Equity styles and the Spanish flu

Covid-19 first appeared at the start of December 2019. The outbreak has since become a pandemic, with over 900,000 cases confirmed worldwide and tens of thousands of deaths. In March, global equity markets fell sharply, as worries grew about the spread of the virus and the economic consequences of lockdown measures. In the year to date, US equity markets are now down by approximately 20%.

Summary

- Over the World War I-Spanish Flu period markets lost 20% and recovered

- High dividend and low volatility offered protection but not as much as in other corrections

- Over major market sell-offs and subsequent recoveries, combined styles added value

Since the beginning of 2020, equity styles (or ‘factors’) have performed in very disparate ways, as the table below shows. The relative returns of these four styles are shown versus the market index, in US dollars, as at Tuesday 31 March. We use publicly available MSCI and S&P indices.1

Momentum and low volatility displayed positive performance relative to the market, whereas small caps and high dividend (value) stocks underperformed.2 In hindsight, investors should have focused on low volatility and momentum only, in order to find some protection during the first quarter of 2020. March was particularly challenging for factors. Small tilts to small value stocks would have hurt performance significantly during the sell-off.

Table 1 | Market and factor returns in Q1 2020

Source: Robeco, Bloomberg

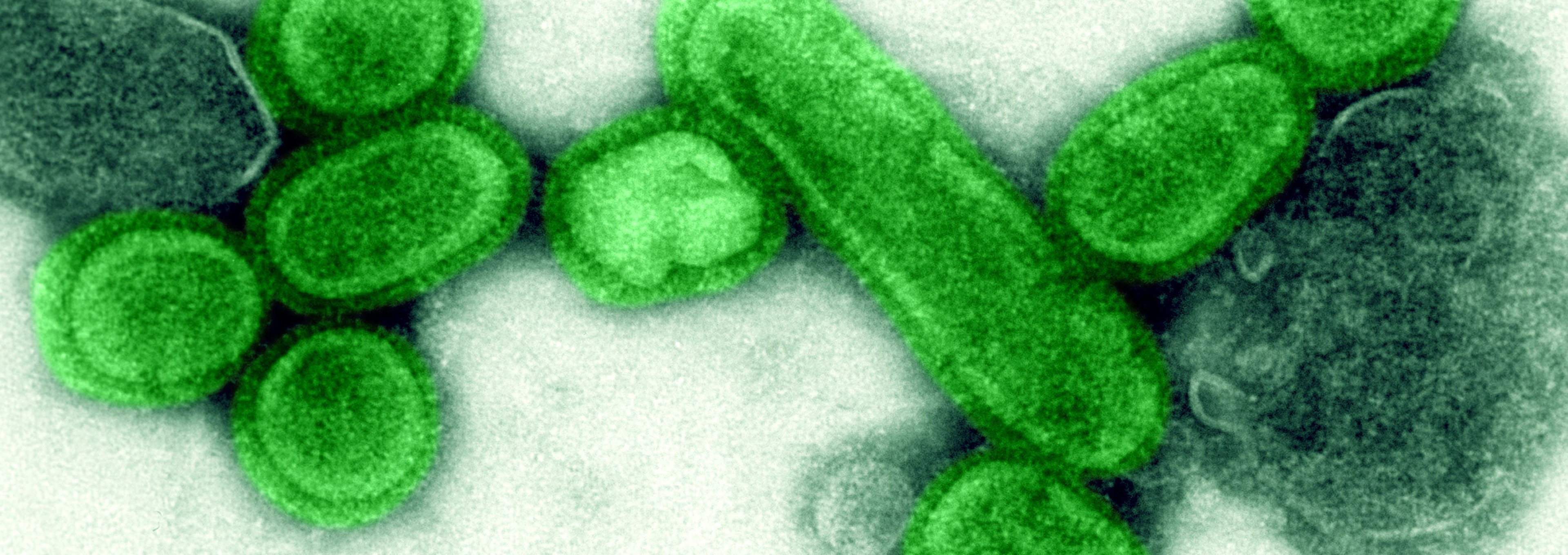

To understand better the performance of equity markets and factors during pandemics, we analyze the period of the Spanish flu outbreak of 1918-1919 in more detail.

To paraphrase the first sentence of Tolstoy’s Anna Karenina, all bull markets are alike (nothing bad happened), but every bear market is bearish in its own way. Each crisis is different, but perhaps history can offer some guidance. The world has experienced other pandemics in the past, most notably the ‘Spanish’ Flu of 1918-1919.

This influenza pandemic occurred in three waves throughout 1918 and 1919. The first wave began in March 1918 and lasted until the summer. The second wave was the most lethal and occurred during the fall of 1918 (October to December). It was followed by a third wave in the spring of 1919 (February). After that, the virus disappeared, probably due to improved treatments, or a mutation of the virus into a less lethal form.

