Value could outperform for five years or more

The resurgent Value style could bring market-beating returns for the next five years and beyond as interest rates rise, Robeco’s Value experts say.

Summary

- US Value trend may replicate other post-traumatic periods

- Asian Value stocks are trading at a ‘double bargain’ discount

- European Value can benefit from new investment regime

Market conditions are expected to be dominated by central banks raising interest rates and removing stimulus packages, partly to combat record levels of inflation as the world emerges from Covid. The Fed is already seen making up to five rate rises in 2022.

Such an environment is well-suited to the value investment style, which has been outperforming growth stocks since economic normality began to return with the mass vaccinations programs that began in 2021. In the January 2022 market meltdown, caused by inflation fears, value stocks considerably outperformed their growth counterparts as investors looked for safer havens.

Value investing is a style which looks for stocks whose share prices do not reflect the company’s true potential and are sometimes considered the ‘unloved gems’ of the market. It takes many different forms, but the end goal is the same: to invest in businesses that are undervalued by the market for one reason or another before they rerate to a higher level.

“What’s been happening lately is very reminiscent to what happened during the build-up to the tech bubble in the late 90s,” says Duilio Ramallo, Portfolio Manager of the US Premium Equities strategy at value investors Boston Partners.

“When the bubble burst in 2000, value had a significant outperformance period over the course of the next six to seven years. The value style generally tends to perform very well during traumatic periods in the market, and the market today reminds me of the post-tech bubble.”

“There was a similar pattern just after the Great Financial Crisis when value did very well, and also after the large market drawdowns during the Brexit scare. More recently, value has outperformed the market coming out of the pandemic. So, we think that value could have a decent run over the course of the next five years or more.”

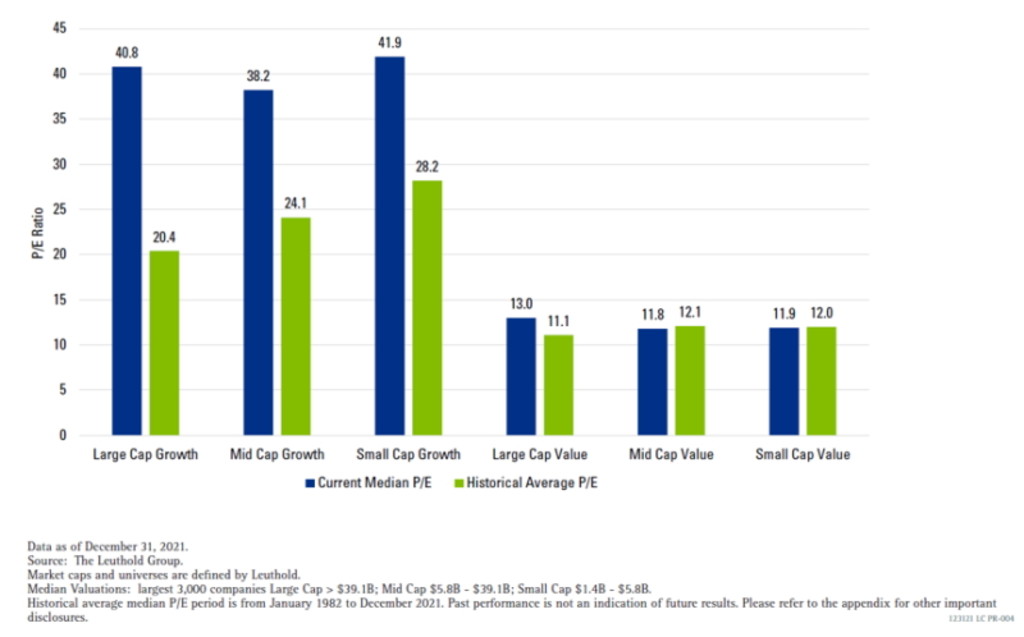

Value looks attractive relative to growth across all capitalizations

Source: The Leuthold Group.

Past performance is no guarantee of future results.

“On the growth side, you still have valuations that are very elevated, both on an absolute basis and relative to history. Value indices look much more attractive on both a relative and absolute basis and significantly more attractive compared to their growth counterparts.”

Why size matters

Ramallo says it remains important to look for trends within the market, particularly for an all-cap portfolio like his that can target any size of company. Small-cap and mid-cap companies began to enjoy the value rotation first as the large-cap sector is dominated by giant tech companies that fueled the growth stock boom during Covid.

That tech-driven growth boom may now be over as people return to work and become less reliant on home technology or entertainment. “I think this could be the beginning of the end of very strong growth markets that we've witnessed over the last five years,” Ramallo says.

“Across the market capitalization spectrum, we believe value still has a long way to run. And with respect to the Fed tightening, certainly our portfolio is very well positioned for a tightening cycle given the weight of financials in it that will benefit from higher interest rates.”

Asian Value: seeking Value in a bargain region

Asian stocks are trading at a deep discount to their developed market counterparts but are now ideally placed to catch up, says Arnout van Rijn, Chief Investment Officer for Robeco’s Asia-Pacific region.

