Investimenti quantitativi

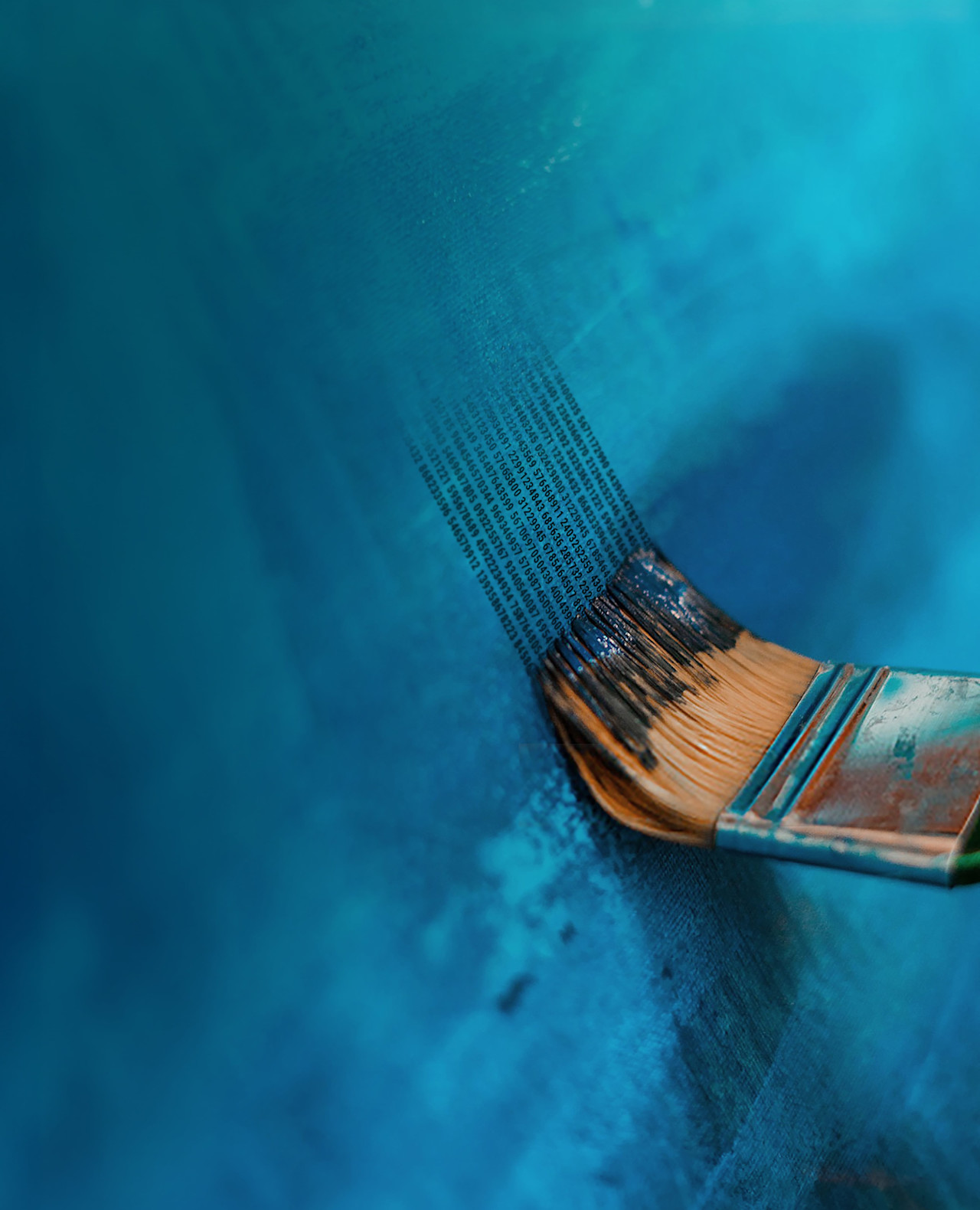

Investire liberandosi della componente emotiva

Noi di Robeco crediamo nel potere della ricerca. I nostri esperti sono leader del settore e sanno non solo svelare ma anche sfruttare tutte le forze trainanti che contribuiscono a creare ricchezza in modo sostenibile.

Investire liberandosi della componente emotiva

Una lunga storia di innovazione

Ignorare i rumori di breve termine

Apri il portafoglio ai temi più interessanti

Creare rendimenti tutelando il mondo in cui viviamo

Questo video non è disponibile in quanto non hai ancora accettato i nostri cookie pubblicitari. Se li accetti, sarai in grado di visualizzare tutti i contenuti: