Fragility beneath the shine will provide opportunities in 2026

Investors will need to be selective this year as over-exuberant stock and metal markets face potential corrections, says portfolio manager Colin Graham.

Summary

- Stock markets trade on AI enthusiasm rather than underlying valuations

- Gold and silver epitomize market instability decoupled from fundamentals

- Opportunities may arise in dips, China and bonds that were unpopular in 2025

He sees opportunities in buying the dips that would follow if equity markets fall from record highs, along with Chinese stocks monetizing artificial intelligence, and the traditional alternatives to pricey stocks such as government or corporate bonds.

“As the first quarter of 2026 unfolds, the global investment landscape is defined by a striking paradox,” says Graham, Head of Robeco Multi-Asset Strategies and Equity Solutions. “Record-breaking technological progress is masking structural fragilities in the rest of the economy, such as inflationary pressures and a gloomy manufacturing sector.”

“While indices like the S&P 500 sit at all-time highs, the ‘everything rally’ since the so-called Liberation Day last April when President Trump’s tariffs were announced has created a market vulnerable to a sharp reality check.”

“Success in 2026 will require buying into the dips of crowded and consensus positions, and managing performance drag from out-of-favor allocations to defensive hedges and valuation-driven ideas.”

It’s not just stock markets that have reached new peaks; the gold price also hit record highs of above USD 4,000 an ounce on continued geopolitical turmoil and heavy central bank demand, while silver has soared because supply can’t meet future industrial demand.

“Precious metals have provided diversification and returns, but the recent surge in silver – up 30% in 2025 – epitomizes the current market’s instability,” Graham says. “While industrial demand from the solar and 5G sectors is real, silver’s price has decoupled from fundamentals.”

“Conversely, gold remains a premier hedge. Central bank demand is projected to stay at four times pre-2022 levels, a key demand factor to monitor this year. Interest from exchange-traded funds (ETFs) in both metals has grown significantly; 22% of the 220,000 metric tons mined sits in gold coins and gold-backed ETFs – larger holdings than those of central banks.”

“So, the financial interest will be the overriding driver of gold and silver, and we can therefore expect volatility and trading on technicals.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Private debt facing a crunch

Then there is the private debt market, which may face a crunch that could make more traditional debt instruments like sovereign bonds and credits more attractive in 2026 than they were last year, when both asset classes largely declined in value.

“Private debt is where systemic risks have been rising, as demand has driven a ballooning ‘dark pool’ of non-bank lending without the kind of transparency or rigorous stress-testing that listed debt issues are subject to,” Graham says.

“With deep connections to the traditional banking system, a liquidity crunch in private credit could trigger a sudden seizure in public markets. Private debt managers would firstly sell what they can, starting with the liquid debt, and then banks would liquidate the collateral (Treasuries, investment grade bonds, equities) to cover the markdowns.”

“The roll-back of US bank balance sheet regulation will provide a cushion, as such short-term pricing anomalies will present themselves for skilled debt managers. So, opportunities can arise in equities, high yield and government bonds if the sell-off is not driven by other fundamentals.”

Chinese AI looks promising

The market obsession with AI stocks have led many to believe that it’s a bubble about to burst. Nvidia1, which makes AI chips, became the world’s first company worth more than USD 5 trillion, a market cap greater than the GDP of every European nation.

“The AI narrative is shifting from ‘storytelling’ – valuations based on future potential – to ‘deployment’, with realized efficiency and return on investment,” Graham says.

“US tech (storytellers) remains dominant in large language model (LLM) development. But 2026 is likely to be a year of rationalization, leading to a ‘growth scare’ as hyperscalers face pressure to justify the trillions they are spending in capex.”

“Conversely, China (deployers) is winning the ‘applied AI’ race. By focusing on lowering unit costs in manufacturing and logistics, Chinese AI is already showing up in 1% of GDP gains. From our perspective, we have not written off Chinese equities that will benefit for AI deployment, such as in industrial automation.”

Equity exhaustion

So, is time running out for an equity bull market that has now lasted for more than three years? Once a decade, the S&P 500 delivers four consecutive years of positive performance, going into a bubble or out of a recession.

