themes simultaneously detected

Capture themes as they emerge

The Dynamic Theme Machine is a quantitative thematic strategy that uses artificial intelligence to detect and invest in emerging and established themes. The strategy rotates through themes, buying attractive ones and selling those in decline.

- ~100

- ~25

themes held in the fund

- >100K

texts used to find themes

Why invest in the Dynamic Theme Machine?

Themes can drive equity market returns, but not all themes work all the time. Some themes are attractive while others are fading away. This strategy offers access to attractive themes while avoiding declining ones.

Top themes

The leading themes in the portfolio, ranked by active weight, are:

Digital advertising and media streaming

About 70% of worldwide advertising spending is digital and this share continues to grow as brands find they can target customers better. In media streaming, a few dominant companies are emerging after the conclusion of the “streaming wars” during the pandemic.

Artificial Intelligence and Cloud Technologies

Artificial intelligence (AI) is diffusing in many industries, with chipmakers benefiting from higher capital expenditures. Software companies are also incorporating AI models in their products to enhance functionality. At the same time, computing continues to shift from on-premise to the cloud.

Cancer Treatments

Cancer is the cause of nearly one in six deaths globally and substantial medical advancements are being made to detect and treat cancer. Early cancer detection can be especially helpful in increasing quality and quantity of life.

Mental Health and Neurology

Mental health diseases are becoming more common and better detected, driven by population aging, societal pressures and dwindling social taboos. Funding is increasing and companies are making progress in bringing treatments to patients.

Biological Research and Technology

This theme includes various developments including next-generation HIV treatments, shifting from small molecules to biologics and drugs for infectious diseases.

Other themes

The fund also has exposure to the following themes:

Genetic medicine

Genetic editing is projected to reach a USD 30 billion market by 2030. In 2023, the US approved its first gene therapy. Genome sequencing costs fell from USD 1,200 in 2015 to USD 500 in 2024.

Satellite communications

Satellites can now connect directly to mobile phones and in a few years getting data from satellites will be common. The number of successful orbital launches more than doubled from 114 in 2020 to 263 in 2024.

Immersive gaming

Augmented reality devices keep getting better and are being adopted by consumers. In the last two years Ray-Ban and Meta sold over 2 million smart glasses. Virtual reality still remains in its infancy, though.

Autonomous vehicles

In the US, the number of driverless taxi rides has more than doubled in the last year to 200,000 per week, showing autonomous vehicle technology is making it into the real world.

Travel and leisure

More consumers, especially younger ones, prioritize experiences over goods, driving travel and leisure spending. Older generations, including boomers, are also spending more as they retire in good health and with wealth.

The strategy

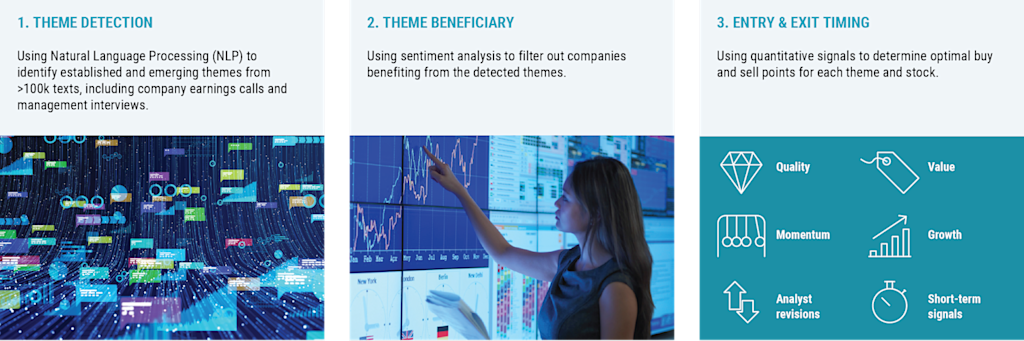

The investment process of the Dynamic Theme Machine has three parts. First, we detect themes from a vast amount of data, including company earnings calls, news articles and management interviews using a form of AI called natural language processing. Second, we use sentiment analysis – a process which classifies whether a text is positive, negative, or neutral based on the vocabulary choice – to select the most attractive companies. Third, we purchase the selected themes and their beneficiaries using Robeco’s quantitative models.

Portfolio construction is done through Robeco’s quantitative portfolio optimizer and this results in a portfolio of about 25 themes and around 100 stocks. The portfolio has good factor exposures and is risk controlled with a tracking error of about 5% (source: Robeco).

The strategy enables clients to have a balanced exposure to emerging and established themes through the use of AI, proven quantitative models and with supervision from Robeco’s strong quant and thematic teams.

Dynamic Theme Machine UCITS ETF USD Acc

- performance ytd (31-1)

- -0.84%

- SFDR (31-1)

- Article 8

- Dividend Paying (31-1)

- No

- Current Price (10-3)

- 5.70

- Inception date (31-1)

Robeco active ETF range

Learn how Robeco’s active ETFs can enhance your portfolio.

This video isn't available to you because you have not accepted our advertising cookies yet. If you accept them, then you'll be able to view all content:

Investment process