“We're now starting to see an almost inevitable pick-up of long-term interest rates,” he says. “Bond investors know that when rates are going up, you would like to own short duration. Within equities, value stocks offer that desirable short duration profile as cash flows are nearby.”

“For years, the tailwinds have been behind growth stocks because they were long duration and interest rates kept going lower. The mindset of low rates forever has changed and that sets a very different stage.”

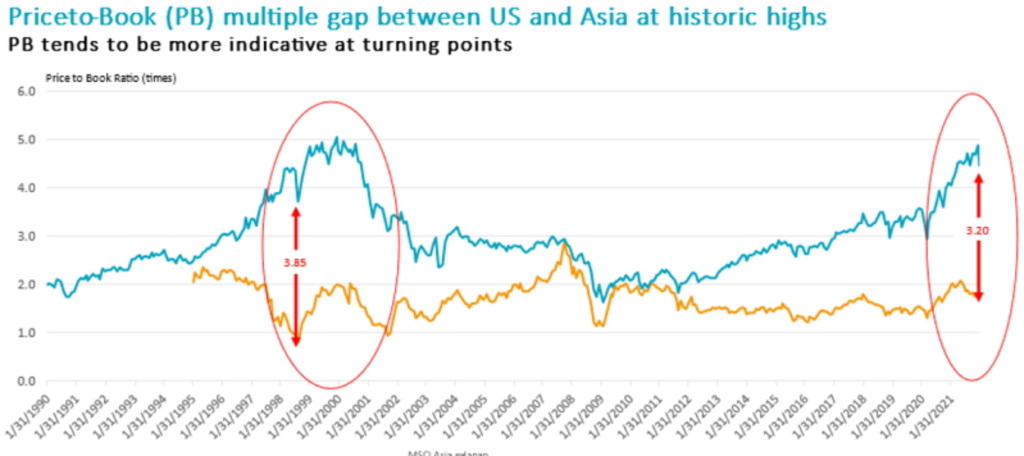

“Asia has massively underperformed the rest of the world, particularly in 2021. Asian stocks are trading at about 1.7 times book value (at end-2021) compared to 4.9 times in the US. That gap hasn’t been as large since the tech bubble in the late 1990s, after which it started to reverse quite dramatically. Asian value stocks went on to have a very nice run of outperformance.”

The price/book multiple gap between Asia and the US is at a record high, reminiscent of the late 1990s tech bubble.

Source: MSCI, Bloomberg, Robeco.

Past performance is no guarantee of future results.

Avoiding the value trap

Van Rijn says it remains important to avoid the ‘value trap’ – stocks that are cheap because the company actually doesn’t have a great outlook due to poor business momentum. “We call ourselves value investors with a future,” he says. “We're also looking for momentum in the stocks that we own.”

“We don't want to buy stocks that basically are being put out of business. That's the ‘value is dead’ element. Most of our portfolio stocks have cyclical upsides, or are sensitive to the rate cycle in the US, and therefore also to interest rates in Asia. Stocks such as under-appreciated banks will go up as rates go up.”

“Asia is also actually the leading region for the tech supply chain which has seen a lot of scarcities. The market is quite consolidated, so those companies have a lot of pricing power, and we really like that in our portfolio. We call these companies ‘best-in-tech’ because they are under-appreciated tech with pricing power and structural growth drivers.”

“Apart from ‘cyclical upsides’ and ‘best-in-tech’, we also see a lot of hidden gems in the ‘new energy’ segment and frontier markets in the ASEAN region, such as Indonesia and Vietnam. So, we’re finding more and more stocks that actually do have value in Asia.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Europe: the opposite of Nasdaq

In Europe, value stocks have also lagged, but the tide is turning as central banks including the ECB start turning the screws, says Jan Sytze Mosselaar, Portfolio Manager in the Robeco Quantitative Equity team.

“One way of looking at European value is you could say it's the opposite of the Nasdaq,” he says. “The Nasdaq has had a fantastic run for the last seven years, while European value has basically lagged every other index. That's quite astonishing.”

“January 2022 was quite a turnaround in absolute returns, with a 10% performance difference with growth. With interest rates now rising from very low points, especially in Europe, you could basically say we are now in a new investment regime.”

The relative performance of European value stocks compared with the MSCI Europe – the tide has turned.

Source: MSCI, Bloomberg, Robeco.

Past performance is no guarantee of future results.

Rising yields will help

Mosselaar says rising rates combined with the reversal of the quantitative easing money tree that fueled the growth stock rally are key to value’s fortunes.

“European value can be a very promising strategy for the years to come, especially when yields are expected to rise,” he says. “Last year, markets were mostly driven by inflation expectations going up. But in January, real yields started to creep up. We think that this rising yield environment, especially in Europe, can be a tailwind for value equities.”

“On the whole, the bull market basically passed European value investors by. Now, we think this combination of more moderate macro environments, higher yields, low valuations and earnings that have recovered means that all the traffic lights are on green for European value.”

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.