Consumer trends in 2024: The resilient shopper

Markets are still facing a wall of worry, but in an ever-changing consumer landscape, moderating inflation, strong household finances and the likelihood of interest rate cuts give us reasons for confidence.

Summary

- Moderating inflation supports consumers and markets

- Weight loss drugs and influencer brands challenge staples companies

- ‘Magnificent Seven’ earnings outlook outpaces the market

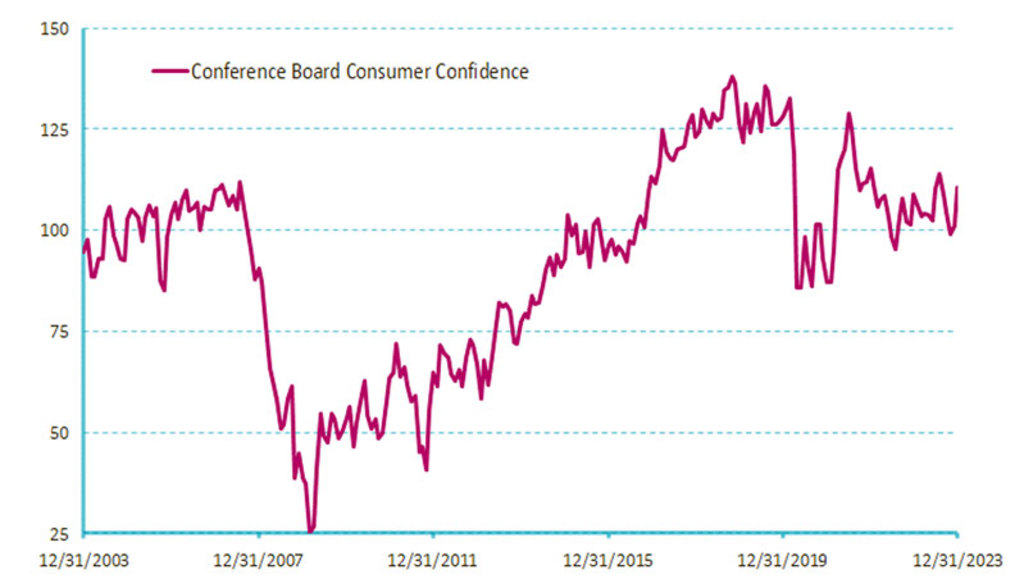

2024 will see moderating inflation positively impacting consumers and markets. Despite potential economic concerns like geopolitical tensions and a global economic slowdown, we believe strong household finances and the prospect of interest rate cuts will support consumer spending. The US economy showed resilience in 2023 despite challenges, with inflation falling and wage growth outpacing inflation, which boosted consumer confidence. Retail sales, excluding autos, have begun to outpace inflation.

Figure 1: Viewed from a historical context, consumer confidence is currently at relatively healthy levels

Source: Bloomberg, Robeco

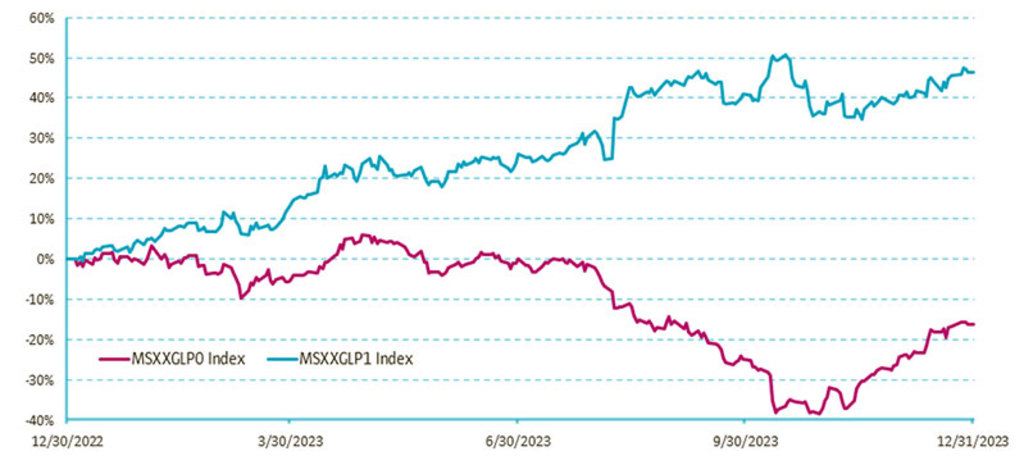

Consumer staples however are facing one of their toughest periods, underperforming for two consecutive years. High inflation and rising interest rates have led to a market reset while changing market dynamics are impacting previously defensive product categories.

Consumer Trends

The rise of GLP-1 drugs

GLP-1 drugs, initially for Type 2 diabetes, are gaining traction as weight loss solutions, significantly affecting consumer spending on food, especially in the US. This trend poses a risk to companies producing processed foods and beverages.

