Full steam ahead: The US economic pressure cooker

An overheating US economy should be ringing alarm bells for investors as it may bring headwinds for both equities and bonds, says multi-asset investor Colin Graham.

Summary

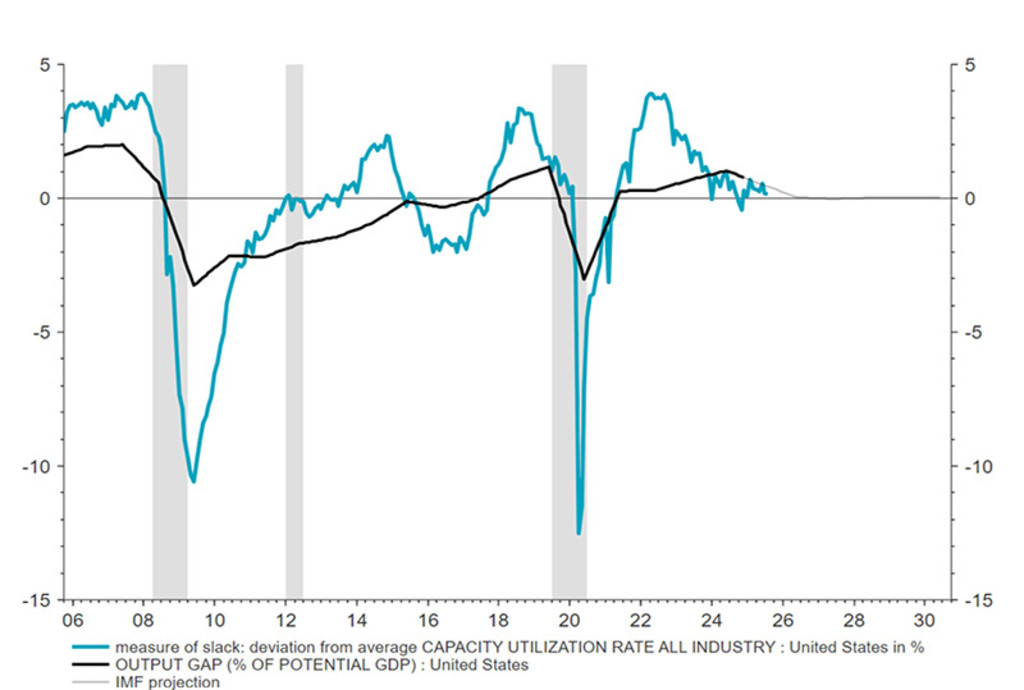

- US economy has little slack to absorb the stimulus led by tax cuts

- Fed is cutting rates even though inflation remains above its 2% target

- Equities face a mixed outlook with headwinds for government bonds

A combination of both fiscal and monetary stimulus is occurring while there is little spare capacity in the world’s largest economy. It leaves little room for the pressure cooker to blow off steam and may end with an unwelcome bang, says Graham, co-head of Robeco Investment Solutions.

This kind of scenario pressures both developed and emerging market equities along with long-duration government bonds, though commodities tend to do well, as seen in the recent gold rally, he warns.

“Over recent years, the US has increasingly exhibited characteristics of a high-pressure economy – a scenario where robust growth with full employment meets limited economic slack, and is further pumped up by policy stimulus through tax cuts and lower interest rates,” Graham says.

“The additional stopper, to prevent pressure release, is tariffs, as this will prevent importing the deflation dynamic we saw in previous bull markets of the 1990s and 2000s. This environment presents both opportunities and risks that are reshaping the macroeconomic landscape and investor behavior.”

“While this is not our core scenario, the signposts of lower rates to come, a delayed tariff impact and more tax cuts mean there is an increasing probability that financial markets will price this in. We are not at that point yet, but the fiscal and monetary largesse is turning up the heat on the US economic pressure cooker, without a means of blowing off steam.”

