Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

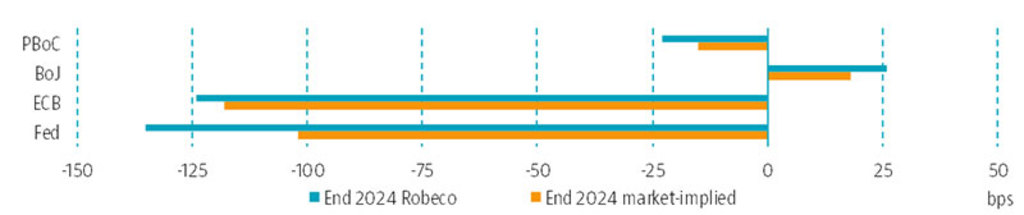

In our view, rate cuts are coming – one way or another. They will come more quickly if a financial accident or sharp growth slowdown does occur, and more slowly if further disinflation, which we expect, allows central banks to trim the restrictiveness of their policy stance.

Behind the curve on the way up, DM central banks are understandably cautious in starting the descent from higher policy rates. This is particularly true given the challenges posed in the last mile of bringing down inflation, with labor markets remaining relatively tight and concerns about an impending (or deepening) economic malaise having shifted to the background. On balance, we agree with the current market pricing for (late) Q2, when we expect the first Fed and ECB rate cut to be delivered.

In assessing bond market valuations, the exact timing of the first rate cut is less important than the trajectory of rates over the next few years. Although we agree that in a looser fiscal policy regime central bank rates are likely to settle at higher levels than before the pandemic, we have started to see markets overdoing it (as in Q3 last year). Specifically they have priced in terminal rate levels that are ‘too high.’

Meanwhile, in China, the weak growth and low inflation backdrop piles pressure on the PBoC to ease further. Further rate cuts have indeed become more likely, though we expect balance sheet tools to continue to do the heavy lifting. In Japan, the BoJ remains on a gradual course towards tighter policy. Indeed, one way or another, negative policy rates look set to disappear this year.

Source: Bloomberg, Robeco, change by end 2024, based on money market futures and forwards; 9 February 2024

Subscribe to our newsletter for investment updates and expert analysis.