Figure 2: The gap between stocks deemed to be beneficiaries/victims of GLP-1 drugs has risen throughout 2023

Source: Morgan Stanley, Bloomberg, Robeco. December 2023

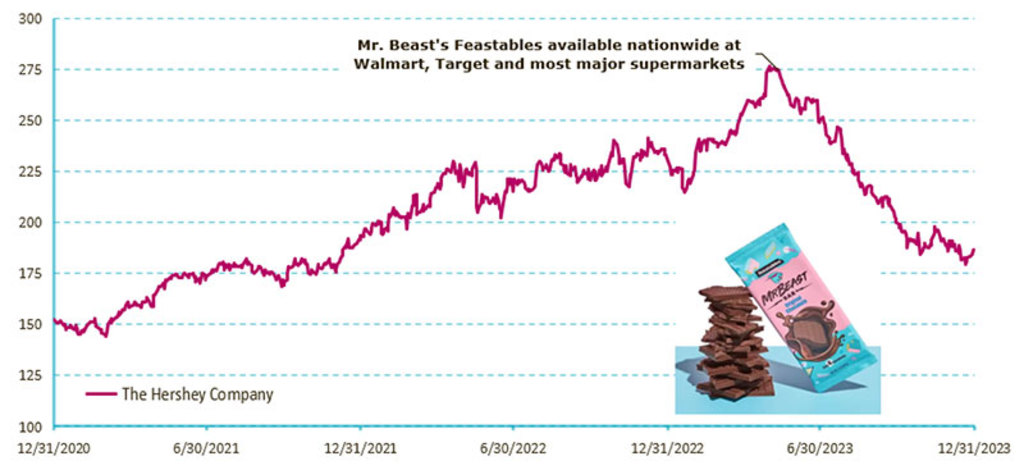

Influencers building brands

Social media influencers and celebrities are disrupting consumer markets by launching their own brands. While this trend isn’t new, having impacted liquor and beauty categories in the past, it’s now spreading to other mass-market categories like candy, snacks and sports drinks. In some cases, these brands, often launched at lower prices, are rapidly eroding the market share of established companies.

Figure 3: Hershey’s shares have melted after a YouTube star launched a rival brand

Source: Robeco, Bloomberg

Impact on Robeco Global Consumer Trends strategy

In response, we are adjusting our exposure to consumer staples, while investments in companies less affected by these trends are maintained. The focus is also on health and well-being, beauty, and personal care sectors.

Performance of the ‘Magnificent Seven’

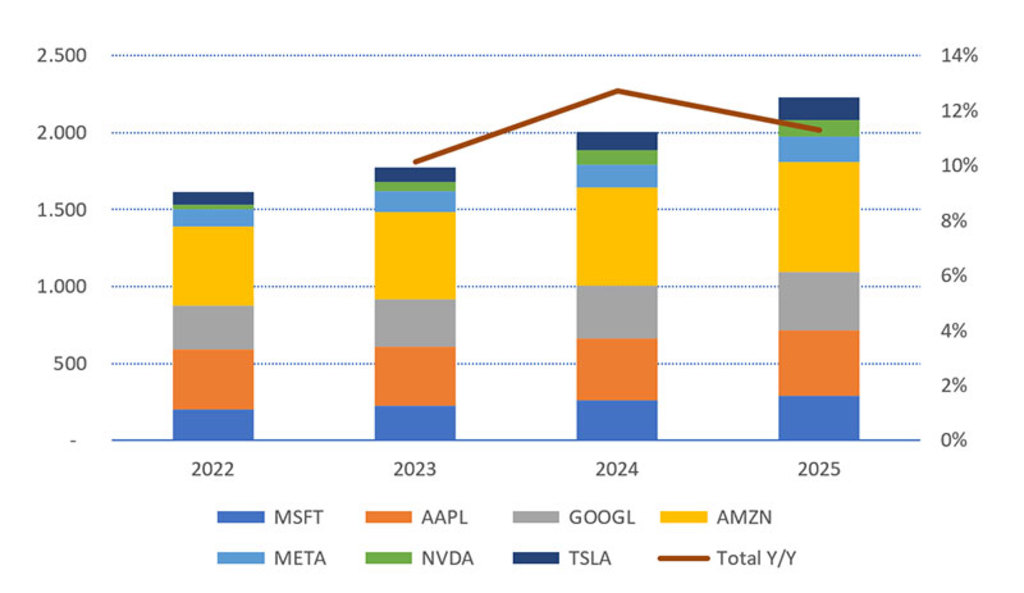

In 2023, the ‘Magnificent Seven’ (Apple, Amazon, Alphabet, Nvidia, Meta Platforms, Microsoft, Tesla) significantly outperformed the market. Their diverse and resilient business models, along with strong balance sheets, position them for continued success. Despite high valuations, their growth prospects remain attractive.

Figure 4: Magnificent Seven revenue & growth forecasts, USD billions

Source: Bloomberg, Company filings

Outlook for 2024

Overall, consumer spending in 2024 looks promising. Factors like lower gasoline prices, a strong labor market, and easing borrowing costs should support consumer spending. Growth in ecommerce, electric vehicle sales, global advertising, and IT spending are key trends to watch. The Magnificent Seven are expected to see continued revenue and earnings growth, albeit at a moderated pace compared to 2023.

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.