.

It is reassuring to see that in 2022, real estate companies in our sample improved GHG emissions disclosure and targets, especially for Scope 3. Our sample companies account for 89.5% of the weight in the S&P Global Developed Property Index, and around USD 1.6 trillion in terms of market cap.

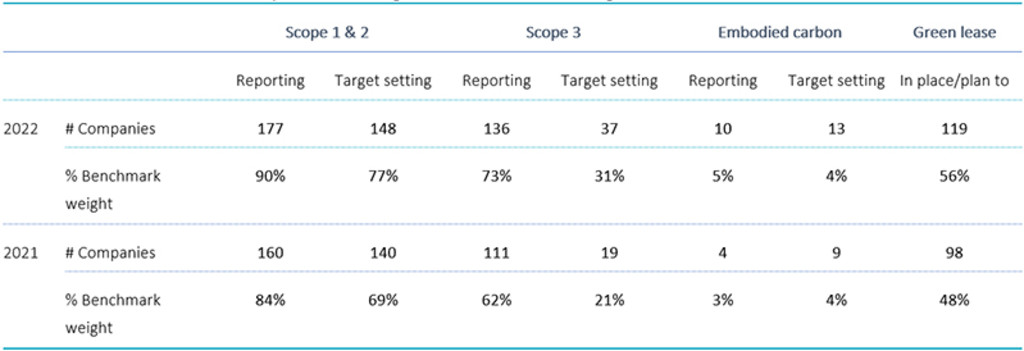

Table 1 - Disclosure of environmental performance, targets, and use of tools to manage carbon emissions

Source: Corporate reports, Robeco.

Geographically, Hong Kong, the UK and the EU are ahead in regard to carbon disclosure reporting and target setting, while the US is lagging.

Figure 1 presents the decarbonization pathways for the S&P Developed Property Index and for the Robeco Sustainable Property strategy. The weighted average carbon intensity is measured in tCO2e/million USD. In 2022 the strategy’s holdings had a 38% lower weighted carbon intensity (3.88 vs 6.22 for the S&P Developed Property Index), demonstrating that the strategy remains better positioned on the decarbonization pathway than the industry as a whole.

In 2030, the strategy‘s holdings are expected to decrease their carbon intensity even further, reaching 2.84, compared to 4.33 for the index. Taking into account the lower starting point, calculated from the benchmark level, the strategy’s average annualized reduction rate is 9.3%, in contrast to 4.4% for the index. Importantly, to achieve the targets set in the Paris Agreement, emissions must fall by 7.6% per year between 2020 and 20302 . While the strategy’s holdings are now more in line with the Paris Agreement and seem better prepared for future regulations, the overall reduction of emissions in the property sector has to accelerate to reach 2050 targets.

Figure 1 – Decarbonization pathways for the S&P Developed Property Index and Sustainable Property strategy

Source: Corporate reports, Robeco – 2024. Please download the full report to see the complete methodology and assumptions.

How did the property sector perform in terms of decarbonization in 2022?

