How will carmakers survive the shift to electrification?

Regulation, changing consumer preferences and new entrants are cranking up the pressure.

Summary

- The transition to electric will require large investments from carmakers

- Emission regulation and consumer tastes are strong incentives for change

- We look for credit issuers who will reap the benefits of their investments

The automotive industry is transitioning towards an electrified future.1 It is laser-focused on reducing the carbon emissions of its product offering, through more efficient internal combustion engines (ICE) and, most importantly, hybrid and fully electric vehicles (EVs). In addition, automotive manufacturers have become increasingly active in vocalizing their climate strategy, which generally entails targets for electric vehicle sales, zero tailpipe emissions, and carbon reduction or even neutrality.

The transition towards electric vehicles requires substantial investments from automotive manufacturers (OEMs) to fund research and development and the build-out of manufacturing capabilities based on new technologies. These investments are critical to OEMs’ ability to meet their ambitious targets that, in turn, require a significant increase in electric vehicle sales.

The multi-decade transition has begun, as illustrated by the number of successful battery electric vehicles (BEV) that have already hit the tarmac. We believe that the ability of an OEM to make the transition towards an electrified future is significant for two reasons: at a global scale, it will contribute to the goal of reducing carbon emissions. From an industry perspective, it will be a key determinant of the company’s ability to survive and for industry leaders to maintain their position in the next automotive era. As credit investors, we actively search for these qualities in issuers, seeking to invest in companies that will survive and thrive in this transition.

Strong incentives for innovative change

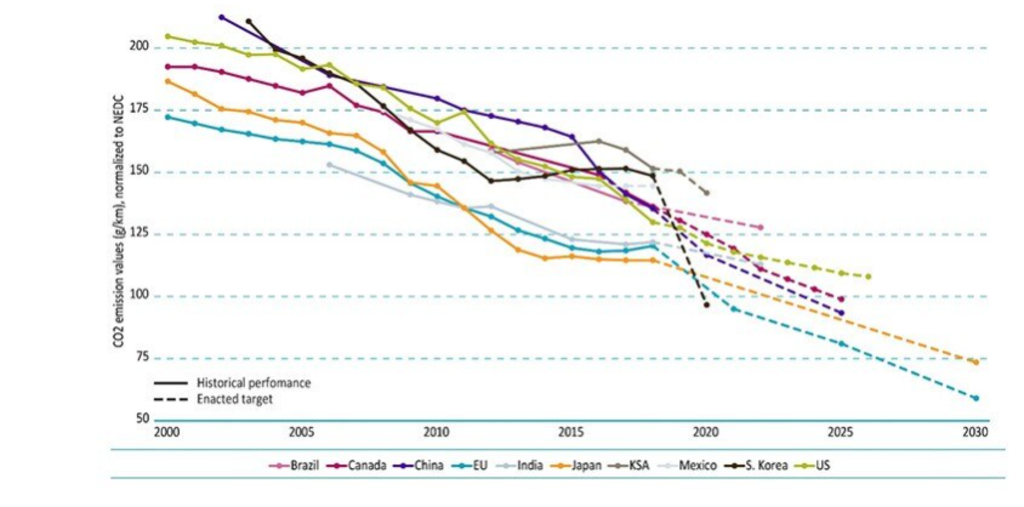

We believe the increasingly stringent regulatory limits for CO2 and NOx emissions are a key catalyst for the technological transition. Regulators around the globe have set clear and strict emission limits for new vehicles.

European regulators are setting the global example, with regulation including not only strict emission targets, but also non-compliance penalties if an automotive manufacturer breaches these limits. Such penalties provide a meaningful incentive for manufacturers to allocate resources to R&D and capital expenditures.

Manufacturers’ ability to maintain profit margins varies considerably by company. In general, the switch to electric vehicle sales will initially have a negative impact on margins, as electric vehicles do not yet have sufficient economies of scale and hence generate lower margins than ICE vehicles. It is therefore vital for automotive companies to reach significant scale in electric vehicle production as soon as possible, in order to retain overall profitability.

Figure 1 | Passenger car CO₂ emissions - normalized to the New European Driving Cycle (NEDC)

Source: The International Council on Clean Transportation; data to May 2020

The good news is that consumers are increasingly adopting electric vehicles. Many of the typical arguments against buying an electric vehicle, such as the higher acquisition cost, limited range and lack of charging infrastructure, are becoming less compelling. Manufacturing costs for ICE and electric vehicles are expected to reach parity in the next few years, the ranges of electric vehicles are increasing as the products are further developed, and the rollout of charging infrastructure continues. We are even seeing a decent number of electric vehicle launches in the US pick-up truck segment, which many had labeled as one of the last segments to make the transition.

Covid-19 accelerated electrification pathways

Certain developments triggered by the emergence of the Covid-19 pandemic in early 2020 have been very beneficial for the electrification of the automotive industry. Governments and other national regulatory bodies introduced attractive incentive schemes for consumers and subsidies for manufacturers to ease the financial impact of the pandemic on the automotive industry. These incentives and subsidies focused mainly on the entry and mid-market electrified models, for both fully electric as well as plug-in hybrids. In addition, governments offered scrap bonuses to eliminate high-polluting vehicles that are near the end of the product life cycle.

As the pandemic progressed, automotive sales were boosted by the trend to avoid public transport and instead rely on private transportation, as well as by the faster-than-expected recovery in the global economy. As a consequence, vehicle production volumes recovered faster than anticipated, with the added benefit that consumers are buying a higher share of low-emission vehicles than previously foreseen. We do note that the current semiconductor shortage is temporarily limiting car production.

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.

Implications for legacy OEMs

It is inevitable that the market for ICE vehicles will shrink as electric vehicle penetration increases. Depending on the pace of electric vehicle adoption, the ICE market may end up having significant excess manufacturing capacity, which in turn will squeeze profit margins and may result in asset write-downs and expensive plant closures. Being too slow in moving away from ICE vehicles may also mean unnecessarily allocating resources to a declining business, whereas the return on those resources could be far better if spent on electrification.

Investment implications: the race is on

As the shift towards electrification could have a notable impact on the development of a company’s credit quality, it has become a key component of our fundamental analysis of automotive companies.

One important element of this analysis is our assessment of the EV product strategy. Here we have a preference for purely electric vehicles over hybrid vehicles, as they are better able to reduce emissions and benefit from the relative simplicity of their product; hybrids, by contrast, still require two powertrains, i.e., both a combustion and an electric engine. Furthermore, we favor automotive manufacturers that apply a universal ‘modular’ platform that can be utilized for a multitude of different models, as this allows for higher economies of scale and consequently higher margins.

Another aspect we look at is the OEM’s expected market share development in electric vehicles. Ideally, the OEM is an early adaptor and has already incurred most of the R&D costs and capital expenditures. If not, we look at the magnitude of the capex and R&D plans. For example, we would assess if the expenditures are sufficient to realize the targets, and how the company would be able to fund these expenditures.

Footnote

1This article is based on a slightly longer paper with the same title.