Diversify your portfolio with Asia-Pacific equities

US markets have made up all the ground lost after the 2 April ‘reciprocal’ tariff announcement, but trade disruption combined with geopolitical tension are here to stay. This period of calm offers investors a clear opportunity to diversify equity exposure into Asia-Pacific, the world’s engine of growth.

Summary

- Asia-Pacific equity inflows have turned positive in the trade turmoil

- Asian economies will be cushioned by monetary easing and stimulus

- Solid fundamentals and a big valuation discount provide a good starting point

A month is a long time in equity markets. Since 9 April when President Trump announced a 90-day pause in his plan to impose ‘reciprocal’ tariffs on the rest of the world, the S&P 500 has rallied hard. The 90-day détente between the US and China, announced on 12 May, and soft US inflation data on 13 May solidified the US market gains, putting talks of a rotation from US assets on to the back burner.

Given the US’s trading framework agreement with the UK and its 90-day détente with China still imply much higher tariffs levels, we think the euphoria may be premature. The negative impact of Trump’s trade policies will hit the US the hardest and that is not yet reflected in economic data. In previous cycles equity market weakness has translated to US dollar strength in a ‘flight-to-safety’ but that appears to have changed in this cycle with the dollar proving vulnerable to swings in market confidence. Moreover, the US fiscal position is likely to only worsen, with Trump certain to plough revenues from tariffs into tax cuts, and that will be dollar-negative. Global investors remain very overweight US equities and we believe there will be a gradual move to increase allocations to other regions, and especially Asia-Pacific.

Asia-Pacific starting to get inflows

Investors remain very underweight Asia-Pacific equities which is more a reflection of the past decade of US dominance than Asia’s economic fundamentals. However in recent weeks there has been a nascent change in trend with April 2025 inflows into Asia equity ETFs at USD 33.31 billion exceeding those into both US (USD 31.0 billion) and European (USD 9.1 billion) equivalents, indicating the region is a destination for those seeking to diversify. Japan is seen as a particularly attractive market for the ‘de-dollarization’ trade, attracting USD 57 billion into equities and bonds, the biggest monthly inflows since records began.2

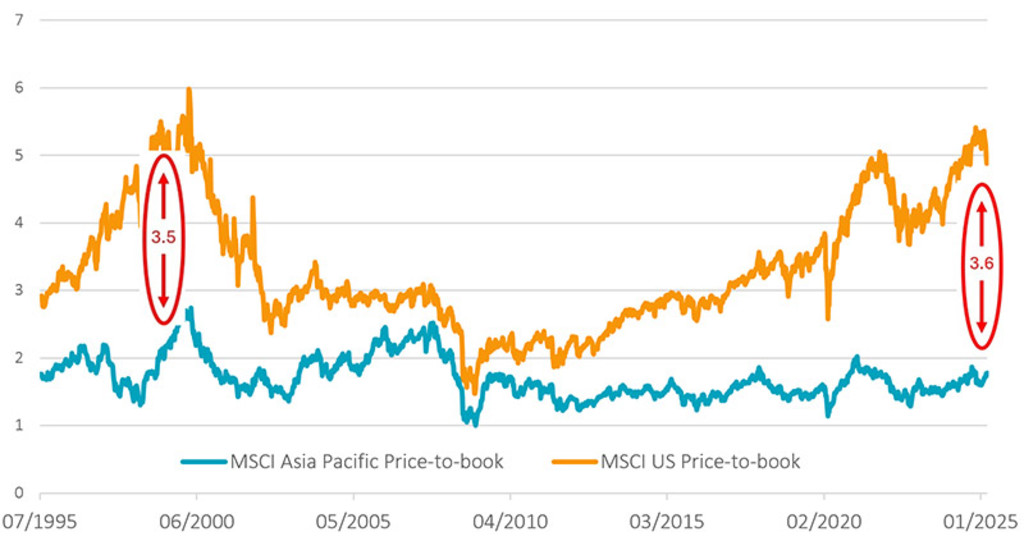

Asia-Pacific equity valuations are close to trough levels compared to the US. On that basis, even given the US tariff headwinds, there is significant value to unlock. For an Asia-Pacific strategy focused on value like ours, this makes the region a target-rich stock-picking environment.