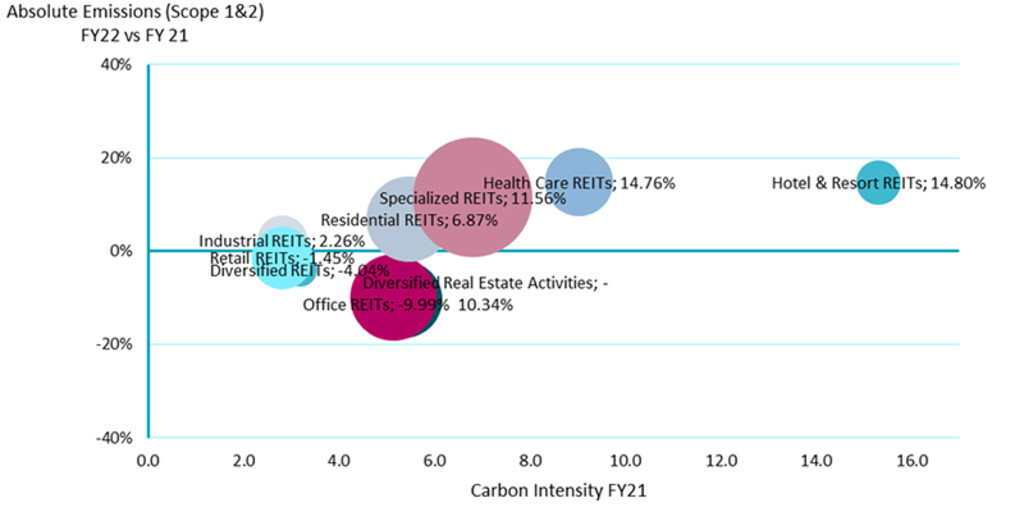

Our analysis reveals that companies in our sample increased their carbon emissions by 3.0% 3 over 2022 compared to a decline of 4.7% in 2021. The sector had begun to gradually recover business momentum when lockdowns were lifted throughout 2021 and continued to normalize operations in 2022, resulting in higher emissions.

Figure 2 - Absolute carbon emissions (Scope 1 and 2) per segment, 2022 versus 2021

Source: Trucost, Corporate reports, Robeco.

Carbon emissions and energy efficiency go hand in hand and we expect future regulation to focus not only on overall carbon emissions but also on the energy intensity of individual assets. This shift will necessitate substantial investments in retrofitting programs, as detailed in our previous research4 assessing the costs associated with reducing energy intensity.

An emerging focus: Biodiversity in real estate

The World Economic Forum estimates that nearly 30% of biodiversity loss globally occurs in relation to the real estate sector, for example, through changes in land use, the unsustainable sourcing of building materials, and the previously discussed emissions related to building construction and operation.

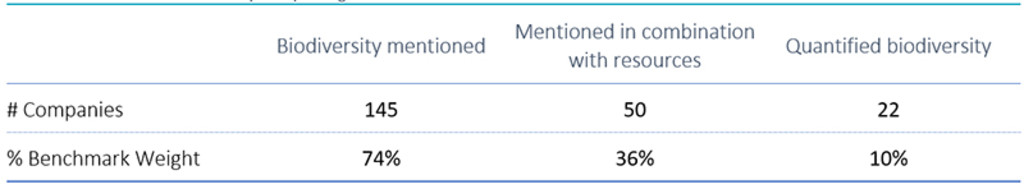

Table 2 shows that 145 companies, representing 74% of our benchmark, mentioned biodiversity in their reporting, demonstrating the growing importance of the topic. Exactly one quarter of companies (36% of the benchmark) mentioned biodiversity in relation to resource management, such as water use and waste prevention. Data points relating to these topics are more widely reported in 2022. Many companies in our sample mentioned biodiversity as part of their overall strategy; however, only a few have extended their reporting into quantifiable objectives. Roughly 10% (22) of benchmark companies quantified biodiversity to some extent. Even among the companies that do report more extensively on biodiversity, target setting is not common (see Table 2).

Table 2 – Mentions of biodiversity in reporting

Source: Corporate reports, Robeco.

While reporting remains limited across geographies, we have observed the UK at the forefront when it comes to reporting on quantifiable objectives relating to biodiversity.

Hot topics of discussion in regard to biodiversity are preservation and restoration activities, responsible sourcing of materials, waste management, biodiversity net gains, as well as water use and management.

Conclusion

The companies in our sample have improved their carbon disclosure and target setting in comparison to the previous year. This is particularly true among the companies in the Robeco Sustainable Property strategy that are better positioned to comply with the standards set by the Paris Agreement; however, the wider sector must accelerate efforts to align with the Paris Agreement goals.

Footnotes

1Carbon equivalent emissions will be referred to as carbon emissions throughout this article.

2UN Environment Programme (2019), Emissions Gap Report 2019.

3This number is derived from the analysis of Scope 1 and 2 emissions of companies that have disclosure for both the years 2021 and 2022.

4See the Robeco white paper, The Impact of Deep Energy Retrofit Costs on the Real Estate Sector, for more information.

Download the publication

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.