Fintech’s powerful momentum: 10 key charts

With the Magnificent Seven grabbing headlines, the outperformance of fintech companies has flown under the radar in 2024. Here are ten charts showing the fintech trends underpinning this powerful momentum.

Summary

- Strong recovery in fintech continues as sector outperforms in 2024

- Rapid global consumer penetration in payments, data and financial services

- Capital markets fuse is lit as earnings start to flow

As the ten charts we have assembled below show, investing in fintech will expose you to an incredibly diverse group of sub-sectors and eco-systems far beyond the payments companies and neobanks that generate headlines in the financial media. After a difficult period when the Covid-era euphoria subsided, the growth potential of the fintech investment universe is now only starting to be realized, making it an opportune time to gain exposure.

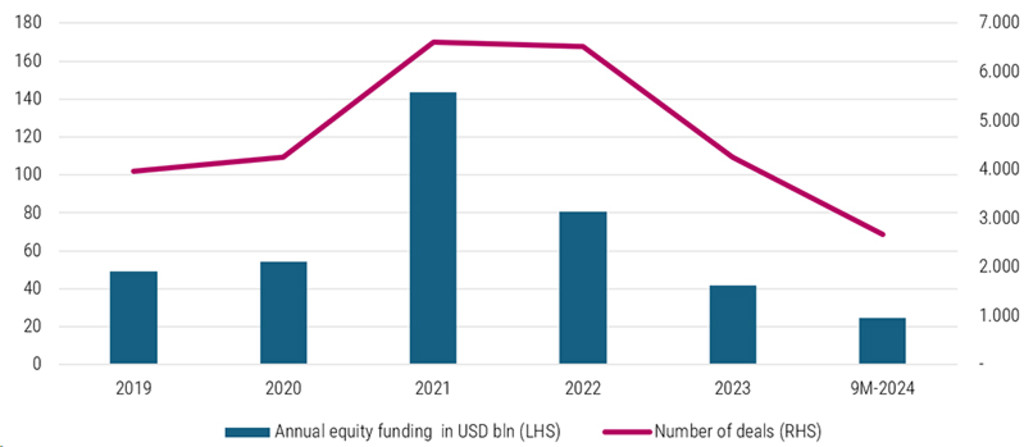

Since the US election, excitement in M&A teams is at fever pitch on anticipation of a much more permissive regulatory regime under Trump 2.0, with the financial sector in general and fintech in particular likely to be in focus for dealmakers. Figure 1 shows that activity has has potentially reached trough levels and is expected to rebound on looser monetary conditions, and increased confidence in the growth potential of fintech business models.

Figure 1 - Private fintech funding set to rebound

Source: CB Insights, Robeco, October 2024.

This recovery in capital markets activity was highlighted in public markets by Capital One acquiring Discover Financial for USD 35 billion. In the venture capital space we have seen 12 new unicorns in the year-to-date according to CB Insights, which brings the total to 325 fintech unicorns (private companies valued at more than USD 1 billion). We have also seen exits like Airbase being sold for USD 325 million to Paylocity, Tegus being acquired for USD 930 million by AlphaSense, and S&P Global taking over Visible Alpha for circa USD 500 million.

IPOs in 2025

Interest in fintech IPOs is clearly on the rise with buy now pay later (BNPL) pioneer Klarna announcing it intends to launch an IPO on the Nasdaq with an anticipated valuation between USD 15-20 billion.0F1 Its success will be a good gauge of how the market views this segment. Stripe, and Revolut could follow suit, and the rumor is that Chime is planning to go public in 2025. As one of the leading US neobanks, Chime has gained prominence by offering customers the perk of accessing their paychecks two days early by opening a Chime checking account.

According to Forbes, Chime boasts an impressive 38 million checking account customers, with half of them considering Chime their primary checking account provider. This translates to a market share of 8.1%, comparable to giants like Wells Fargo (8.5%) and JP Morgan Chase (7.6%). While Chime’s early paycheck access remains free, the company generates revenue by collecting a portion of interchange fees from customer debit or credit card transactions. As it gears up for its IPO, Chime faces the challenge of diversifying its revenue streams and demonstrating a clear path to profitability.

Footnote

[1] Klarna’s Seb Siemiatkowski — from burger flipping to billionaire club – Financial Times, 15 November 2024

What’s trending?

All the latest thematic investing trends just one newsletter subscription away.