Investing in the circular economy

The boundless appetite for resources, fueled by linear production and consumption patterns, is exceeding the planet’s regenerative capacity. Regulatory actions for higher circularity are amplified by consumers opting for circular products. With ongoing innovations and technological advancements, prospects for de-materialization look better than ever. But how can investors navigate this transition to benefit from the emerging investment opportunities?

Summary

- Today’s linear global economy uses resources at an average rate of 1.75 times higher than the Earth’s regenerative capacity.

- Innovations, consumer pressure, and regulatory actions promote higher circularity

- Our systematic framework identifies four key investment areas

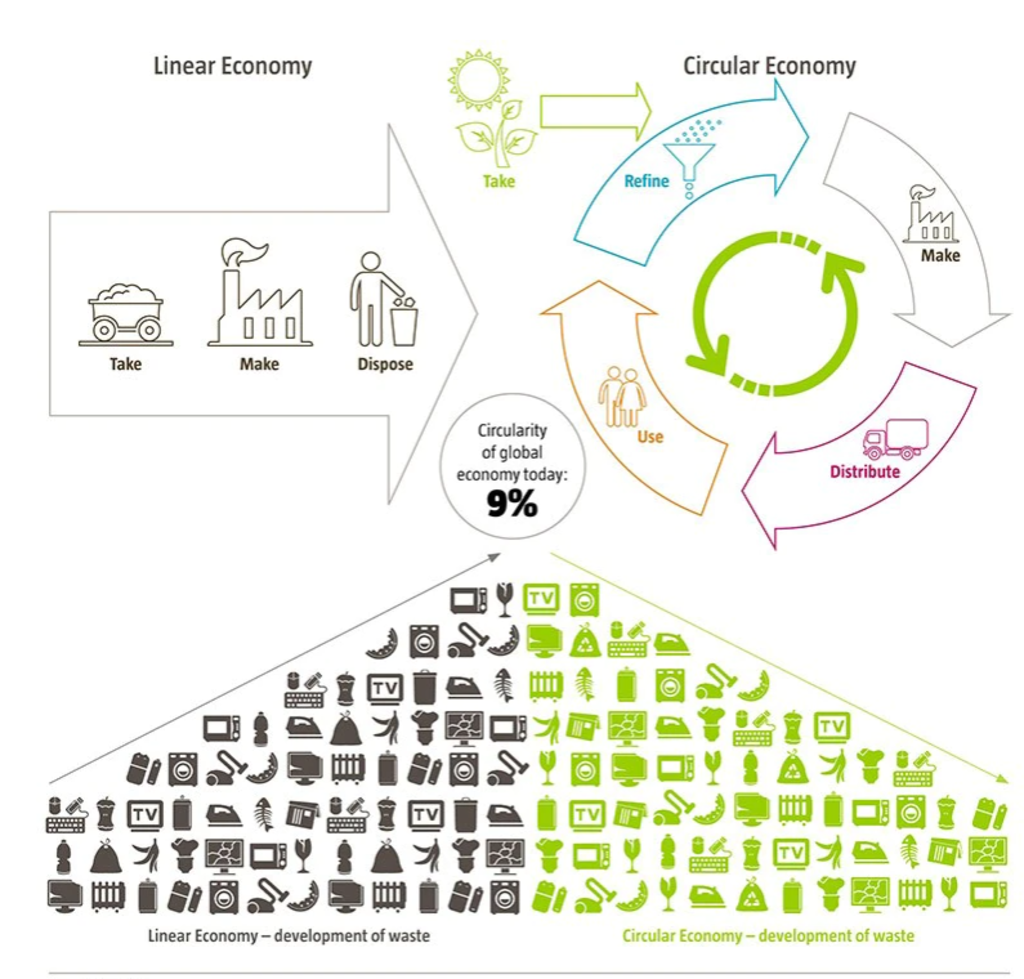

The traditional linear economy based on the “take-make-dispose” production and consumption model has pushed the planet’s capacity out of balance, and has led to a growing coalition of scientists, innovators, policy-makers, and consumers calling for a transition to closed-loop production and consumption systems that minimize waste and emissions as well as material and energy losses. The switch to the circular economy could unlock an estimated USD 4.5 trillion of value globally by 2030, with innovative technologies providing new ways to create service models and to extract value from closed-loop systems.

The switch to the circular economy could unlock an estimated USD 4.5 trillion of value globally by 2030

Source: Robeco

Technological drivers of the circular economy

Technology is becoming a key enabler of the transition to a circular economy. Advances in artificial intelligence (AI), digital platforms and cloud-based solutions have greatly eliminated the need for physical assets, helping to de-materialize entire value chains. The ongoing digital penetration of production and logistics improves the traceability of resource and product flows and can help optimize product use over their lifetime, including predictive maintenance solutions. Increased visibility enables not only better control over potential waste creation, but also creates more accountability for companies along the value chain. Meanwhile, the advancement of new chemicals and catalysts enables production of bio-based materials to replace fossil alternatives.