Professional investors should beware of the influence of retail investors who have piled in using low-cost ETFs, lured by ever-rising stock prices, and the continuing prospect of an AI bubble, Graham warns.

“The shift in ownership toward price-sensitive retail and tactical investors has created ‘fragile hands’,” he says. “US Equity ETFs now hold roughly USD 8.2 trillion in assets, with retail influence (including fee-based advisors) exceeding 40% of this.”

“We are already seeing ‘retail exhaustion’, where net flows have turned negative for five consecutive weeks, suggesting that the ‘buy the dip’ mentality is fading. Then there is the ‘sentiment gap’, as fund manager surveys show high investment levels despite a widespread belief that the market is in an AI bubble. This creates a ‘crowded exit’ risk.”

US-mid-terms

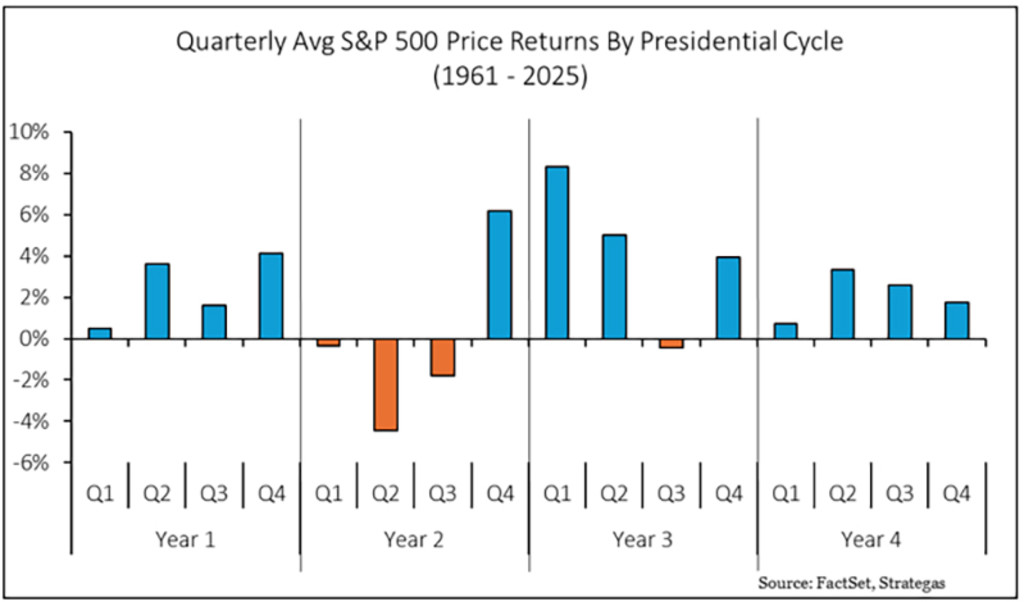

This year is also a US mid-term elections year, when all of the House of Representatives and one-third of the Senate will be elected in November. Since 1961, US equities have struggled in the first three quarters of a Congressional election year, followed by a Q4 rally.

This is shown in Figure 1, where 2026 is the second year of the current presidential cycle. “This year may not be as plain sailing as the consensus thinks,” Graham says.

Figure 1: Equity performance in US presidential cycles

Source: FactSet, Strategas, Robeco, January 2025

Cash is not king

And don’t forget that cash levels have declined while borrowing has increased as everyone caught the AI bug, he says. “There are now leverage risks, as global cash balances have dropped to a precarious 3.7%, a level historically preceding significant stock market declines,” Graham warns.

“And equity markets are still trading on earnings growth in AI-related businesses and technicals, not valuations.”

“During these bouts of volatility, we will rely on our own multi-asset investment process, checking the fundamentals for any changes in our outlook, for example for company earnings, or the path of interest rates. This will inform the decision to buy the dips in risk assets or step away to build a more defensive portfolio. Time will tell.”

Footnote

1The companies shown are for illustrative purposes only. No inference can be made on the future development of the company. This is not a buy, sell, or hold recommendation.