It takes the right metrics to engineer a Paris-aligned portfolio

We outline the most effective analytics for building climate-resilient and optimized buy-and-maintain portfolios.

Summary

- Achieving a portfolio net-zero pathway requires an integrated approach

- Proper application of relevant forward-looking analytics is key

- Portfolio optimization addresses investor-specific investment objectives

Insurers and pension funds face the imperative of finding investment solutions that generate sufficient returns while also managing risk, in a world of high inflation, geopolitical uncertainty and increasing regulation. The focus on sustainability and specifically climate change is also rising, with increasing pressure to set net-zero commitments.

Setting and implementing climate targets are the next steps in this challenge. Targets typically include emission reductions, engagement and investment in climate solutions, with the ultimate aim of reducing real-world emissions and enabling the transition to a low-carbon economy. Implementing these targets requires forward-looking climate analytics that go beyond traditional carbon footprint data and that can be applied to anticipate future emission pathways.

We consider the most effective metrics for building Paris-aligned portfolios and illustrate how they can be used in conjunction with other portfolio metrics to construct buy-and-maintain and constrained credit portfolios.

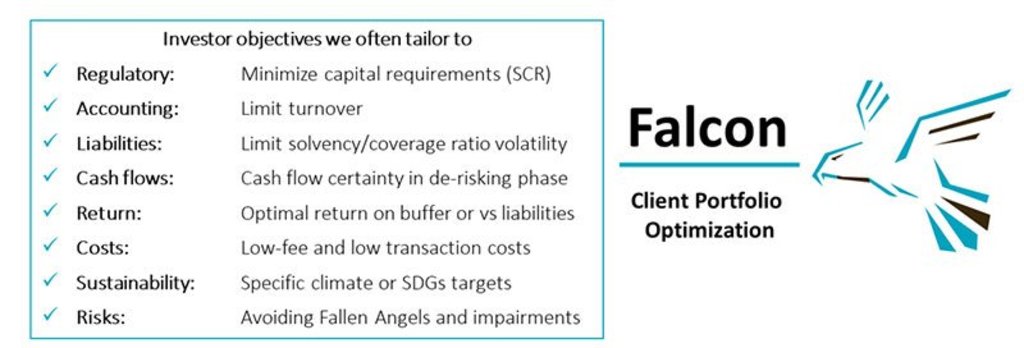

For insurers and pension funds, the challenge is to balance the economic and regulatory profile of the portfolio with restrictions and objectives that are driven by sustainability. Figure 1 shows an overview of the objectives on which we typically optimize portfolios using our proprietary Fixed income Asset & Liability Client Optimization Navigation (FALCON) tooling.

Figure 1 | Typical investor objectives

Source: Robeco. For illustrative purposes only.

When it comes to aligning a portfolio with a net-zero 2050 ambition, an important aspect to consider is the forward-looking portfolio profile of the carbon footprint. Forward-looking climate analytics play an important part in this.

Forward-looking climate analytics

There are different ways of estimating and assessing the future pathway of emissions for a company. We discuss four metrics that we use for this assessment: two proprietary in-house metrics and two external metrics.