Figure 1: Asian stocks are trading at a deep discount to the US, and history

Source: MSCI, Bloomberg, data to 2 May 2025

Pressure on to reduce US tariffs

Asia-Pacific economies are very exposed to global trade flows with major export economies like Japan, Korea and Taiwan potentially facing very high tariff levels (24%, 26% and 32%, respectively) unless they can agree a framework for reductions by early July when the 90-day reciprocal tariff pause expires. Emerging export-driven economies are in the same boat, with Vietnam (46%), Indonesia (32%), and Thailand (37%) all seeking to negotiate.

Given the détente with China, the Trump administration’s desire to be seen to do deals, and geopolitical leverage via longstanding security ties, we expect the tariff levels to trend toward the baseline 10% Trump originally set. The net effect on trans-Pacific trade will be negative, and economically this is means 2025 Asia-Pacific GDP growth estimations at around 3.7%3 at the start of the year could be difficult to achieve, but growth will still be much higher than projections for the US and Europe.

For the region, the most immediate countervailing policy response will be fiscal expansion in key economies including China, India and Indonesia. Moreover, inflation is already trending lower across the region giving central banks room to ease policy more, especially if the USD weakens further.

Positive Asia fundamentals will attract long-term investors

For investors seeking long-term diversification from an overweight position in US equities, Asia-Pacific equities have a compelling investment thesis. An Asia-Pacific portfolio gives exposure to developed markets like Australia and Singapore as well as emerging markets like Indonesia and India across all sectors from commodities and industrials to technology, financials and consumer discretionary.

Industrial powerhouses

We believe exposure to the North Asian industrial economies of China, South Korea, Taiwan and Japan is essential, with world-class companies and an increased focus on shareholder value. Japan remains the Robeco Asia-Pacific Equities strategy’s largest overweight. Reasonable valuations, increased shareholder returns, governance reform, and structural reform are all reasons to remain positive on the country. South Korea’s ‘value up’ initiative is at an earlier stage but should have a similar impact on corporate governance there.

Confidence in China’s international competitiveness and continued ability to innovate was boosted in January 2025 by the release of the DeepSeek Large Language Model (LLM), which was developed at lower cost than similar LLMs from the US. China is already capitalizing on advantages like rapid adoption of new technologies, a vast domestic market, and an unrivaled manufacturing base, to lead in key industries including electric vehicles and renewable energy. In these markets where you potentially have declining populations, Robeco’s Asia-Pacific Equities strategy focuses on optimizing capital and investing selectively, where the return on invested or the marginal return on invested capital is high.

What EM opportunities are out there?

Receive our newsletter to dive deep into EM investment opportunities.

Dynamic emerging economies

In the emerging markets of Southeast Asia where the population is rising, increasing technology adoption and mass consumption are underpinning domestic-driven growth to complement traditional strength in commodities and manufacturing. Recent weakness due to fears over the impact of US tariffs is providing good entry points for long-term opportunities that fit into our value-driven investment process. In contrast, India equities are richly valued compared to Asian peers so we are being very selective and remain underweight the country. Nevertheless, India is building on its economic momentum by extending its manufacturing base, with trade deals with the UK, and perhaps later in the year with the US, helping. From the market peak in 2024 Indian equities have underperformed Asian peers. Combined with the recent tension with Pakistan, this has brought valuations to more reasonable levels, so we are now gradually increasing our India exposure.

Valuation gap will close

Our conviction is that the enormous valuation gap between Asia-Pacific and the US will narrow in 2025 and beyond. It is crucial to focus on the fundamentals and take advantage of the volatility to identify medium-term alpha opportunities. We believe an active approach with a tested stock selection process is the best way to build and hold long-term exposure to Asia-Pacific equities.

Footnotes

1 Source: Bloomberg – May 12 2025

2 Foreigners snap up $57bn in Japan assets in ‘liberation day’ rush – FT – 14 May 2025

3 Moody’s Analytics 2025 Macro Outlook – November 2024

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.