Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Digitalization is everywhere. And money is no exception. While most media attention around digital money has focused on cryptocurrencies – mainly bitcoin – over the past couple of years, other more discreet but equally transformational developments have been taking place in the background. This is the case for so-called central bank digital currencies (CBDCs).

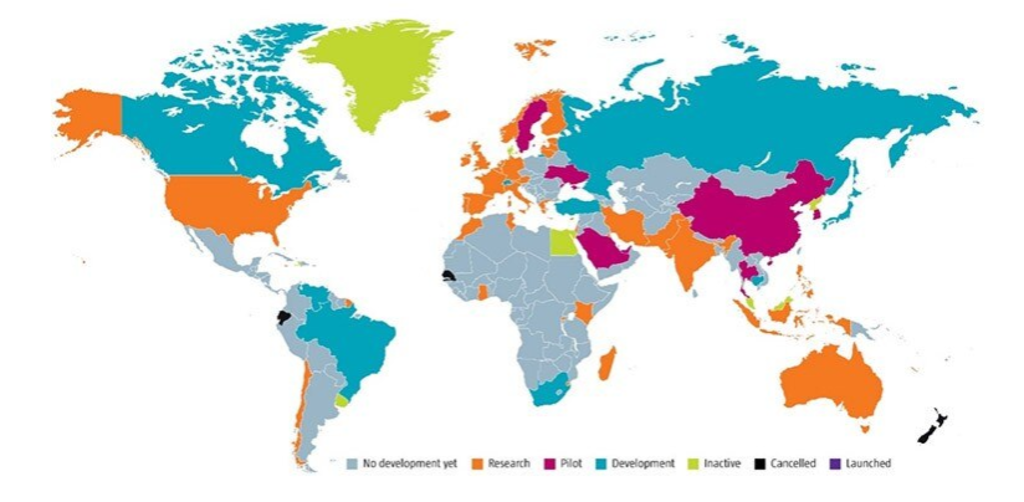

The rapid rise of digital finance has pushed many central banks to mull over launching their own digital currencies. In fact, central banks from more than 70 countries, representing the bulk of global GDP, have been or are currently exploring the idea of setting up CBDCs, although a few of them have also decided not to proceed further for the time being.1

China’s PBoC seems to be currently the most advanced in this field among the world’s major central banks. The PBoC has already deployed its so-called DCEP system in various Chinese cities. With this digital cash, individuals can carry out transactions with selected merchants, without using Chinese yuan coins and banknotes, nor the QR code-based payment systems offered by Alibaba and Tencent.

China’s PBoC seems to be currently the most advanced in this field among the world’s major central banks

Source: Atlantic Council, Robeco, April 2021.

For now, most central banks seem to be considering CBDCs mainly as a potential replacement of physical cash. While existing infrastructures of commercial bank accounts and digital payments systems already provide relatively accessible and cost-efficient financial services in many countries around the world, CBDCs could also offer important advantages.

The first reason to consider CBDCs is that they would be a liability of a central bank and would therefore not require any deposit insurance. CBDCs would be issued and maintained by a central bank, which would provide the underlying technical architecture. Commercial bank deposits, on the other hand, are the liability of fallible entities and must be backed by reserves.