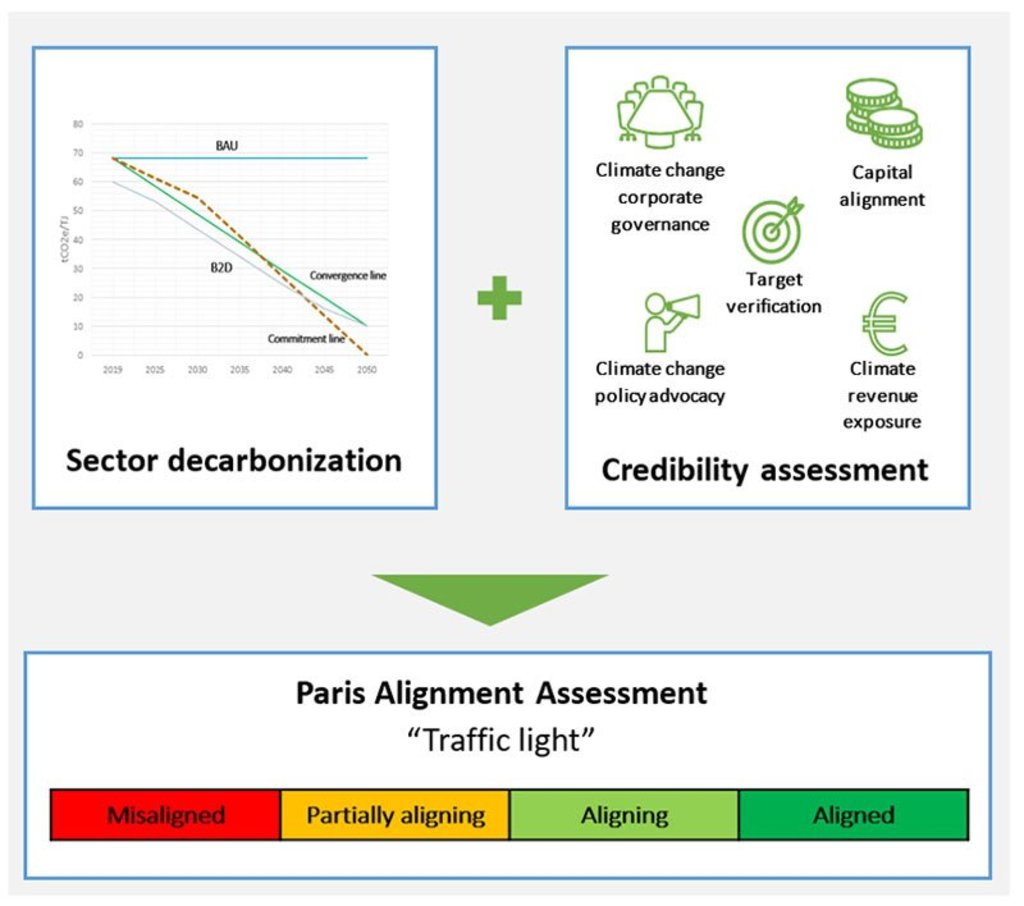

1. The Robeco Paris Alignment Assessment (‘Traffic Light’)

The Robeco Traffic Light assesses a company’s degree of alignment with a below 2 °C scenario. The categories of alignment can vary from ‘aligned’, ‘aligning’ and ‘partially aligning’ to ‘misaligned’ (see Figure 2). Our SI research analysts assess a company’s degree of alignment by determining the following:

Are this company’s projected emissions in line with its required sector decarbonization pathway?

Does the company have verified targets and a credible plan for achieving its emission-reduction plans?

Figure 2 | Robeco Paris Alignment assessment

Source: Robeco. For illustrative purposes only.

We use the Paris Alignment assessment for three main purposes: engagement, voting and portfolio construction. While this is our preferred method for assessing the future trajectory of portfolio emissions, external metrics can also be used to assess alignment. Two such metrics are Science Based Targets initiative approval and Implied Temperature Rise.

2. Robeco Climate Risk Assessment

The Traffic Light is also an important input in our fundamental assessment to determine to what extent climate risk could have an impact on a firm’s business fundamentals. This climate risk assessment by our fundamental credit analysts of a company’s credit risk profile has three components: assess the level of climate risk exposure, establish how the firm is dealing with climate risk, and estimate the potential financial impact. It incorporates internal and external metrics. We see this as the most complete assessment of a company’s exposure to climate change and the potential impact on default and downgrade risk.

3. Science Based Targets initiative (SBTi)

The SBTi was created in 2015, following the Paris Agreement, to measure the robustness of companies’ targets relative to the ambition of the Paris Agreement. To do this, the SBTi created sectoral methodologies to determine the required reduction in emissions per sector and to establish which metrics are most relevant. The SBTi assesses whether the trajectories of companies are aligned with different pathways. The main advantages of this metric are that it is simple, has a transparent methodology and is widely used and scrutinized. One of the drawbacks is that it can not confirm the likelihood of a company’s ability to meet its targets.

4. Implied Temperature Rise

Implied Temperature Rise (ITR) metrics reflect an implied global temperature rise that is calculated using a company’s emissions overshoot or undershoot relative to a given carbon budget. It is an intuitive metric that, by making a number of assumptions, data providers are usually able to achieve high coverage of the investment universe. However, the modeling entails significant complexity and various assumptions, which can result in a wide range of possible portfolios and outcomes. And, as is the case with the SBTi, most providers rely on the targets set by companies and do not include any assessment of the credibility of these targets.

