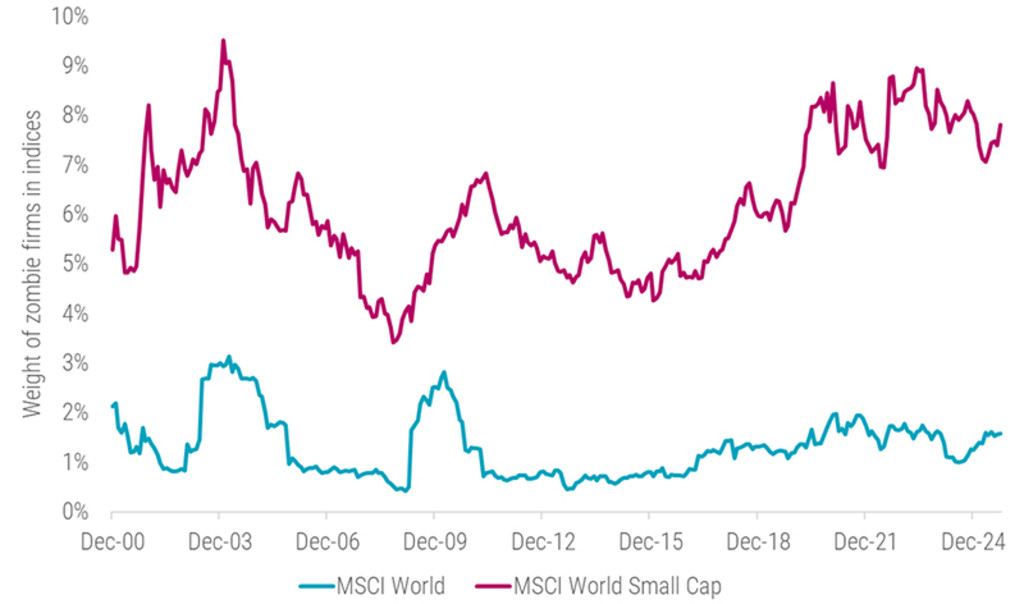

Figure 1 shows the weight of zombie firms in the MSCI World (blue line) and MSCI World Small Cap (red line) indices over time. Zombie firms make up only a little more than 1% in the mid- and large-cap space of the MSCI World, and apart from the rise following the dot-com bubble and the global financial crisis, the increase in recent years has been modest. In contrast, zombie firms on average account for more than 6% of the MSCI Small Cap Index over the sample period. Their weight rose from less than 5% ten years ago to 7.8% at the end of September 2025. 3

The difference between the two indices reflects that small caps are typically less mature firms; often less profitable with weaker bargaining power with lenders. While the MSCI World Index represents a far higher share of the total equity market than the MSCI World Small Cap Index (85% vs. 14%), the number of constituents is much higher in the small-cap segment (3,855 vs. 1,320), underscoring its importance for the broader economy.

Why does this matter? Zombie firms are often accused of negatively affecting productivity, capital allocation, and entrepreneurship. They tie up labor, credit, and investor capital that could otherwise flow to healthier firms. Passive strategies that purely replicate market indices without assessing the quality of the underlying companies may inadvertently support their survival.

In contrast, active strategies not only offer alpha potential, but also play an important role in directing capital toward stronger and more sustainable business models. Fundamental investors do so through deep company analysis and selective conviction. Quantitative investors, meanwhile, take a systematic approach; making thousands of small, data-driven active bets that, together, can steer capital efficiently away from ‘zombie firms’ and toward those with enduring financial strength.

Footnotes

1 Caballero, R. J., Hoshi, T., and Kashyap, A. K. (2008). ‘Zombie lending and depressed restructuring in Japan’, American Economic Review, 98(5).

2 See McGowan, M. A., Andrews, D., and Millot, V. (2017). ‘The walking dead? Zombie firms and productivity performance in OECD countries’, OECD Economic Department Working Papers No. 1372, Banerjee, R., and Hofmann, B. (2018). ‘The rise of zombie firms: causes and consequences’, BIS Quarterly Review, September 2018, and Albuquerque, B., & Iyer, R. (2024). ‘The rise of the walking dead: Zombie firms around the world’, Journal of International Economics, 152.

3 When measured by the fraction of companies rather than market weight, the share of zombie firms is slightly higher for both indices.