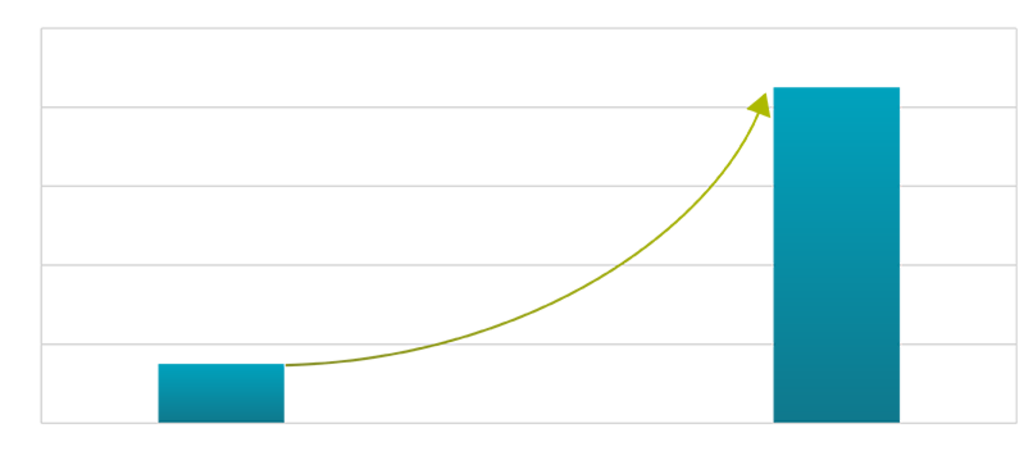

Stronger growth prospects

Emerging markets benefit from younger populations and lower debt levels compared with developed economies.

For investors seeking long-term growth and diversification, emerging markets (EM) are becoming an essential part of a global portfolio. Investing in EM offers higher long-term growth potential than many developed markets. In 2025, global investors are increasingly shifting capital toward EM economies due to:

Emerging markets benefit from younger populations and lower debt levels compared with developed economies.

The US-led trade war is accelerating intra-regional trade and boosting the influence of major blocs such as ASEAN and the Gulf Cooperation Council (GCC), supporting long-term economic resilience.

Expectations of easier US monetary policy and a weaker US dollar create more favorable conditions for EM assets.

Fast-growing companies in leading emerging markets are gaining momentum in semiconductors, electric vehicle batteries, renewable energy, and fintech, adding technology-driven upside to traditional strengths in natural resources and manufacturing.

Emerging markets are characterized by a high degree of dispersion – in the level of development, the institutional framework, economic policy, level of reliance on natural resources and political culture. This heterogeneity creates a fertile environment for active management.

Index-only approaches often underperform over the long term, hampered by withholding taxes, limited liquidity, or the inability to capture inflection points in local cycles. Active management, on the other hand, makes it possible to balance interest rate and currency risks in a targeted manner, to identify countries with recovery potential and to avoid those that are on the threshold of crisis.

Investors remain underweight many of the world’s most innovative economies. As a result they are missing direct exposure to some of the best value and growth companies.

Volatility, which has traditionally been a weakness of emerging markets, is now the same as developed markets, while valuation metrics show emerging markets still trading at a discount to comparable developed market assets. We think the risk/reward balance has shifted considerably as US trade and foreign policy signals an end to the rules-based era. We are convinced that countries committed to innovation and with lower debt will be key beneficiaries of this new global order.

Past performance is not a guarantee of future results. The value of your investments can go down as well as up. Capital is at risk. There can be no assurance that any investment objectives will be achieved.

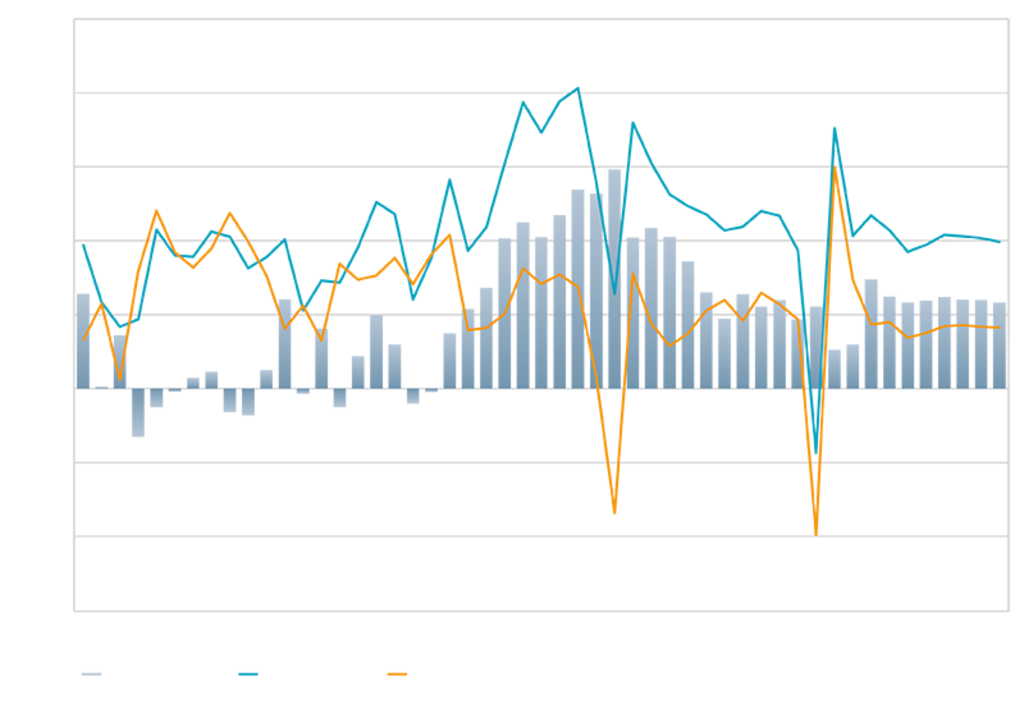

Emerging markets are taking a bigger share of global exports with regions like Asia, Latin America, and the Middle East creating global value chains in industries that were previously dominated in the US and Europe. This is also reflected in a higher trend rate of GDP growth in EM economies as the multiplier effects of increasing trade and growing wealth begin to manifest.

Source: Robeco, World Bank data as of end December 2024.

Source: World Bank, IMF, October 2025

Robeco’s emerging markets team has unrivaled experience with stable investment teams since the foundation of fundamental emerging market investing in 1994, and quantitative emerging market investing in 2006. This consistency and long track record also mean we leverage a rich source of country, sector and stock data. Bolstered with renowned sustainability and next-generation quant expertise, Robeco can find the best opportunities in the vast emerging market investment universe.

Our multi-decade track record in emerging markets investing has been built on the foundations of proprietary, award-winning research. We find an edge at region, country or sector level, and rely on our analysts, quant researchers and sustainability experts to find the best opportunities.

Robeco has long been a leader in SI, taking sustainability into consideration since 2001 and integrating ESG factors since 2011. Assessing existing and potential ESG risks and opportunities helps us make better informed investment decisions.