During this pandemic, which spread across the globe via travelers and soldiers engaged in World War I, around 40 million people died worldwide from early spring 1918 to late spring 1919, of which 675,000 people in the United States (about 0.8% of the 1910 population).3

During this pandemic, many businesses faced economic disruption due to a lack of available workers, temporary closure of other businesses, and a drop in demand. Moreover, the pandemic occurred towards the end of World War I, a period of widespread economic stress and a severe market correction, as highlighted below.

How did the equity market and factors behave during this period? The years around 1918 are not covered by the widely-used CRSP database, which starts in 1926. As a result, most investors ignore how factors performed during the Spanish flu outbreak period. Perhaps lessons could be drawn from this period (and other market sell-offs prior to 1926).

The pandemic occurred towards the end of World War I, a period with large economic stress and a severe market drop

To answer this question, we use the data on all listed US stocks and their characteristics from Baltussen, Van Vliet and Van Vliet (2020). When studying equity styles, it is very important to correct for any size effects, since small stocks tend to be more biased and volatile and can dominate results. Also, the pre-CRSP period was characterized by many listings of small, thinly traded stocks, making it important to value-weight stock returns in order to study economic significant effects for investors. Baltussen, Van Vliet, Van Vliet (2020) therefore supplement their stock database with hand-collected data of the market capitalization of US stocks, extending the CRSP period to 1866.4

In line with Fama-French, factors are constructed by splitting all stocks in two groups: small and big, and are subsequently sorted on value (dividend yield; ‘DIV’), volatility (36-months return volatility: ‘LowVol’) and momentum (12-1 month returns; ‘MOM’) as a 2x3 sort. We will focus on the largest 50% of stocks for the equity styles. In addition, we construct the value-weighted returns on all small stocks (‘SMALL’).

As the Spanish flu occurred around World War I stocks markets were especially occupied with worries about the war. The peak of the stock market was reached in November 1916, but then sold off to bottom a year later. With the relief about the end of the war a recovery started in which the Spanish flu occurred. The figure below shows the performance of the stock market and the equity styles for the period from the stock market peak during World War I and the Spanish flu period (November 1916), to bottom (November 1917) and subsequent recovery (February 1919).

Over this period, the market dropped by about -20% from peak to bottom due to negative developments around World War I. High-dividend stocks and low volatility stocks offered protection, although not as much as in other market corrections. All stock moved in tandem and correlations went up. There was nowhere to hide. This is a bit like the recent March 2020 sell-off. After that markets recovered, with a dip around the first outbreak of the Spanish Flu.

The markets fully recovered by the end of February 1919. During the correction, small caps underperformed, and winner stocks performed in line with the market. In the following recovery period, small caps showed the strongest performance.

High-dividend stocks and low volatility stocks offered protection, although not as much as in other market corrections

Looking at other historical equity market corrections

Historically, epidemics and pandemics have often caused short-term equity market corrections (such was the case with SARS, MERS, the Hong Kong flu and others). As equity corrections are less rare than pandemics, it is especially interesting to take a closer look at the different equity styles during other market corrections in the pre-1926 period.

This selection of market crises include market episodes which are not often studied. This includes the 1907 Bankers’ Panic, also known as the Knickerbocker crisis5 , and also the panic of 1903, 1893, 1884, and 1873. In these six market corrections, the stock market fell by about -20% to -25%. During these periods, we see the pattern emerging of low volatility and momentum offering protection, similar to March 2020.

Intriguingly, during the recoveries that followed (the timing of which is by the way generally hard to predict) small caps and high dividend outperformed, as shown in the figure below. We also present a multi-style ‘conservative’ strategy following Blitz and Van Vliet (2018), in which low volatility, momentum and yield are combined in one strategy (‘LowVol+).6 Overall, this ‘multi-style’ strategy managed to limit losses and outperform over the correction-recovery cycle.

Final thoughts

Pandemics are rare events, but history can give us important guidance on what to expect. Over the past centuries, pandemics emerged, like the Spanish flu (1918-1919), the Black Death (1348-1351) and others, teaching us that they come in waves, with big impact on society and markets. The case presented in this study can provide some initial insight into the impact of pandemics and market corrections on equity styles, but is by no means comprehensive. Cases and circumstances change. That said, we believe history gives guidance, as many studies reveal there is some predictability in how investors react to news. Please note that this study is not yet peer-reviewed and will be updated in the months ahead.

Footnotes

1We use respectively the MSCI Minimum Volatility, value-weighted, momentum, high-dividend, momentum, small cap US indices and the S&P500 low-volatility, pure value, momentum, high dividend US indices and the Russell2000 (small cap) index.

2Significant differences exist within the same style in 2020. We therefore combine (equal weight) the different style indices of MSCI and S&P and focus on the US market only.

3Garrett, T.A., 2007, Economic Effects of the 1918 Influenza Pandemic, working paper Federal Reserve Bank of St. Louis.

4Study will be available later this year including all details on the investment universe and database construction. For the 1918-1919 case study, we cover 523 US stocks for which we have market capitalization data and at least one year of returns.

5https://en.wikipedia.org/wiki/Panic_of_1907

6https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3145152

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.