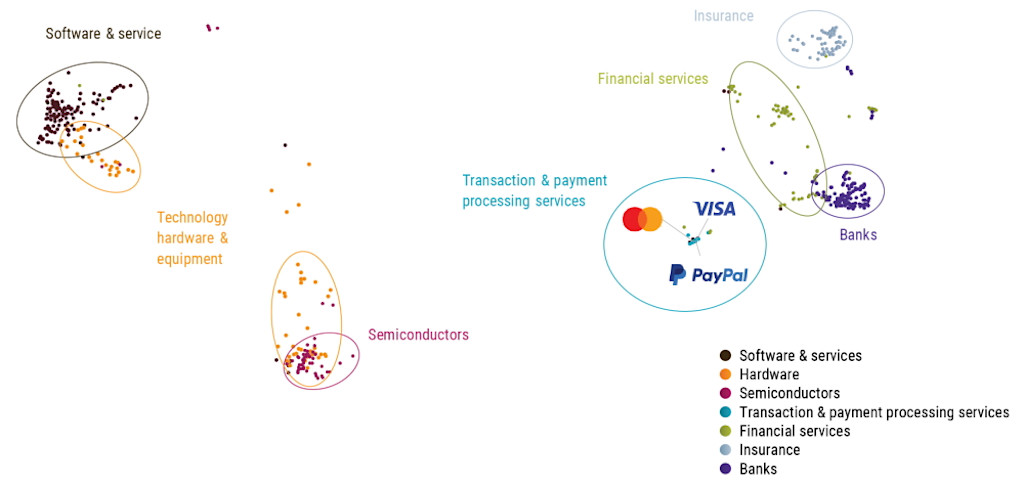

The GICS is the classic framework to classify similar firms into sectors, industry groups, industries and sub-industries. But the GICS methodology is rigid. Revisions are infrequent and take years to implement, as they involve extensive consultations with market participants. As a result, alternative methods of classification have been suggested based on customer-supplier data, textual similarities in companies’ 10-K business descriptions, comparable technologies based on patent data or shared analyst coverage.

One of the major changes in the recent GICS revision is the creation of the new sub-industry transaction and payment processing services under the financials sector. This new sub-industry will include companies such as Visa, Mastercard and Paypal, which were previously included in the data processing & outsourced services sub-industry, under the software & services industry group and the information technology sector.

The change reflects both the increasing role these companies play in facilitating payments across various platforms and markets, and the fact that these activities are closely aligned with the business activities covered under the financial services industry group. However, this change only took effect on 17 March 2023, two years after the first consultation on the subject started.1

Text-based stock clustering (TBSC) is an interesting alternative to GICS. It uses NLP techniques to analyze textual data from various sources, such as 10-K reports. TBSC has several advantages over GICS:

TBSC can be more adaptive and flexible because it can update its classifications more frequently based on new information.

TBSC can be more granular and accurate because it can capture the similarities and differences among companies within or across sectors based on their specific products or services.

TBSC can be more informative and insightful because it provides explanations for its classifications based on textual evidence.