Weighing the pros and cons of nuclear power as climate urgency grows

Robeco has revised its stance on nuclear power as part of efforts to transition to a net zero economy.

Summary

- Nuclear power seen as part of the energy transition, though risks remain

- SDG Framework to assess and manage the risks of nuclear waste and safety

- Exclusion removed in Sustainability Focused and Impact Investing ranges

While the nuclear industry retains significant risks, led by the potential for accidents and the problem of safely storing radioactive waste, its major advantage of having virtually zero emissions does offer a pathway away from reliance on fossil fuels.

The dynamics of the industry are also changing as nuclear technology gradually moves towards safer means of generating electricity and a better means of dealing with spent fuel. Meanwhile, the urgency to deal with potentially catastrophic global warming caused by burning fossil fuels is rising, along with the risks of energy security and energy poverty as families become unable to afford higher natural gas prices.

Taking all these factors into account, Robeco has dropped the exclusion of nuclear operators from its Sustainability Focused and Impact Investing ranges, which have higher sustainability criteria for portfolios. Nuclear power operators had been allowed in the Sustainability Inside range which has lower sustainability thresholds, a policy that will continue.

While outright exclusions have been removed, restrictions will still remain in place when assessing the suitability of a nuclear operator for any portfolio. Robeco’s proprietary SDG Framework for the Sustainable Development Goals will be used to carefully evaluate the risks.

The new policy coincides with a decision by the European Parliament on 6 July to label both nuclear power and natural gas as ‘green’ in the EU Taxonomy providing strict conditions are met. The Taxonomy aims to standardize definitions of sustainability across the 27-nation bloc.

The EU’s stance on nuclear power is similar to Robeco’s in recognizing its critical role in the energy transition. However, given the risks of nuclear safety and waste, Robeco believes nuclear is ‘amber’ rather than ‘green’, as reflected in the SDG framework.

Playing a role in net zero

“In any scientific scenario, nuclear power plays a role in the energy transition, because without it the energy transition simply becomes much more costly,” says Lucian Peppelenbos, Climate Strategist at Robeco.

“Next to massive investments in renewable power, we also need investment in new-generation nuclear technologies for baseload capacity.”

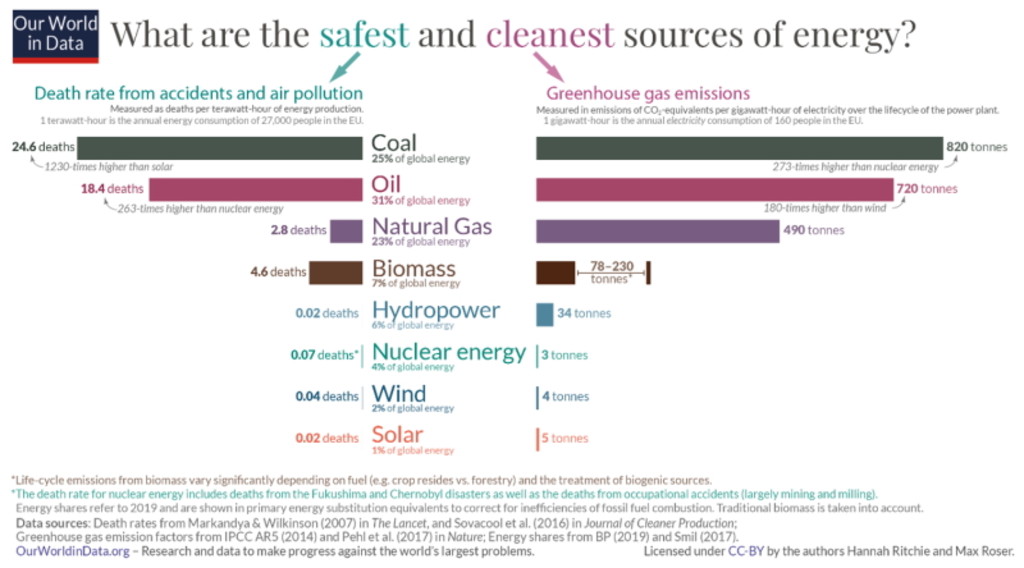

“We are well aware of the risks of nuclear technologies. But interestingly, if you look at the statistics over the past decades, then nuclear is one of the safer energy technologies out there, certainly in comparison to any fossil fuel. That includes all the deaths that happened in Fukushima and Chernobyl. Statistically, it is a relatively safe technology, but of course, it's one with very heavy tail risks.”

“So you need to manage those risks very, very well, for which there is a recognized system run by the International Atomic Energy Agency that sets out all sorts of standards and reviews. We feel we can rely on such a system, and countries that score well on nuclear safety are the ones for us that are investible.”

Despite high profile tragic accidents such as at Chernobyl and Fukushima, nuclear power has one of the lowest death rates of energy sources, along with the lowest emissions. Source: Our World in Data.

What to do with the waste

A growing role for nuclear power in the energy transition hinges on effectively resolving the waste issue. “The world has a backlog of about 250,000 tons of highly radioactive waste which requires permanent storage solutions,” Peppelenbos says.

“The first permanent storage facility of this kind is being built in Finland and will open in 2025. They bury the toxic waste deep in the ground in ultra-stable bedrock. The stored waste would though need to be tracked for a long time before it’s fully proven that it’s a solution.”

“Other countries like Sweden, France and the UK are also developing permanent storage facilities. Technology development in this area is critical. In our assessment framework, we will review whether nuclear power companies and their host countries have concrete plans for permanent waste storage.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Move to new-generation technologies

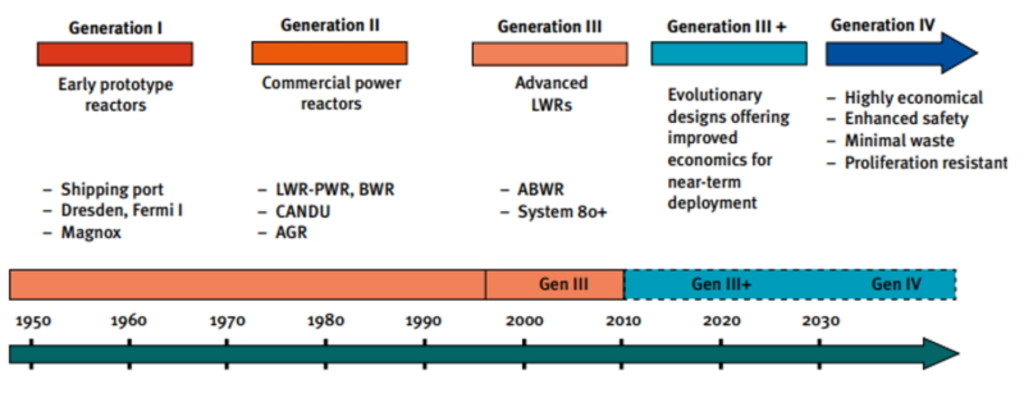

New-generation nuclear technologies focus on minimal waste and enhanced safety. There is also the longer-term promise of moving away from nuclear fission, which has been the means of generating power since the 1960s, to the fusion era. Nuclear fission splits the atom to create the energy in power stations, and is also used in nuclear weapons. Nuclear fusion merges a hydrogen atom into helium to create energy – in the same way that the sun does – and is much safer.

The expected progression of nuclear power reactors in the 2020s and beyond. Source: IAEA, Robeco

“A key point to make about nuclear fission is that it’s still the technology that we're using today since the first nuclear power installations in the 1960s,” Peppelenbos says. “Now, new generation technologies have been developed, and will continue to be developed.”

“We want that technological innovation to be able to play out well for the future solutions that are necessary. And that's why we don't want to exclude it.”

Giving the amber signal

One question to answer following the policy revision is whether nuclear power is now being viewed as sustainable. It’s not completely green like wind or solar power… but it’s not as bad as oil or coal.

“We say that nuclear is not necessarily green, but it's not necessarily grey either,” says Peppelenbos. “It's somewhere in between, and therefore some call it amber. But given that the industry has virtually zero emissions, it does have a role to play in the net zero transition.”

Robeco has signed a net zero carbon pledge which commits the firm to making all assets under management carbon neutral by 2050, in line with international agreements. This sometimes means taking a broader view as priorities change, while accepting that there is no perfect solution to any sustainability issue, Peppelenbos says.

The bigger battle

In all, it’s vital to see the bigger battle against climate change, the risks for which are mounting daily, Peppelenbos says. “In recent years we have witnessed growing impacts and risks of climate change, and increased support from science and policymakers for nuclear power,” he says.

“In that context, our assessment of nuclear opportunities and risks has shifted to a more positive balance, in which we continue to be critical of the associated risks, but we no longer exclude. An outright exclusion would not be justified given the current state of climate affairs.”

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.