Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Investors should focus on the disruptive potential of the blockchain-based ecosystem in finance and the wider economy, not speculation in cryptocurrencies.

Cryptocurrency prices crashed in 2022 as tighter global financial conditions impacted the higher risk portion of capital markets, attracting huge media coverage and encouraging some investors to dismiss Digital Assets as a purely speculative phenomenon.

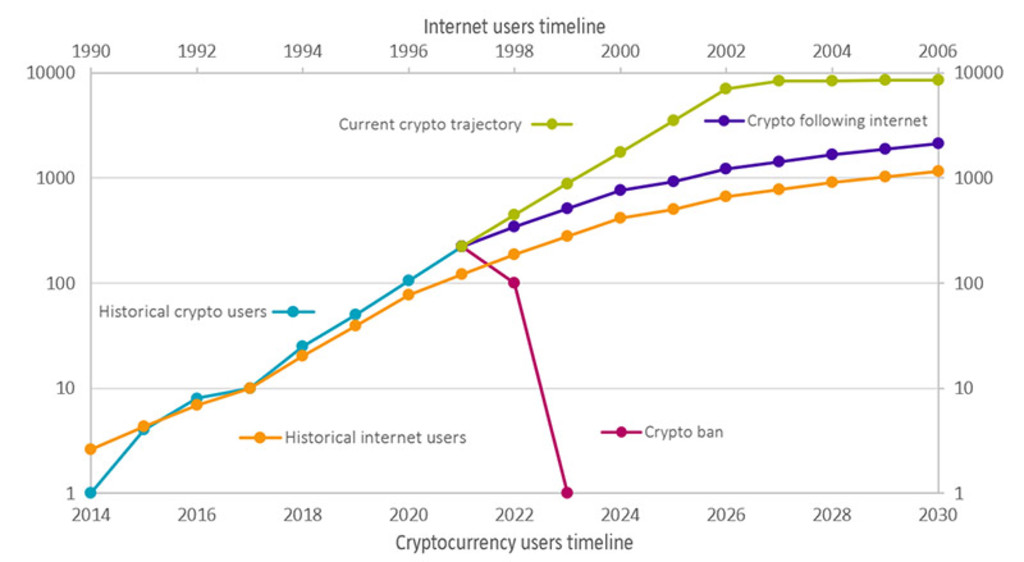

The Digital Assets ecosystem is certainly used to a great deal of volatility, and the implosions of the third largest stablecoin Terra USD (LUNA), crypto lending platforms Celsius and BlockFi, crypto hedge fund Three Arrows Capital, and cryptocurrency exchange FTX are making it a hard crypto winter. The period from 2017 to 2022 has been reminiscent of the dot-com bubble where, amid steep user growth (Figure 1), investors gave massive valuations to business models which were speculative and sometimes fraudulent.

Source: World Bank, Crypto.com, Robeco estimates, 2021.

Underneath the surface, however, powerful trends are still developing based on the underlying blockchain technology, a record of transactions that does not require an external authority to validate the authenticity and integrity of data. This has become known as Web3 – a catch-all term for the vision of a new, better internet or the third generation of internet services – built upon the core concepts of decentralization, openness, and greater user utility. Blockchains, smart contracts and tokens are used to give power back to the users in the form of ownership. You could summarize it as: Web1 was read-only, Web2 is read-write, and Web3 will be read-write-own.

Subscribe to our newsletter for investment updates and expert analysis.

Progress in fixing the crypto regulatory gap has been slow, largely because regulation always lags innovation, and blockchain technology is relatively new. However, the 2022 cycle that saw the implosion of opaque and unnecessarily complex business models – which was aggravated by high leverage, lack of oversight, no separation of duties and poor risk management – put pressure on global regulators.

In 2023 we believe regulators will finally take concrete steps to restore confidence and legitimize the use of Digital Assets and the underlying technology in the wider economy. Regulatory standards should mitigate downside risks while promoting innovation – an aim that is embedded in most recent legislation drafts. In 2022 the EU published its plan to manage the crypto industry ('Markets in Crypto-Assets agreement' or MiCA) and in the US the White House presented recommendations from its research on the space ('First-Ever Comprehensive Framework for Responsible Development of Digital Assets').

It’s likely that Decentralized Finance (DeFi) players will soon be obliged to hold 100% reserves when issuing stablecoins, disclose more information about their balance sheets when engaging in lending, limit asset concentration, and promote more careful risk management. Clear regulation would boost user trust and engagement, augmented by developers building solutions to real-world problems.