“We believe that this scenario will end with a bang, though whether that is before the end of 2025 or 2026 or beyond is uncertain.”

Figure 1: There is little slack in the US economy, as the deviation trend is close to zero

Source: LSEG Datastream Robeco, October 2025.

How we got here

A high-pressure economy arises when economic activity operates at or above its potential output, leaving little slack in labor and supply chains, and potentially leading to rising wages and consumer prices. In the US, this condition is driven by several factors, led by pro-cyclical fiscal stimulus and accommodative monetary policy occurring at the same time.

“Government spending remains robust, as fiscal measures continue to boost consumer and business demand,” Graham says. “This stimulus supports consumption and investment, and pushes the economy against the full capacity limit.”

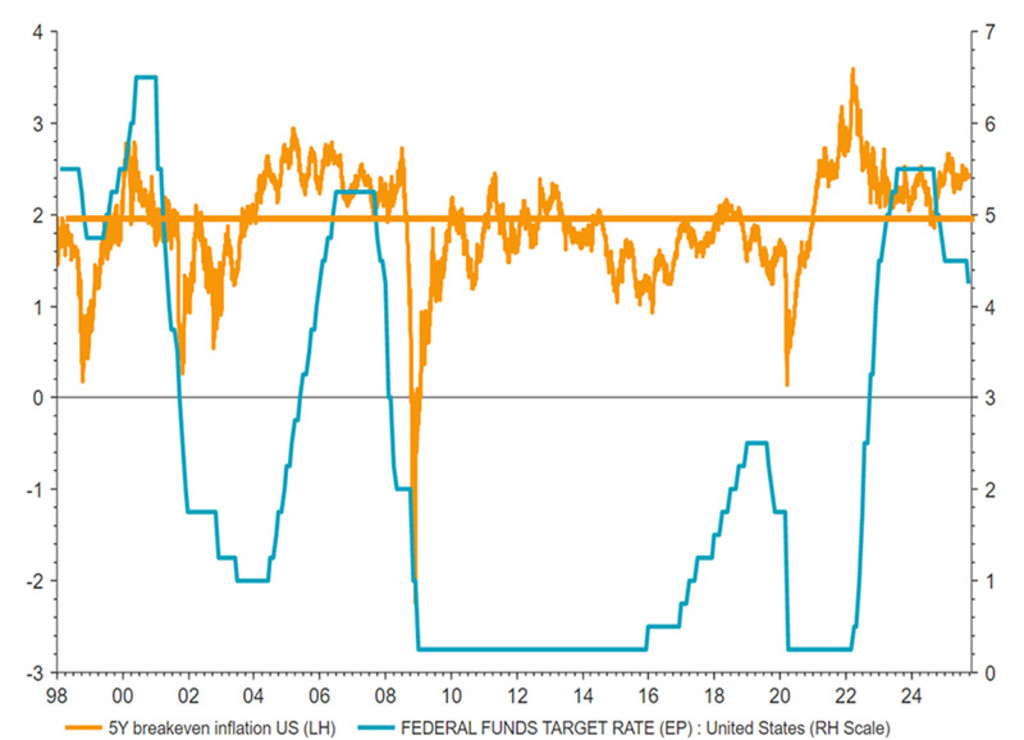

“At the same time, the Federal Reserve has maintained historically low interest rates for an extended period, encouraging borrowing and investment, despite inflation climbing above target levels. This stance has contributed to sustaining elevated demand in selected parts of the economy. The central bank is now embarking on further rate cuts while inflation remains above target and without widespread weakness in economic data.”

Labor markets and supply chains

Meanwhile, the US unemployment rate is near historic lows, exerting upward pressure on wages, while restrictions on migrant labor means lower payroll growth is required to maintain full employment.

“And persistent disruptions in global supply chains, shortages of key inputs, and logistical bottlenecks are limiting the ability of producers to keep pace with demand – further contributing to inflationary pressures,” Graham says.