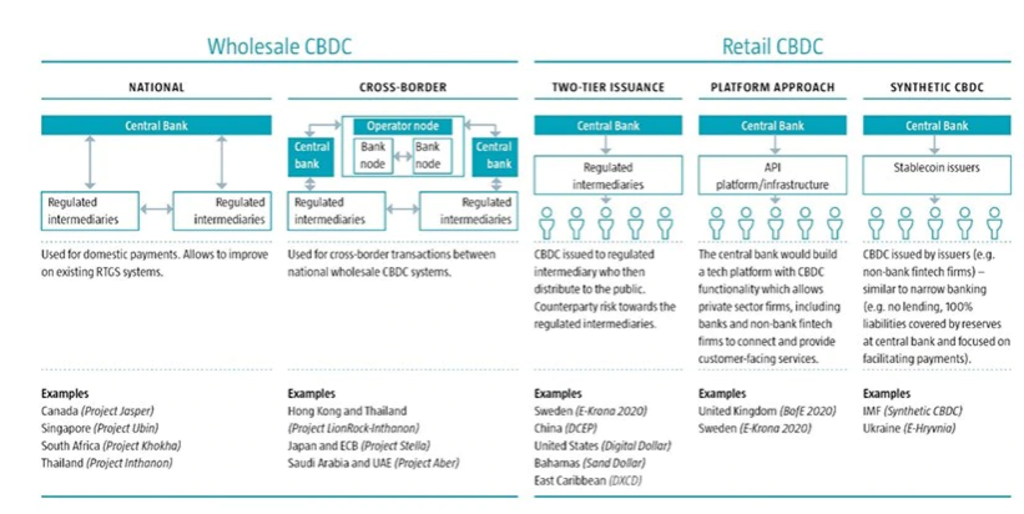

A second important reason to consider CBDCs is that they could reduce the need for financial intermediaries. This could lead to lower friction costs for users. However, it would also depend on the type of CBDC chosen, with the main distinction being made between wholesale and retail CBDCs, and whether regulated financial intermediaries should be part of the issuance of CBDCs.

Source: Henri Arslanian/Twitter, Robeco, August 2020.

Subscribe to our newsletter for investment updates and expert analysis.

Figure 2 describes in detail the different types of CBDCs considered around the world and provides concrete examples of countries exploring them. One fundamental difference between CBDCs and existing traditional currencies is that with retail CBDCs, individuals could have an account directly with a central bank.

As a consequence, central banks opting for this model would need to perform ‘know-your-customer’ (KYC) and ‘anti-money-laundering’ (AML) checks. These grueling tasks are currently performed by heavily regulated financial institutions, typically commercial banks, many of which have been heavily fined for their shortcomings.

This crucial choice between setting up direct retail accounts at the central bank, or still using commercial banks as regulated financial intermediaries, brings us to the third important reason for central banks to consider CBDCs: improving financial inclusion.

This is relevant not only in emerging countries but also in developed ones, where a non-negligible share of the population still doesn’t have access to a bank account. According to the World Bank, 1.7 billion adults across the world, or 31% of all adults, did not have a basic transaction account in 2017, even after 1.2 billion people opened a bank account between 2011 and 2017.2

In the absence of credible technological solutions to ensure digital identification, as well as KYC and AML duties, commercial banks will remain much needed

As central banks continue to investigate CBDCs launches, one would almost forget their potential impact on banking systems. In our view, the economic damage could be significant if central banks were to launch retail and wholesale CBDCs that would squeeze out most of the commercial banking system.

For one, despite challenger banks, fintech companies and tech giants encroaching on the most profitable segments of financial services, incumbent commercial banks still fulfill very important roles. Yet, in the absence of credible technological solutions to ensure digital identification, as well as KYC and AML duties, traditional commercial banks will remain much needed.

The Aadhaar project sponsored by the government of India, for digital identification, provides a good example. Aadhaar is a 12-digit unique identity number based on biometric and demographic data. But its status has become less powerful since September 2018, after the Supreme Court of India declared its mandatory linking with bank accounts or mobile phone SIM cards as unconstitutional.

The ruling came after several Indian civil rights groups voiced privacy concerns. The Indian government is clearly frustrated about the ruling, as it hampers financial inclusion which had greatly improved with the help of Aadhaar. As a result of the Court’s ruling, Aadhaar remains in use, although it is not mandatory to open bank accounts.

Another key function of commercial banks is that they take deposits and lend money to individuals and companies. CBDCs could change those dynamics. Potential funding issues could be ‘solved’ by offering direct central bank funding. But that would increase the power of central banks, while many of them – due to their independent status – are not subject to any significant external control.

Finally, the potential economic impact resulting from central banks deciding to play a more important role in cross-border money transfers, through wholesale digital currencies, could also be material. On the positive side, such currencies could replace existing and less efficient international money transfer systems, such as SWIFT. But wholesale digital currencies could also challenge, and potentially kill, other more efficient commercial initiatives, thus restricting potential innovation.

All in all, we believe that most large central banks will therefore be very cautious when they eventually implement CBDCs. For example, they might restrict individuals to limited deposits with them. This would curtail potentially destabilizing deposit flights from commercial banks to central banks once retail CBDCs are introduced.

From this perspective, the disruption in the financial industry, that can be expected from the rise of CBDCs, should remain relatively limited for the foreseeable future.

1Source: Atlantic Council, April 2021.

2See: “The global Findex Database 2017” report, The World Bank.