There is overlap between these four metrics and each has advantages and disadvantages, ranging from issuer coverage and data quality, to comprehensiveness of assessment. In our view, the metrics are best used in combination, with our fundamental assessments of climate alignment and risk being an overriding factor for issuer selection.

Case study: Balancing climate integration with risk, return and regulatory considerations

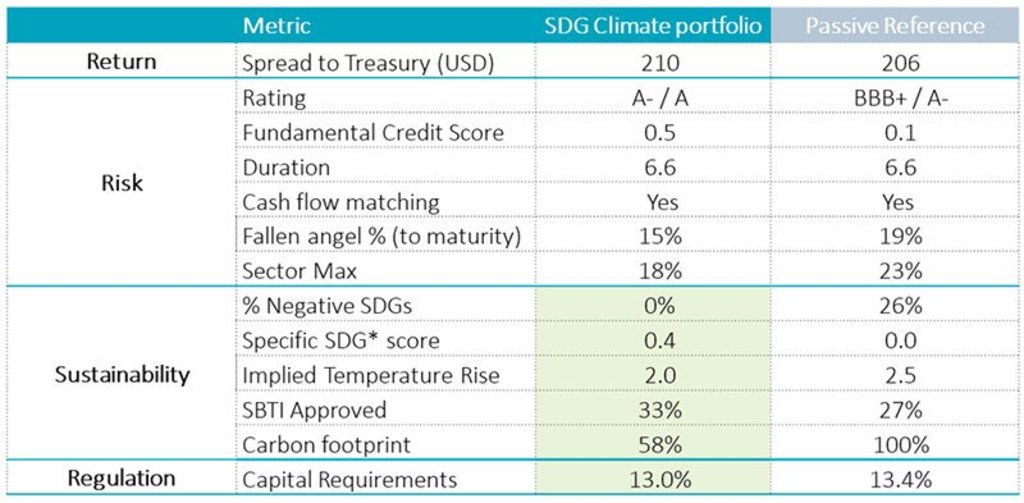

We illustrate our approach to incorporating climate targets using a cash flow-matching case study that is a typical for many life insurers or when de-risking a pension scheme. The portfolio in this case study needs to limit the number of fallen angels, match the target cash flow, uphold a minimum rating, have an optimal spread, maintain low capital requirements, make an impact across the SDGs and limit the current and future carbon footprint.

After in-depth client consultation, we construct a portfolio that balances the client’s various risk, return, regulatory and sustainability criteria, and we show across a range of metrics how this portfolio measures up versus a passive reference, as illustrated in Figure 3.

Figure 3 | Case study portfolio characteristics

Source: Robeco, Trucost, SBTI, MSCI, Bloomberg and using September 2022 valuations. For illustrative purposes only and based on model assumptions. Fundamental score ranges between -3, +3 and reflect Robeco’s credit analysts’ assessment of the credit quality. SDG score ranges between -3, +3 and reflects Robeco’s SI analysts’ assessment of the SDG alignment. Carbon footprint is scope 1,2 & 3 and indexed to passive reference. The Fallen Angel % uses average historical rating migration numbers. *refers to the portfolio score on the most climate-related SDGs: 7. Affordable and Clean Energy, 11. Sustainable Cities and Communities and 13. Climate Action.

The SDGs can be used to further generate a targeted impact on specific investors’ sustainability objectives through alignment with a specific set of the UN SDGs. Also, by allocating solely to companies that score positively on the SDGs, an SFDR article 9 portfolio can be created.

Conclusion

Investors have their work cut out in implementing ambitious investment-related targets for Paris-aligned investing. Forward-looking climate metrics are crucial in this process of constructing and maintaining portfolios that decarbonize over time. In practice, we see that incorporating meaningful climate and SDG objectives into a portfolio can usually be achieved with limited impact on the return potential and quality of the portfolio. The more constrained the portfolio is, however, the more challenging this becomes. We can help investors assess the possible financial impact of incorporating SDG and climate-driven constraints on their portfolio.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.