billion assets under engagement*

Actively exercising our stewardship responsibilities is an integral part of Robeco’s SI approach. We believe that being active owners of the companies in which we invest contributes to both investment results and society. We are experienced in using engagement to seek improvements in the sustainable characteristics of companies, and voting on issues at shareholder meetings.

Stewardship

Stewardship means responsibly managing the assets that have been entrusted to us, and reporting openly on how we uphold sustainability principles when doing so. Actively exercising our stewardship responsibilities is an integral part of Robeco’s SI approach.

It is closely aligned with our investment mission – to use research-based, quality-driven processes to produce the best possible long-term results for our clients. Therefore, our stewardship activities are aimed at long-term value creation in our wide range of portfolios.

Active ownership reporting

Keeping clients and stakeholders informed of our stewardship activities is an important element of exercising our responsibilities. Every quarter we outline the highlights of our active ownership activities, providing insight into our voting and engagement achievements, trends we observe, and the major themes we’re following.

Facts & figures

- 178EUR

- 75

markets voted

- 301

companies engaged

- 87EUR

billion assets under voting*

- 63%

of engagement cases closed successfully

- 24

engagement themes

- 324

engagement cases

- 56%

meetings with > 1 vote against management

- 6,655

shareholder meetings voted

- 67,757

proposals we voted on

Source: Robeco, Stewardship Report 2024

*The assets-under-engagement figures we show above are based on Robeco’s equity and credit portfolios for which we conduct engagements and voting. Robeco also votes and engages for clients whose portfolios are run by other asset managers; we call these ‘overlay clients’. During 2024, we welcomed a new engagement overlay client, while two other clients no longer required our services. In total, we have 10 overlay clients, representing approximately EUR 650 billion in assets, as per 31 December 2024.

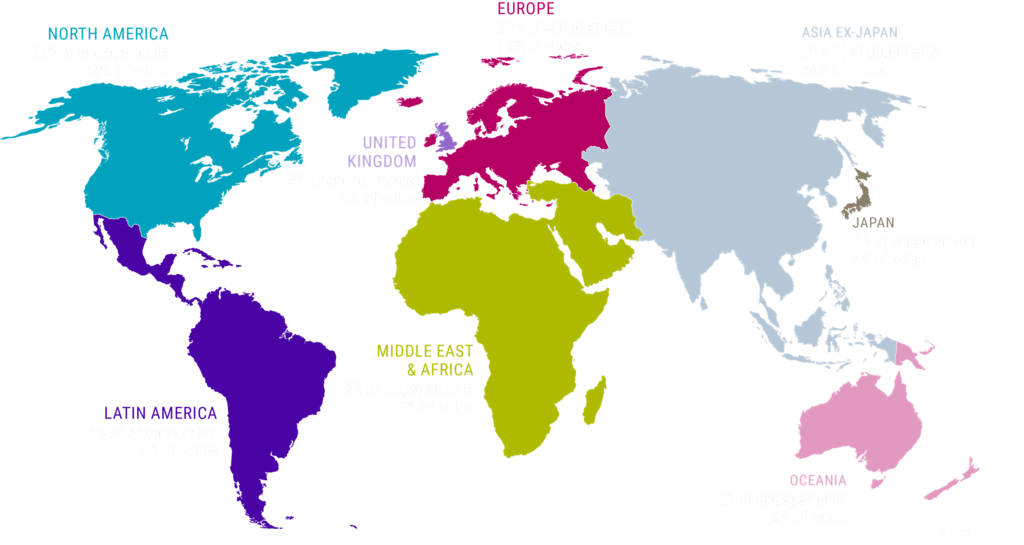

Where we engage and vote

Proxy voting results

Robeco votes at around 8,000 shareholder annual general meetings every year. Transparency is a vital part of sustainability, therefore we publish our voting records on our website and in quarterly and annual reports. Robeco has not been afraid to vote against contentious proposals or resolutions at shareholder meetings, and has often voted against the reappointment of directors who have not fulfilled their obligations to good governance, including issues of remuneration.

ShareAction ranks Robeco best

Robeco’s commitment to using its vote was recognized in January 2024 by ShareAction, the UK-based research group. Its latest survey assessing how 69 of the world’s largest asset managers voted at company AGMs in 2023 ranked Robeco among the best for voting on shareholder resolutions addressing environmental and social issues. It follows ShareAction’s 2023 report in which Robeco was the only one of 77 asset managers given an AA rating for sustainable investing.

Stewardship & collaboration

Robeco believes strongly in collaboration in a rapidly changing world. We therefore work with a wide range of international organizations as part of our commitment to making financial markets more sustainable. We are signatories to a diverse array of global initiatives, such as the Principles for Responsible Investment, the United Nations Global Compact and the International Corporate Governance Network. We are also members of more bespoke initiatives such as the Institutional Investors Group on Climate Change, the Transition Pathway Initiative. Put simply, we believe we are stronger together.