Circular economy

Investing in the circular economy

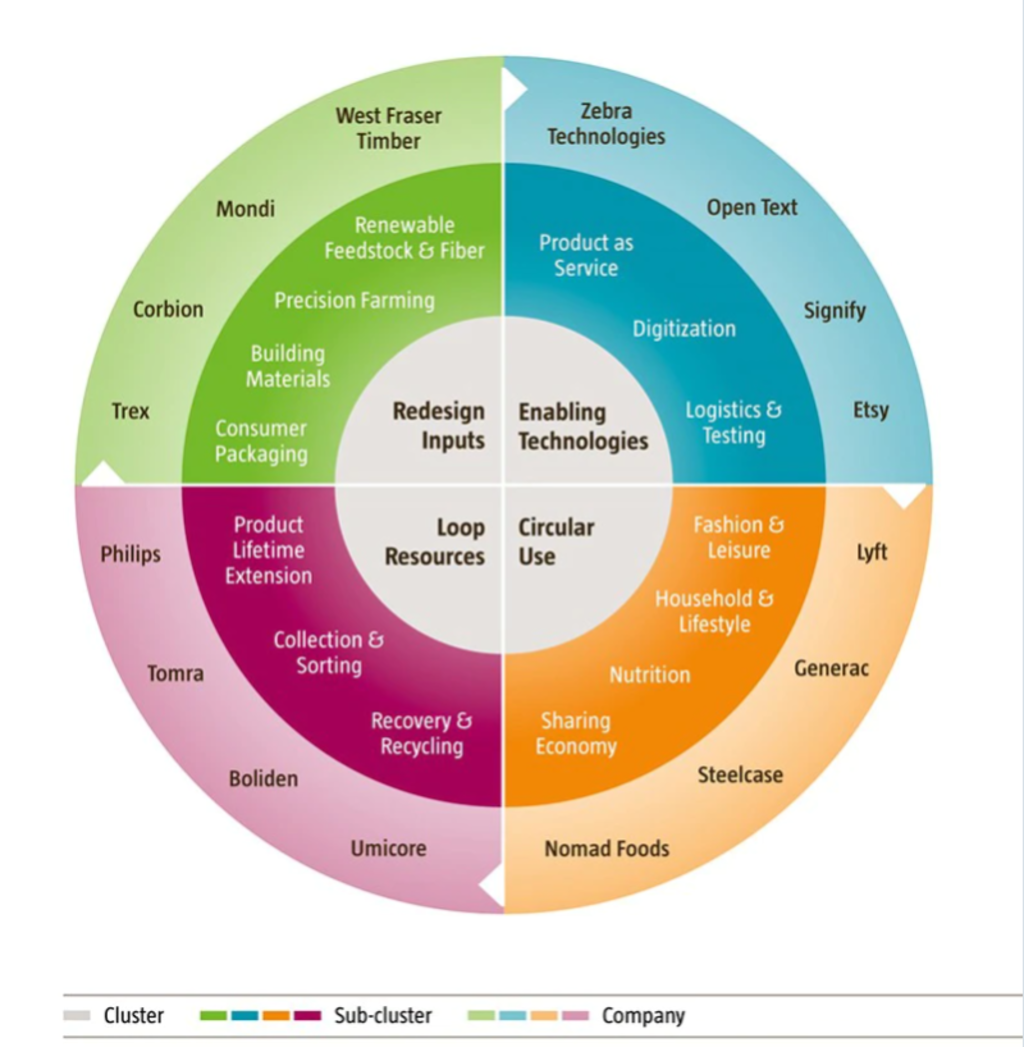

We have identified four investment clusters that are set to benefit from the transition to the circular economy: the redesign of production inputs, enabling technologies, circular use, and loop resources.

The first cluster – ‘redesign inputs’ – captures investment opportunities that exploit the shift from fossil-based inputs to renewable ones. The ‘enabling technologies’ cluster focuses on solutions that either provide the infrastructure for circular economy businesses, contribute to the de-materialization of production or create new, non-linear business models such as product-as-a-service. The ‘circular use’ cluster includes companies that support circular consumption patterns through sustainable sourcing, sharing economy, product longevity, and reusability. The ‘loop resources’ clusters focuses on providers of solutions that extend product lifecycles or recover embedded value from disposed products.

Source: Robeco

Conclusion

The time looks ripe for directing the global economy toward higher circularity. Governments are standing firm behind their commitments to the circular economy despite the economic challenges due to the ongoing pandemic. By exposing critical vulnerabilities in global supply chains, the current pandemic has even lent additional urgency to the shift from linear to system thinking, while providing a glimpse into the extensive de-materialization possibilities ahead, empowered by maturing digitization solutions across several sectors.

As innovative technologies are helping to unlock new value from the circular economy, the shift to higher circularity is becoming a matter of basic economics rather than a trend driven purely by environmental urgency. Companies pursuing circular business models are set to win from the structural changes ahead, with innovation leaders applying circular economy principles to differentiate their product offering. Forward-looking investors can benefit from this as yet largely untapped growth story by allocating capital to business models aligned with circular economy principles or to the enablers of this transition.