Who we are

Nice to meet you

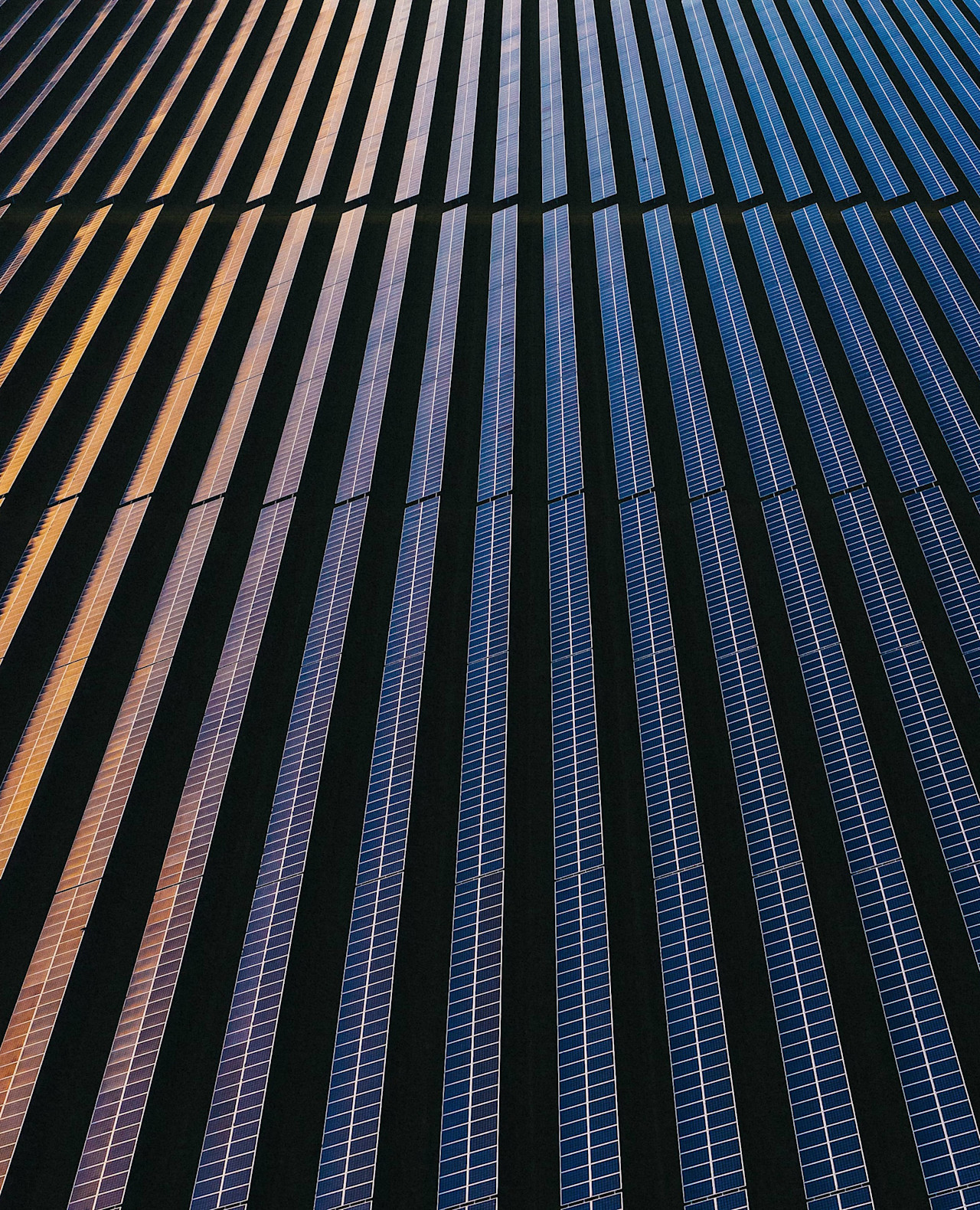

As a global asset manager, we center our solutions around your needs. We’re driven by endless curiosity, rigorous research and a proven passion for sustainability, and we’ll guide you towards ground-breaking active investment strategies.

Interested in investing for today and tomorrow’s needs? Having our investments contribute to a healthy planet and society is our common goal. Let’s share the conversation: talk to one of our colleagues.

Robeco Active ETFs

Robeco Active ETFs Yearly Outlook

Yearly Outlook2026 Investment Outlook: The synchronized shift

Our latest insights

Opportunities

We are pleased to highlight some opportunities selected by our experts.

A taste of our products

QI Global Developed 3D Enhanced Index Equities

Systematic and sustainable factor approach as an alternative to passive investing

Emerging Stars Equities

Investing in emerging economies based on top-down country analysis and bottom-up stock selection

Credit Income

Targeting a consistent level of income by investing in companies that contribute to the SDGs

Climate Euro Government Bond UCITS ETF

A novel investment solution aligning sovereign debt portfolio with climate action