“While costs can be passed through in the short term, we assume that 50% of the tariff increases will end up in the prices of consumer goods. Longer-term margins will be pressured unless there are productivity gains from artificial intelligence.”

“These elements combine to create an economic pressure cooker with no outlet.”

2026 Investment Outlook: The synchronized shift

After years of discord, 2026 is shaping up for a short-lived but synchronized upswing.

Rate cuts alarm bell

One alarm bell has been the Fed cutting rates – possibly under pressure from President Trump – while inflation is still above the central bank’s long-standing 2% target. Lower rates tend to encourage borrowing and spending, which can drive inflation even higher.

“The persistence of inflation in a high-pressure economy complicates the Fed’s policy decisions,” Graham warns. “If inflation expectations become unanchored, the Fed may be forced into a more aggressive tightening cycle, involving rapid interest rate hikes and possibly balance sheet reduction.”

Figure 2: The Fed is cutting rates while inflation remains above the 2% target

Source: LSEG Datastream, Robeco, October 2025.

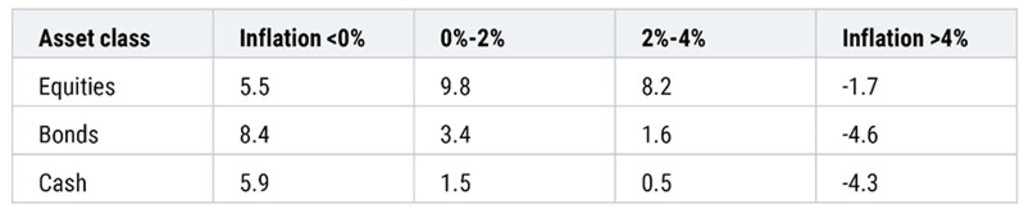

Asset class implications

For investors, this increases market volatility and heightens the risk of policy-driven economic slowdowns or recessions. The implications for asset classes are:

Equities: In a high-pressure economy, equities often face a mixed outlook. On the one hand, strong economic growth and corporate earnings support equity valuations, particularly for sectors with pricing power and those involved in the AI revolution. Conversely, sectors reliant on low rates and thin margins, such as consumer stocks, may experience heightened downside risk.

Bonds: Rising inflation and interest rates pose headwinds for traditional fixed income, especially long-duration government bonds. Usually, investment grade credit and selective high yields with strong fundamentals can offer better risk-adjusted returns than sovereign bonds. However, spreads are already at historic lows, so they offer lower protection this time around.

Emerging markets: The prospect of Fed tightening and a stronger US dollar tends to pressure emerging markets via capital outflows and currency depreciation. This is contrary to Robeco’s longer-term view in Expected Returns of a greenback derating from expensive valuation levels.

Commodities: Commodities and real assets such as gold, which has reached record highs lately, tend to perform well amid inflationary pressures, benefiting from robust demand and supply bottlenecks.

“From our vantage point, when you extend time horizons, there is significant divergence in returns across asset classes when inflation rises and monetary policy does not turn the heat down by raising interest rates,” Graham says.

As the table below shows, when inflation is in the ‘ideal’ 0-2% range, average historic equity returns are at their highest at 9.8% on an annualized basis. But when it is above 4%, equity returns become negative at -1.7% as stock markets fall. Bonds also decline by 4.6% and cash by 4.3% due to the higher inflation eating into returns.

Table 1: Asset class returns, 1875-2021

Past performance is no guarantee of future results. The value of your investments may fluctuate.

Source: Robeco

“The US high-pressure economy reflects a delicate balance of strong demand, constrained supply, and evolving pro-cyclical policy responses,” Graham concludes. “While it supports near-term growth, the persistent inflation risks necessitate vigilant monitoring of monetary policy and economic indicators.”

“For investors, understanding this regime’s nuances is critical to navigating asset allocation and managing risk effectively and assessing when the pressure cooker is about to blow.”

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.