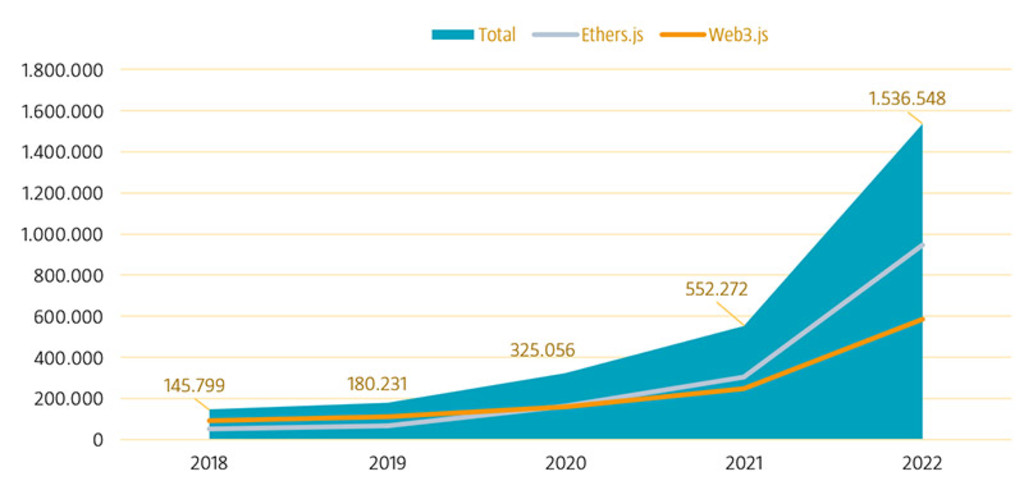

Despite the turmoil in 2022, interest in crypto and Web3 is still growing. Although user activity is down, Coinbase reported 108 million verified users at the end of September, which is 48% more compared to September 2021. More significantly, Alchemy, a blockchain development platform empowering Web3 users, pointed out in their Web3 development report that downloads of two critically important Web3 libraries, Ethers.js and Web3.js, have almost tripled over the past year, reaching over 1.5 million per week (Figure 2).

Source: Web3 Developer Report, Q3 2022.

The fact that speculative interest in cryptocurrency has declined while development interest in the underlying technology is still growing fast is very positive, indicating a shift in focus from token prices to the underlying disruptive potential of blockchain.

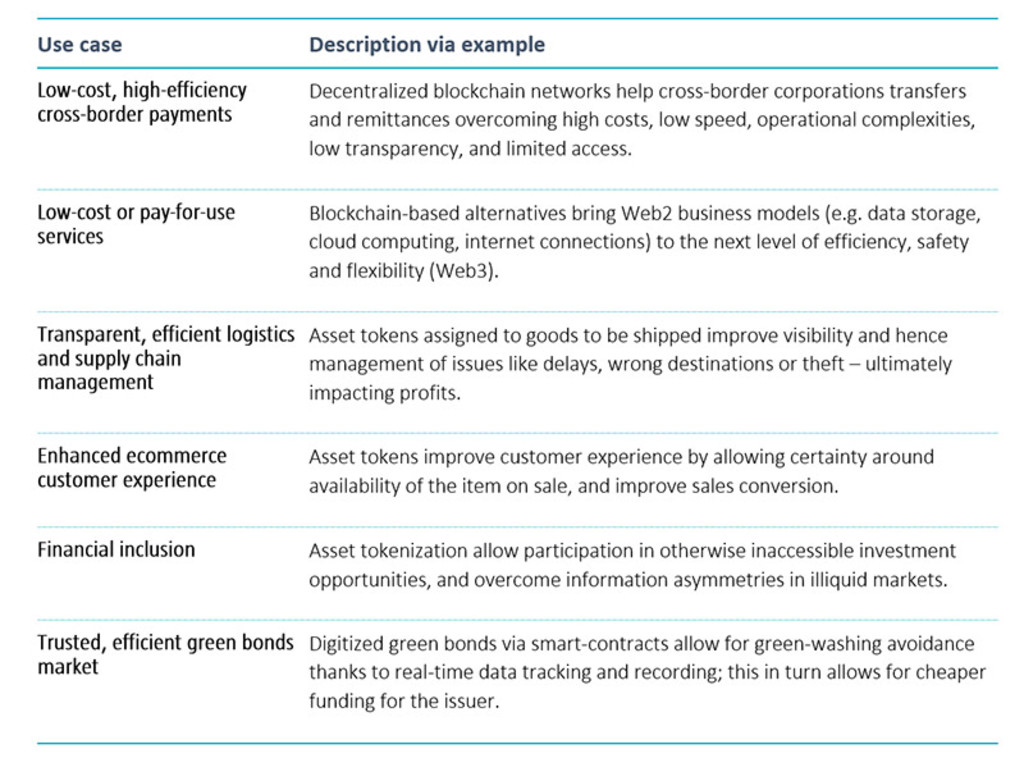

Beyond the headlines there is a quiet revolution going on as start-ups and corporations apply blockchain technology to change and enhance the way they do business. Examples include MGM applying smart-contracts to concert tickets with additional perks, JP Morgan processing more than USD 430 billion worth of tokenized intra-day repo transactions, and Walmart’s tokenizing its supply chain to reduce a specific food’s provenance tracking from 7 days to 2.2 seconds. We have provided a non-exhaustive list of current use cases in Figure 3 below.

Source: Robeco analysis.

An interesting development from an investor perspective is the potential challenges to existing cloud computing and storage incumbents from Web3. While companies like Google, Amazon and Dropbox have been leaders in offering best-in-class cloud solutions, the Web3 era is enabling those services for a fraction of the price and exponentially higher efficiency and flexibility. What potentially makes this possible is a decentralized and open source cloud computing marketplace connecting those 'having' unused computing capacity with those 'needing' it, on the back of transparent, validated and tracked agreements among parties.

If an appropriate regulatory framework is set and energy around the space continues to persist, then creativity is the only limit on the potential of blockchain. In fact, while real-world issues that could be addressed are countless, the expression of its potential is still at a very early stage and it’s crucial to continue tracking developments. As part of our FinTech equity strategy, we invest in several companies that leverage blockchain technology using the ‘pick and shovel’ approach. There are few listed equity investments giving exposure to the rise of Digital Assets, but we are eagerly following developments and stand open to opportunities.

Download our whitepaper for a more in-depth analysis of the cryptocurrency crash, the regulatory outlook, real use cases for Blockchain, and a simple explanation of the key technologies and terminology in the Digital Assets ecosystem.